Summary:

- NetApp, Inc. trading around fair value, hold recommendation justified.

- Strong fundamentals, innovative attributes, but not undervalued anymore.

- Technical analysis shows potential for more capital gains, but limited upside due to overbought conditions.

Thomas Barwick

Investment Thesis

I recommend holding NetApp, Inc. (NASDAQ:NTAP) because it is trading around its fair value. In my previous bullish thesis, I recommended a buy decision guided by my estimated fair value of $129.67 alluding to a 20% margin of safety. Since that publication, the stock has exploited that runway and rose as high as $135.01 before dropping slightly to its current price of $126.15. This implies that the stock is trading within its fair value, where a hold decision is justified.

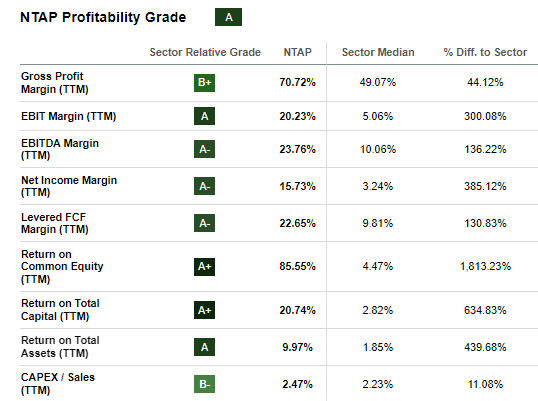

While my previous bull thesis was anchored on innovation, NTAP is maintaining its innovative attribute, which bodes well for its future sustainable growth. Its fundamentals are also robust, with a very attractive profitability and balance sheet.

Seeking Alpha

With a total debt of $2.65 billion and total cash of $3.26 billion, it has net cash of $0.61 billion, speaking volumes on the strength of its balance sheet. On the other hand, its cash flows are very solid with an operating cash flow of $1.68 billion, which is enough to cover its total debt by 63.4%. The CFO has a YoY growth rate of 52.21% compared to the sector median of 19.06% indicating that NTAP has a healthy financial status and therefore can sustain its operations. In a nutshell, its fundamentals are strong and attractive. Despite how attractive this company looks, it’s not undervalued anymore, and therefore a hold rating is warranted.

Technical Approach

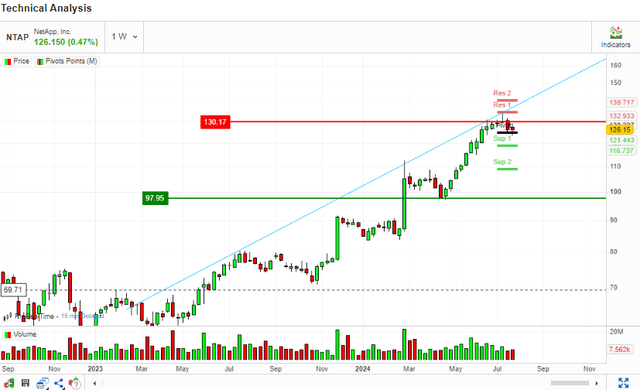

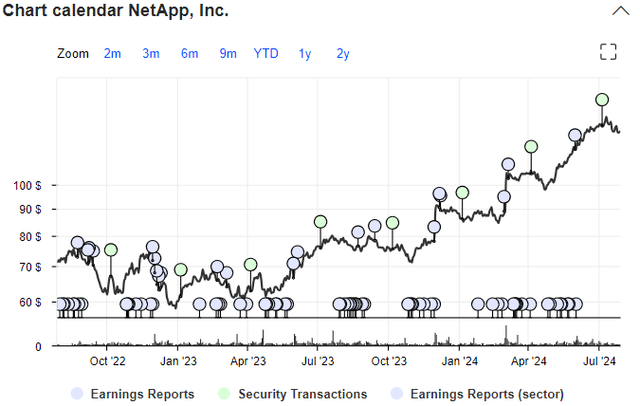

Now that the stock is trading close to its fair value, let’s examine the charts to determine the outlook. Since May 2023, NTAP has been on an uptrend, as shown by the blue trend line on the chart below. Recently, it hit its 52-week high of $135.01, and it has since been on a downtrend. However, I find four major pivot points for this stock, with two support zones at about $109.6 and $119.1. Further, it exhibits two major resistance zones at about $141.1 and $134.8, respectively.

