Summary:

- Netflix delivered strong Q3 results with impressive margin expansion and free cash flow growth.

- The partnership with Microsoft is seen as a positive development.

- I am upgrading to a ‘Buy’ rating with a fair value of $550 per share.

hocus-focus

Netflix’s (NASDAQ:NFLX) stock price has moved up 29% since I published my introductory article. They delivered quite impressive Q3 results, marked by strong margin expansion and free cash flow growth. Their disciplined approach to content spending continues to propel both margin and free cash flow growth. The partnership with Microsoft (MSFT) for targeted marketing is seen as a positive development for Netflix. I recommend upgrading to a ‘Buy’ rating, setting a fair value of $550 per share.

Q3 Result and Q4 Outlook

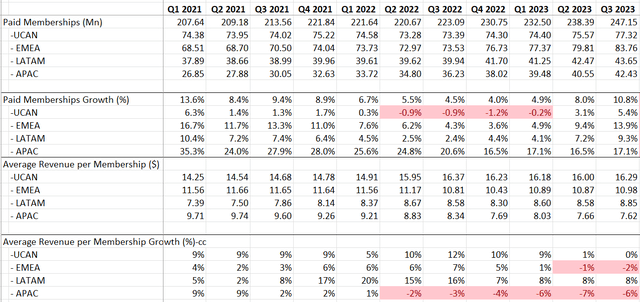

During Q3 FY23, Netflix achieved a noteworthy 7.8% revenue growth and a substantial 10.8% increase in paid memberships. The ads plan membership, experiencing a significant 70% quarter-over-quarter surge, played a pivotal role in driving the overall membership growth.

It is notable that Netflix anticipates full-year free cash flow to reach $6.5 billion, a notable increase from the previous guidance of $5 billion. This growth is particularly impressive, especially when compared to the $1.6 billion achieved in FY22. The revised guidance incorporates approximately $1 billion in lower-than-expected cash content spending, attributed to the WGA and SAG-AFTRA strikes.

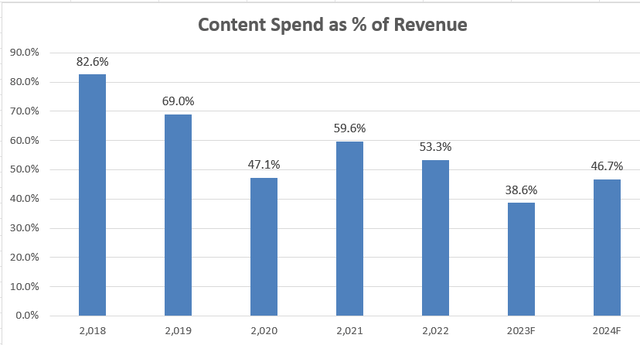

A key highlight from their earnings call is the consistent margin improvement. They project a 20% operating margin for FY23, with a further increase to 22-23% in FY24. As I highlighted in my introductory article, disciplined content spending will be crucial for achieving margin expansion in the future.

This margin expansion is indeed remarkable in my view. The guidance appears reasonable and realistic for several reasons.

Firstly, disciplined content spending remains a significant driver for margin expansion. While Netflix spent $13 billion on content in FY18, representing over 82% of total revenue, they expect to maintain a similar level of spending in dollars in FY23. However, it’s worth noting that this fiscal year’s revenue is estimated to be 2.1 times higher than the level recorded in FY18. This underscores their strategic approach to content investment in relation to revenue growth.

Netflix Earning Calls and Disclosures

Secondly, the adoption of their ads plan continues to grow, allowing Netflix to generate revenue from both membership and advertising streams. The ads plan incurs minimal incremental costs for Netflix, as it leverages the existing technology platform, personnel, and infrastructure.

Lastly, it appears that subscribers are not overly sensitive to content quality. Netflix recognizes that it doesn’t need to maintain the same content spending rate as its revenue growth rate. Moreover, Netflix has moved beyond the heavy spending phase, transitioning towards a more mature phase in their business.

