Summary:

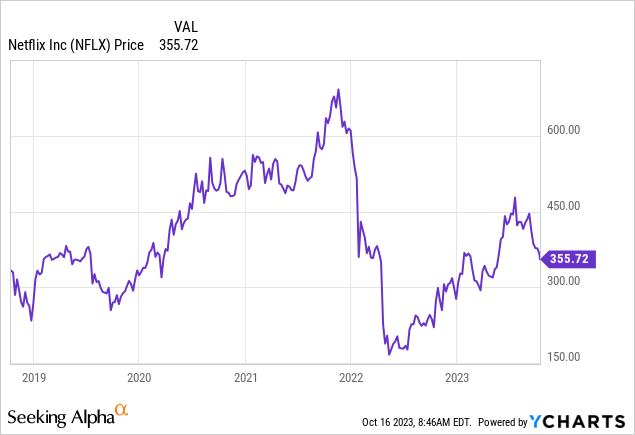

- After recovering from its multi-year lows during 2022, the narrative around Netflix stock remains mixed.

- Growth is slowing down meaningfully, but expectations around new revenue streams are running high.

- Costs are rising and Netflix’s free cash flow will likely remain highly volatile.

- Investors’ expectations are running high as the company reports its Q3 results later this week, but the medium-term outlook remains weak.

stockcam

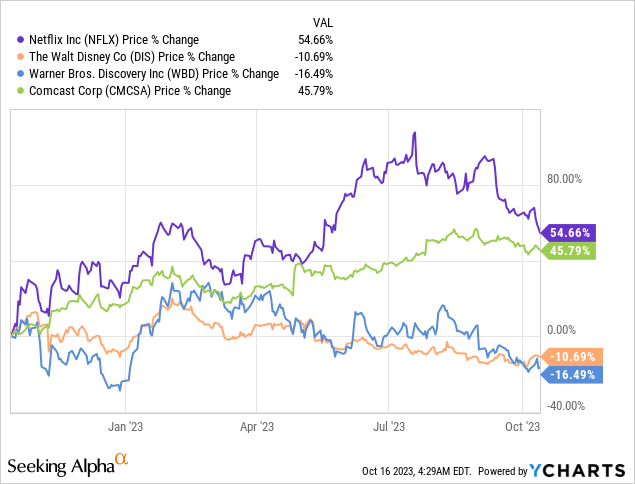

Netflix (NASDAQ:NFLX) has been riding the wave of short-term optimism over the past year as the company was the only one among its major peers (see below) with a share price return of above 50%.

Only Comcast (CMCSA) came close, but as a cable company it’s not a direct comparable to NFLX.

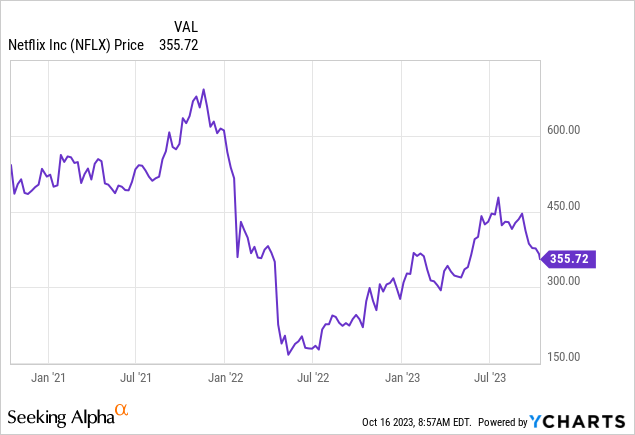

This spectacular performance came after a rough start of 2022 when Netflix share price fell from nearly $700 a piece to below $200.

