Summary:

- Netflix is scheduled to report their Q2 ’24 financial results after the bell on Thursday, July 18 ’24.

- The Street consensus is expecting revenue of $9.53 billion for expected 16% y-o-y growth and EPS of $4.72 for expected 43% y-o-y growth.

- Netflix’s story the last few quarters has been subscriber growth has come in much better than expected, even though management has said they are going to stop reporting subscriber and ARPU metrics.

Wachiwit

Netflix (NASDAQ:NFLX) is scheduled to report their Q2 ’24 financial results after the bell on Thursday, July 18 ’24, with Street consensus expecting:

- Revenue: $9.53 billion for expected 16% y-o-y growth

- Operating income: $2.43 billion for expected 33% y-o-y growth

- EPS: $4.72 for expected y-o-y growth of 43%

Netflix’s story the last few quarters has been subscriber growth has come in much better than expected, even though management has said they are going to stop reporting subscriber and ARPU (average revenue per user) metrics.

- In Q1 ’24, 9.3 million new subscribers were added versus the 4.8 expected

- In Q4 ’23, 13.12 million new subscribers were added versus the 8.8 million expected

Also, advertising, a developing business niche within the NFLX model, is growing at a 65-70% sequential rate every quarter. Per one source, advertising grew 70%, 70% and 65% sequentially the last three quarters respectively.

With the Q1 ’24 revenue guidance, management expected in-line revenue versus consensus in Q2 ’24 and a slightly lower operating margin than Q1 ’24’s 28%.

Netflix guided to 13-15% revenue growth in for full-year ’24, which is also slightly conservative to consensus, which stands today at an expected 15%.

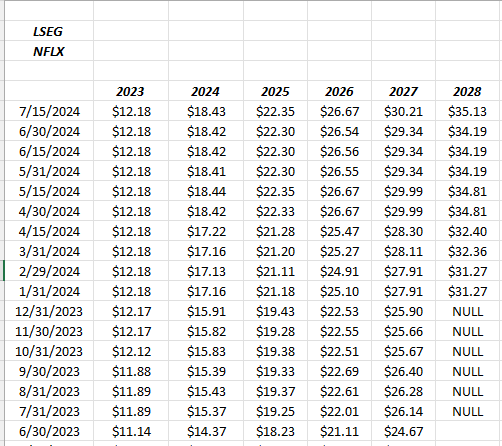

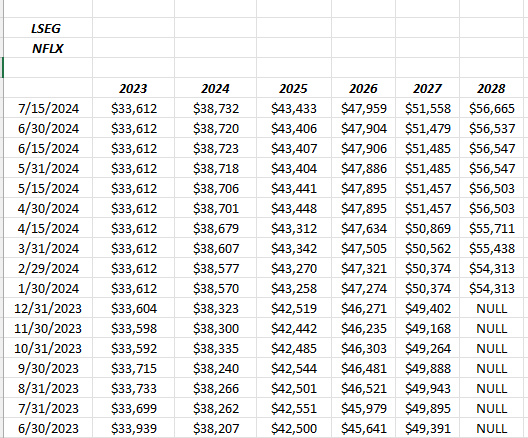

Trends in NFLX’s EPS and Revenue estimates

(Source: LSEG)

The trends in EPS estimates are quite positive, and to a much higher magnitude than revenue estimates, and that’s because of NFLX’s operating margin increase.

Netflix stock bottomed in May ’22 at $162 per share. Here’s the change in the company’s operating margin since Q2 ’22:

- Q2 ’24: 26%-ish (guidance)

- Q1 ’24: 28%

- Q4 ’23: 17%

- Q3 ’23: 22%

- Q2 ’23: 22%

- Q1 ’23: 21%

- Q4 ’22: 7%

- Q3 ’22: 19%

- Q2 ’22: 20%

Valuation

To be clear for readers, Netflix is a growth stock, and it sports a growth stock valuation.

