Summary:

- I believe NetApp’s valuation at 17x forward non-GAAP EPS is attractive for a tech company with its growth potential.

- I’m impressed by the company’s focus on AI workloads, cloud integration, and flash storage, which are key growth drivers.

- NetApp’s ability to outpace the S&P500 since my initial bullish call further supports my confidence in its future performance.

- Despite a competitive market, I trust NetApp’s raised guidance and 15% EPS growth potential make it a worthy long-term investment.

Erik Isakson

Investment Thesis

NetApp (NASDAQ:NTAP) is a tale of two parts.

The bear case is rather straightforward. As we look ahead over the next twelve months, this is a tech company that is barely delivering mid-single growth rates. That’s never a good position for a tech company, as the multiple that investors are eager to pay can suddenly compress if a company is perceived to be a dead company walking.

That being said, the saving grace here is that investors are only asked to pay around 17x forward non-GAAP EPS.

Thus, as far as IT storage providers go, there’s little doubt that NTAP is attractively valued.

Rapid Recap

Back in March, I said,

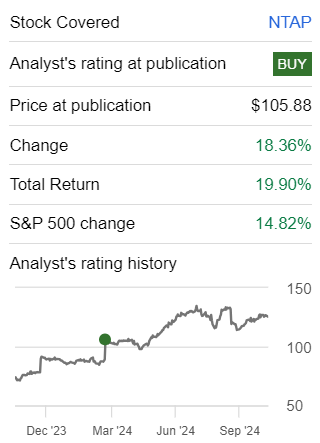

[…] not only has NetApp reached record profitability, but it turns out that there’s still some growth left in this business.

Author’s work on NTAP

Since I made that bullish call, NetApp has been a strong performer and nicely outpaced the S&P500. Now, looking ahead, I remain bullish.

Why NetApp? Why Now?

NetApp provides a comprehensive storage and data management platform, enabling businesses to manage and protect their data across diverse environments, from on-premise to cloud domains.

Their solutions, particularly in flash storage, help customers manage data efficiently for various applications, including mission-critical tasks.

NetApp’s value proposition lies in its ability to simplify cloud integration, AI workloads, and address complex data challenges, all the while providing flexibility to operations.

In the near term, NetApp is cautiously optimistic in its unique data infrastructure solutions, particularly as it raised its guidance for fiscal 2025 a smidge.

The company has experienced strong demand in key areas like all-flash storage, with notable wins in AI and cloud environments.

In sum, NetApp is well-positioned to continue to capitalize on cloud storage and flash market opportunities.

Given this background, let’s now discuss its fundamentals.

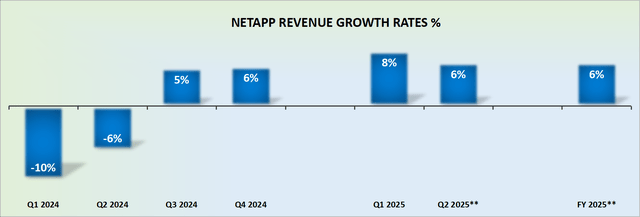

Revenue Growth Rates Continue to Tick Along

Allow me to provide further context. This is what I said in my previous analysis:

[…] given that the next couple of quarters’ comparables are very easy to compare against, this will allow NetApp to deliver close to double-digit growth rates all the way into fiscal H1 2025, simply from the business performing “as is”, without a lot of new customer growth.

Simply put, there’s a situation where the status quo will allow NetApp to shine, and for management to put forth an alluring turnaround narrative.

Fiscal Q2 2025 hasn’t yet been reported, but given management’s guidance, I believe that approximately 6% topline guidance, is approximately what we are likely to get.

Therefore, this means that my expectation for ”close to double-digit growth rates all the way into fiscal H1 2025” did not turn out as I forecast.

Therefore, to put it bluntly, this means that NetApp’s revenue growth rates are struggling against what was going to be an easy period for the company. And as it comes up against its most challenging period, we are going to end up with rather meek growth rates.

That’s the bear case, front and center. Now, onto the bull case.

NTAP Stock Valuation — 17x Forward Non-GAAP EPS

As an Inflection investor, it’s important to get a sense of the financial footing of the company you are backing. This takes a few minutes, you don’t need to be overly detailed. Simply put, is the company’s balance sheet an asset to your bull case or not?

Generally, I like to back companies that have a strong net cash position, where the net cash position reaches 10% of the market cap.

On this note, NetApp doesn’t fare strongly. More specifically, there’s approximately $600 million of net debt, which means that its net cash position stands at approximately 2% of its market cap.

Next, looking ahead over the next twelve months, it appears that NetApp is on a path towards approximately $7.50 of EPS. This consideration assumes that NetApp’s underlying profitability continues to outpace its topline growth, and grows by approximately 15% y/y, as a forward run-rate from fiscal Q2 2025.

This means that NetApp is priced at 17x forward non-GAAP EPS. This is not an excessive valuation, and it’s attractive enough, that keeps me bullish on this stock.

Investment Risks

The main risk here is the most obvious one, that I’ve discussed amply already. NetApp needs to convince investors that it has what it takes to continue delivering some topline growth into the back end of fiscal 2025, and into next year. If it fails to do so, then, investors are rapidly going to become anxious.

If investors become concerned over NetApp’s medium-term prospects, the stock will become highly volatile, and the smooth sailing that investors have had since I made my bullish call, will turn into a stock that is not ”for the faint-hearted”.

What’s more, keep in mind that NetApp operates in a highly competitive sector, particularly in storage and cloud services.

While the company continues to capture market share in flash storage and AI solutions, it also faces stiff competition from hyperscalers in public cloud and data management services, with the obvious names being Amazon’s AWS (AMZN) and Microsoft Azure (MSFT), but there’s plenty more too.

This will continue to impact NetApp’s near and medium-term growth prospects.

The Bottom Line

NetApp presents a compelling investment opportunity right now due to its reasonable valuation and steady growth potential.

At 17x forward non-GAAP EPS, the stock offers an attractive entry point, especially considering its focus on profitability and the potential for 15% EPS growth.

While its revenue growth may not be stellar, NetApp’s position in flash storage and cloud integration positions it to capitalize on key trends in AI and data management.

The company’s cautious optimism for fiscal 2025 and its raised guidance indicate that it can navigate the competitive landscape and continue to deliver value to shareholders.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.