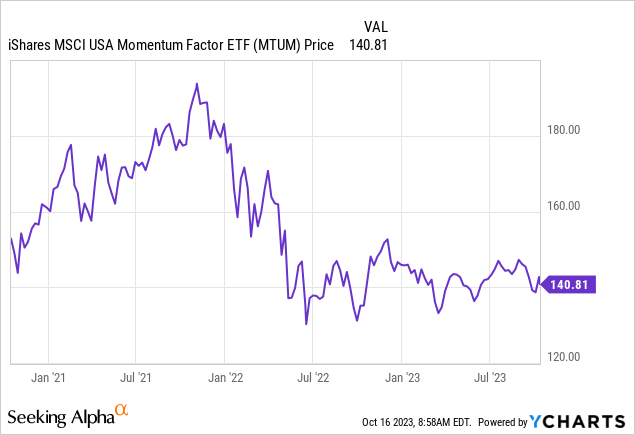

Although there were specific business development behind this drop, the overall sentiment toward momentum stocks was among the key drivers for NFLX performance in that period.

Now that the company is about to release its third quarter results in an environment of intensifying competition, writer strikes and a risk of economic slowdown, the narrative around the stock is mixed.

Seeking Alpha

What Happened To The Growth Story?

For many years, the main narrative around Netflix has been gravitating around the company’s high revenue growth and the first mover-advantage in streaming.

In spite of the worries around profitability and free cash flow, this brought outstanding shareholder returns at a time of unprecedented liquidity in the markets. Pandemic tailwinds also were significant and long lasting as they brought forward years of revenue growth.

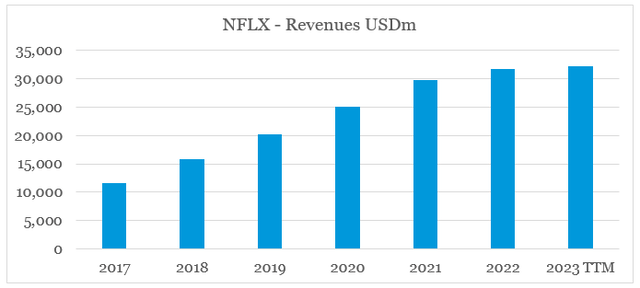

But as the outside environment is turning from highly supportive to neutral, Netflix business momentum also is fading. Gone are the days of 20% to 30% annual revenue growth rate as year-on-year growth for the first half of 2023 stood at slightly above 3%.

prepared by the author, using data from SEC Filings

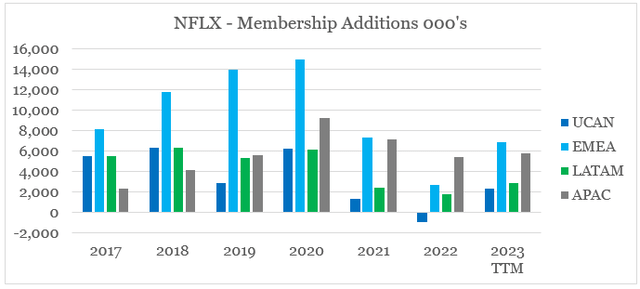

After membership additions in UCAN (United States and Canada) and LATAM (Latin America) already were on a downtrend in 2019, the pandemic brought a major tailwind for new subscriptions in 2020. In 2021 we already saw significantly lower number of additions and 2022 noted the first decline in UCAN.

prepared by the author, using data from SEC Filings

The hype is now back after new additions recovered somehow in the first half of 2023 on the back of Netflix efforts around paid sharing rollout. Nevertheless, membership growth opportunities appear limited as competition intensified significantly in recent years and Netflix now relies more on increases in average paid membership.

Our revenue growth in Q3 will come from growth in average paid memberships.

Source: Netflix Q2 2023 Earnings Transcript

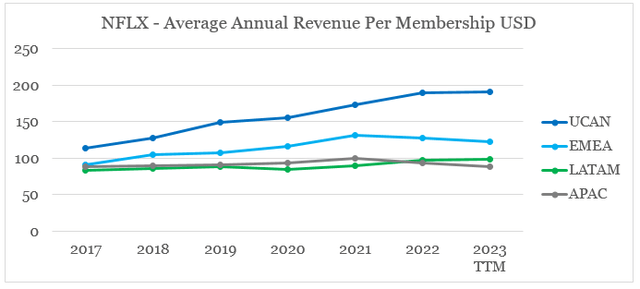

But once again, rivaling streaming services with strong offerings significantly limit Netflix ability to increase prices even a highly inflationary environment. As we could see in the graph below, average revenue per membership in UCAN has not changed materially for the first half of 2023 and is down in EMEA and APAC as the U.S. dollar remains strong.

prepared by the author, using data from SEC Filings

Investor expectations are now focused on the company’s ad business, which holds a lot of potential for revenue growth beyond the short term. In the meantime, paid sharing rollout is expected to fill in the gap in the coming quarters.