Market Screener

Looking at the established pivot points, it is apparent that the stock is likely to form a new higher high and a new higher low, an indication that the uptrend may continue above the fair value translating to more capital gains for current investors.

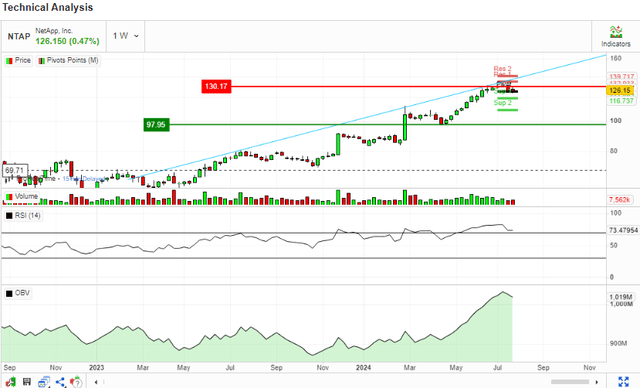

Looking at the RSI, it is at 73.5 which is in the overbought region, meaning that the stock has a limited upside potential, which explains why the highest resistance point is not very high. Above all, given that trading volume is essential in determining the outlook of a stock, NTAP had exhibited a rising OBV which appears to be peaking now, meaning that what had been an incremental cumulative trading volume is cooling, and therefore the upward momentum could be losing steam at least in the short run.

Market Screener

In conclusion, NTAP has been on an upward trajectory which has led the stock in the overbought region where the upside is limited. Although there are signs of a potential for some more capital gains as shown by the pivot zones, the declining OBV indicates that the upward momentum may be losing steam. Given this mixed outlook, I recommend a hold decision as we wait for the price movement perhaps at the pivot points.

Current Affairs: NTAP Keeps Innovating

In my previous coverage, I extensively covered NTAP’s innovativeness, especially in cloud computing where I discussed some of its key products such as Amazon FSx for NetApp, and Blue XP among others. Since my last coverage, the company has made some strides forward on the innovation front. NetApp is introducing new capabilities to help with the advancement of intelligent data infrastructure installations that better support strategic workloads such as GenAI and VMware environments. These features include:

NetApp GenAI Toolkit for Microsoft Azure NetApp Files Version: Customers can now incorporate private enterprise data stored in Azure NetApp Files into retrieval-augmented generation (RAG) operations in a secure, automated manner. By merging private data with pre-trained, foundation models (FMs), GenAI projects can produce more distinctive, high-quality, and ultra-relevant results. The combination of the NetApp GenAI Toolkit with Azure NetApp Files creates a powerful synergy that enables clients to leverage sophisticated language generation capabilities.

BlueXP Workload Factory (for AWS): For critical workloads like GenAI, VMware cloud environments, and business databases, this intelligent data infrastructure service automates the planning, provisioning, and management of cloud resources and services using established industry best practices. Utilizing BlueXP Workload Factory, customers can maximize the deployment time, cost, performance, and resource protection for strategic workloads and the data that goes along with them. BlueXP Workload Factory enables customers to profile infrastructure requirements for target workloads and compare various resource options for cost and performance needs, hence simplifying workload migrations to the cloud. Subsequently, the service can allocate the designated resources, transfer any current workload data to these freshly allocated cloud installations, and continuously enhance the complete setup to guarantee the necessary cost and performance objectives.

