Summary:

- I have a hold rating on NFLX due to its strong growth trajectory but fair valuation and technical resistance near its pre-bear-market highs.

- NFLX reported strong Q2 results with EPS of $4.88 and revenue of $9.56 billion, but shares slipped due to a light top-line guide.

- Key risks include uncertainty in its paid sharing program and ad-supported tier adoption, but NFLX remains best in class in the streaming wars.

- The $610 to $625 zone offers a solid risk/reward play, with potential support at the 200-day moving average and rising trendline.

Alistair Berg

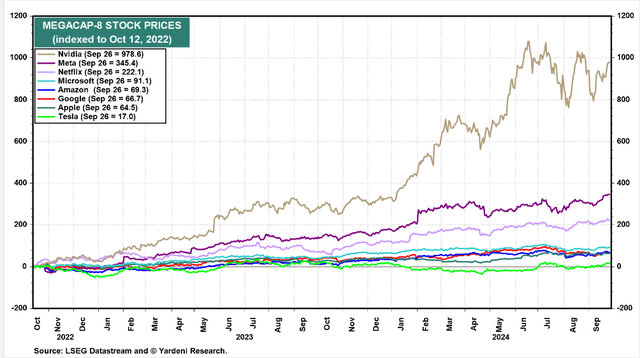

We are coming up on two years of the current bull market. January through mid-October of 2022 was a downright awful stretch for investors, and losses were largest among the mega-cap stocks. Back then, the “Magnificent Seven” moniker was not much talked about, but rather the “Mega-Cap-8” was in focus.

Netflix (NASDAQ:NFLX) was then left out of the bullish narrative following the S&P 500’s low on October 12, 2022. Shares, however, are up 222% in that stretch – behind just NVIDIA (NVDA) and Meta Platforms (META). The outperforming Communications Services stock trades at a fair earnings multiple in my view, though I have some concerns about the chart now that the NFLX has revisited its pre-bear-market highs.

I have a hold rating on the stock and will note a key price point that could offer a buy-the-dip opportunity as we head into Q4.

Mega-Cap-8 Returns Since the October 2022 Bear-Market Low

Back in July, NFLX reported a strong set of quarterly results. Q2 GAAP EPS verified at $4.88, topping the Wall Street consensus target of $4.74. Revenue, meanwhile, registered at $9.56 billion, up 17% from the same period a year earlier, and was about in-line with estimates. The Movies and Entertainment-industry firm reported global streaming paid memberships up 8.05 million compared to Q2 2023, resulting in a total of more than 277 million subs.

Shares slipped in the session that followed, dropping 1.5% compared to an 8.4% implied stock price move based on the options; it was the second straight negative earnings reaction. The post-earnings downside was perhaps driven by a light top-line guide, but Netflix’ management team did forecast an above-consensus EPS forecast.

For the quarter about to end, revenue growth is expected to come in at +14% year-on-year and +19% on a constant-currency basis. Net paid additions may be lower than the gain seen in Q3 2023 – that was the first full quarter impacted by its new paid sharing service. The growth story remains strong, at least according to what the company relays to the street – its FY 2024 revenue is seen rising between 14% and 15%.

For the quarter about to be reported, the consensus calls for a GAAP EPS of $5.09 (versus $3.73 in Q3 2023) on revenue of $9.76 billion (up from $8.54 billion last year). Over the past 90 days, there have been a high 29 sellside EPS upgrades compared to just a pair of downgrades.

The options market prices in a relatively small 6.8% earnings-related stock price swing when analyzing the at-the-money straddle expiring soonest after the October report, according to data from Option Research & Technology Services (ORATS).

Key risks include uncertainty but also significant upside potential in its paid sharing program. While it could result in higher recurring revenue, if competitors catch on and drop pricing, the gains could be less impressive. Its ad-supported tier adoption is another unknown, and we may find out more about its progress in the upcoming earnings release and conference call. Finally, there’s no getting around the streaming wars impacting the industry, though Netflix is best in class on that front.

