Summary:

- NetApp has benefited from a surge in AI infrastructure spending, helping push its billings growth rates to the double digits.

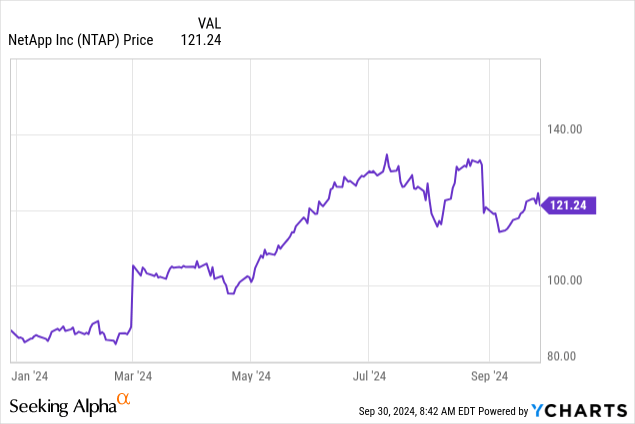

- The stock has risen ~40% year to date in response to renewed growth trends. But in spite of the YTD rally, the stock is still reasonably valued at ~16x forward P/E.

- Despite already closing AI deals today and having many exploratory AI conversations with its customer base today, company leadership believes the bulk of opportunity is still ahead.

- With just under a 2% yield and cheap multiples, this is a great “growth at a reasonable price” AI stock to invest in.

JHVEPhoto

With the S&P 500 sitting near all-time records, it’s well recognized that beyond the recent rate cuts, the other major driver to move the markets this year has been excitement over the prospects of AI to revitalize a tectonic new shift in the technology industry. AI is slated to touch many aspects of modern business, but many of the core software names that have direct exposure to AI (such as Palantir (PLTR)) have already shot up tremendously and are sitting at expensive valuations. Many value investors are wondering: are there any stocks tangential to AI that still trade at decent value?

NetApp (NASDAQ:NTAP), in my view, is a great answer to that query. This storage software vendor, which for many years had seen staid growth rates as its industry grew to be commoditized, especially with much more competitive players in the flash storage space, has seen AI interest rekindle its sales. Year to date, shares of NetApp have jumped ~40% on the renewed growth trends: but in my view, there’s still plenty of room for NetApp to rise further.

A great price today for tremendous AI spending opportunity in the near future

I last wrote a bullish note on NetApp when it was trading below $70, in 2022. Now, with the AI opportunity coupled alongside strong sales execution in the flash storage segment, I’m renewing my buy call on NetApp.

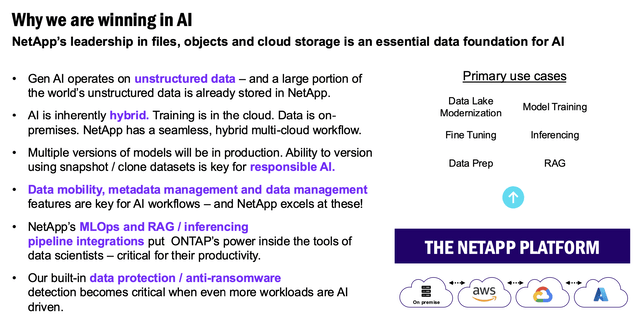

One of the key realizations to make in the AI space (and one that also props up my strong buy rating on raw memory manufacturer Micron (MU)) is the fact that AI models function by gorging on vast amounts of data. AI, in particular, relies heavily on unstructured data: that is, data like free-form internet responses and videos that may not neatly stack in rows and columns, which is what’s often referred to as tabular or structured data. And so the race to build and deploy AI applications often starts with setting a solid data foundation, for which vast amounts of storage are needed.

NetApp is a beneficiary of this surge in infrastructure spending to support AI models. The chart below shows NetApp’s competitive advantages in AI: in short, the company already operates massive data lakes for major corporations, and it’s helping many of its customer retrofit these data lakes to be digested by AI models.

NetApp AI opportunity (NetApp Q1 earnings deck)

Hunger for unstructured data storage has already revitalized NetApp’s growth rates, but unlike many of the hotter trades in the AI sector, NetApp still trades at a very cheap valuation today – even in spite of its YTD rally. In my view, the best advantage to investing in NetApp is its very modest valuation against bottom line results. Despite strong growth rates and sky-high software margins, NetApp is valued essentially no better than a typical manufacturing concern – even after this year’s generous rally.

