Summary:

- Since the 2Q earnings, Netflix’s shares outperformed market indices.

- The coming quarterly report can be not as good as consensus-forecast expects. Management’s 1Q result guidance may disappoint investors.

- Given the high valuation of the company shares, poor reporting can lead to a dramatic sell-off of the company’s shares.

- I avoid buying Netflix’s shares before the earnings report publication and consider opening a short position.

GoodLifeStudio

Background

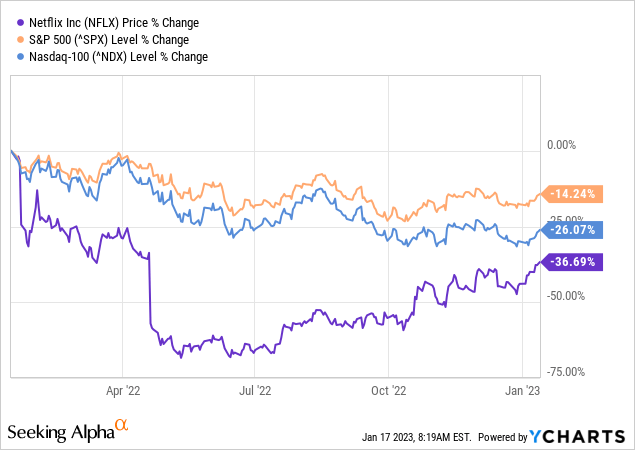

The last quarterly report helped Netflix (NASDAQ:NFLX) partially get investor’s interest back to its shares. After falling by 60% since the beginning of the 2022 year (by the time of the previous quarterly report publication), the company’s shares have significantly outperformed the market indices since the last reporting. Since the 3Q2022 reporting, Netflix shares rose by 36% as of January 13, while the S&P 500 index rose by 7% over the same period, and the NASDAQ 100 rose by only 3%. Such a strong positive dynamic was associated with the return of investors’ faith in the streaming business model and the success of some series of the service (Wednesday). In anticipation of the next quarterly report, let’s look at what to expect from it. Looking ahead, I note that I expect the actual results to be close to the consensus estimates. However, the management’s outlook for 1Q 2022 could disappoint investors. Taking into account the high valuation of Netflix’s shares, I avoid buying the stocks before the quarterly result publication and consider opening a short position.

What awaits consensus from the 4Q reporting?

Consensus forecast for Q4 2022 assumes Netflix’s revenue growth of 2% YoY to $7.8 billion. The net subscriber addition for the 4th quarter is forecast at 4.5 million. The subscriber base is expected to reach 227.1 million (+2.4% YoY). Netflix’s operating profit is projected at $372 million (-41% YoY, margin 4.7%) and free cash flow loss is forecast at $266 million (margin (-3%)). Diluted EPS is expected at $0.41 (-69% YoY).

The consensus forecast is slightly more positive than the company’s management forecast. Netflix’s management forecasts the 4Q revenue growth of 1% YoY and an operating margin of 4% on the previous conference call. For comparison, the YoY revenue growth was 16% a year earlier, and 6% a quarter earlier. The slowdown in revenue growth was due to the slower subscriber growth as well as changes in foreign exchange rates. Recall that the company’s revenue outside the US and Canada accounts for about 55%. Management noted in its previous report that it expects the Q4 revenue growth to be negatively impacted by an 8 percentage point of the dollar index appreciation. Given that the dollar index has fallen by 7% since the last quarterly reporting, the impact will be smaller, but still significant. I estimate around 5% F/X impact on the quarterly revenue growth. The decrease in margin is also associated with the strengthening of the US dollar YoY as approximately about 75-80% of the company’s costs are in the US dollars.

Can the company results exceed consensus and management expectations?

It should be noted that the fourth quarter was seasonally strong for the company. In previous years, the maximum net subscriber addition was in the fourth quarter. Even if the forecast of 4.5 million subscriber addition comes true, it will be the worst fourth quarter results since 2014. Such a conservative forecast gives a chance that the company will surpass it, but that is not so simple. On the one hand, the 4Q content release schedule was very tight. That should help exceed the consensus. On the other hand, end-of-quarter content didn’t meet expectations. The unexpected success of Wednesday (1.28 billion hours viewed in the first 28 days after release, the service’s second most viewed series after Stranger Things S4) was partially offset by the complete failure of The Witcher prequel, The Wither: Blood Origin (average audience rating 13% on Rotten Tomatoes). The Knives Out‘s sequel partially smoothed over the failure of The Witcher‘s prequel.

Streaming data in the US also does not give an exact confidence in the consensus being exceeded. While streaming has generally increased its share of TV hours viewed in the US, YouTube firmly held the top place among streaming services, surpassing Netflix in share of TV time usage since September. In October, Netflix reduced its share of TV time usage by 0.1 p.p., and increased by 0.4 p.p. in November, to a level of 7.6% of total TV hours viewed. November growth can be explained by the release of Wednesday (November 23). December data has not yet been published (publication is expected in the coming days).

