Summary:

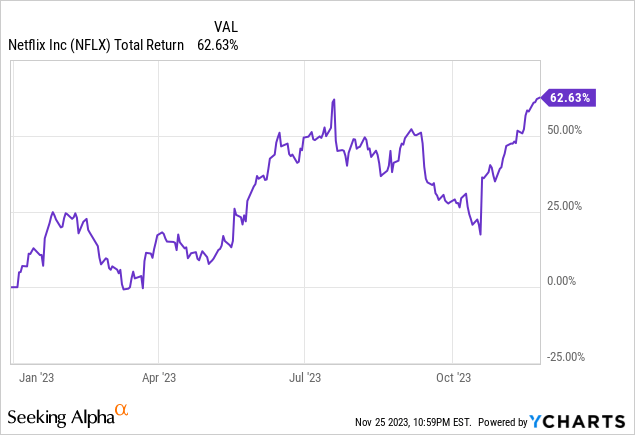

- Netflix shares have risen by 63% in 2023 due to various factors including a tech sector rally, crackdown on account sharing, pricing increases, and the launch of an ad-supported tier.

- Streaming is highly competitive, with Netflix facing competition from YouTube, Disney, Amazon, and others resulting in a thin moat.

- NFLX has had success in raising prices historically but recent data suggests pricing power going forward may be more limitd.

- NFLX has enjoyed a significant boost in membership growth over the past few quarters due to a crack down on password sharing but this is likely to provide only a short-term boost.

- The company trades at a fairly high valuation which leaves just a slim margin of error and thus I am initiating NFLX with a hold rating.

hapabapa

Shares of Netflix (NASDAQ:NFLX) have risen by 63% so far in 2023. The move higher was driven by a number of factors including a broad tech sector rally, a crackdown on account sharing, pricing increases, and the launch of ad supported tier.

While NFLX has delivered strong returns for shareholders over the long-term, there are four reasons why I am currently cautious:

1. Streaming is a highly competitive business which results in a relatively thin moat for NFLX

2. Future price increases may be more limited as prices are approaching consumer willingness to pay

3. Subscriber growth rates are likely to moderate as growth driven by paid sharing slows

4. The stock trades at a very high valuation and thus the margin of safety is currently very low

1. Streaming is a highly competitive business which results in a relatively thin moat

While NFLX was the pioneer of the streaming business, it now competes with many other players. Competitors include YouTube (owned by Alphabet), Disney (DIS), Amazon (AMZN), Paramount (PARA), Comcast (CMCSA), Warner Bros Discovery (WBD), Apple (AAPL), and others.

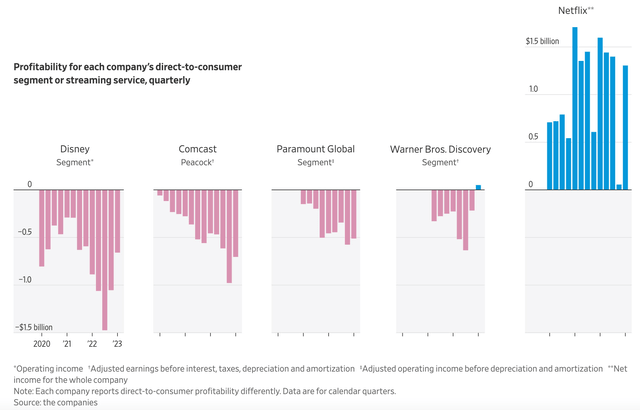

The high level of competition in the industry has created a situation in which many of the leading platforms have been losing significant amounts of money.

NFLX stands out as the most profitable of the major streaming platforms. NFLX has benefited due to its scale (i.e. having a very large subscriber base to spread out the cost of new content) but the ability to continue generating strong results rests upon the company’s ability to deliver high quality content. Thus, NFLX must invest heavily each year in content creation to maintain its edge vs other platforms.