At $656 per share (as of Tuesday night’s close), it is trading at 36x times ’24 EPS of $18.43, with 43% EPS growth expected this year. Looking at the average P/E and growth rate, NFLX is trading at 29x earnings for an expected 31% growth rate in the next three years (through ’26).

Revenue growth is expected at 15% in ’24, and then to average 13% over the next 3 years.

Price-to-cash flow and free cash flow (FCF) is in-line with the P/E multiple at 33x and 35x.

Cash flow and free cash flow have improved dramatically since the stock bottomed in mid-’22. Trailing twelve-month (TTM) cash flow is $7.3 billion and TTM FCF is $6.9 billion. TTM capex has averaged around $500 million per quarter the last 12 quarters.

Here’s what interesting about NFLX’s valuation relative to its peak on November ’21:

- In the September ’21 quarter, NFLX was trading at a 58x TTM PE, while today that same TTM P/E is 41x.

- The forward P/E was 59x, today it’s 36x.

- TTM cash flow in September ’21 was $658 million, with a 442x multiple, while today TTM cash flow is $7.3 billion with a 33x multiple.

- TTM FCF in September ’21 was $131 million, while today TTM FCF is $6.9 billion, or a 35x multiple.

- Maybe most interesting, in terms of quality of earnings, both TTM cash flow and free cash flow cover net income 1x.

Morningstar’s fair value estimate for NFLX is $440, very close to its current 200-week moving average of $447-450.

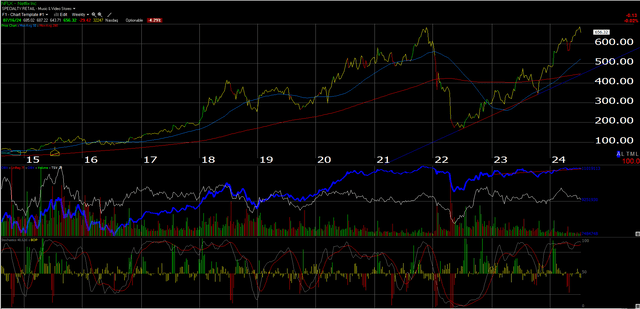

Technical Analysis

$700 is a big level for Netflix, as that price level was the mid-November ’21 high before the stock fell to $162 by mid-2022.

A higher-volume breakout above $700 on Netflix (if and when it happens) will be a significant move for the stock.

Breakout or breakdown (in the stock)? As the old country lawyer said, “I can argue it either way”.

Summary / conclusion

Although growth and momentum stocks need a break in this market environment, the fact is after writing this preview, I remain more positive than the negative on NFLX’s longer-term outlook as they branch out into advertising and look to turn subscribers into higher average revenue per member.

The US and Canadian markets are thought to be saturated, while the growth is in Europe and non-US markets. Netflix did announce this quarter they have 270 paid subscribers, and they could likely get that to 500 by tweaking the model.

However, the momentum in EPS and revenue estimates, and NFLX’s changing business model to include live sporting events is (in my opinion) quite important. Netflix announced during the second quarter that they will be carrying two live NFL games on Christmas Day ’24, which will likely only help advertising.

However, maybe the most compelling argument to own Netflix was Bob Iger’s May 7th statement calling Netflix “the gold standard” in streaming, which says something, coming from one of your closest competitors.

Personally, I’ve always judged Netflix based on what’s available on a nightly basis. I thoroughly enjoyed the Tour De France (TDF) documentary that covered the 2022 and then 2023 TDF. As a weekend biker, it was fascinating to learn the different strategies employed within the peleton and the breakaways, and the detail of the sport.

The 200-week moving average for NFLX (the stock) is in the $447-450 area. That’s a price level where more would be bought for client accounts.

The stock could correct on a tech and growth / momentum pullback, but buy the business, not the stock.

Clients currently own a 1.5% position in the stock, and the goal is to own more on a healthy pullback.

Netflix has a substantial first-mover advantage, and while Disney (DIS) was supposed to be a threat to Netflix a few years ago, with their substantial content library, they have not moved the needle against Netflix.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.