Summary:

- NetApp is a strong tech stock with solid earnings and a reasonable ~17x P/E, despite a challenging macro climate and a high S&P 500.

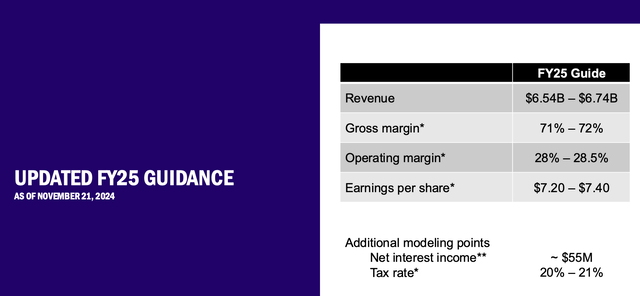

- The company delivered a beat-and-raise in Q2, lifting its full-year EPS guidance to $7.20-$7.40 (with the previous high end of its range now the new low end).

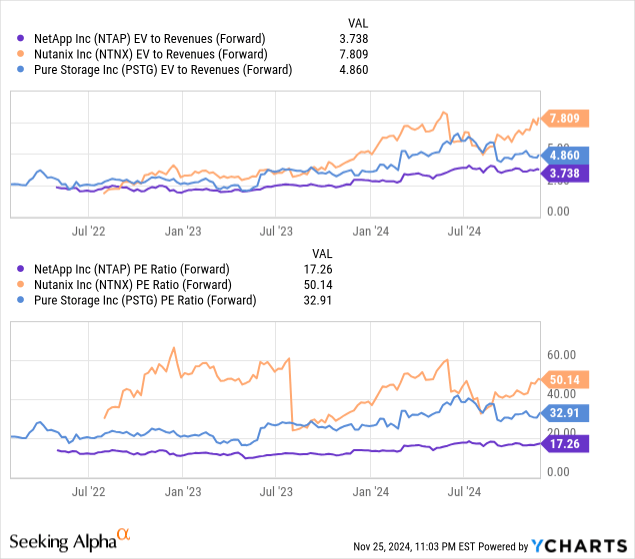

- The stock trades considerably cheaper than direct rivals like Pure Storage and Nutanix on both a P/E and revenue basis.

- Use the current lull in NetApp’s stock as a buying opportunity, given its strong fundamentals and growth prospects.

JHVEPhoto

With the S&P 500 continuing to hover around all-time highs, it has become increasingly challenging to find growth stocks that still trade at decent value and also have meaningful catalysts to spark continued earnings growth through 2025, despite a potentially tougher macro climate. Investors have to deploy careful stock-picking in order to beat the markets from here on out.

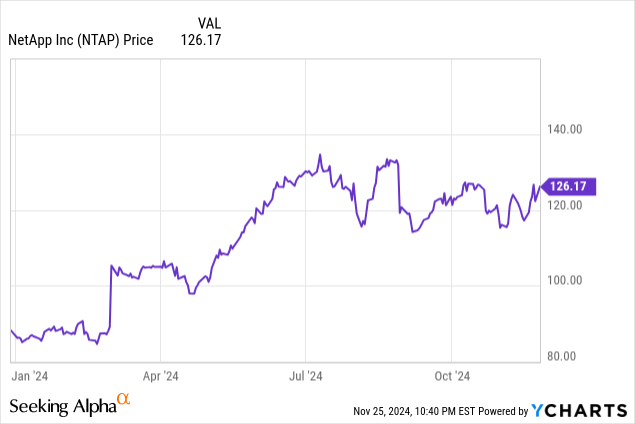

NetApp (NASDAQ:NTAP), in my view, is a great tech stock to invest in for investors who still want a solid earnings base and a reasonable P/E entry point. The storage vendor has seen 40%+ YTD gains, but in my view, this upside has been more than justified by the company’s consistent margin expansion and EPS growth.

I last wrote a bullish note on NetApp in September, when the stock was trading just above $120. Since then, NetApp has traded in a flattish pattern, despite the fact that the company just released strong fiscal Q2 (September quarter) results that featured double-digit EPS growth as well as ARR expansion. In my view, the fact that Wall Street is ignoring NetApp’s strengths makes this a perfect moment to add to your position here in an otherwise expensive stock market; and as such, I’m reiterating my buy position on NetApp.

In my view, here are the core reasons to be bullish on this company:

- Tremendous AI tailwinds from data lake modernization projects – Deploying AI applications requires training AI models that, above all, consume copious amounts of data. This means that enterprises that want to deploy AI tools have to maintain huge “data lakes” for AI models to work with. NetApp, meanwhile, specializes in providing storage solutions for these mounds of data at an efficient cost.

