Summary:

- Netflix reported mixed Q2-23 results, as subscribers and profits crushed expectations, whereas revenues and guidance fell short.

- The stock responded with a 9.0% selloff, a legitimate post-earnings panic considering the stock doubled in less than a year and there are apparent headwinds from the Hollywood strike.

- Despite missing revenue expectations, it’s clear that the password-sharing strategy and plan optimization is on pace to deliver substantial growth.

- Fundamentally, Netflix provided investors with everything they needed to hear. Growth is projected to accelerate, margins are expanding, and free cash flows will continue to scale.

- I believe the sell-off provides a decent opportunity and reiterate a Buy rating.

Mario Tama/Getty Images News

Netflix (NASDAQ:NFLX) reported mixed Q2-23 results. Revenues totaled $8.2B, compared to an expected $8.3B, and EPS came at $3.29, compared to the expected $2.86, as operating margins continued to expand. The company added 5.9M net subscribers, reflecting its password-sharing crackdown is already a success, as revenue in each region is higher than pre-launch, and sign-ups are exceeding cancellations.

Management increased its free cash flow guidance for the year from $3.5B to $5.0B, primarily due to production delays caused by the ongoing strikes. On the flip side, revenue guidance for the next quarter is below expectations, and ARM is slightly decreasing.

As Netflix continues to expand the gap over its struggling streaming peers, I reiterate a Buy rating and raise my price target to $487 per share.

Background

About a month ago, I published Netflix: 3 Reasons Why It’s Not Too Late To Buy, Yet and began my coverage of the company with a Buy rating. I urge you to read that article, in which I explained my investment thesis thoroughly, as well as described the company’s growth acceleration strategies, margin expansion potential, and free cash flow scalability, as well as provided full valuation analysis, and went over the company’s major risks.

Now, let’s begin by revisiting the investment thesis and assess how the drivers for growth acceleration (password sharing, ads, market share gains) are progressing. Then, we’ll discuss the margin and free cash flow outlook, and provide an updated model.

Revising The Investment Thesis

In my previous article, I summarized my thesis as follows:

My investment thesis in Netflix is simple. Looking at its historical content investments, we realize that right around the $17B level is where the company is able to grow subscribers and keep them satisfied. Thus, as it reaches scalability, every incremental dollar of revenues should lead to a better operating margin and a better free cash flow margin.

And while most of Netflix’s peers are struggling, most of the data suggests that Netflix’s trough is behind us. So the investment thesis is based on three legs. One, growth re-acceleration due to success in password crackdown and ad tiers, as well as overall market growth and market share gains; Two, continued margin expansion leveraging economies of scale and-; Three, sequential free cash flow growth as content investments become a lower portion of sales.

Let’s see how each of those legs performed during the quarter, beginning with growth re-acceleration.

Growth Acceleration

Netflix reported revenues of $8.2B in the quarter, representing a 2.7% reported growth or 6.0% on an F/X neutral basis. Nothing to brag about in those numbers. However, the company said it expects 7.5% growth in Q3, on a reported basis, and further acceleration in Q4.

Growth will be driven primarily by new subscribers, as Netflix added 5.9M net paying subscribers in the quarter, more than double the 2.2M expected. The company said it expects a similar level of subscriber growth in the current quarter, which also would be well ahead of forecasts.

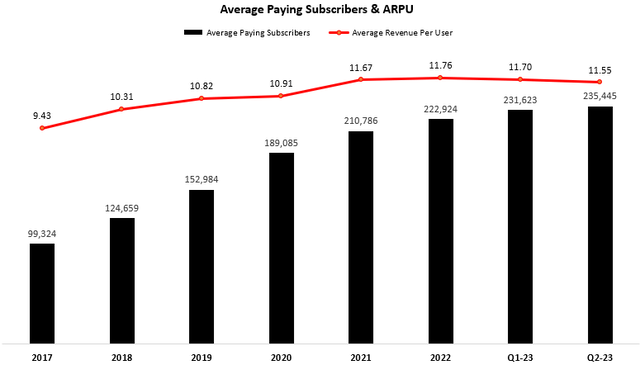

Created by the author using data from Netflix financial reports; Subscriber amounts in thousands.