For ads, that new revenue stream, we’ve expected a gradual revenue build and so that’s not expected to be a big contributor this year. So continues to be on target. So most of our revenue growth this year is from growth in volume through new paid memberships and that’s largely driven by our paid sharing rollout.

Source: Netflix Q2 2023 Earnings Transcript

Netflix’s large global scale and the company’s broad IP library puts the company in a very good position as advertisers want a scaled solution, but the overall size of this opportunity remains hard to quantify at this point in time.

I’m super bullish and confident in the long-term opportunity of ads a big – advertising as a big incremental revenue and profit contributor to the business. But we do have to build it over time. And there are those secular things.

Source: BofA Media, Communications & Entertainment Conference

Moreover, recent management changes in the division have created the impression that the ad business is off to a bad start and the road ahead won’t be a smooth sailing.

As of June, ad sales and ad-supported subscriber numbers were running at about half of internal projections, according to the report.

Source: Seeking Alpha

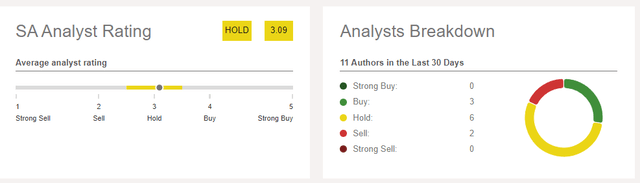

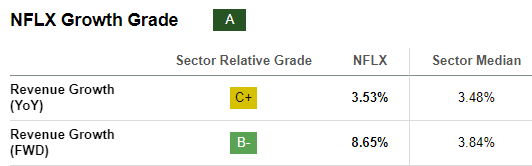

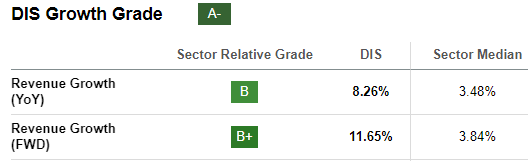

Having said all that, sell-side analysts are currently expecting Netflix to deliver revenue growth of below 9%, which is not very enticing for what’s supposed to be a growth company, but is still an improvement from recent results.

Seeking Alpha

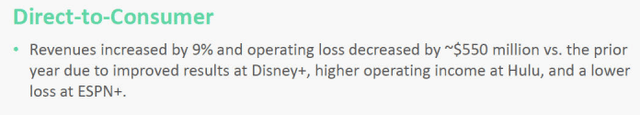

For comparison, Disney’s (DIS) Direct-to-Consumer segment is currently growing at 9%, in spite of all of the company’s recent problems associated with content quality and political leanings.

Disney Q3 2023 Earnings Presentation

On a total company basis, DIS is expected to do even better as revenues from Parks & Experiences are likely to improve.

Seeking Alpha

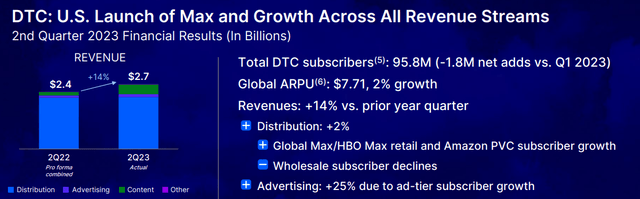

The other major competitor of Netflix in the streaming space – Warner Bros. Discovery (WBD) is growing even faster at double-digit rates and will be a major competitor for NFLX ad business due to its wide global reach.

