Summary:

- We’re guarded on Netflix stock and continue to be sell-rated on the stock in the near term.

- We expect the company to struggle to boost revenues toward 2H23 as ad spending slows due to intensifying macro headwinds.

- Netflix is down nearly 17% since our last note in early February. We expect more downside ahead and recommend investors exit the stock at current levels.

- We’re bullish on Netflix in the long run and will continue to monitor Netflix closely, waiting for the stock to factor in near-term headwinds.

Wachiwit

We’re still bearish on Netflix (NASDAQ:NFLX). Netflix boosted subscription levels last quarter, boosting investor confidence, but we still don’t believe Netflix is in the clear. We remain cautious about Netflix stock in 1H23; we expect the company to grow its subscribers as it lowers prices in specific regions and after the launch of its ad-tier plan last November. The catch, however, is that we expect the higher subscriptions won’t manifest into revenue growth in the near term as we see global ad spending pulling back. We believe Netflix is better positioned than last year to grow but see the stock dipping as the company is now exposed to ad spending behavior.

Netflix is recovering well from the lows of 2022, during which the stock dropped 51%. We don’t expect to see the stock dip to its 52-week-low of $162.71 again but do see it dropping due to slower revenue growth. We recommend investors take any profits, exit the stock at current levels, and revisit once the potential downside of weaker ad spending has materialized. We’ll continue monitoring Netflix closely to upgrade the stock after the near-term headwinds have been factored in, but remain less hopeful about the stock rebounding in the first half of the year.

Subscription growth to cost (an) ARM

Netflix joined the ad-dependent wagon after it launched its “Basic with Ads” subscription in November. Our bearish sentiment is primarily driven by our belief that an ad spending pullback will weigh down on Netflix’s revenues in the first half of the year. In early 2022, we were bearish on Netflix as we believed weaker consumer spending and intensifying competition would depress subscription numbers. We now believe that Netflix has a solid strategy to boost subscription numbers after introducing the ad-tier subscription and, more recently, dropping prices on various subscription plans. We’re no longer worried about Netflix’s subscription numbers; we’re shifting more focus on Netflix’s revenue. Netflix’s 4Q22 confirms our worry is well-placed; the company reported GAAP EPS of $0.12, missing expectations by $0.38, and reported inline revenue of $7.85B.

We believe Netflix is laying out all its cards to boost subscriptions and let revenue growth follow. It won’t be difficult to surpass subscription growth from 1H22, during which Netflix lost nearly 1.2M subscribers. Still, we don’t believe the company will successfully boost revenues amid a weaker spending environment. We specifically expect Netflix to report lower ARM, which defines the company’s streaming revenue divided by the average number of streaming paid members divided by the number of months in a given period. In 4Q22, Netflix reported ARM declining by 2% Y/Y. We believe Netflix lowered prices betting on attracting a sufficient amount of new customers to compensate for the revenue shortfall caused by lower prices. It’s tricky to tell whether this plan will pan out. In the near term, we continue to expect lower prices to reduce revenue and recommend investors wait for the downside of near-term macro headwinds to be factored into the stock before buying.

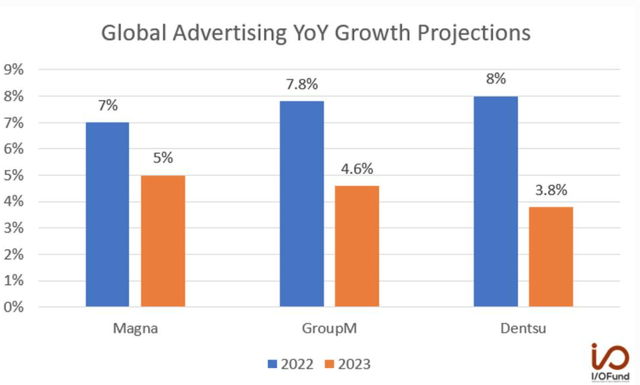

Netflix is not an ad-dependent company per se; we don’t expect the company to be as impacted by weaker ad spending as Amazon (AMZN), Meta Platforms (META), or Alphabet (GOOG) (GOOGL). Still, we don’t believe this means it’s shielded from macro headwinds pinching advertising and consumer budgets. Netflix, Disney (DIS), and Warner Bros. Discovery’s (WBD) lower-cost subscriptions are subsidized by advertising; hence with slowing ad spending, we don’t expect these companies to experience meaningful returns on ad-tiers in 1H23. Based on data from 100 ad markets worldwide, ad spending in 2023 is forecasted to slow significantly; World Advertising Research Center (WARC) projects ad spending to grow 2.6% this year compared to 8.3% in 2022. Ad firm, Magna, predicts global ad revenue will grow 5% in 2023 to $833B, compared to 7% in 2022. The following graph outlines global ad growth projections for 2023 compared to 2022.