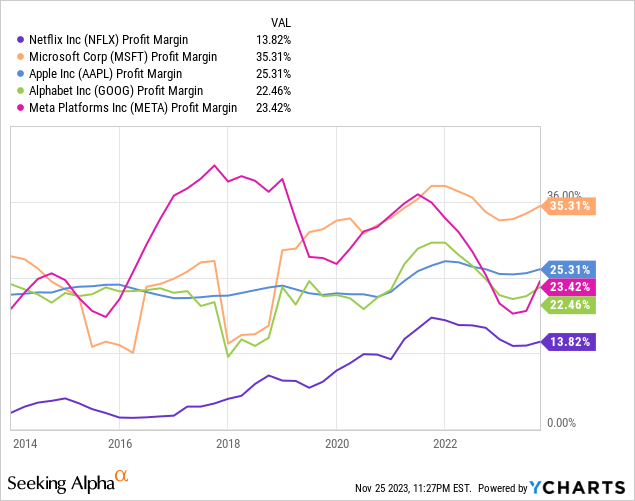

While NFLX has been able to generate best in class margins, the company still has net profit margins in the low double digits. Comparably, other companies with stronger moat’s such as Apple, Alphabet, Meta, and Microsoft have significantly higher net profit margins.

Wall Street Journal

2. Future price increases may be more limited as prices are approaching consumer willingness to pay

On October 18, 2023 NFLX announced a series of price increases in the U.S., UK and France. In the U.S., NFLX increased the price of Basic subscriptions by $2 to $11.99. NFLX also raised the price of Premium subscriptions by $3 to $22.99. Prices in the UK and France increased by a similar amount.

This price increase follows increases in January 2023 of a slightly smaller magnitude. In January 2023, NFLX raised the price of its Basic subscriptions by $1 and its Premium subscriptions by $2.

In 2013, NFLX rolled out is Premium offering at a price of $12 per month and has steadily increased prices overtime. However, I believe the company may now be pushing the upper limits in regards to how much it can increase prices.

A Forbes Home survey released in March 2023, which was after NFLX raised prices in January 2023, found that 35% of respondents would unsubscribe from NFLX is it increased fees and password sharing rules are enforced. While NFLX has continued to see subscription increases despite password sharing crackdowns, I believe this survey is important to consider as it suggest NFLX may have more limited pricing power going forward.

It is difficult to make a precise estimate of what consumer willingness to pay for NFLX products is but I believe we may be getting closer to an inflection point and the risk of NFLX overreaching has increased.

3. Subscriber growth rates are likely to moderate as growth driven by paid sharing slows

In April 2022, NFLX posted a loss of 200,000 subscribers for Q1 2022. In response to declining subscriber growth trends the company began testing a paid sharing strategy in Chile, Costa Rica, and Peru. The paid sharing program is NFLX’s way to crackdown on password sharing. NFLX began rolling out its paid sharing program globally including in the U.S. in May 2023.

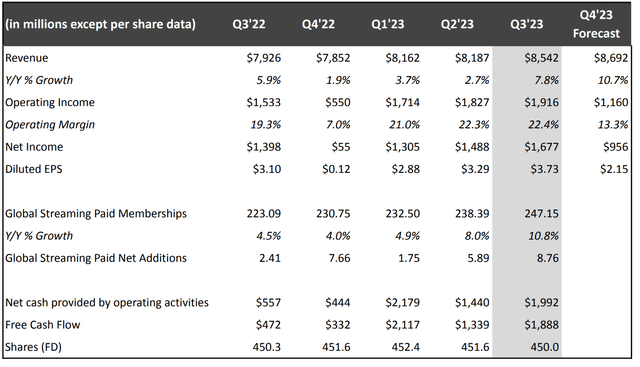

The paid sharing program has been hugely successful and led to a major acceleration of subscriber growth for NFLX in Q2 2023 and Q3 2023. As shown by the chart below, NFLX paid membership YoY growth has accelerated from a recent trough of 4.0% in Q4 2022 to a rate of 10.8% in Q3 2023. The company expects Q4 2023 paid membership additions to be similar to Q3 2023. Assuming the company adds another 8.76 million paid members in Q4 2023, the total paid membership count will increase to 255.91 million members representing a 10.9% YoY growth rate vs Q4 2022.