Looking at the company’s average paying subscribers and ARPU for the quarter, we can understand why revenue growth isn’t as impressive as paid net additions. The gap between the company’s end-of-period subscribers and average subscribers for the period is reminding us of how it used to look in the past when the company was still in a major growth phase.

Clearly, a new paying subscriber which is added in a quarter doesn’t have a full-quarter effect on revenues. Moreover, some new subscribers are joined through deals that are allowing them to enjoy an initial period for free, also delaying the revenue contribution. Thus, the subscriber growth transformation to revenue growth is a several-quarter journey.

Regarding ARPU, we see a drop QoQ and YoY, with Netflix being logically reluctant to increase prices during its ongoing password-sharing crackdown.

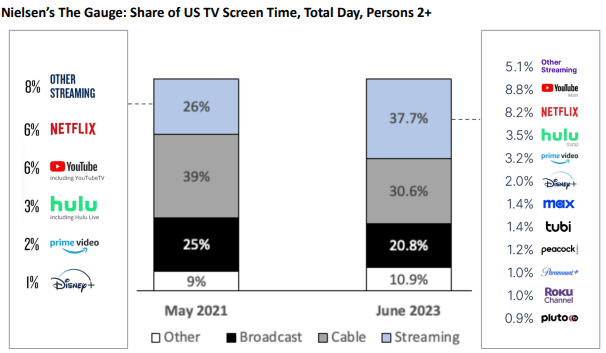

Netflix Q2-23 Letter To Shareholders; Based on Nielsen Data.

Looking at streaming share, it’s continuing to grow, taking 37.7% of U.S. TV screen time in June 2023, compared to 26.0% in May 2021, and 34.0% in the first quarter of 2023. While June is typically a better month for streaming without many live sports happening, the trend is clear. Furthermore, Netflix continues to take share in streaming, with 21.6% in June 2023, compared to 20.5% in Q1-23.

This is enabled by the company’s unparalleled content offering. Netflix had the top original streaming series in the US for 24 of the first 25 weeks of 2023, and the top movie for 21 weeks.

Overall, I’m pretty certain that with the combination of ads, plan optimization, password sharing crackdown, screen time share gains, and reasonable price increases, Netflix’s growth will accelerate in the second half of the year and return to high-single digits for the foreseeable future.

Margin Expansion

So we understand the revenue growth upside, but as we mentioned, the days of growth at all costs are over. For continued upside, it’s crucial that Netflix will showcase operating leverage as well.

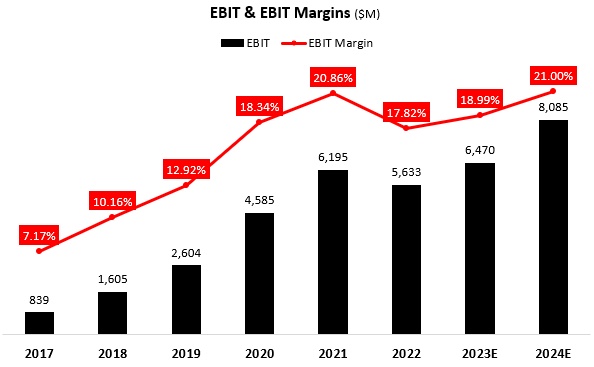

Created and calculated by the author using data from Netflix financial reports and the author’s projections.

In Q2, operating profit amounted to $3.5B, reflecting a 22.3% operating margin, which is 2.5 percentage points higher than the prior year period and 1.3 points higher compared to last quarter. Specifically, marketing expenses and R&D both decreased as a percentage of sales, demonstrating the company’s operating leverage. Looking forward, management is guiding for a 22.2% margin in Q3 and a 19% margin as the mid-point for the full year.

