Summary:

- We have initiated a walk of shame for now, given how we have belatedly turned bullish on Netflix, Inc., despite our previous bearish stance.

- It’s better to be late than never since Netflix has demonstrated that it deserves its premium P/E valuations compared to its streaming peers.

- We recognize that subscription growth has been erratic of late, significantly destabilized by the recent launch of an ad-supported tier amid worsening macroeconomic outlook.

- Early reports of its ad-supported tier show notable cannibalization effects as well, with 43% comprising downgraders in November 2022.

- However, we choose to remain patient for now since Netflix comprises a tiny fraction of our portfolio for now. Only time will tell.

scyther5

We have previously covered Netflix, Inc. (NASDAQ:NFLX) here as a pre-earnings article in October 2022. Its ad-supported tier has been viewed as a risk to its profitability, due to the potential cannibalization effect. The management’s choice to go with CPM rates of up to $65, halved monthly subscription fees, and minimal ad minutes per hour seem unlikely to yield success as well. Especially when compared to the industry standards of a $20-$30 CPM rate and up to twenty minutes of ads per hour.

For this article, we will be focusing on NFLX’s early performance in the ad-supported tier, with November reports being relatively pessimistic. However, we will also discuss why we have chosen to add now, despite our overly bearish stance in the past. Netflix, Inc. has proven to be GAAP net income profitable in its streaming-only segment, with many of its peers struggling to even achieve positive EBIT margins. In the short term, its strong subscription numbers may also mitigate the macroeconomic headwinds.

Investment Thesis – This Is Why NFLX Commands The Premium Valuations

Author’s Historical Rating On NFLX

It may be a hard pill to swallow, however, we have been very wrong about NFLX after all. It is worth explaining why we have belatedly turned bullish on the stock and have added a very small position to our portfolio as a result.

NFLX has been able to generate impressive profitability in the global streaming market, despite its elevated expenses thus far. In the last twelve months [LTM], the company reported a 9.63% YoY growth in the cost of goods to $19B, 9.4% in operating expenses to $6.75B, and -11.90% in capital expenditure to $0.46B. Despite so, it continued to record impressive EBIT margins of 18.2%, leading to an excellent YoY growth of net income by -1.36% to $5.04B and Free Cash Flow by 643.27% to $717.01M at the same time. These metrics are important, since D2C profitability has been a challenge for other streaming companies.

Disney’s (DIS) D2C has significantly underperformed, with EBIT margins of -30% in the last quarter, partly attributed to the higher subscription growth from lower-priced markets. Its lack of profitability has naturally raised concerns among investors, which has hurt its theme parks and cable networks excellent earnings so far. It also remains to be seen how much advertising revenue Disney+ can garner from its recently launched ad-supported tier in December 2022, since November results show that NFLX has underperformed.

Warner Bros. Discovery (WBD) similarly recorded an abysmal EBIT margin of -27.4% for its D2C segment in the latest quarter, despite the excellent advertising revenue of $2.04B growing by 10.41% QoQ. However, we may see a potential boost ahead, due to the pulled-forward HBO Max/Discovery+ streaming service by spring 2023. The management has also guided raised subscription prices for HBO Max next year, potentially improving its top-line and margin expansion then. Nevertheless, it remains to be seen when WBD can match NFLX’s excellent EBIT margins in the D2C segment.

