Summary:

- I’m reiterating Netflix with a Buy, and I believe venturing into Sports is the new leg for growth.

- I think the company’s focus on engagement as a new key metric will show up in the top line in 2HFY24.

- In my opinion, Netflix’s original content is its bread and butter and will boast engagement and subscriber growth in the near term.

- I share my thoughts on Netflix here and why I think it has more upside in FY2024.

stockcam

Investment Thesis

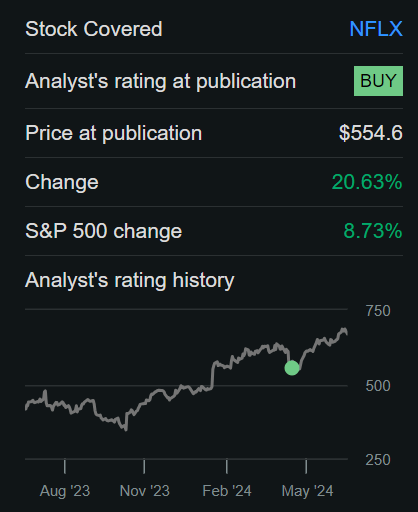

I last wrote about Netflix (NASDAQ:NFLX) post-1Q24 earnings in late April, with a positive outlook on top-line growth supported by management’s focus on profitability and their improved go-to-market strategy. I’m reiterating my buy rating on Netflix in light of management’s commentary about shifting more focus to engagement as the new key growth metric.

The stock is up ~21% since, outpacing the S&P 500, up ~9% during the same period, as shown below. I’m maintaining my bullish sentiment heading into the second half of the year, as I expect Sports expansion to boost subscriber growth in 2024. The positive thesis of subscriber growth driven by the company’s venture into Sports has been getting more traction; JPMorgan Chase shares the sentiment and states that the new Tyson-Paul event “could be the most watched boxing match ever, given ease of access and Netflix’s large global subscriber base,” which, in turn, in my opinion, will boost revenue and ad tier monetization. JPMorgan analyst Doug Anmuth believes Netflix’s diverse offerings put it in a position to be a “default choice” for viewers; according to Bloomberg, consensus for Netflix’s full-year earnings is up 7.1% over the last three months, and revenue estimates were up 0.5%.

SeekingAlpha

My positive outlook on Netflix’s position in the market and among its peer group still stands. The thesis I promised back in April was based on my belief that investor disappointment in Netflix’s revenue guide of $9.49B lower than the consensus was ill-founded. I think management’s focus on developing its new revenue model and diversifying content to attract a wider customer base will pay off big time in 2025.

I’m most positive about management’s efforts to focus on engagement as a driver of revenue and subscriber growth.

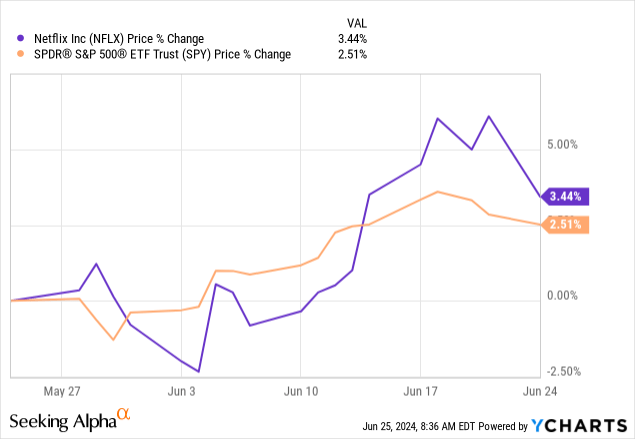

The last time I wrote on Netflix, the stock dipped ~11% post-earnings due to Netflix’s soft outlook for 2Q24, but the stock is regaining its losses, as shown below on the one-month chart against the S&P500. The stock is up 3.4% on the one-month chart against the S&P500, which was only up 2.5%.