Free Cash Flow & Content Investments

As we all know, Netflix’s free cash flows have been a major concern for investors, as the company was one of the first pure streamers to generate profit, and yet cash flows were non-existent. This was a result of huge content investments compared to the company’s cash generation.

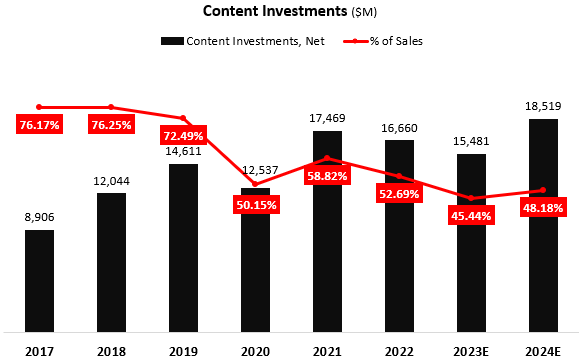

Created and calculated by the author using data from Netflix financial reports.

However, the cash flow problem seems like a story of the past, as management is now guiding for $5B in free cash flows for the year, and as we can see, content investments as a percentage of sales are decreasing significantly, while in absolute terms, they remain high.

In H1, cash spent on content investments amounted to $6.5B, which is 39.5% of total sales. Investments in content are currently especially low due to the ongoing Hollywood strike, which we will discuss in further detail later. The company’s improved cash flow guidance is partially due to delayed production caused by the strike, meaning some of it is pulled forward from 2024. However, management is expecting continued positive FCF until further notice, and while some lumpiness could occur, I expect approximately $5B in FCF in 2024 as well, despite much higher content investments.

Important Notes

[Strikes] We produced heavily across all kinds of content TV, film, unscripted, scripted, the local domestic, English, non-English, all those things and they’re all true. But besides the point, the real point is we need to get to this strike to a conclusion so that we can all move forward.

— Ted Sarandos, Co-CEO, Q2-23 Earnings Call

Among pure streamers, no company is better positioned to deal with the strike than Netflix. Management won’t be blunt about it, but the truth is they can manage a few more weeks or even months. First, Netflix’s content for the next twelve months is mostly ready; Second, it has significant production capabilities outside Hollywood and even outside North America, and; Third, it’s the only company that is generating positive cash flows and isn’t bleeding cash.

While some competitors like Apple and Amazon will probably be just fine, and YouTube has nearly zero exposure to the strike, among the narrow group of true competitors like Disney+, HBO, Peacock, etc., Netflix is clearly the least worried.

[Advertising] We’ve got a lot of work to grow this business. And the first priority that we’re focused on is scale. We know that reach is one of the predominant consideration — the dominant considerations that advertisers have when they think about where to go to spend their dollars. We want to be in that top list. We grew ads planned membership almost 100% quarter-to-quarter. So that’s good growth.

— Greg Peters, Co-CEO, Q2-23 Earnings Call

One of the more significant growth drivers for the company is its ad-based tiers, which grew subscribers by almost 100% QoQ. Ad-tiers are generating higher ARM (average revenue per member) than Netflix’s basic tiers, which has led the company to cancel those in three major markets, including the U.S., Canada, and the United Kingdom.

As linear TV continues to struggle, Netflix is extremely confident in its ability to take ad dollars from cable into its streaming platforms. That being said, management expects the process to achieve the 10% of total revenues target will take time, as there are a lot of new capabilities the company needs to develop.

[Free cash flows] I mean what you see in our cash flow forecast, we took it up for 2023 in terms of our expectations. It’s really driven by a few things. One, just higher certainty in our forecast with the success of the early success of the paid sharing rollout. We also had some move in production timing, just the typical ins and outs of the schedule. And then lastly, the impact of the strikes. And so there’s still a pretty wide range of outcomes for where we — where we’re going to ultimately land on cash flow this year given the ongoing strikes, but — and that may also create some lumpiness actually between 2023 and ’24. So still a substantial expected free cash flow in ’24, but some lumpiness between the years.