At current share prices near $121, NetApp trades at a market cap of $24.83 billion. After we net off the $3.02 billion of cash and $2.39 billion of debt on NetApp’s most recent balance sheet, the company’s resulting enterprise value is $24.20 billion.

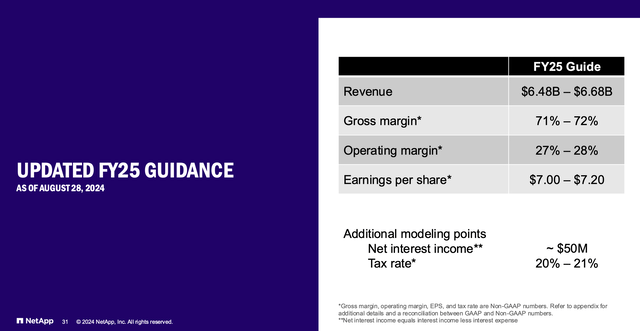

Meanwhile, for FY25 (the year for NetApp ending in April 2025), the company is guiding to $6.48-$6.68 billion in revenue, and $7.00-$7.20 in pro forma EPS.

NetApp outlook (NetApp Q1 earnings deck)

And for next year FY26, consensus is pointing to $6.93 billion in revenue (+5% y/y) and $7.59 in pro forma EPS (+7% against this year’s midpoint). This puts the stock at valuations of:

- 3.7x EV/FY25 revenue and 3.5x EV/FY26 revenue

- 17.0x FY25 P/E and 15.9x FY26 P/E

Given the S&P 500 is still trading at 20x earnings multiples against calendar 2025 estimates, I’d say NetApp offers a great trade-off between decent earnings growth power plus a reasonable valuation entry point.

In my view, if investors are looking for an AI play that still combines a “growth at a reasonable price” investment philosophy, NetApp is a fantastic choice.

Q1 download

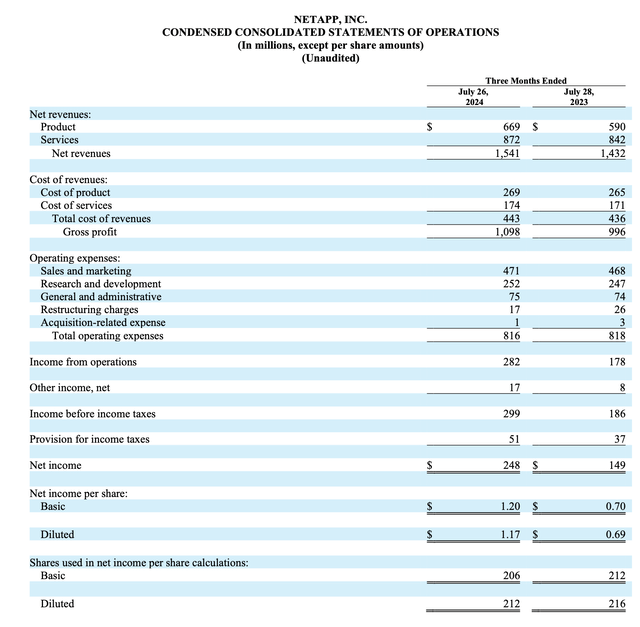

Let’s now go through NetApp’s latest quarterly results to emphasize further how the company has revitalized its performance amid its new AI growth catalysts. The fiscal Q1 (July quarter) earnings summary is shown below:

NetApp Q1 results (NetApp Q1 earnings deck)

NetApp’s revenue grew 7.6% y/y to $1.54 billion, surpassing the midpoint of the company’s initial (and rather wide) guidance range of $1.455-$1.605 billion, or 1.6%-12.1% y/y growth.

That wide initial guidance range is a reflection of how unpredictable the demand environment is currently, with large AI drivers tempered by a softer macroeconomy in which many IT leaders are pinching their budgets. And while ~8% top-line growth doesn’t sound immediately impressive, there are two things to consider. First, over the past two years, NetApp didn’t deliver any growth at all: in fact, FY24 revenue declined -1.5% y/y, while FY23 grew only 0.7% y/y.

