Summary:

- Netflix, Inc. still has significant potential for long-term growth, as the economics of the ad tier look very promising.

- Rise in free cash flow paves the way for more share buybacks.

- There was modest growth in Netflix subscribers in Q1 2023, but that was largely expected.

Brandon Bell

Investment thesis

Netflix, Inc. (NASDAQ:NFLX) is tinkering with how it monetizes its content. It is cracking down on password sharing and hopes to convert borrowers into subscribers. Moreover, it has introduced an ad tier that was initially aimed at more price-sensitive viewers. However, based on the latest information from management, the revenue generated from the ad tier is on par with the standard plan. This means that the ad tier widens the potential customer base without being dilutive to the average revenue per membership.

I believe that Netflix is about to enter a new growth stage that sees ads as a major driver of incremental revenue. I upgrade my rating on Netflix to Buy.

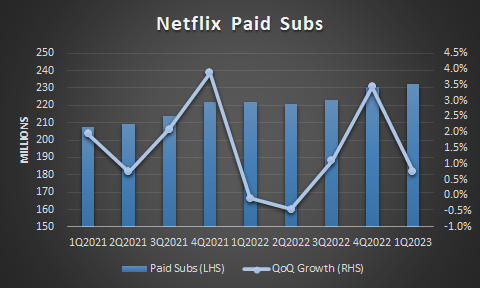

As expected, growth in subscribers slows down in 1Q2023

Netflix added 1.8 million subscribers in 1Q2023, which translates into a modest increase of 0.8% QoQ in the subscribers base. This is a considerably slower pace than the 7.7 million subscribers that the company added in 4Q2022. However, this slowdown in growth was largely expected by the street, as management had indicated that the fourth quarter had benefited from favorable seasonality.

Figure 1: Total Paid Subs

Calculated by Author using data from the company

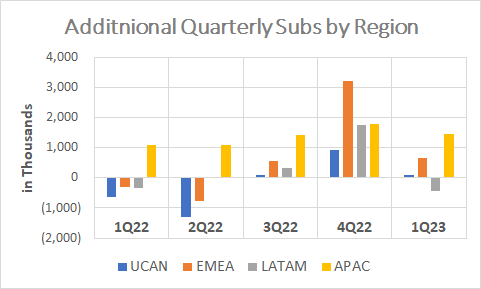

Performance by region was a mixed bag. The Asia-Pacific (APAC) region was the key source of additional subscribers in 1Q2023, as 1.5 million additional subscribers were added from the region. The Latin America (LATAM) region lost 0.5 million subscribers in the quarter and was a key source of weakness.

Figure 2: Additional Subs by Region

Calculated by Author using data from the company

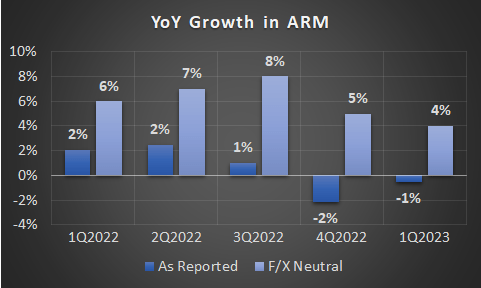

Strong USD is still hindering ARM

The Average Revenue per Membership (ARM) declined by 1% YoY in 1Q2023 on a reported basis, but was up by 4% YoY on an F/X neutral basis. We can see from Figure 3 that the strong USD has been a major headwind for Netflix in the last five quarters, as it reduced ARM by 400 to 700 basis points in each quarter. That is why I prefer to look at the F/X neutral ARM to assess the pricing power of the company.

Figure 3: ARM – Negatively Impacted by a Strong USD

Calculated by Author using data from the company

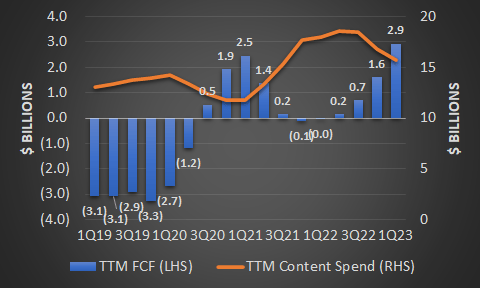

Higher FCF leads to a rise in share buybacks

Netflix spent $2.5 billion on new content in 1Q2023, and this is well below its recent trends. This is actually the lowest quarterly spend on content since 3Q2017. A good side-effect of the lower spending on content has been the rise in free cash flow (“FCF”). The TTM FCF reached $2.9 billion in 1Q2023 and this has led to a more aggressive stance from management on share buybacks. Netflix spent $400 million on share buybacks in 1Q2023, and management indicated during the earnings video call that they have around $2.4 billion of excess cash that could be directed toward further share buybacks.

