Summary:

- NetApp, Inc. beats earnings estimates, with FYQ2 2025 EPS and revenue surpassing expectations, driven by strong growth in its Hybrid and Public Cloud segments.

- NetApp’s focus on AI and cloud infrastructure is evident, securing over 100 AI and data-lake modernization wins and expanding partnerships with Google Cloud and AWS.

- Analysts have mixed ratings but raised price targets, citing macro concerns. NTAP’s solid execution and strategic positioning suggest a “cautiously optimistic” stance.

- NTAP trades at a reasonable valuation with a forward P/E of 16.8x, reflecting strong earnings growth and potential in AI and cloud segments. Rated as a Buy.

Morsa Images

NetApp, Inc. (NASDAQ:NTAP) is an intelligent data infrastructure company that provides software, systems, and services for hybrid and multi-cloud environments to clients across industries and the globe. The company was founded in 1992 and has around 11,800 employees, earning over $6 billion in revenue annually. Its Hybrid Cloud segment is its primary revenue driver that provides hardware and software for data infrastructure. Its smaller Public Cloud segment provides software solutions across all major cloud providers. With a market cap of over $26 billion, NTAP is an established stock in the IT space and one that is in a good position to benefit from the AI boom that has started in the last couple of years.

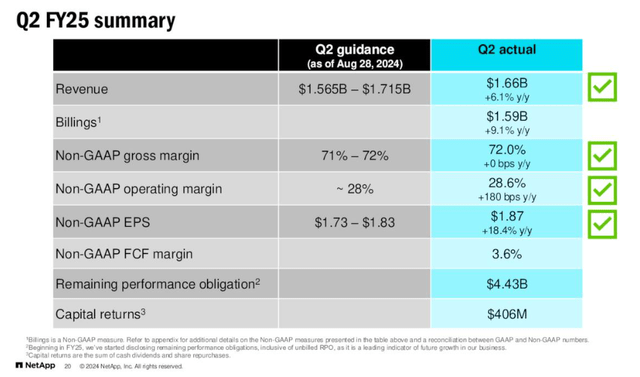

FYQ2 2025 Earnings

NTAP recently released FYQ2 2025 earnings results and posted beats over EPS estimates ($1.87 vs. $1.78 expected) and revenues estimates ($1.66B vs. $1.65B expected). The company is pretty consistently beating earnings estimates and is currently on a seven-quarter streak of topping revenue estimates as well. However, the sales surprise of 0.8% was the weakest in that string of beats. The better-than-expected results saw a tame reaction in the markets, as investors might have been expecting something more impressive given the boom seen in other companies related to AI.

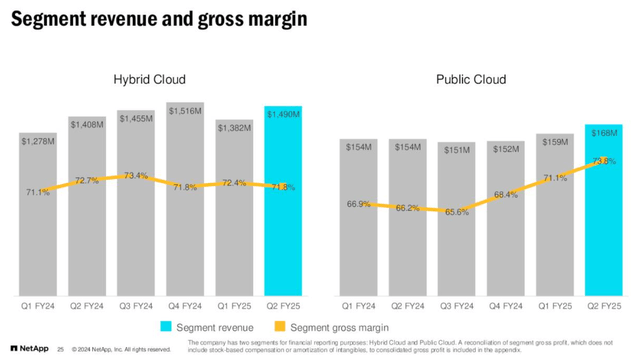

Top-line results reflected a continuation of stable, solid growth rates after the 2023 quarters. With net sales up 6.2% YoY in FYQ2, NTAP saw its second-largest increase in sales in the last four quarters. The Hybrid Cloud segment saw sales up 5.8% YoY and 7.8% QoQ, and the smaller Public Cloud segment saw slightly stronger growth of 9.1% YoY and 5.7% YoY. Most of the gain in sales came in the delivery of product (up 8.8% YoY and 14.8% QoQ) while support and professional services sales were mostly flat sequentially (1.3% QoQ) and slightly higher year-on-year (2.8% YoY). The area with the most explosive growth in FYQ2 was cloud storage services, growing 43% YoY, as this area saw sales grow from new business wins and partnerships with major cloud service providers. In general, top-line growth rates remain solid for NTAP, and that is summed up in its comprehensive annualized flash array revenue run rate growth of 19% YoY, which is the fourth consecutive quarter of high-teens to low-20s growth in that metric.

Moving to profitability, FYQ2 2025 results showed a mixed performance across segments. The large Hybrid Cloud segment saw gross margins contract -60 bps sequentially and -90 bps from a year ago to 71.8%, the joint lowest in the last five quarters. The decline in margins looks to be a result of rising component costs, specifically SSD costs, and the decision to try to lock in the supply of the component as prices rose throughout the year. In the smaller Public Cloud segment, the margin picture was much rosier. Public Cloud’s gross margins jumped 270 bps sequentially and 760 bps from a year ago to 73.8%, the first quarter that Public’s gross margin was higher than Hybrid’s. The success in the cloud operations helped to keep the overall non-GAAP gross margins unchanged YoY at 72.0% which is at the upper bound of the guidance of 71-72% set out for the quarter. Additionally, NTAP’s post-adjustment operating margin saw an increase of 180 bps YoY to 28.6%, topping FYQ2 guidance of ~28%.