I believe the recent growth rate in terms of memberships is not sustainable as much of the low hanging fruit in terms of paid sharing conversions will be finished over the next few quarters. Even NFLX management expects membership growth to moderate going forward.

On the Q3 2023 earnings call NFLX CFO Spence Neumann said:

So 2023 was a pretty unusual year where essentially all of our growth came from member growth. And going forward, more broadly, not just 2024 and beyond, we’ll grow our business by continuing to kind of improve our service, increasing engagement, increasingly satisfying current and future members. And now that, as Greg discussed, I know we’ve got an account sharing solution, we have a more clear path to more deeply penetrate that big addressable market of a half a billion connected TV households and growing. And with our continued plan evolution, pricing sophistication and all that hard work on our ads business, we’ll keep getting better at monetizing that big and growing reach and engagement.

So we believe – we’ve got a long runway for growth in both kind of more membership and higher ARM over time in a more balanced way than what you saw this year, which was again a pretty unusual year.

It is interesting to note that revenue growth has been slower than paid membership growth. During Q3 2023 average revenue per membership (“ARM”) decrease 1% on a YoY basis. The company attributed declining ARM to a number of factors including a higher percentage of membership growth from lower ARM countries, limited pricing increases over the past 18 months, and some shift in plan mix.

Given the lack of ARM growth, I believe revenue growth in the near-term will be driven by membership growth. Thus, as membership growth rates moderate due to the fact that paid sharing growth is mostly played out I believe NFLX revenue growth will moderate as well

NFLX Shareholder Letter

4. The stock trades at a very high valuation and thus the margin of safety is currently very low

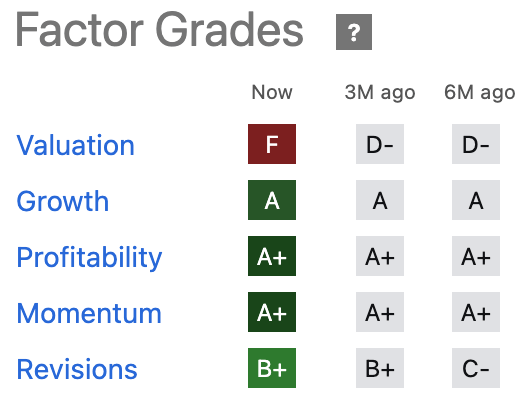

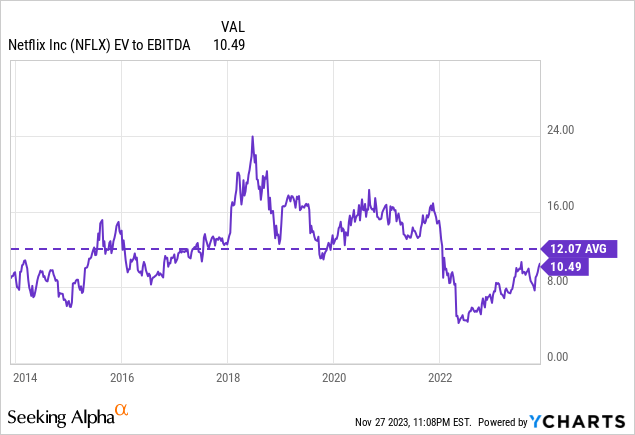

Currently, NFLX receives a valuation grade of F from Seeking Alpha quant scores. I tend to agree.

