Summary:

- NetApp stock has outperformed the S&P 500 by 40.8% over the past year.

- The company is at the forefront of intelligent data infrastructure and offers sustainable growth potential.

- NetApp has a strong financial health, innovative market position, and promising growth potential, making it a good investment opportunity.

Just_Super/iStock via Getty Images

Investment Thesis

NetApp (NASDAQ:NTAP) stock has gained about 67.03% over the last year, outpacing the S&P 500 by a margin of about 40.8%.

While this solid performance could be attractive to investors, I believe we ought to be rational enough before making any investment based on this past performance alone.

In the wake of the evolving IT industry, I believe investors should invest in companies that not only lead in innovation but also offer sustainable growth potential. With this background, I am bullish on NTAP since it’s at the forefront of intelligent data infrastructure characterized by an innovative market position. Additionally, the company has a compelling growth potential and robust financial health, which adds to my bullish stance. For these reasons, I believe this company is a good investment opportunity and rate it a buy.

Company Overview

NTAP is a global company specializing in intelligent data infrastructure solutions. It was founded in 1992 and has been a pioneer in providing unified data storage, integrated data services, and CloudOps solutions to its customers. Its portfolio is made up of three major components. First is unified data storage, which offers the flexibility to store any data type and run any workload across various environments. The second one is the integrated data services which provide cyber resilience, governance, and application agility to create the most value for data. Lastly is the CloudOps solution. This utilizes AI-powered optimization to maximize the performance and productivity of cloud and on-premises infrastructure.

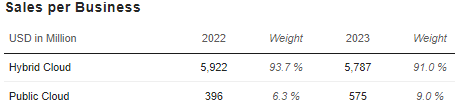

The company operates through two major segments whose revenue distribution is as shown below.

Market Screener

The company has been listed in the Fortune 500, and it continues to influence the data management industry with its innovative approach to handling data in the cloud era.

Innovative Market Position

Over the years, NTAP has acquired itself a niche as an intelligent data infrastructure company. The company offers a very unique silo-less approach that combines unified data storage with enterprise-grade storage services natively embedded in the world’s largest cloud. Let’s dive deeper into the company’s innovativeness and look at two examples of its unique products. The first example I will consider is the Amazon FSx for NetApp ONTAP service. It is a fully managed multi-protocol storage service that enables organizations to extend their on-premises data onto AWS for enhanced data protection, as well as migrate organization workloads without refactoring and running stateful Kubernetes applications.

This innovation is very unique in that it combines NetApp’s ONTAP features with the flexibility and scalability of AWS. The product appeals to many customers because it addresses some unique customer needs, some of which I will highlight. To begin with, it addresses the need for high-performance and multi-protocol storage. This is possible because it offers high-performance file storage that is accessible from Linux, Windows, and MacOS compute instances via several protocols such as NFS, SMB, and iSCSI. The multi-protocol access allows for a broad range of applications and use cases. The other customer need addressed by this product is the data management capability. Given its features like snapshots, clones, and replication; customers can manage their data effectively. For instance, the FlexClone feature allows for instantaneous point-in-time cloning of volumes, which is particularly useful for testing database operations before executing them in production environments. Another unique need addressed by his product is seamless data migration. With the integration with NetApp SnapMirror replication, it enables easy and efficient migration from on-premises ONTAP deployments to the AWS cloud. These are just a few examples of how this unique offering is addressing unique and diverse customer needs. As I conclude with this first example, I will mention one of its advantages, which is cost effectiveness. This product supports compression and deduplication, which can reduce storage costs by eliminating redundant files and minimizing storage overheads.

The second innovative product is the NetApp BlueXP which is a comprehensive data management solution designed to provide unified control across hybrid multicloud environments. The product is unique in that it can offer a single point of control for storage and data services, which supports an intelligent data infrastructure. For this article, I will just mention two of its many unique features. To begin with is its unified control across environments. It delivers a consistent management experience for storage and service for all data, be it on-premises or spread across multiple cloud platforms. The other unique feature is its powerful AIOps capability. BlueXP simplifies operations by offering actionable insight and automation through AI-driven operations, which helps to manage the complexity of today’s data infrastructure.

Through its innovative product which is unique and very relevant in the dynamic tech industry, especially in the wake of AI adoption, NTAP has earned itself a leading position in the industry. According to Frost & Sullivan, NTAP will be the leading company for hybrid cloud storage management in 2024. For the Q3 2024, NTAP reported a revenue of $1.46 billion, which was an improvement from $1.38 billion in the previous year. I expect this trend to continue given that the company is projected to deliver a revenue of $1.66 billion in the current quarter, marking a growth of 5.1%. Given that the hybrid cloud contributes more than 91% of the total revenue, I expect it to contribute about $1.51 billion this quarter, which would be a significant improvement.