Figure 4: TTM FCF and TTM Content Spend

Calculated by Author using data from the company

Ad-based tier is a game changer

The Q1 2023 earnings release had some very important updates about the rollout of the ad tier. First is that engagement for the ad tier has been much higher than management’s initial expectations. Also, there has been very little switching from higher tiers to ad-based. Content for the ad tier is now at 95% parity with the other paid tiers. But the information that would likely surprise many people is that the ARM generated by the ad tier (subscription + ads) in the U.S. is higher than the standard plan. This means that the new subs that will come from the ad tier are not likely to be dilutive to the average ARM. I do not think many people were expecting this to be the case. This is why management has recalibrated its ad-based offering to be at a video quality of 1080p (instead of 720p) along with two concurrent streams.

Short-term risks remain high due to the complexity of management’s actions

I believe the key risks for the stock come from rising expectations by investors, especially those heavily focused on growth in subscribers. Netflix will begin its crackdown on password sharing in the U.S. in 2Q2023. The expectation is that this will lead to a slight dip in subscribers upon implementation (due to cancellations) but eventually lead to new account activations. Management is looking at its experience in Canada as a blueprint for the U.S. However, it is not a guarantee that the lost subscribers will be quickly recovered (if at all). Thus, there is significant uncertainty in the short term from management actions.

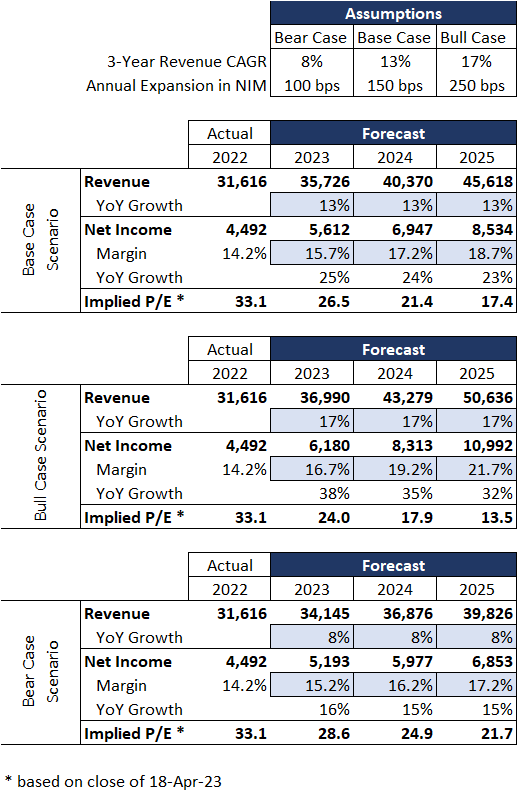

3-year outlook and valuation

I formulated three scenarios for Netflix, where the base case largely reflects the guidance from management. For the base case, I modeled a 13% compound annual growth rate (CAGR) for the next three years combined with a 150 bps expansion in net income margin (I am assuming that the expansion in the operating profit margin will flow to the bottom line). In addition, I modeled two additional scenarios-a bull case and a bear case. Based on the new information about the ARM of the ad-based tier, I now believe that the company could achieve results somewhere between the base case and the bull case scenario.

Figure 5: Outlook and P/E Ratio Under Different Scenarios

Calculated by Author using data from the company

Final thoughts

I am now very excited about the prospects of the ad-based tier, and Netflix, Inc. seems to be giving it a bigger push due to stronger-than-expected economics. The crackdown on password sharing coupled with an ad-based tier could reignite subscriber growth by converting borrowers into actual paying subs. Finally, the FCF generation is impressive and is paving the way for more share buybacks.

I believe that Netflix, Inc. will enter a new growth stage and surprise many who believe that it has reached maturity. I upgrade my rating on Netflix, Inc. to Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

DISCLAIMER: This article is purely for informational and educational purposes. This is NOT investment advice. You should not treat any opinion expressed by SMR Finance as specific investment advice to make a particular investment or follow a particular strategy but only as an expression of opinion. SMR Finance is not under any obligation to update or correct any information provided in this article. You should be aware of the real risk of loss in following any strategy or investment discussed in this article. Investment involves risks. This article is not to be relied upon as a substitution for the exercise of independent judgment. Investors should obtain their own independent financial advice and understand the risks associated with investment products/ services before making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.