Summary:

- Netflix, Inc.’s market capitalization is almost $200 billion, but the company is heavily overvalued.

- The company’s growth has been supported by its total streaming memberships, which have reached 247.15 million with 10.8% YoY growth.

- Netflix remains popular, but there are concerns that its growth may not be sustainable, and its market share may cap out.

Nanci Santos

Netflix, Inc. (NASDAQ:NFLX) is the largest publicly traded streaming company in the world, with a market cap of almost $200 billion. The company’s share price has more than doubled, as investors remain excited about the company’s ability to turn around its portfolio. However, as we’ll see throughout this article, the company is heavily overvalued.

Netflix Results

Netflix is back up to a market capitalization of almost $200 billion, supported by the company’s growth.

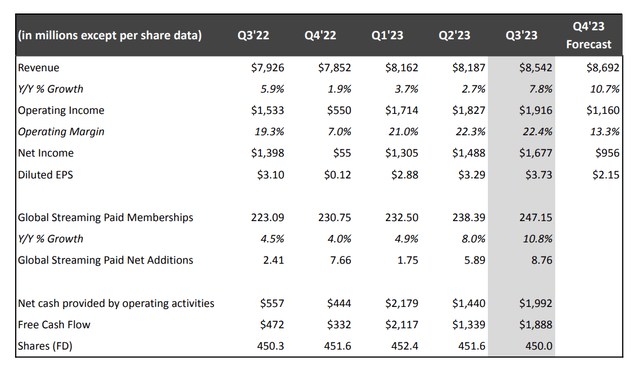

The company has total streaming memberships of 247.15 million, with 10.8% YoY growth. That’s surprising in our view, as the company did not have the growth de-acceleration from enforcing double accounts that we expected. The majority of customers decided it was economical to simply get a single account.

The company did have $8.54 billion in revenue for the third quarter, up 7.8% YoY, indicating that companies are shifting to lower-priced accounts. Operating margins also improved very slightly, enabling diluted EPS to grow. The company’s free cash flow (“FCF”) was $1.8 billion, and the company is guiding for $6.5 billion FCF for the year, but that’s still only 3% of its market cap.

Netflix Popularity

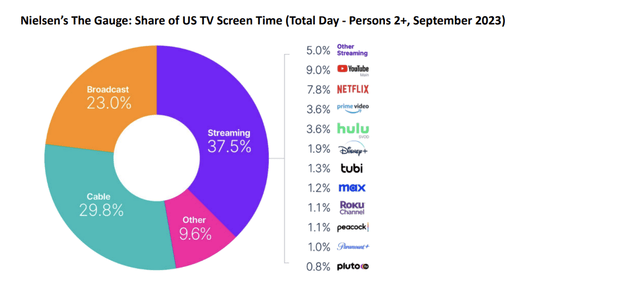

Netflix remains among the most popular streaming services, but we expect that to cap out.

The company has a 7.8% streaming viewership share. That’s almost as big as Netflix. Prime video is 3.6%, and Disney/Hulu is 5.5%. Max is 1.2% and Apple TV isn’t big enough to appear. The business does remain the largest streaming platform, but it’s worth noting that Disney/Hulu, for example, is roughly 70% the size.

Another risk here is that the company’s popularity might be tapped out. Even if the company achieved recent growth by convincing customers to not share accounts, there’s no indication that the growth is sustainable. The company’s growth had slowed to a trickle before its most recent set of actions.

Netflix Cash Flow

At the end of the day, the company’s cash flow is based on its ability to drive shareholder returns.

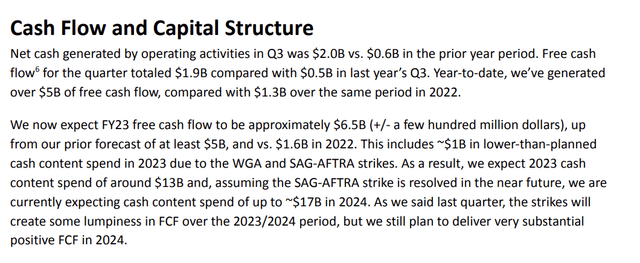

The company earned $1.9 billion in FCF, which almost quadrupled YoY. The company generated $5 billion in FCF YTD, strong YoY growth, and is now expecting $6.5 billion for the year. It’s worth noting that $1 billion of this is due to lower cash spend due to the WGA and SGA-AFTRA strikes. Cash content spend is forecast for $13 billion in 2023and it’s expected to grow to $17 billion in 2024.

The company is expecting to remain FCF-positive in 2024. However, with the growth in content spending, we don’t expect the company’s FCF to grow from 2024 levels. It’s also worth noting the company’s $6.5 billion in FCF guidance comes from annualized revenue of ~$33 billion. The company’s margins grew slightly but to grow FCF it needs continued top-line revenue growth.

The company at its market cap needs 3x its current FCF to justify investing. That means it needs 3x the revenue, without strong opportunities to grow margins, even if margin growth makes up for savings from the strike. Obviously, there are some fixed expenses, but revenue growth needs to remain strong. That will substantially hurt the company’s ability to drive returns.

Thesis Risk

The largest risk to our thesis is the disappearance of competition because they decide it’s not worth it. The Walt Disney Company (DIS) is purchasing Hulu to become the second largest player in the game, but Amazon (AMZN) and Apple (AAPL) have had a large impact as well. Should they decide the industry is not worth it, they could exit enabling Netflix’s costs to decline and margins to remain strong.

Conclusion

Netflix is a solid company. The company offers a great product. However, too often a solid company is given an unreasonably high valuation, especially in a bull market. Netflix is that company. To be fair, the company has had some short-term strength which we didn’t expect, impacted by customers choosing to make a second account.

The company’s guidance highlights this, as revenue growth is expected to slow down. Margins have improved slightly, supported by the WGA and SGA-AFTRA strikes. However, long term we don’t see the company as having the portfolio to justify its valuation, making it a poor long-term investment. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.