Summary:

- We’re downgrading NetApp to HOLD ahead of earnings.

- We believe enterprise spending headwinds will persist through 1H24 due to macro uncertainty, and we expect large deals to take longer to close.

- NTAP’s market share has been slowly being eaten away by major cloud providers, i.e. MSFT and AMZN.

- Although NTAP has been cutting costs, we don’t think this strategy is enough to sustain long-term earnings outperformance.

- We expect the stock to continue to be an in-line performer through 1H24.

mmac72/E+ via Getty Images

We are moving NetApp (NASDAQ:NTAP) to a HOLD. The stock is up 78% since our initial BUY rating at the end of 2020, outperforming the S&P 500 by 47%. While we’re seeing signs of enterprise spending normalizing as the optimization spend wraps up in 2023, we see no near-term catalysts driving an acceleration in growth for its Hybrid Cloud business. The stock’s outperformance has been moderating over the past three months, and we believe investors would be better positioned on the sidelines for the near term.

The table below outlines our initial buy rating on the stock at the end of 2020.

Seeking Alpha

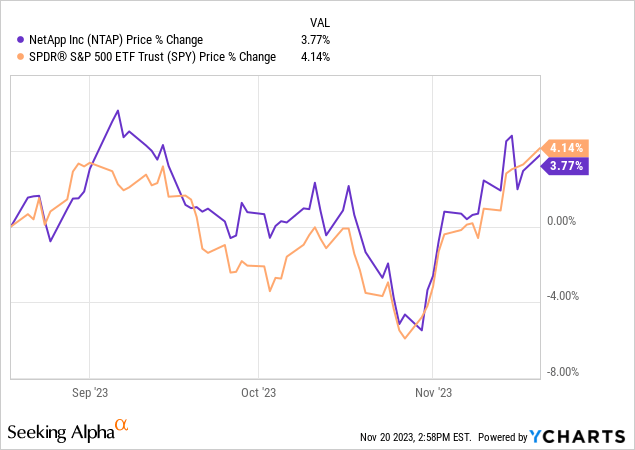

NetApp stock’s outperformance has moderated in 2H23; over the past six months, the stock is up 19%, outperforming the S&P 500 by 10%. Meanwhile, the stock has underperformed the S&P 500 over the past three months by 40 bps. We anticipate the stock to be an in-line performer through 1H24 due to macro weakness coupled with a lack of near-term catalyst.

The following graph outlines the stock’s performance compared to the S&P 500 over the past three months.

TSP

Our neutral sentiment on the stock is based on our belief that the company’s product and services revenue will have limited room to grow in the near-term due to the mixed-demand environment and competition. We don’t expect NetApp to fare as well as the competition in the near-term.