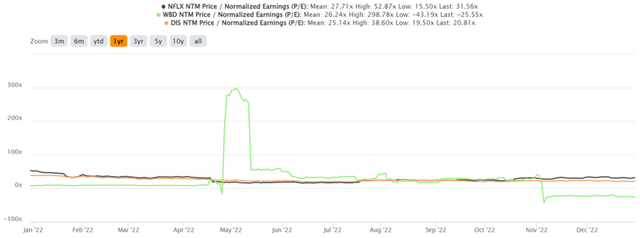

NFLX 5Y EV/Revenue and P/E Valuations

Therefore, we can now understand why NFLX continues to trade at a premium, compared to its streaming peers. The stock is currently trading at an NTM P/E of 31.56x, lower than its 5Y mean of 64.03x though higher than its 1Y mean of 27.71x. Its streaming peers, such as DIS and WBD, are naturally trading at lower NTM P/E of 20.81x and -25.55X, respectively. Based on NFLX’s projected FY2025 EPS of $16.82 and current P/E valuations, we are looking at an aggressive price target of $530.8, with an excellent 80.01% upside potential. On the other hand, Mr. Market is more pessimistic than expected due to its price target of $298.28, suggesting a minimal margin of safety for those who chose to add at current levels. However, we choose to be unusually optimistic, due to the strength of its excellent subscription thus far.

While NFLX may also report elevated debts of $13.88B and annual interest expenses of $725.04M, we must also highlight the fact that these numbers have been moderating by -12.20% and -5.53% since FY2020 levels, respectively. Furthermore, its balance sheet proved robust, with $6.11B of cash/ investments, safeguarding its liquidity at a time of macroeconomic uncertainty. DIS may boast an expanded cash/ investments of $11.61B against WBD’s $2.42B in the latest quarter, however, both companies reported tremendous debts of $45.29B and $48.61B as well. These explain their higher annual interest expenses of $1.54B and $2.13B at the same time.

The deal is made even sweeter with Netflix, Inc.’s leading subscription of 223.09M globally for the latest quarter, compared to Disney+ at 164.2M, Peacock at 18M, Paramount+ at nearly 67M, and Warner Bro Discovery at 94.9M. Then again, we recognize that the rate of growth has been erratic over the past few quarters. As discretionary spending tightens, the launch of its ad-supported tier in November 2022 and the suppression of password sharing from 2023 onward may also hurt its subscription growth. Though we remain optimistic about NFLX’s long-term prospects, subscription headwinds remain a concern for its stock valuations in the near term.

Early Reports Of NFLX’s Ad-Supported Tier Are Unfortunately Not Promising

Unfortunately, Netflix, Inc.’s ad-supported tier proved less popular than expected, with Antenna reporting a minimal 9% new November sign-ups in the U.S. Of those, a cannibalization effect has notably occurred, with 43% downgrading from its premium plans, with others either signing up for the first time or rejoining the service. This early report differs tremendously from WBD, which recorded a robust 15% new sign-ups in its first month, with only 14% downgraders.

Moreover, NFLX’s advertising revenue is uncertain in the short term, since it reportedly had to refund advertisers when viewership failed to meet expectations by a large margin of 20% in November 2022. According to agency executives, their initial deals were structured on a “pay-on-delivery” basis, where advertisers will only pay for viewership originated. The unspent ad dollars would later be refunded at the end of the quarter. This strategy naturally differs from conventional TV networks, which usually owe advertisers future viewership instead. Therefore, NFLX’s transition from subscription to hybrid streaming may be fraught with challenges indeed.

NFLX’s ad pricing has proven to be overly ambitious as well. Originally, the company sought $65 CPM, exceeding Disney+’s $50 CPM and the industry standard of $20-$30 CPM. In light of its early underperformance, advertisers will likely negotiate for an even lower price than the current contract agreement of $55 CPM. The lowered advertising revenue may trigger more headwinds in the company’s forward profitability and stock valuations indeed. Only time will tell, since things are still rapidly developing, significantly worsened by the worsening macroeconomics.

However, in light of Netflix, Inc.’s stellar performance thus far, we have decided to remain patient and optimistic, while the management works out hybrid streaming over the next few quarters. In the meantime, hesitant investors may still wait a little longer and look forward to its upcoming FQ4’22 earnings call on 19 January 2023. It would be particularly interesting to hear what the management has to say about the ad-supported tier indeed. We reckon that it would be a highly anticipated conference, seeing that DIS has also launched a similar tier, though at a slightly higher entry price.

In the event that Antenna’s report is correct, we might see a moderate Netflix, Inc. stock retracement ahead, further testing its previous support level at $214 in October 2022.

Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.