Various ad firms are forecasting different growth rates for 2023, but the common theme across the board is weaker spending. We expect that Netflix’s venture into the ad space will be a lagging growth driver that will materialize towards the year’s second half.

Making moves for the bull market

Netflix is making moves despite the harsh macroeconomic environment, from price cuts to crackdowns on password-sharing. We’re bullish on Netflix in the mid-to-long run as management prepares for a bull market. Our bearish sentiment is based on our belief that the company’s revenue will not grow meaningfully in the current bear market. The following outlines Netflix’s two moves in positioning itself for growth in the bull market.

1. Price cuts:

The company recently cut prices in more than 30 countries across Central and South America, Sub-Saharan Africa, the Middle East, and North Africa, among other regions. The price drops are reported to affect more than 10M of Netflix’s 231M users, the majority of which are in the Basic tier subscription, with discounts for the Basic tier ranging between 20% to 60% for new and existing subscribers. We expect the price cuts will significantly grow Netflix’s subscription numbers but remain guarded on whether the new customers will offset the lower ARM.

2. Crackdown on password sharing

Password sharing has been a massive issue for Netflix, and the company is now doing something about it, a huge change from when Netflix tweeted, “love is sharing a password,” shown in the image below.

Netflix rolled out a system that charges for extra member sub-accounts if users outside the same household use the same membership. Last year’s subscriber loss pushed the company in the right direction to monetize account sharing. It remains unclear how much the extra member fee for password sharing will be in the U.S., but we know so far that, on average, the first wave of countries hit by the fee will be charged 43% of the Standard plan price. Canada already felt the brunt of the price cuts, with users being charged nearly half the Standard plan price for each extra member. If the same strategy were applied to the U.S., we’d look at an additional charge of about $7.50 per each extra member sub-account. We’re constructive on Netflix controlling password sharing but still don’t expect this to boost revenues in the first half of the year.

Valuation

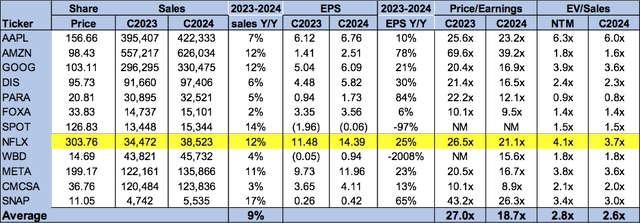

Netflix is not cheap, trading above the peer group average. On a P/E basis, the stock is trading at 21.1x C2024 EPS $14.39 compared to the peer group average of 18.7x. The stock is trading at 3.7x EV/C2024 Sales versus the peer group average of 2.6x.

The following table outlines Netflix’s valuation.

Word on Wall Street

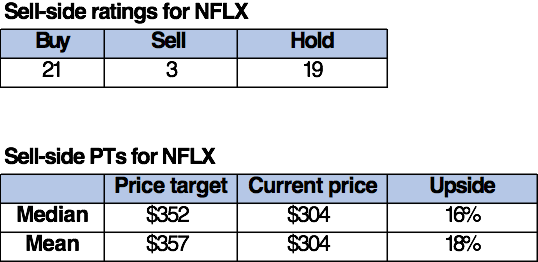

Wall Street is divided on Netflix’s rating. Of the 43 analysts covering the stock, 21 are buy-rated, 19 are hold-rated, and the remaining are sell-rated.

The following table outlines Netflix’s sell-side ratings.

TechStockPros

What to do with the stock

We’re guarded on Netflix stock in the first half of the year and hence maintain our sell-rating. We expect the company to continue to struggle to boost revenues in 1Q23 due to macroeconomic headwinds slowing advertising budgets. We’re constructive on the company’s crackdown on password sharing, and price slashes to grow subscriptions in the mid-to-long run but don’t see Netflix recovering in 1H23. We see more near-term downside and recommend investors exit the stock at current levels and revisit it toward the end of the year once the weaker spending environment has been priced into the stock.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.