Summary:

- Netflix’s leadership in streaming, robust first-party content, and tech-first approach justify a buy rating, despite competition and high valuation.

- Recent earnings show strong revenue and EPS growth, with increased subscriber additions and ARPU, supporting positive full-year guidance.

- The firm is expanding into advertising, with 45% of new sign-ups choosing ad-supported options, aiming to diversify revenue streams.

- Key risks include high valuation, competition, and the need to develop advanced advertising technology, but Netflix’s history of execution inspires confidence.

bymuratdeniz

Introduction

Netflix (NASDAQ:NFLX) is the global leader in streaming video on-demand or SVOD. The firm has close to 280 million global subscribing households and given the average household size is likely greater than two, this means the company reaches close to 600 million end users.

The firm is an iconic brand whose history was forged in the disruption of linear TV. Originally the firm licensed content to stream over the internet but since 2013, in an initiative led by current co-CEO Ted Sarandos, the firm leaned into creating first party content. This initiative was massively successful, leading to hit shows such as Stranger things, Black Mirror and Narcos which have proved essential for growing a loyal and sticky user-base.

Netflix has enjoyed a substantial first-move advantage in streaming and it enjoys the benefit of being able to continue to invest through internally generated cash, without being encumbered by managing a declining legacy media business at the same time. Netflix faces increasing competition from the likes of Disney (DIS), Warner Bro. Discovery (WBD) and Comcast (CMCSA). However, I believe Netflix’s head start, tech-first approach, top-tier management and market leading content production will allow the stock to continue winning.

I recommend Netflix as a buy on a reasonable valuation when adjusted for growth and the likelihood that advertising will allow the growth engine to keep marching forward.

Recent Earnings

Netflix reported strong Q2 earnings in July with revenue growth of 17% and an excellent EPS growth of 48%. The firm continue to execute upon its strategy of growing the top line while boosting margins and delivering operating leverage, leading to an out-sized bottom line gain. The results were highlighted by net subscriber additions of 8 million along with an increase in the average revenue per user or ARPU of 5%. The strength of the results allowed management to nudge up their full year guidance, as they now expect to deliver top-line growth of 14-15% for the full year 2024 while achieving an operating margin of 26%.

The firm also announced prior to earnings that they had secured rights to stream Christmas NFL games over the next three years. The deal to show prime time NFL games is the continuation of an on-going strategy to gradually expand the firms core offering to include select sports events. On the earnings call management noted they favor one-off showpiece games rather than entering into full rights deals with sports leagues due to the prohibitive cost of sports rights as evidenced by the recent NBA renewal contract. A more targeted approach to sports allows Netflix to be involved without required the huge capital commitment.

Advertising

A key takeaway for me from the first Q2 earnings was the emphasis on creating an advertising platform to drive the company forward and diversify revenue beyond the core subscription model. Management noted that in markets where ad-supported Netflix is available, 45% of new sign ups chose the ad-supported option.

“And there’s sort of two main fronts here. One is our go-to-market capability. So we’re adding more sales folks, we’re adding more ads operation folks, building our capabilities to meet advertisers. A big component of that is giving advertisers more effective ways to buy Netflix. It’s a big point of feedback that we heard from advertisers”. (Greg Peters, co-CEO)

The main challenge for Netflix is not demand from advertisers, rather its ensuring the ad-technology is up to the required standard that advertisers have come to expect. Advertisers want quality analytics so they can ascertain who their ads are being seen by and how efficacious the ads are in translating to business. Netflix is at its roots a silicon valley tech disrupter, I have no doubts that management will navigate the required investment into, and development of the required tech infrastructure.

Valuation

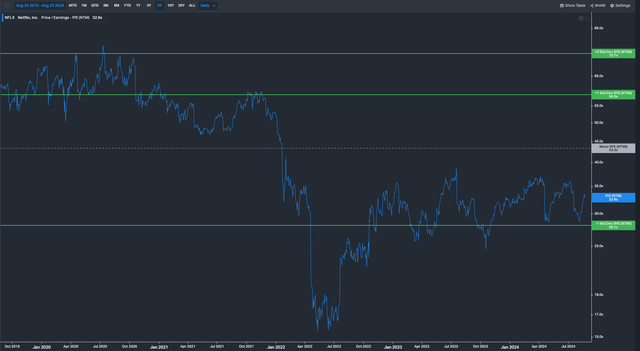

Netflix is a tricky stock to value based on history as it is only in recent years that the stock has started to see meaningful flow through to the bottom line. As the business has achieved greater scale they have had the ability to maintain robust top-line growth while boosting margins and thus profitability. Just seven year ago the firm was generating a measly 7% operating margin vs closer to 24% today. Given the firm has started to earn meaningful margins the P/E ratio has become more relevant. Looking below we see the forward P/E for the firm is around 33x.