YCharts

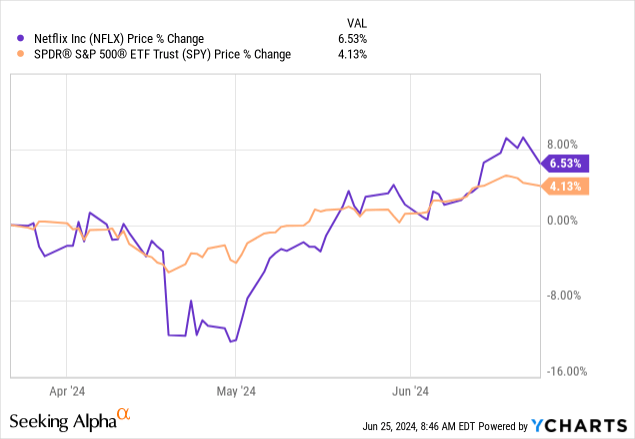

The company’s good financial health makes it all that more attractive to me. The stock also outperformed the S&P500 on the three-month chart by 2% and was consistent with outperformance on the six-month chart, up ~37%, while the S&P500 is up ~14%.

YCharts

Engagement: “The best proxy for consumer happiness”

I believe the streaming business is evolving, and the odds are in Netflix’s favor as management is more focused than ever on engagement. Netflix management said the company won’t be reporting quarterly membership results and ARM data starting 2Q25, giving investors time to adjust. The key metrics are shifting, and Co CEO Greg Peters said the company will be adding a new annual guidance on revenue range for long-term investments and will be reporting “revenue, on OI, OI margin, net income, EPS, free cash flow” as part of their key metrics.

The company is focused on “member satisfaction” through engagement, and according to Co-CEO Ted Sarandos, engagement is the “leading indicator for retention and acquisition over time… members watch more, stick around longer…which all grows engagement, revenue, and profits, our North Stars.”

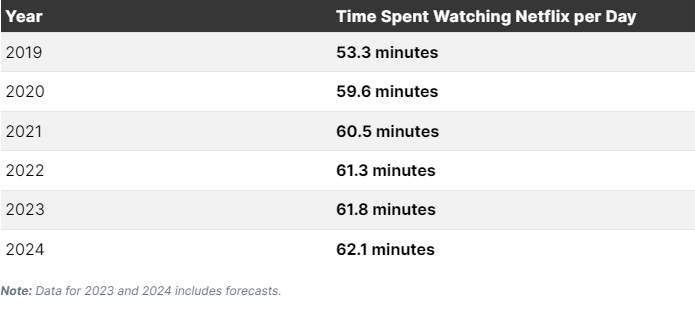

As shown in the Statista data below, the number of hours spent watching Netflix has increased since 2019. Management is finding new ways to make customers stick around and spend more time streaming, and the Data shows some success.

Statista

Netflix is a hit in the streaming industry; it functions as a metric for what to do next and where to create growth. I will bluntly say this: Netflix walked so everyone could run. But it is still winning the race among its competitors in the content they’re creating. Netflix continues to “invest in our slate, even as competitors are pulling back,” according to Peters. I believe Netflix has an edge over its competitors. Disney (DIS) agrees that Netflix is “a gold standard when it comes to streaming,” and I touched on this in my article on Disney stock in late May.

Sports: A new leg of growth

I discussed the venture into sports, particularly that of WWE RAW, in my last article and its importance in boosting subscriber growth. As of next year, Netflix will start offering the weekly program Raw globally. According to Peters, their goal is to “do at-scale events around the world every week, and we are not even breaking a sweat.” In my opinion, this is a good way to gain more while doing less.

Earlier this month, Netflix aired “The Roast of Tom Brady,” and it was the most popular title for a couple of days in a row. The company will also be showing a huge boxing event between Mike Tyson and Jake Paul in July. The company has many plans for the sports initiative, and I see this showing in the top and bottom lines in the second half of 2024; Netflix will also be airing two National Football League games in Christmas.

But Netflix isn’t the only one wanting a piece of this cake. Other streaming services also want in; Amazon (AMZN) is closing a deal with the National Basketball Association for its Prime service, and Disney is expected to spend up to $12.2 billion investing in sports in 2026. According to Bloomberg Intelligence, sports will also help NBC’s Peacock “stand out” as well.

In my opinion, prioritizing efforts on engagement and branching out into sports will give Netflix access to a whole new customer base. Sports fans will now have Netflix as a one-stop for all their streaming needs. Netflix hasn’t marketed itself as a Sports platform, so this will be a change in how the service is perceived, which may come with some hurdles. Nonetheless, I see branching into sports as increasing retention rates, lowering turnover, and also eliminating threats of competition.