Regarding revenue guidance, they anticipate Q4 FY23 revenue to reach $8.7 billion, reflecting an 11% year-over-year increase or 12% on a foreign exchange-neutral basis. Given their robust growth year-to-date, the Q4 revenue guidance seems quite reasonable.

Netflix is set to announce their Q4 results on January 23, along with the issuance of FY24 guidance. I anticipate robust free cash flow growth in FY24, driven by several tailwinds. Firstly, with the resolution of the strike, revenue growth is expected to accelerate compared to FY23, as more content becomes available on their platform. Secondly, the momentum of their ads plan continues to build, contributing to increased incremental revenues that will positively impact profits. Lastly, if the Federal Reserve starts to cut interest rates in 2024, it could benefit Netflix, as consumers would have more discretionary dollars to subscribe to streaming services. In summary, I am optimistic about their FY24 guidance.

Strike is Over

After nearly five months of strikes, members of the Writers Guild of America have concluded their protest and returned to work. As mentioned earlier, this strike resulted in a $1 billion reduction in content spending for Netflix in the current fiscal year. Looking ahead, they plan to allocate $17 billion to content in FY24, compensating for the underspending in FY23.

The aftermath of the strike is essentially reflected in Netflix’s content spending pattern over these two fiscal years. It could be argued that the strike posed some headwinds to revenue growth for Netflix in FY23, particularly impacting the release of new titles. With the strike now concluded, there is optimism that Netflix’s revenue growth will improve in the upcoming period.

Partnership with Microsoft for Target Ads

Netflix’s ad plan has experienced rapid global growth, with a notable 30% of new sign-ups opting for the ads plan in countries where it is available. This advertising strategy stands out as a significant driver for Netflix’s membership growth.

A noteworthy collaboration with Microsoft involves working on targeted ads, and this program is poised to be implemented in the near future. The partnership is anticipated to hold substantial meaning for Netflix’s future growth. To mitigate the impact of ads during streaming services, Netflix is committed to making their ads more relevant to viewers. This approach aims to ensure that viewers are not excessively bothered by ads during their streaming experience. Targeted marketing is considered the most effective way to achieve this goal.

Furthermore, Netflix’s management has conveyed their intention to introduce additional avenues for programmatic purchasing through Microsoft. This initiative is designed to provide buyers with increased accessibility to Netflix’s inventory. This move positions Netflix as a crucial marketing platform for global advertisers, offering diverse and strategic ways for advertisers to engage with the platform’s audience.

Valuation Updates

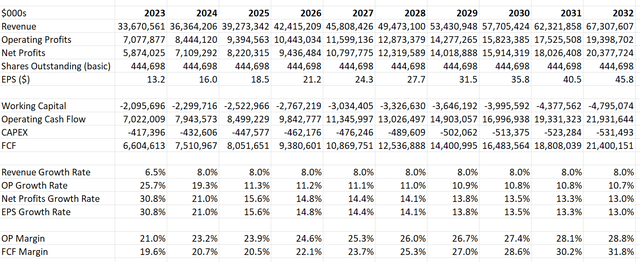

The assumptions for FY23 align with the guidance provided, projecting a 6.5% growth in top-line revenue and a substantial 25.7% growth in operating profit. To arrive at normalized 8% revenue growth, a 6.8% increase in paid membership and a 1.2% rise in average revenue per membership, driven by additional Ads revenue, are assumed in the model. I believe Netflix will achieve margin expansion over time, attributed to their disciplined approach to content spending.

Netflix DCF- Author’s Calculation

The model utilizes a 10% discount rate, a 4% terminal growth rate, and a 15% tax rate, resulting in an estimated fair value of $550 per share.

Verdict

I appreciate their margin expansion and free cash flow growth, and their disciplined approach to content spending is a significant driver. The partnership with Microsoft is quite promising. I am upgrading to a ‘Buy’ rating with a fair value of $550 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.