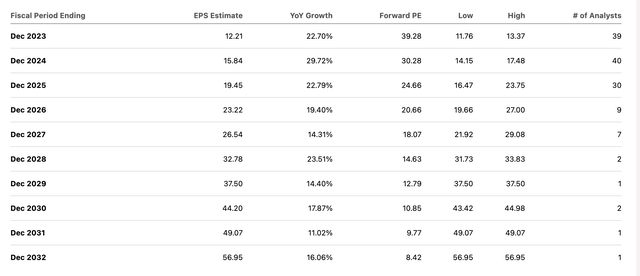

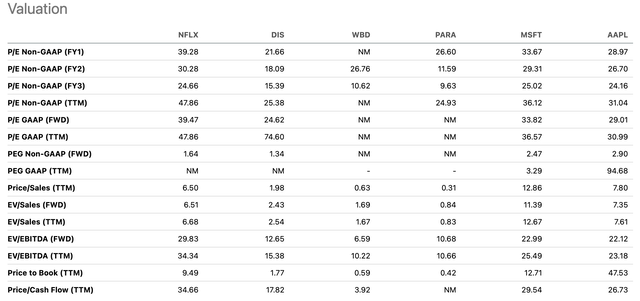

The company trades at 30.3x consensus estimated FY 2024 earnings and 24.6x consensus estimated FY 2025 earnings. Comparably, the S&P 500 trades at ~18.7x consensus FY 2024 earnings. However, NFLX is expected to grow EPS at a much faster pace than the S&P 500.

NFLX EPS is expected to grow by 30% in 2024 and by 23% in 2025 before decelerating to a mid teens growth rate in the following years. If NFLX is able to meet these growth rates, the current valuation may be reasonable. However, I believe a lot of the low hanging fruit has already been picked in terms of price increases bringing the product closer to customer willingness to pay and a global crackdown on password sharing which has led to significant paid sharing membership growth.

Given the highly competitive nature of the streaming business, I am not confident that NFLX will be able to grow EPS at mid teen percentages over the next 10 years as analysts currently expect.

In terms of valuation relative to peers, NFLX is currently trading at a significant premium to DIS, WBD, and PARA. While NFLX does deserve to trade at a premium valuation to these companies due to a stronger business, the company’s high valuation leaves very limited room for operational errors. NFLX is trading at a valuation which roughly inline with mega cap tech companies Microsoft (MSFT) and Apple (AAPL). While NFLX is a very different business, I think MSFT and APPL are relevant comps as they represent high some of the highest quality wide moat businesses in the world. Comparably, while NFLX has better growth potential, the company has a much weaker moat around its business. For this reason, I do not find NFLX’s current valuation attractive compared to these companies.

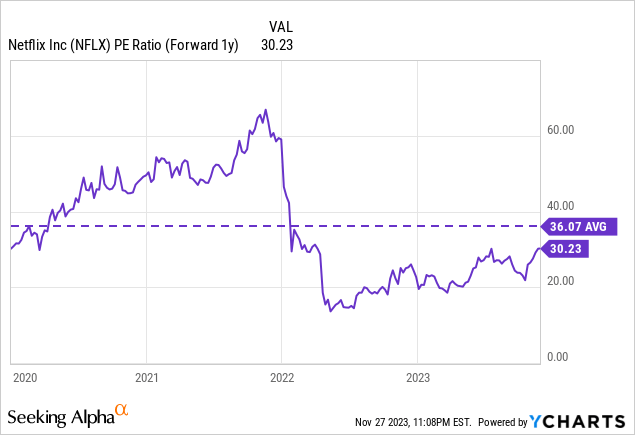

In terms of valuation relative to historical norms, NFLX is currently trading at a modest discount. However, I view this discount as warranted given that the company is now more mature and faces more competition than was previously the case. Over the past 5 years, NFLX has grown EPS at a 29% CAGR and revenue at a 17% CAGR. I believe it will be very difficult for NFLX to grow at these levels going forward.