Why Original Content Matters

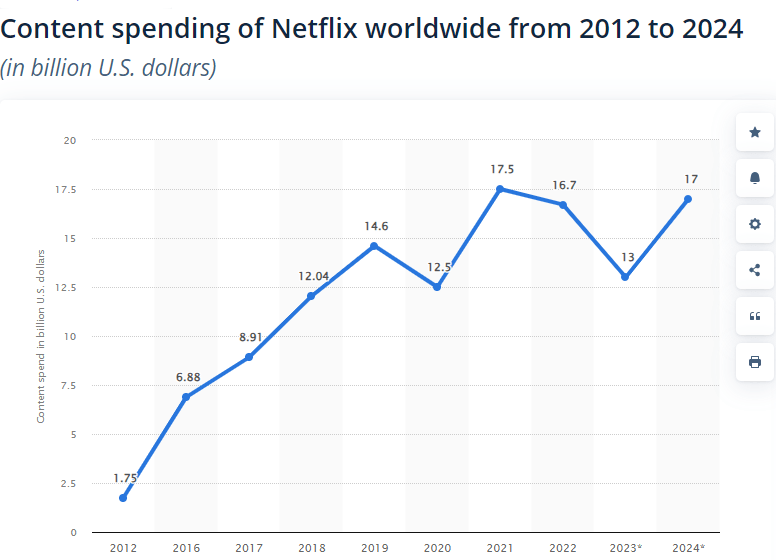

Netflix’s original content is a strong driver of subscriber growth and engagement, which I’ll get to in a second. The company understands its customer base, and that is why management prioritizes pumping new content going forward. I’ll let the numbers speak for themselves: As seen in the graph below, spending content went up from ~$7 billion in 2016 to ~17 billion this year, operating margins increased and went up over six times, from around 4% in 2016 to ~25% this year, and cash flow went from a negative ~$2 billion in 2016 to ~$6 billion this year. Netflix content spending slowed in 2023 to $13 billion, a 22% decrease from 2022 at $16.7 billion due to Hollywood strikes. But the company made a comeback this year and is planning to spend a big bulge of its $17 billion allocated budget for content on its original content.

Statista

Eight out of the first 11 weeks of the year, Netflix got the number one film on streaming, and in nine out of the 11 weeks, they had the number one original series. Netflix hits include Avatar: The Last Airbender, Love is Blind, Griselda, and 3 Body Problem. Netflix is global, and it understands the scale and cultures in which it functions; in my opinion, the art behind knowing what every culture needs is what makes Netflix shows such a huge hit. They’ve also dabbled in a fairly new initiative: “local unscripted,” such as Physical 100 season 2 in Korea and the new Love Is Blind: Sweden. The streaming giant sets itself from the competition as its original shows are “hard to replicate… engagement captures all of this and none of that’s possible without great tech and product,” as stated in the recent earnings call.

Justified Valuation

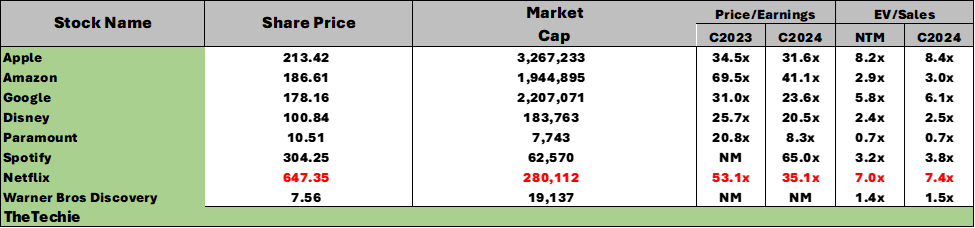

Using a relative valuation method, I think Netflix’s valuation is fair on two factors: the company’s position as the golden standard for streaming (legacy presence), and the long term secular growth tailwinds in the Video Streaming market or SVoD, estimated to grow at CAGR of 8.27% between 2024 and 2027. The stock currently trades at a ratio of 35.1 for CY2024, higher than the peer group average of 32.1, but slightly lower than its PE/ratio back in April at around ~36.9. The interesting thing is that the peer group average is actually a bit higher at 32.1 now versus 31.5 in my last note. Netflix’s EV/Sales ratio in CY2024 is 7.4, higher than the peer group average of 4.1 and slightly higher than its April ratio of 7.2. The peer group average here is again higher than it was in April. I’m not worried that Netflix is trading above the peer group in both of these ratios.