Amazon FSx to Improve NetApp ONTAP: With improved scalability and flexibility features, AWS unveiled the next-generation Amazon FSx for ONTAP cloud storage solution, which can support up to 6 GB/s of throughput for a single highly-available [HA] pair using 512 TiB of SSD storage. With a 300 percent improvement in network burst throughput and a 150 percent boost in disk burst throughput, next-generation file systems provide virtualized applications with greater growth room. Second-generation Amazon FSx for ONTAP systems allows dynamic scalability by adding HA pairs as needed, up to 24 nodes, enabling large-scale, high-performance workloads like GenAI. This gives 1 PiB of SSD storage the capacity to transfer up to 72 GB of data per second, offering increased performance and flexibility for changing business requirements.

These upgrades expand on NetApp’s current product line, which supports data operations and storage for clients who need to set up and oversee highly capable, strategic workloads like VMware and GenAI systems. For instance, NetApp recently revealed that all of its customers would now be able to utilize its exclusive BlueXP data classification feature, which automatically classifies and categorizes data for improved governance and secure ingest into GenAI and RAG data pipelines. This feature is now a core control plane capability and is free of charge.

My Take On The Innovative Upgrades: What Does It Mean?

In light of the above significant progress in innovation, NetApp is positioning itself to better support data-intensive workloads and make the management of these workloads across hybrid multi-cloud environments simpler by introducing services like the GenAI Toolkit for Microsoft Azure NetApp Files and the NetApp BlueXP Workload Factory for AWS. Given the strong predicted growth in cloud computing, which is estimated to grow at a CAGR of 21.2% between 2024 and 2030, I believe this will earn NetApp a significant market share in this projected growth.

In terms of competitiveness, NetApp distinguishes itself by providing AI-driven data storage solutions that include comprehensive security and protection. Leading analysts have recognized its leadership and innovation in data management, providing it with a competitive advantage. The company’s hybrid multi-cloud management approach, as well as its ability to simplify numerous settings, may help it differentiate itself from competitors.

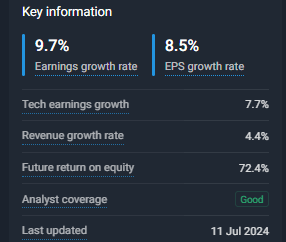

NetApp’s earnings and revenue are expected to grow by 9.7% and 4.4% per year, respectively. The EPS is projected to grow at an annual rate of 8.5%, with a return on equity of 72.4% in three years. These estimates indicate an optimistic future for NetApp’s growth, implying that the company’s strategic innovations may result in greater market share and profitability in the cloud services arena.

WallStreet

Calendar: Near-term Catalyst Expected On 28th August

Looking at the company’s calendar, the nearest catalyst is its Q1 2025 earnings report expected on 28th August 2024. Looking at historical data, the price has been responsive to news and events especially earnings reports which makes this upcoming event significant. In my view, should the report reveal solid performance, I expect the market to respond positively pushing the price slightly higher and vice versa.

Market Screener

Where The Rubber Meets The Road

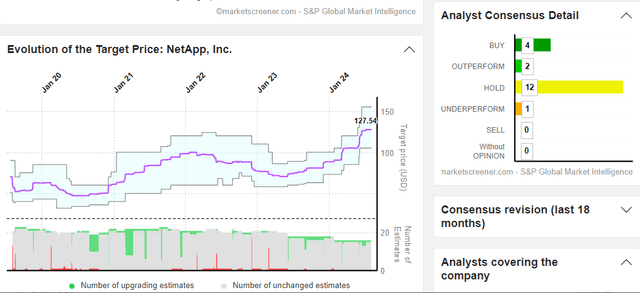

In summary, despite the cutting-edge innovations, solid fundamentals, and bright outlook in financials, NTAP has realized its fair value warranting a hold rating. My rating matches the consensus recommendations of 19 other analysts who have an average price target of $127.54 which is slightly below my estimated fair value of $129.67. This tells us that indeed this stock is trading within its intrinsic value justifying a hold decision.

Market Screener

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.