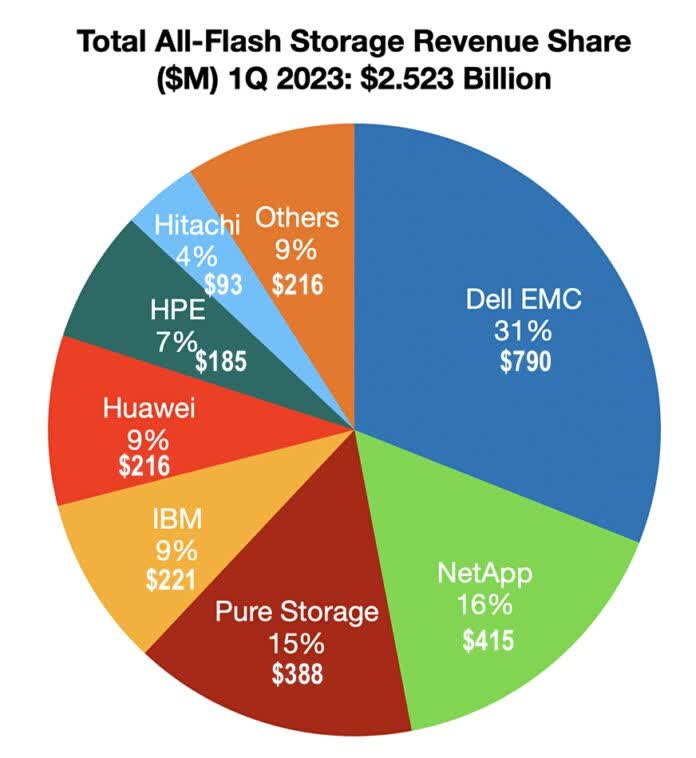

We think NTAP faces increased competition on the cloud storage front, especially as SMBs face economic difficulties and budget tightening in response to high-interest rates and macro uncertainty. We think NTAP will face longer deal times in its cloud services into next quarter. The company is navigating a highly competitive market dominated by cloud giants like Microsoft (MSFT) Azure and Amazon (AMZN) AWS with the financial leverage and economic moat to support resilience to market downtrends. Regarding its highly competitive All-Flash Array (AFA) business segment, Gartner reported in 1Q23 that NTAP experienced a decline in market share. Gartner reports that in the first quarter of this year, NTAP had a 16% market share compared to 22% the prior year. We believe the loss in market share in both cloud and on-prem will continue as NTAP faces pricing pressure, high customer acquisition costs, and low enterprise spending. While we think NetApp is well positioned to be relatively resilient, we expect near-term headwinds will weigh on the stock.

The pie chart below, compiled by Gartner, shows the market cap of NTAP and various competitors.

TSP

Valuation

From a valuation standpoint, NTAP is trading at a 2.5 multiple on an EV/Sales ratio for C2023, while the peer group trades at 4.2x. On a Price-to-earnings ratio, NTAP is trading at a multiple of 13.8 for C2023, while the peer group is trading at 22.1x. While NTAP seems to be undervalued compared to the peer group, we believe that investors shouldn’t buy the stock on weakness as we don’t see material outperformance into the first half of 2024. Staying on the sideline would be the optimal recommendation, in our opinion.

The table below outlines NTAP’s valuation against the peer group.

TSP

Word on Wall Street

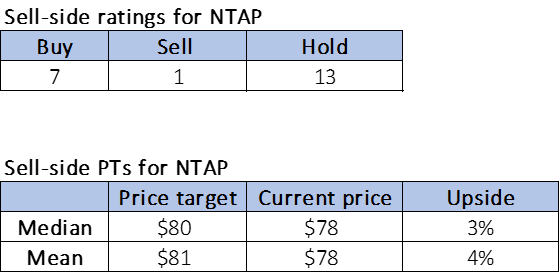

Wall Street shares our neutral sentiment. More than 21 analysts from the Sell Side cover NTAP, of which 13 are HOLD-rated, seven are BUY-rated, and only one is SELL-rated. Looking at the price targets, the median sell-side price target is $80, and the mean is $81, with a potential upside of 3 and 4%, respectively. We think there is little room for upside. Although there is a rerating possibility on the table, we believe this is unlikely in 1H24 as there is no incentive due to the uncertain macro environment and lack of a near-term catalyst.

The below outlines Wall Street’s sentiment on the stock in more detail.

TSP

What to do with the stock

We are downgrading NTAP to a hold ahead of its earnings announcement. We believe enterprise spending will remain stiff into the first half of 2024, influenced by ongoing macroeconomic uncertainties. We think this environment may result in large deals taking longer to close. While the company has been actively reducing costs, we think this strategy alone may not be sufficient to drive long-term earnings outperformance. Thus, we anticipate NTAP to perform in line with market expectations through the first half of 2024.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Our investing group, Tech Contrarians, discussed this idea in more depth alongside the broader industry and macro trends. We cover the tech industry from the industry-first approach, sifting through market noise to capture outperformers.

Feel free to test the service on a free two-week trial today.