I believe Netflix is a growth stock. I think the market is pricing in future earnings that the company will be able to achieve through enhanced engagement that’ll allow for scaling of 1. its original content and 2. ad business. I also believe its venture into Sports is noteworthy as it proves that management is introducing new edges to remain competitive with the likes of Disney, and it’s being well received. In my opinion, Netflix’s higher multiple is justified by its growth trajectory, considering its scaling initiatives and strong cash flow generation.

Image created by The Techie with data from Refinitiv

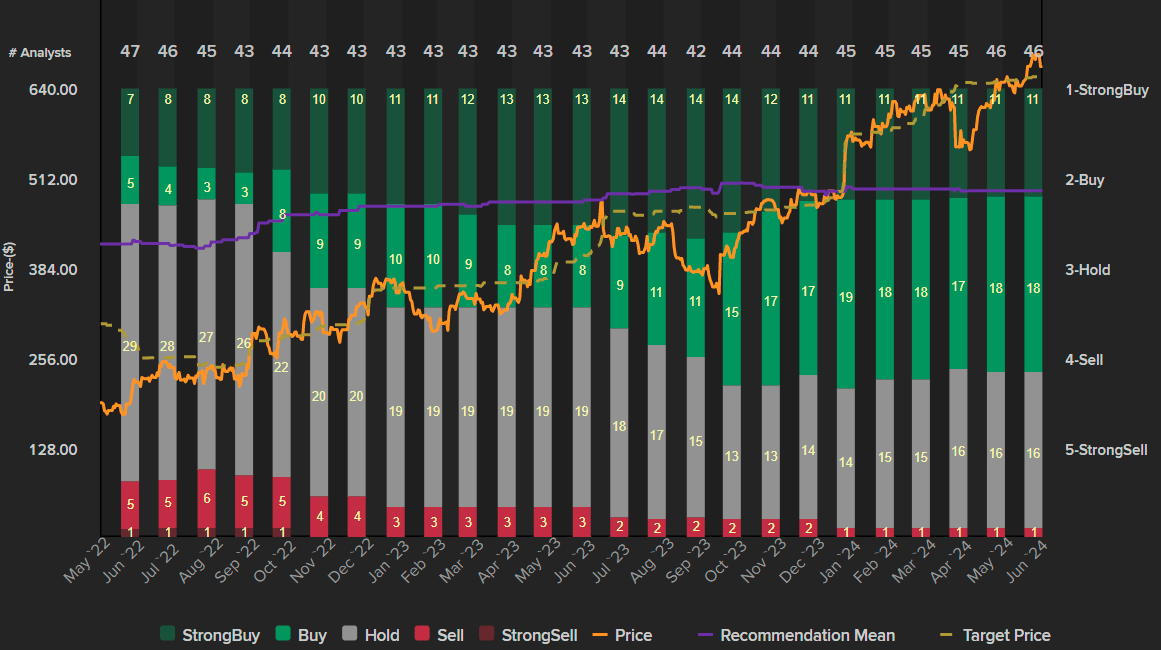

Most analysts recommend the stock as a strong buy; ~24% of analysts are strong buys, 39% are buys, around 34% are hold, and only ~2% are sells. According to Data from Refinitiv, the price target median for Netflix stock was $600 in March and has since increased by $65. The median PT was $655 for April and May and has now been revised higher. The mean has also been consistently increasing; at $597.2 in March, the mean increased to $646.3 in April, $649.4 in May, and $654.6 currently. The upward revision of price targets and the stock price performance (as shown below) confirms my positive outlook on Netflix in spite of the higher valuation.

Data from Refinitiv

What’s Next?

Netflix has observed a rebound in subscribers since 2021, post-COVID pandemic, due to the password crackdown and ad tier initiatives. I think the next big thing for the company is scaling its engagement. According to management, if there were an average of at least two per household, the company would have a customer base of over half a billion people. “No entertainment company has ever programmed at this scale and with this ambition before.” Netflix currently accounts for around 8% of TV viewing in the US and is a leader in most of the world’s media markets, according to Bloomberg.

I see the new interest in sports offerings as a catalyst for growth in the near term. That, along with the focus on boosting engagement, will support revenue growth into the 2HFY24.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.