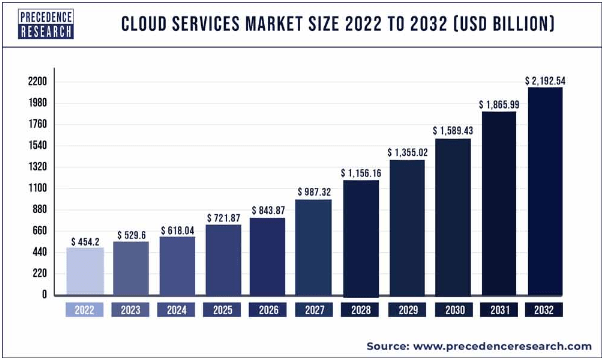

It is estimated that 88% of enterprises will adopt a hybrid cloud and 83% of those live in a hybrid multi-cloud world. This implies that NTAP’s products are in demand, given the projected high adoption. Further, according to precedence research, the global cloud service market is projected to grow at a CAGR of 17.105 between 2023 and 2032.

Precedence Research

In my view, this projected growth in a dynamic industry offers NTAP opportunities to keep innovating, something I believe will serve as a major growth catalyst.

Financials

Looking at the company’s financial performance and balance sheet, its financial health is very robust. First off, since 2021, NTAP has consistently grown its top and bottom lines, translating to a robust and resilient performance amidst several macroeconomic headwinds. The company grew its revenue from $5.74 billion in 2021 to $6.36 billion in 2023. Similarly, its operating profit and net margin improved from $1.18 billion and 12.71% respectively in 2021 to $1.54 billion and 20.03% in 2023. Further, in the MRQ (Q3 2024 report dated 29th February 2024), the company maintained its solid performance. It reported revenue of $1.61 billion, marking a growth of 5.24% YoY. Over the past three quarters, the company’s revenue has been growing consistently from $1.43 billion in Q1 2024, $1.56 billion in Q2 2024 to $1.61 billion in Q4 2024.

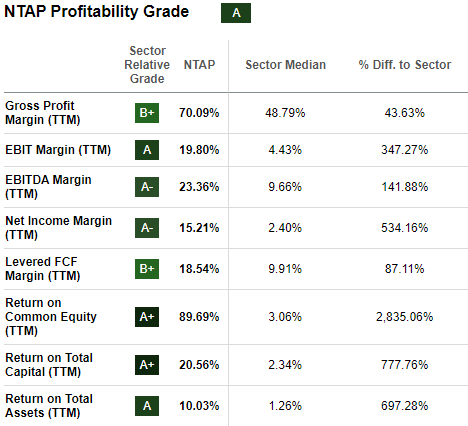

Its EPS came in at $1.94 beating estimates by $0.25. Given the company’s strong financial performance, it has become a top dog compared to its peers in profitability, as shown below.

Seeking Alpha

In my view, its outstanding profitability is a reflection of the company’s efficiency as well as effective cost management, which makes it an attractive opportunity for profit-oriented investors.

Besides the solid financial performance, the company’s balance sheet is very strong. With a total debt of $2.66 billion, the company’s cash of $2.92 billion can pay the total debt, something which speaks volumes on the company’s strong liquidity and deleveraged status. Further, given the company’s total assets of $9.37 billion cover the total debt more than 3.5x, this affirms that this company is highly deleveraged and that it has minimal debt risk. Most interesting, the company has interest coverage of more than 22x. This shows the company’s solid position to meet its financial obligation. Additionally, the company has strong cash flow generation ability, as shown by its trailing operating cash flow of $1.31 billion.

In a nutshell, NTAP has a very healthy financial status which translates to strong fundamentals which more often result in bullish sentiments. In addition, its strong balance sheet serves as a buffer against economic uncertainties, and it also offers the company financial flexibility to invest in growth opportunities. Lastly, this solid financial footing instills confidence in investors and this could result in high demand for the stock, resulting in a high valuation.