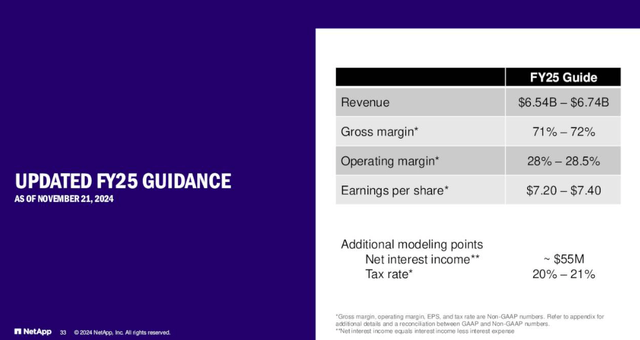

NTAP’s business expansion continued to show a focus on AI and cloud infrastructure. Management noted that it had secured “over 100 AI and data-lake modernization wins across geographies and industries” including some strong enterprise wins like Anaplan, Aruba, San Jose Sharks (NHL team), and Domino Data Labs. It also expanded partnerships with major cloud providers Google Cloud and AWS, where NTAP technologies will be used as data storage for AI-focused cloud services. Additionally, NTAP gained access to new opportunities in the US public sector through a distributor agreement with Carahsoft Technology. The new business growth caused an optimistic management to upgrade the full-year guidance of net sales for FY2025 from $6.48B-$6.68B to $6.54B-$6.74B. The strong reading of consolidated operating margins in FYQ2 also gave management confidence to raise guidance of that metric from 27-28% to 28-28.5%.

Analyst Reactions

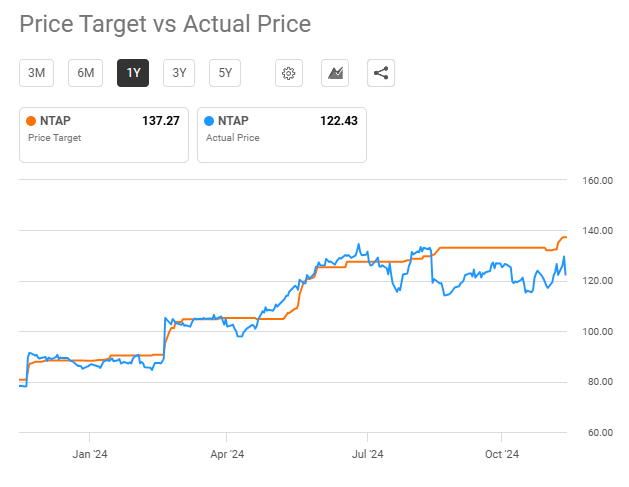

The reactions to NTAP’s earnings by analysts were mixed, with no changes in ratings on the stock. TD Cowen and Stifel remained the most optimistic, maintaining “Buy” ratings while analysts from other institutions stuck with neutral ratings (including “Neutral,” “Market Perform,” and “Equal-Weight”). BofA analyst Mohan did not move from his “Underperform” rating and was the most bearish. Despite there being no changes in ratings, every analyst raised their price target (even Mohan) following the earnings results, pushing the average target price across the major analysts up from $127.38 to $135.63 (in the chart, $137.27 refers to the average of all analysts covering NTAP). The general caution towards the stock comes from an assessment that the macro environment is still unfavorable to NTAP, and enterprise spend on storage is not increasing like analysts would like to see. There was an appreciation of the solid growth that NTAP showed in its results; although, there was also a feeling that the robust all-flash revenue growth could not be sustained.

SeekingAlpha

The analysts’ caution seems excessive given NTAP’s demonstrated execution and strategic positioning. While macro concerns are valid, the company has shown it can grow and take share even in a challenging environment. The stock trades at reasonable valuations given its growth and profitability profile, and the company has multiple growth drivers (flash, cloud, AI) that could support continued outperformance. A more appropriate stance might be “cautiously optimistic” rather than neutral/cautious, particularly given management’s proven ability to execute and the company’s strong positioning for emerging opportunities in AI infrastructure. Management noted in the conference call that the “large opportunity of enterprise AI is still ahead of us” which means that investors will probably need to wait for an NTAP AI boom, but the potential is there. The market’s initial negative reaction to strong results suggests sentiment might be overly pessimistic, potentially creating an opportunity for investors with a longer-term horizon.

Valuation

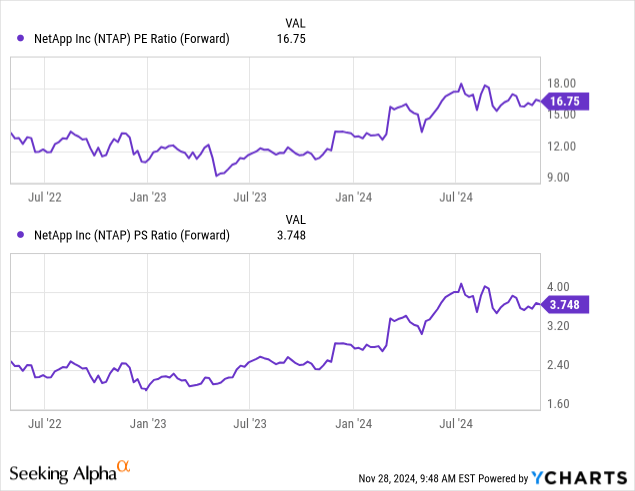

NTAP’s value comes from its ability to drive revenue growth into earnings growth through a business with solid margins. This is demonstrated through the differences between its price-to-sales (P/S) and price-to-earnings (P/E) ratios. The market currently trades NTAP with a forward P/S multiple of 3.75x, which is high relative to the technology sector’s already elevated median of 3.20x. However, strong earnings growth has NTAP’s forward P/E ratio at 16.8x, which is cheap for a technology stock (median for the sector is 25.4x) that has exposure to the AI trend.

In the end, the valuation driver of gains relies on NTAP maintaining solid profitability through the continued expansion of its business, even if that expansion slows in a tougher macro environment. I rate NTAP as a Buy with an eye on future earnings results to monitor its profitability as it grabs market share in the AI and cloud segments.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.