Thus, given the conservative outlook and the tight release schedule (albeit with occasional setbacks), it is likely that the company will near consensus expectations. Historical data confirm this. In recent years, the subscriber net addition factual result exceeded the forecast on average by 1 million. However, it is not worth expecting that the result will be significantly better than consensus expected. Nevertheless, the behavior of investors will be determined not by the actual results, but by management’s forecast for the next quarter.

What is the consensus forecast for Q1 2023?

Consensus forecasts Netflix’s 1Q revenue of $8.1 billion, implying 3.4% YoY growth. Net subscriber addition is expected to reach 3.5 million. According to consensus, the Asia-Pacific region will become the main contributor to subscriber growth (37%). Operating profit is expected at $1.7 billion, implying a margin of 21%. Free cash flow is projected at $890 million (11% margin).

Taking into account the content release schedule, the consensus forecast of subscriber growth looks optimistic. For comparison, in the 1st quarter of 2022, there was a net outflow of 0.2 million subscriber. However, there was an effect from the termination of the service in Russia. Adjusted for this, the inflow was at the level of 0.5 million. A year earlier, in 2021, the net addition was at the level of 4 million, but then there was the impact of the pandemic and there was less competition among streaming services. As before, the 1Q subscriber net addition will be largely determined by the content release schedule.

After the Q4 tight release schedule, the Q1 content slate traditionally looks poor. The entire schedule for March is not known yet, but according to preliminary data, the 1Q will be less busy. According to the company’s website, about 60 original series and films are expected to be released in Q1, which is significantly less than in Q4 (154 original films and series).

The key factor for the subscriber addition will also be the launch of the ad-supported subscription plan, which was launched in November 2022. However, I don’t expect a significant subscriber addition from this plan yet. Rather, an ad-supported plan will help reduce current subs churn.

Historical data suggest that management’s guidance for the next quarter was, on average, 0.3 million worse than consensus expected. At the same time, since the beginning of 2019, there were only 4 quarters when the management guidance exceeded consensus expectations.

Thus, the likelihood that the company will beat consensus expectations is low. We will probably see a forecast that will be worse than the current consensus expectations. A positive surprise can only come from the ad-supported plan subscriber addition.

What does Netflix’s current stock valuation tell us?

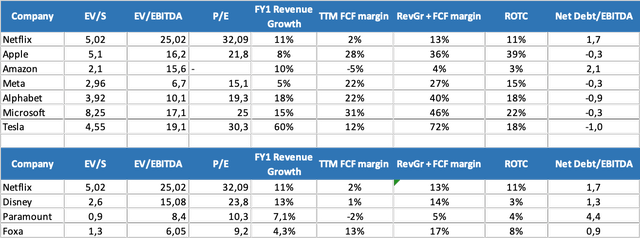

Netflix shares are trading at multiples that are higher than those of the two peer groups. Compared to the extended version of FAANG (+ Microsoft, Tesla), it is worth noting that Netflix has an EV/EBITDA of 25x, while the rest of the companies in this subgroup have the average multiple equals 14.1x. At the same time, in terms of the ratio of the EV/EBITDA multiple to the sum of revenue growth and the FCF margin, Netflix also looks unreasonably expensive. The situation was similar before, when shares were more expensive than their peers for quite a long time. Then, the Netflix’s shares fall was prompted by two consecutive bad quarterly reports (Q4 2021 and Q1 2022).

Netflix’s comparable companies’ data (created by the author based on the company filings and seeking alpha data)

Higher multiples relative to peers raise the risk of a significant fall in the event of poor quarterly results.

What to look for in Netflix’s report and conference call?

In addition to actual results and forecast for the 1st quarter of 2023, management’s comments on three issues will be important:

1) Ad-supported plan launch

2) Solving the problem with account sharing

3) Development of the video game segment

The ad-supported plan was launched in 12 countries in November (costing $6.99 vs. $9.99 for the standard plan). Approximately 90% of the basic plan content will be available on the ad-supported plan. Given the early days of the launch, I do not expect a significant addition from it to the company’s results this quarter and possibly in the next quarter. However, management’s comments on advertisers’ interest in streaming ads would be very interesting.

It is unlikely that a solution to the problem of account sharing will be found in the next quarter or two. Recall that, according to management estimates, about 100 million households share Netflix’s subscription with other households, which provides an opportunity to expand the subscriber base if a solution to this problem is found. The development of the video games is going quite quickly, but management’s detail plans for larger AAA projects are unknown. It is not entirely clear yet whether the company will use internal resources to develop AAA games or will make M&A. As a potential M&A target, I single out CD Projekt RED and Ubisoft.

Final thoughts

I don’t expect a significant positive from the coming quarterly reporting. Actual results may be slightly better than consensus expectations, but management’s guidance for 1Q may disappoint investors. Given the high valuation of the company shares, poor reporting can lead to a sell-off of the company’s shares, so I avoid buying shares before reporting and consider opening the short position. The company’s long-term growth drivers remain, but now they are clearly not the most attractive levels for shares purchase even for the long-term investors. It is better to wait for more attractive levels and a more tight content release schedule.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in NFLX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not investment advice. I am not an investment advisor. Before making any investment, please do your own research!