Given the relatively steady nature of NFLX earnings power and cash flow generation going forward, it is also appropriate to consider a DCF valuation. As shown by the analysis below, when assuming fairly optimistic near-term free cash flow growth through 2033 NFLX still requires a terminal free cash flow rate of ~8.5% to be fairly valued based on the current share price.

Key assumptions in my analysis include a ~16% free cash flow generation drop for FY 2024 vs FY 2023 as the company has noted that it expects content costs to increase from $13 billion in FY 2023 to $17 billion in FY 2024 which will be offset by increases in cash from operations. For 2025 and 2026, my analysis assumes a free cash flow growth rate of 20% which steps down to 15% for 2027 and 2028. These growth rates are generally conservative relative to consensus earnings growth rates. For the period 2029 to 2023, I assume free cash flow growth steps down incrementally until reaching a terminal growth rate in 2033.

While it is difficult to project free cash flow far into the future, I believe this analysis highlights that fact that NFLX has very limited room for error based on its current valuation.

Seeking Alpha

Seeking Alpha

Seeking Alpha

Author

Potential Upside Drivers

While I believe there are good reasons to be cautious on NFLX right now, there are also a number of key upside drivers that investors should be aware of. Perhaps the most significant potential upside driver is revenue growth related to advertising. NFLX is in the very early stages of monetizing its ad-supported tier and is working with Microsoft on its sales strategy. However, the company does not expect advertising to be a significant near-term revenue driver. Over the long-term NFLX believes that advertising revenue has potential to grow to be a multi-billion dollar revenue stream over time.

Another potential driver of significant revenue growth is if NFLX is able to successfully enter the gaming space. On the Q3 earnings call the company highlighted the potential opportunity:

Well, let’s start with the big prize. I think that’s the better way to look at it, which is games is a huge entertainment opportunity. So we’re talking about $140 billion worth of consumer spend on games outside of China and outside of Russia. And from a strategic perspective, we believe that we can build games into a strong content category, leveraging our current core film and series by connecting members, especially members that are fans of specific IPs with games that they will love.

I think it’s worth noting that if we can make those connections and as we make those connections as we’re seeing, we’re essentially sidestepping the biggest issue that the mobile games market has today, which is how do you cost effectively acquire new players. So that’s the real proposition. And we think if we deliver that, we give members great games, entertainment experiences that they love at sufficient scale. Then we leverage back into the core business.

Finally, another potential driver of near-term upside is the company’s share repurchase program. NFLX recently increased its share buyback authorization by $10 billion. The total buyback authorization is now $10.8 billion which represents ~5% of the company’s share count at current levels. If NFLX is aggressive in terms of implementation, the reduction in share count has potential to be a key additional driver of EPS over the next few years. Additionally, NFLX may choose to use additional free cash flow to further increase its buyback program going forward.

Conclusion

NFLX shares have rallied sharply in 2023 as the company has delivered very strong results. These results are particularly impressive given the weak financial performance by other streaming focused companies over the past year.

NFLX operates in a very competitive industry and thus has a relatively thin moat around its business. The company generates only mid teens profit margins compared to other technology companies which generate significantly higher margins.

Recent price hikes have played a key role in revenue growth. While the company just announced another set of aggressive price hikes in key markets, I believe NFLX is approaching customer willingness to pay and may find it difficult to raise prices further from here.

Membership growth has accelerated over the past few quarters as the company has been very successful in its password sharing crackdown strategy. The result has been a significant increase in paid sharing. I view this growth as mostly played out and expect the company to return to more moderate membership growth rates going forward.

NFLX trades at a premium valuation to the S&P 500 and peers. While the company is growing faster than the S&P 500 and peers, the premium valuation does not leave the company much room for error.

For these reasons, I am initiating NFLX with a hold rating. However, I would consider upgrading the stock if the valuation picture improves. Additionally, I would consider upgrading the stock if the company shows it is able to execute on its adverting and gaming opportunities.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.