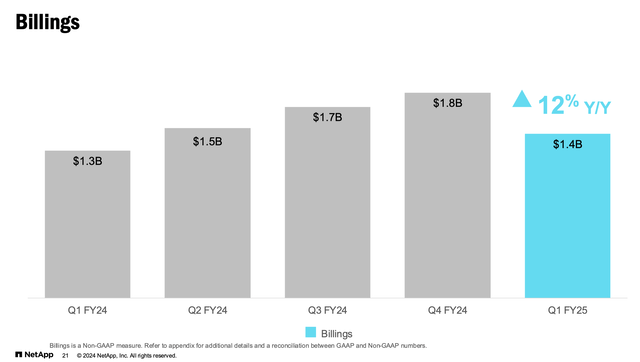

Second: NetApp delivered Q1 billings of $1.45 billion, up 11.5% y/y. As a reminder, for recurring-revenue businesses like NetApp, billings is a great indicator of forward-looking demand as it represents deals signed in the quarter that will be recognized as revenue in future quarters. Stronger billings is a potential indicator that revenue might be tipped to accelerate as well.

NetApp billings (NetApp Q1 earnings deck)

NetApp management still believes the bulk of the AI-related growth acceleration opportunity lies a bit in the future. However, the company is still noting strong current customer momentum with AI-related deals: signaling future growth may surpass today’s as well.

Per CEO George Kurian’s remarks on the recent Q1 earnings call:

AI is the cornerstone of many of my customer conversations, reinforcing NetApp’s position as a proven data infrastructure platform provider and thought leader in this space. Customers are selecting NetApp as their partner at every stage of the AI lifecycle because of our high-performance all-flash storage, unique cloud integration, and extensive data management capabilities. These capabilities support a wide range of needs, from data preparation, model training and tuning, to retrieval-augmented generation, or RAG, and inferencing, and address the requirements for responsible AI, including model and data versioning, as well as data governance and privacy.

While we believe the large opportunity for enterprise AI is still ahead of us, we are seeing good momentum today, with our AI business performing well ahead of our expectations. In Q1, we had over 50 AI and data lake modernization wins. I’ll give you just a couple of examples. We were selected by another of the world’s largest oil and gas companies for their AI and high-performance compute workloads. Our all-flash storage will power the customer’s AI environment, servicing more than 40,000 CPU cores and GPUs, which run simulations and 3D virtualization workloads.”

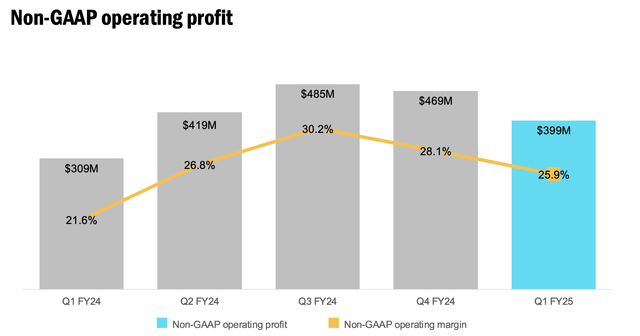

Beyond reinvigorated growth, the company has also achieved significant profit growth. As shown in the chart below, pro forma operating profits rose 29% y/y to $399 million.

NetApp operating profit (NetApp Q1 earnings deck)

This represented a 25.9% margin, 430bps higher y/y. 160bps of the margin expansion came from a richer gross margin profile, as the company achieved a higher-margin revenue mix alongside strategic bulk buys of raw SSD memory that has helped to lower costs. The remainder of the margin expansion came from operating efficiency, as OpEx rose only 2% y/y (versus an 8% top-line growth pace).

Risks and key takeaways

In spite of NetApp’s many timely strengths, we shouldn’t be blind to the longer-term risks that this stock poses. For one, the macro IT buying environment remains unsteady: hence the wide ranges that NetApp is guiding to in its forward quarter, signaling that we may see some very lumpy quarters ahead. And in the long run, while infrastructure players like NetApp are capturing a lot of early preparatory spend in AI, infrastructure and storage tend to be commoditized (think of semiconductors and chips in general) while AI software applications will be the true differentiators. NetApp is hardly alone in its industry, facing competition from the likes of HP Enterprise (HPE) and Pure Storage (PSTG). Right now, there’s enough AI enthusiasm and early investment into infrastructure fueling growth for all parties, but this may not be the case for an extended period of time.

Still, NetApp’s acceleration to double-digit growth in billings in the early innings of AI spending signal that the company has a multi-year expansion trajectory ahead. And with a cheap below-market P/E ratio plus a ~1.7% current dividend at current share prices ($0.52 in quarterly yield, or $2.08 annually) – I’d say there’s both enough valuation buffer and income incentive to keep us invested in NetApp. Stay long here and keep riding recent momentum upward.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NTAP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.