But more broadly, we’re past that most cash-intensive phase of building out our original programming strategy. So we’ll have some near-term lumpiness. But if we apply a multiyear lens, we expect positive and growing free cash flow trajectory in the years ahead.

— Spencer Neumann, CFO, Q2-23 Earnings Call

As I mentioned, management is certain about the company’s positive FCF trajectory from 2023 and beyond. While there could be some fluctuations, it’s clear that the company will demonstrate operational leverage and grow its FCF margins over time.

[M&A] We’ve always looked at these things in terms of the opportunity for IP versus those assets, some of those assets are stressed for a reason. And so we’re mostly looking at when we look at our M&A activity would be mostly around IP that we can develop into great content for our members, which is our real strength in business.

— Spencer Neumann, CFO, Q2-23 Earnings Call

Regarding the Paramount (PARA) and ESPN (DIS) rumors and the likes, management is pretty straightforward with the fact they’re not looking to acquire businesses. They don’t need that. What they’re looking for is IP, which will drive better engagement. Therefore, if a deal happens it will probably be as part of a divide-into-parts kind of framework. Specifically regarding ESPN, Netflix doesn’t want to participate in the sports rights business, stating the economics don’t align.

Valuation

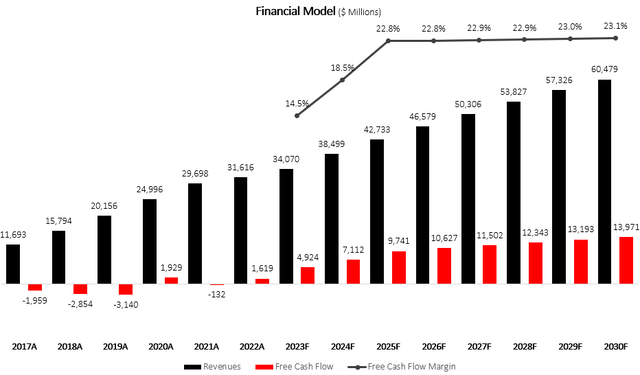

I used a discounted cash flow methodology to evaluate Netflix’s fair value. I assume the company will grow revenues at a CAGR of 8.5% between 2023-2030, based on the growth prospects discussed above.

I project free cash flow margins to increase incrementally up to 23.1% in 2030, as the company’s scale will cause content investments and operating costs to become a significantly lower portion of total sales.

Created and calculated by the author based on Netflix financial reports and the author’s projections

Taking a WACC of 8.0% and adding its net debt position, I estimate Netflix’s fair value at $216.3B or $487 per share.

Explaining The Sell-Off

Netflix is a sell-the-news company, and investors should be pretty much accustomed to double-digit post-earnings declines. Still, between a lot of the good, there was some bad and some ugly.

Starting with bad, investors, and analysts are realizing that the effects of the password-sharing crackdown and the advertising business won’t be immediate, which means near-term revenue estimates are probably overly positive and will be downgraded over the upcoming weeks. After it doubled in a year, it only makes sense that the stock will decline on every bit of bad news.

And the ugly, the strikes provide uncertainty regarding content costs in the future. From what I understand, the demands of the strikers are quite high, and borderline unreasonable, especially given the fact that Netflix is essentially the only company that’s making reliable profits in the industry. Still, investors are worried that their long-term margin targets are now vulnerable to a union dispute.

Conclusion

After a 148% surge from its June lows, Netflix came out of 2022 as the clear, and maybe the only, winner in streaming. Even after the increase, I estimate there’s still an attractive upside, especially after the selloff. Despite the headwinds from the strikes and the longer-than-expected revenue story, I believe the investment thesis remains intact and reiterate Netflix as a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.