- “Storage as a service”- In the past, companies used to buy storage hardware and maintained all of their data in their own data centers. But now, vendors like NetApp are helping their clients to modernize their data strategies, and NetApp in particular can help to build out a “hybrid cloud” model where a company can choose to have some data assets in-house and others in the public cloud.

- Recurring revenue and ARR – In line with the company’s vision of storage as a service model rather than as a hardware purchase, NetApp continues to chase double-digit growth in ARR, which has reached $3+ billion. The company enjoys a recurring revenue stream at a high 70%+ gross margin.

- Margin expansion driven by supply chain visibility – The company has also continued to drive consistent operating margin expansion through keen opex cost controls plus a forward-purchasing model for SSD flash (one of its key raw components) that has protected the company from a recent spike in prices.

Stay long here and use the current lull in NetApp’s stock as a buying opportunity.

Q2 download

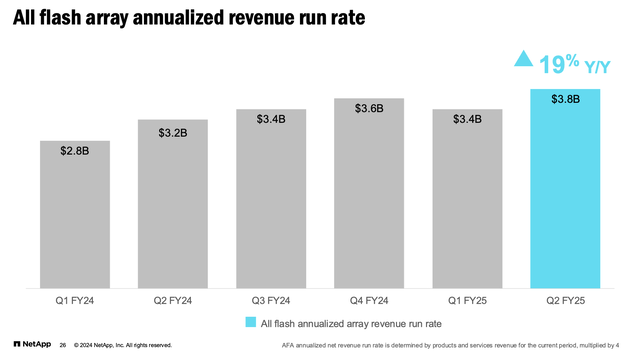

Let’s now go through NetApp’s latest quarterly results in greater detail. The Q2 (September quarter) earnings summary is shown below:

NetApp Q2 earnings (NetApp Q2 earnings deck)

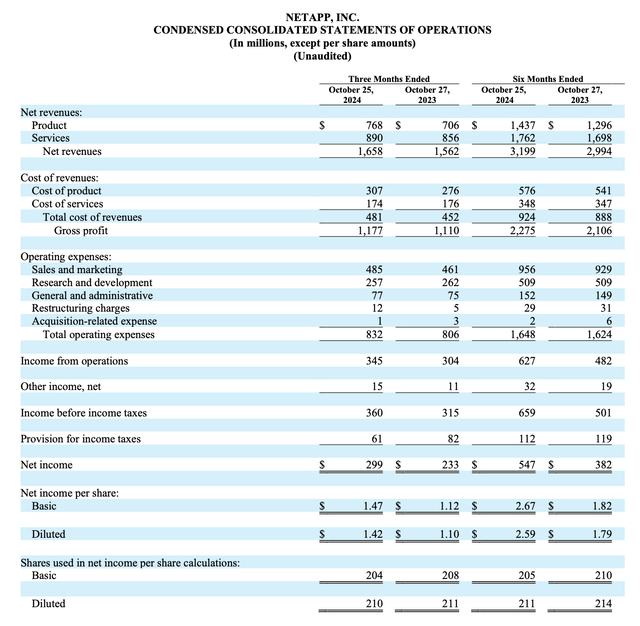

NetApp’s revenue grew 6.1% y/y to $1.66 billion, ahead of Wall Street’s expectations of $1.64 billion (+5.2% y/y) by a one-point margin. Worth noting as well is the fact that billings expanded 9% y/y to $1.59 billion, as shown in the chart below:

NetApp billings (NetApp Q2 earnings deck)

As seasoned software investors are well aware, billings often represent the better picture of forward-looking demand, as they capture multi-period deals signed in the quarter that will be recognized as revenue in future quarters. The fact that billings growth continues to exceed the pace of revenue growth is a signal that revenue isn’t set to decelerate, or may even see acceleration in the quarters ahead.

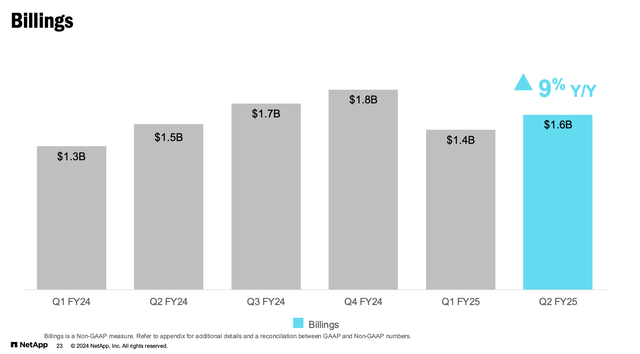

NetApp’s strength in orders is driven, in large part, by continued AI demand. And it’s not simply that NetApp is riding industry tailwinds that is benefiting all vendors, either – management notes that it believes the company is gaining share in the all-flash storage market. Per CEO George Kurian’s remarks on the recent Q2 earnings call:

Broad-based success across the portfolio propelled our all-flash array annualized revenue run rate to an all-time high of $3.8 billion, up 19% year-over-year, the fourth consecutive quarter of high-teens to low-20%’s annual growth. We continue to gain share in the all-flash market, far outpacing the growth rates of both the industry and all of our competition […]

Our AI business performed ahead of our expectations in Q2 with well over 100 AI and data-lake modernization wins. These wins span geographies and industries, with notable early momentum in public sector, manufacturing, financial services, healthcare and life sciences industries. We continue to advance our strong position with the development of GenAI cloud and on-premises solutions in partnership with industry leaders. GenAI is a truly hybrid workload and only NetApp has the breadth of products and services to reduce the complexity, resources, and risks across increasingly complex hybrid multi-cloud environments.”

The company added $0.4 billion in net-new ARR in the quarter, bringing its all-flash ARR to $3.8 billion, up 19% y/y.

NetApp ARR (NetApp Q2 earnings deck)

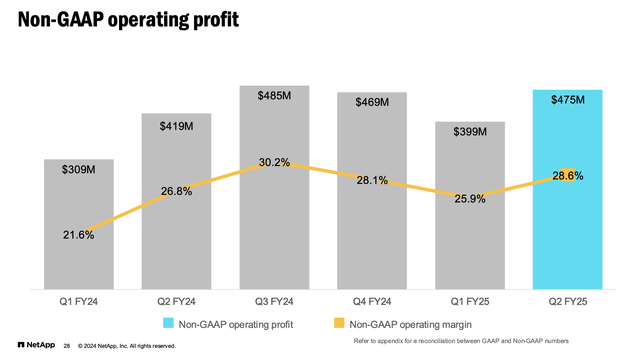

We note as well that double-digit ARR expansion and AI tailwinds have also been accompanied by consistent margin expansion, helped by opex only increasing 2% y/y despite revenue growth that is four points stronger. The company boosted its pro forma operating margins by 180bps y/y to 28.6%, while pro forma operating profits rose 13% y/y in nominal terms to $475 million.

NetApp operating margins (NetApp Q2 earnings deck)

The lynchpin behind NetApp’s margin protection strategy has been to make strategic upfront purchases of its key raw input, SSD (or solid state drives). Rampant AI demand has driven double-digit y/y increases in SSD prices, but in spite of this, NetApp has been able to maintain its gross margins flat at 72%. By committing to SSD purchases in advance, NetApp is sacrificing near-term FCF and building up inventory, but protecting itself from future price spikes.

This strategy has proven solid in the past few quarters as SSD prices have risen. We do note, however, that major SSD supplier Western Digital (WDC) just recently reported a -6% sequential reduction in SSD ASPs per gigabyte in its most recent quarter, after three straight quarters of double-digit increases. NetApp may look to revise this strategy if SSD prices continue to stabilize, but for now, the company is still able to eke out respectable operating margin expansion leveraging this forward-purchasing playbook.

We note as well that NetApp achieved a true “beat and raise” quarter in Q2, with the company raising its full-year EPS guidance to $7.20-$7.40 (11-15% y/y EPS growth), from a prior view of $7.00-$7.20 (8-11% growth).

NetApp guidance boost (NetApp Q2 earnings deck)

The company is also still maintaining its expectations of being able to deliver double-digit EPS growth throughout FY27.

Valuation and key takeaways

Despite these recent tailwinds, we find that NetApp still remains the cheapest of the managed storage-as-a-service vendors that are publicly traded in the markets. On both a revenue and EPS basis, NetApp trades several leagues cheaper than its direct competitors Nutanix (NTNX) and Pure Storage (PSTG), with its ~17x forward P/E also slightly cheaper than the broader S&P 500 despite the company’s commitment to double-digit EPS growth for the next three years.

Of course, there are risks to consider here. Storage has become a “commoditized” business, and as highlighted above, the company already has a number of direct competitors. Nutanix and Pure Storage are currently both growing their top lines at a faster pace than NetApp (though ARR growth at a ~20% clip is similar, and recall that NetApp management still asserts it’s gaining market share). There’s also a risk that the current mad dash to be AI-ready has pulled in a lot of data center and infrastructure investments into the current period, only for vendors like NetApp to see a more muted environment in the years ahead (thereby making its goal of double-digit earnings growth more challenging).

That being said, amid healthy operating margin expansion and reliable ~20% growth in ARR on top of a cheap P/E multiple, I see a very attractive risk-reward profile in NetApp. Stay long here and keep holding out for more gains ahead.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NTAP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.