In absolute terms this is a reasonably expensive multiple, especially given the overall S&P 500 is trading at around 24x and high quality stocks such as Meta (NASDAQ:META) and Google (NASDAQ:GOOG) are trading for below 25x.

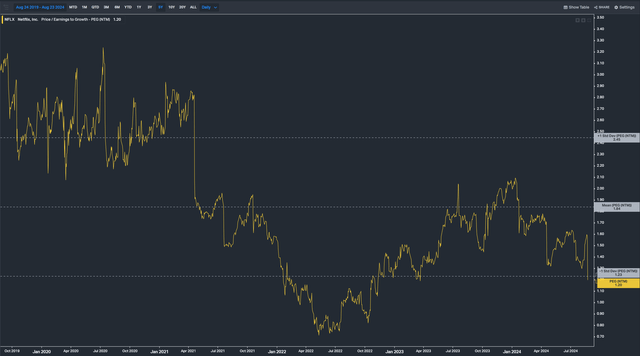

However, when we bring forecast earnings into consideration I think the valuation looks quite compelling. Netflix is trading on a PEG ratio of just 1.2x which is historically cheap for the stock. The flow of steady top-line growth into the bottom line is only expected to continue in the same vain as recent history. Analysts are expecting medium term growth of over 27% CAGR for the stock, an expectation which I believe justifies the headline P/E multiple.

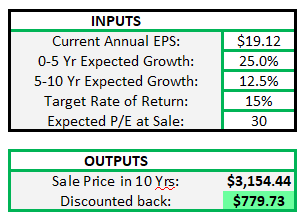

For my own DCF analysis I use a slight discount to analyst consensus for the first stage of growth, analysts are forecasting 27% I have chosen to discount this to 25%. The second stage of growth is tricky to model as there is a wide range of potential growth rates. I have chosen to pick a value which is half of the first stage. My rationale for choosing this value is growth will inevitably slow as time progresses. However, the combination of continued margin improvements with scale and healthy FCF supporting share buy backs, should allow the earnings to sustain a low double-digit rate into the future.

Author Calculation

Risks

In my opinion there are three key risks investors should be aware of when investing in Netflix. The first risk is the valuation, on an absolute P/E basis Netflix is undeniably expensive. As I have laid out above, the stock is not expensive on a relative basis vs its history and when we consider a PEG basis the valuation appears ok. However, the PEG basis relies upon growth forecasts which of course could turn out to be overstated.

The second risk investors ought to be cognizant of is the threat to Netflix’s leadership in streaming from other players, including traditional media player which are ramping efforts to become competitive in streaming. I believe Netflix has built a sufficient moat around its business by taking the wise step many years ago to lean heavily into first party content.

The final big risk I see, is the risk that management fail to successfully build out cutting edge advertising technology. A core part of the future of Netflix I believe will be as a go to destination for advertisers as linear TV continues its secular decline. On the most recent earnings call, management noted there is work to do on the technology to allow advertisers sufficient ability to correctly target ads and generate analytics to assess efficacy. Netflix has always been a disruptive tech-first firm, I have confidence management will be able to successfully develop the necessary tools to become an advertising powerhouse.

Conclusion

In conclusion, I am recommending a buy on Netflix given its clear market leadership in streaming. As discussed above I believe the firm is ripe to pick up significant advertising dollars as marketers divert flows away from linear TV which is undergoing a secular decline. Netflix unlike the majority of its streaming competition is free to focus on its core business without the management distraction from managing a declining side of the business.

Netflix is a proven top-line compounding stock over time and in recent years we have seen the firm increasingly boost margins and profitability. The business invests heavily in first-party content which has been important for building up proprietary IP to keep audiences engaged, the business is now fully self funded through cash generation.

Management have some work to do getting the advertising platform up to the required standard, but given the firms history of execution I am expecting this winner to keep winning.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.