Warner Bros. Discovery Q2 2023 Earnings Presentation

With all that in mind, it would come as no surprise if Netflix quarterly revenues come up strong as membership additions stabilize and the paid sharing rollout moves along.

Beyond that, however, I remain reserved regarding Netflix potential to deliver above market returns even as the company remains among the leaders in the sector.

A Closer Look At Costs, Cash Flow and Pricing

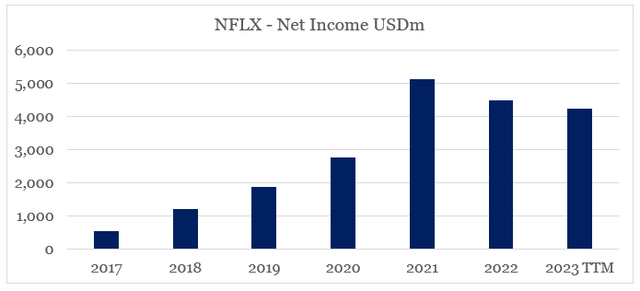

In addition to the slower subscriber and ARPU growth within the industry, costs and cash flow are two key areas that I’m most concerned about. After the visible impact of the pandemic tailwinds in FY 2020 and 2021, Netflix Net Income figure is now under pressure.

prepared by the author, using data from SEC Filings

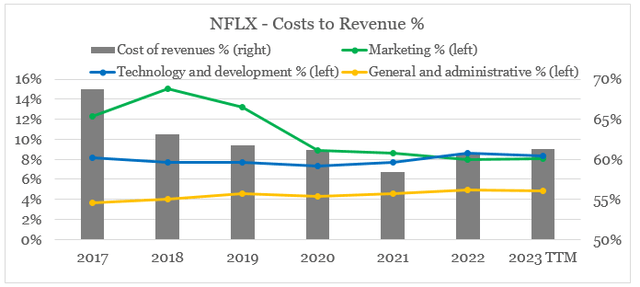

More specifically, development costs continue to increase as economies of scale within the company’s marketing and other fixed costs are now limited. This is largely due to Netflix large global scale which leaves little room for improvement going forward.

prepared by the author, using data from SEC Filings

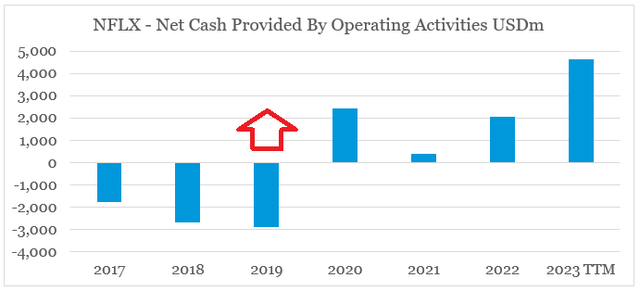

Cash flow from operating activities also remain highly volatile after the company swung from large cash outflow in 2019 to positive cash flow from operating activities in the following years.

prepared by the author, using data from SEC Filings

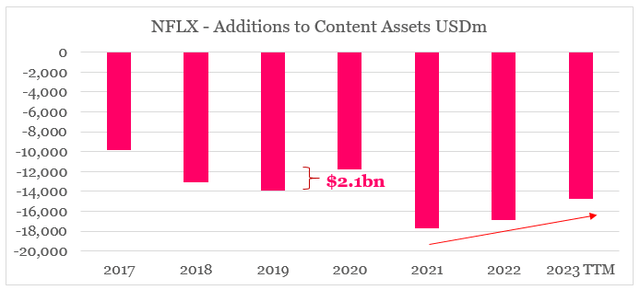

Even though investors assume that this is solely due to the growth in subscribers during the pandemic, in reality NFLX’s cash flow benefited heavily from reduced additions to content assets in FY 2020. As the cash spend on content skyrocketed on FY 2021 it brought the company’s cash flow almost back in negative territory during the year (see the graph above). Since then, there has been a gradual decline in additions to content assets which I do not see as being sustainable in the coming years.

prepared by the author, using data from SEC Filings

Netflix management cannot afford a sustainable reduction in content spend as competition is not staying still. The recent strike also is proof that content spend is bound to increase. On top of all that, Netflix is now forced to seek growth opportunities elsewhere which is unlikely to be a cheap endeavor.