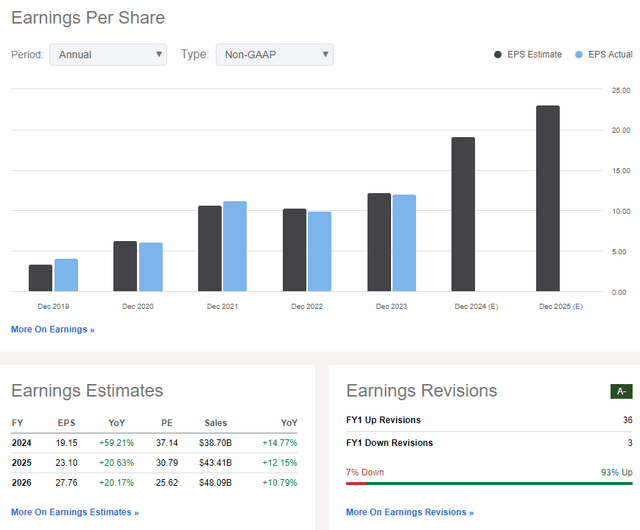

On the earnings outlook, after stagnant EPS trends from FY 2021 through last year, per-share profits are expected to continue to take off, growing by nearly 60% in 2024 and 20% in the out year. By 2026, NFLX may earn close to $28 in operating EPS. The street has also turned more upbeat about the mega-cap just recently, so expectations may be lofty for the Q3 report.

What I like seeing is the firm’s solid free cash flow – the current FCF yield is 2.2% (cash flow growth did take a breather last quarter, however). While not a very high figure, NFLX is managing its cash flow and balance sheet well.

Netflix: Revenue & Earnings Forecasts, Revisions Trends

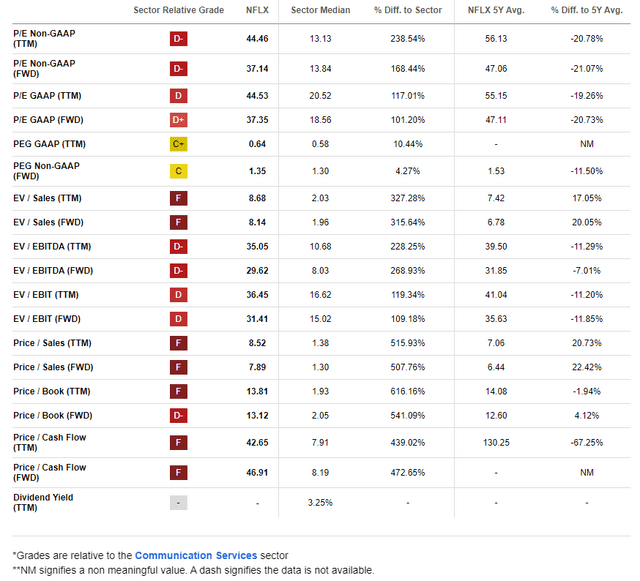

On valuation, given the very high EPS growth rate in the quarters ahead, if we assume a neutral 1.53 forward PEG ratio (its 5-year average) and a long-term EPS growth rate of 21%, then the P/E should be about 32.

EPS over the next 12 months is likely to be near $22. That results in a price target of $704, near where it trades today.

NFLX: Shares Deserving of Premium Valuation Metrics

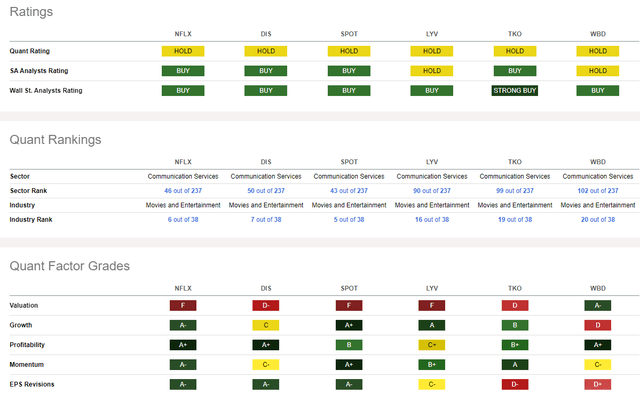

Compared to its peers, Netflix sports a soft valuation rating, though I see the current pricing to be fair. Considering its quality growth grade and industry-leading profitability trends, there are reasons to simply own the stock despite the neutral valuation.