Growth Potential

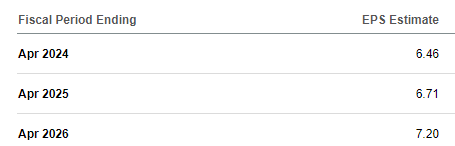

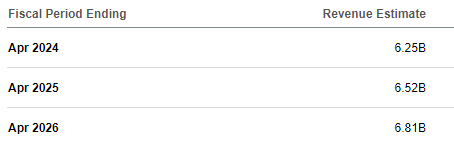

The company’s growth estimates promising with both EPS and revenues projected to grow by 2027. Below are the projected values by 2027 of both EPS and revenue.

Seeking Alpha Seeking Alpha

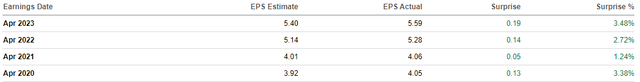

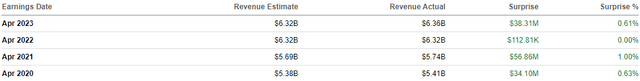

These figures are very attractive when viewed in isolation, but it would be more interesting to assess the company’s potential to meet these projections. One way to evaluate the company’s ability to achieve these figures is through examining its history of beating its estimates. Based on this criterion, NTAP has a high potential of beating these estimates given its strong record of beating estimates over the last couple of years. Since 2020, the company has beaten or at least achieved both its EPS and revenue estimates consistently, something which instills confidence that it will achieve and more likely surpass the projected future growth figures. Below is its earnings surprise history.

Above all, given the strong projected market growth and the company’s innovative and leading market position, I believe NTAP is in a good position to achieve its growth ambitions by leveraging the market opportunities with its diverse and unique products and services. A good example is its innovation in all-flash array storage solutions, which the company reported a significant 21% YoY growth in its all-flash array annualized revenue rate, reaching $3.4 billion.

Valuation

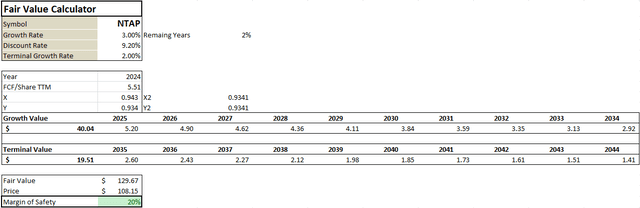

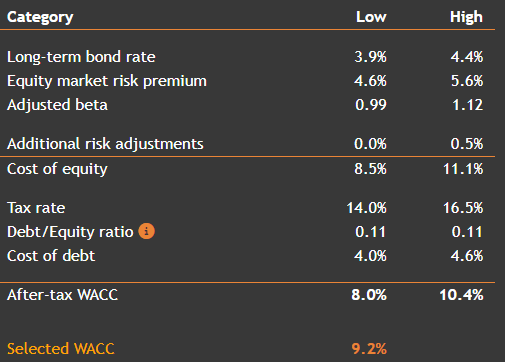

To value this company, I will use both relative valuation metrics and a dcf model. For the relative valuation, NTAP is trading at a trailing GAAP PE of 24.75which is a 16.34% discount compared to the sector median PE of 29.58. This indicates that NTAP is undervalued. To support this, I ran a dcf model with several assumptions. First off, I assumed a growth rate of 3% which is conservative given the company’s 3-year FCF CAGR of 4.74%. The conservative figure is aimed at mitigating the major drawback of a dcf model, which is overreliance on assumptions. Further, I used a discount rate of 9.2% which is the company’s WACC as shown below.

Value Investing

Given these assumptions and using the trailing FCF/share of $5.51 as my base case, below is my model output.

Based on my model, I arrived at a fair value of $129.67 which translates to a discount of about 20%. This implies that this stock is undervalued with double-digit upside potential. For this reason, I recommend this promising stock to potential investors at a discount.

Risk

Just like any other investment, investing in this stock has its share of risks. One of the major risks of investing here is its reliance on the hybrid cloud for the majority of its revenue. As presented earlier in this article, this segment contributes more than 91% of the company’s annual total revenue. This implies that this company is exposed to a great risk should this market segment face an economic downturn or in case competitors introduce a superior product that can eat into NTAP’s market share.

Another risk is technological changes. The tech industry is evolving very fast and that means that NTAP should continuously innovate to stay relevant, failure to which it could be detrimental. As a result, investors should keep a close eye and how the company is adapting to emerging trends to meet emerging consumer needs.

Conclusion

In conclusion, NTAP is a promising investment opportunity given the company’s innovativeness and market leadership. Its profitability is very attractive, and its financial footing is very solid. Given its growth potential and undervaluation, I believe the future is bright and as a result, I rate it a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.