Seeking Alpha

But even after the recent drop in additions of content assets, NFLX currently trades at a free cash flow yield of 2.6% which is not a great proposition for a company expected to grow at 8% which faces rising costs headwinds.

This low free cash flow yield also comes as a result of the major drop in Netflix share price in 2022 which means that levels of around $600 per share are not attainable at this point in time, unless we see another wave of unprecedented liquidity flowing into the markets.

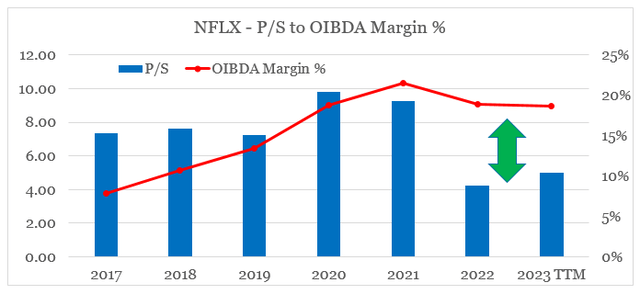

The sharp drop in NFLX share price, however, significantly improved the potential for future returns when compared to the 2020-21 period. This is clearly illustrated by the gap between the Price-to-Sales multiple and operating margin (including depreciation and amortization, but not amortization of content assets).

prepared by the author, using data from SEC Filings and Seeking Alpha

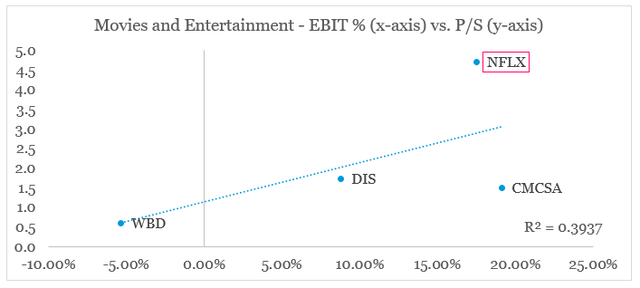

But once we consider everything said above, it’s hard for me to rate Netflix as a buy at this point in time., especially given the company’s high sales multiple relative to its operating margin when compared to peers (see below). Once again, Comcast’s more diversified business model results in the company being priced at a lower multiple, but Disney and Warner Bros. Discovery trade at more attractive levels relative to their business fundamentals.

prepared by the author, using data from Seeking Alpha

Having said that, Disney is not a buy either. I was one of the few contrarians that noticed the problems brewing ahead for Disney all the way back in 2019. If you check my latest analysis on the company, I have recently turned more neutral on the stock, but the strategy problems remain.

Conclusion

After the sharp drop in Netflix share price, investors who are looking for value are now circling around the stock. Although expected returns are now higher than they were back in 2020-2021, the stock could hardly be considered as attractive. Topline growth is slowing and the ad business is off to a rough start. Profitability as well as free cash flow are both under pressure. Last but not least, the stock remains too richly priced given its business fundamentals. That’s why, even though the upcoming quarter could provide investors with some optimism, difficulties beyond the short term remain.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

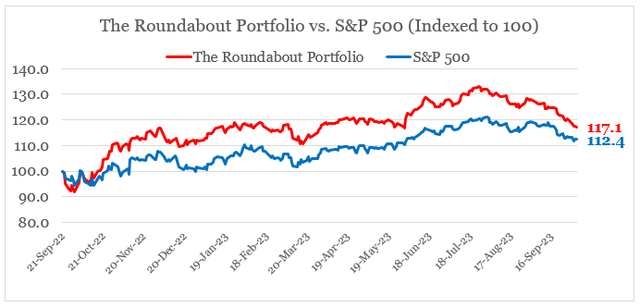

Looking for better positioned high quality businesses in the media space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.