Summary:

- I have considered the changes to NetApp’s consensus forecasts, the management’s comments at recent investor events, and the latest industry surveys, in previewing NTAP’s Q3 FY 2024 results.

- NetApp’s current P/E multiple is lower than its historical average, and a potential earnings beat could be a re-rating catalyst.

- I have left my existing Buy rating for NetApp stock unchanged, as I think that NTAP’s upcoming third quarter results disclosure will be a positive surprise.

hapabapa/iStock Editorial via Getty Images

Elevator Pitch

I still rate NetApp, Inc. (NASDAQ:NTAP) shares as a Buy.

Previously, I shared my expectations of NetApp’s financial performance for the third quarter of fiscal 2023 (YE April 30, 2023) in my prior February 16, 2023 update. My current article is focused on previewing NTAP’s upcoming Q3 FY 2024 (November 1, 2023 to January 31, 2024) financial results.

The major items to consider in the assessment of NTAP’s expected performance for Q3 FY 2024 are industry surveys, the management’s recent commentary, and the changes to the company’s financial estimates and analyst ratings. My prediction is that NetApp’s Q3 FY 2024 results will exceed expectations and drive a valuation re-rating for the stock. As such, my Buy rating for NetApp stays unchanged.

Wall Street’s Consensus Financial Projections For NTAP

NetApp will report its earnings for the third quarter of fiscal 2024 on Thursday, February 29, 2024 after trading hours. The market thinks that NTAP would have achieved an improvement in financial performance for the most recent quarter.

The sell side sees NTAP recording its first positive top-line expansion on a YoY basis in five quarters when it announces its latest third quarter results. NetApp’s revenue is expected to increase by +4.2% YoY to $1.59 billion in Q3 FY 2024 as per consensus forecasts. Earlier, NTAP had suffered from YoY revenue contraction for four consecutive quarters between Q3 FY 2023 and Q2 FY 2024.

Wall Street analysts also estimate that NetApp’s bottom-line growth would have accelerated from +6.8% YoY in Q2 FY 2024 to +23.2% YoY in Q3 FY 2024. Specifically, NTAP’s normalized EPS is projected to have expanded from $1.37 in Q3 FY 2023 to $1.69 for Q3 FY 2024.

My bet is on a Q3 FY 2024 earnings beat for NetApp. In the subsequent sections, I explain why I think that NTAP’s actual third quarter performance will surpass expectations.

Favorable Read-Throughs From Industry Surveys And Forecasts

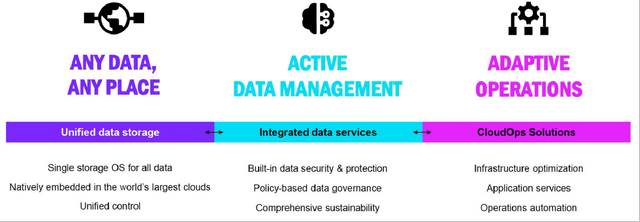

Recent industry surveys and projections point to a positive trend for storage spend, which should have been a tailwind for NTAP. NetApp calls itself a “data infrastructure company” that provides “the only enterprise-grade storage service natively embedded in the world’s biggest clouds” in its media releases.

An Overview Of NetApp’s Customer Value Proposition

NTAP’s Investor Presentation Slides

A January 16, 2024 TechTarget (TTGT) article highlighted that there has been “a revival in demand” for “storage” in recent times. TTGT’s article cited data suggesting that the pricing for data storage had gone up for four straight months running between September 2023 and October 2023.

Another article published in Computer Weekly on February 26, 2024 drew attention to the results of a recent IT survey conducted by Enterprise Strategy Group or ESG. “Cloud storage leads investment plans” for businesses, according to the Computer Weekly piece, which outlines ESG’s survey findings. This is aligned with NetApp’s comments at its Q2 FY 2024 earnings briefing in late-November last year that the company had revised its FY 2024 guidance upwards after considering “the momentum of our all-flash Hybrid Cloud storage portfolio.” In other words, cloud storage demand is likely to be strong, which should have led to higher revenue for NTAP’s cloud storage offerings.

Separately, technology media publication Next Platform estimates that global “server and storage spending” increased by +4.4% YoY in the fourth quarter of calendar year 2023 as compared to a -1.5% contraction for Q3 2023. Next Platform’s numbers are derived by doing a comparison of actual 9M 2023 spend and IDC’s full-year FY 2023 spending projection.

NetApp’s December 2023 Investor Conferences Offer Positive Takeaways

NetApp participated in the NASDAQ London Conference (registration needed), UBS (UBS) TMT Conference (registration needed), and Raymond James (RJF) TMT Conference (registration needed), in December last year, which is in the third quarter of the company’s fiscal year 2024. There are favorable takeaways from the management and analyst commentary at these investor events.

The company noted at the NASDAQ London Conference on December 5, 2023 that the negatives associated with “cloud optimization” for “our larger customers” are “largely now being offset by growth in the rest of it (the other relatively smaller clients)” and “new customers.” In other words, the drag from cloud optimization might be less of a negative factor for NTAP.

At the UBS TMT Conference on December 6 last year, the sell side analyst from UBS commented that Dell (DELL) observed a “sequential uptick in demand” and noted that storage demand tends to follow “general purpose compute” or PC demand with a “quarter or two quarter lag.” NTAP’s management declined to comment on quarter-on-quarter trends, but NetApp agreed with the analyst’s view on the link between PC demand and storage demand.

NetApp also mentioned at the Raymond James TMT Conference on December 6, 2023 that AI will be a “big growth driver” for the company and emphasized that it already “had a program about growing our AI business for 5 years.” This implies that NTAP’s Q3 FY 2024 performance might have been boosted by AI tailwinds to some extent.

A Surprise Is Likely Considering Analysts’ Forecast And Rating Changes

In my opinion, there is a high likelihood of NTAP surprising the market in a positive way with its Q3 FY 2024 performance, taking into account the recent changes in investment ratings and consensus financial forecasts.

NetApp’s consensus top-line and bottom-line projections for the third quarter of fiscal 2024 have been raised by just +0.23% and +0.71%, respectively, for the past three months. I don’t think that the analysts have incorporated the favorable industry surveys and positive management commentary into their financial estimates.

Also, Seeking Alpha News reported that analysts JPMorgan (JPM) and Raymond James have lowered their respective ratings for NetApp to Underweight and Market Perform, respectively in January 2024.

As such, it is reasonable to assume that the analyst sentiment towards the NTAP stock isn’t particularly bullish, which leaves room for positive surprises.

Final Thoughts

NTAP currently trades at a consensus next twelve months’ normalized P/E valuation metric of 13.7 times (source: S&P Capital IQ), which is below its historical 15-year average P/E multiple of 15.2 times. I am of the view that NetApp can achieve an earnings beat for Q3 FY 2024, which should serve as a catalyst for the stock’s P/E ratio to expand to a mid-to-high teens level.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Asia Value & Moat Stocks is a research service for value investors seeking Asia-listed stocks with a huge gap between price and intrinsic value, leaning towards deep value balance sheet bargains (i.e. buying assets at a discount e.g. net cash stocks, net-nets, low P/B stocks, sum-of-the-parts discounts) and wide moat stocks (i.e. buying earnings power at a discount in great companies like “Magic Formula” stocks, high-quality businesses, hidden champions and wide moat compounders). Sign up here to get started today!