I make that assertion because share-price momentum is very high, and I will note important price points to monitor on the chart later in the article. Finally, sellside revisions trends are encouraging.

Competitor Analysis

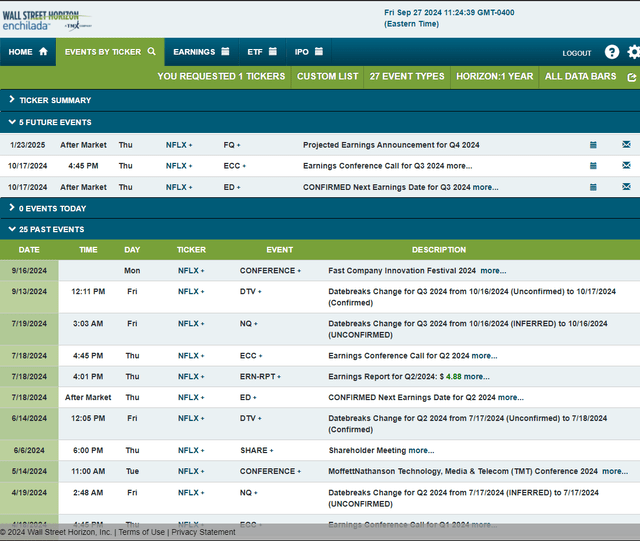

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q3 2024 earnings date of Thursday, October 17 AMC with a conference call immediately after the numbers hit the tape. You can listen live here. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

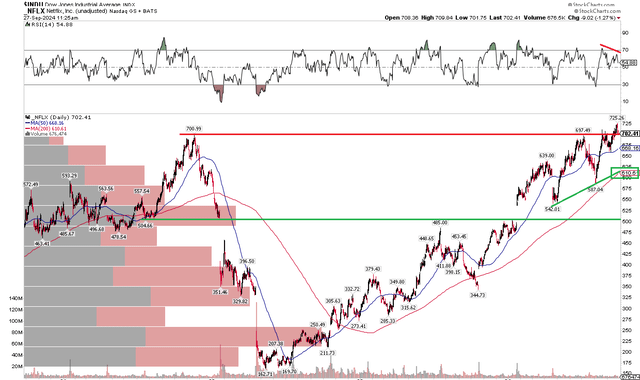

The Technical Take

With healthy fundamentals and shares priced fully, I see the technical situation as neutral in the short term, underscoring my hold rating. Notice in the chart below that NFLX is just now back at its November 2021 high. It’s natural for a stock to pause at this obvious level of significance. A pullback to its long-term and rising 200-day moving average would be ideal for those looking to build a position in NFLX.

Also take a look at the RSI momentum oscillator at the top of the graph – there is modest negative divergence occurring right now, which is a potential sign of an impending price retreat. Along with the 200dma, there is a confluence of support given a rising trendline that may act as support in the low $600s. Bigger picture, I don’t see the stock revisiting a gap near the $500 mark.

Overall, the $610 to $625 zone appears to be a solid risk/reward play on NFLX from the long side with year-end approaching.

NFLX: Expecting a Check Back at the 2021 High, Rising 200dma

The Bottom Line

I have a hold rating on NFLX. The company’s growth trajectory and fundamentals appear strong as it is the leader (and perhaps the winner) in the streaming wars. But with the stock priced near a fair multiple and some technical resistance in play, a hold rating is prudent in my view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.