Summary:

- Netflix has outperformed the Nasdaq and S&P 500 with a 113% total return since 2023.

- The company’s success is attributed to accelerating revenue growth, margin expansion, and declining debt.

- Netflix’s long-term trajectory remains attractive, heading into the Q1 report due on Thursday.

hocus-focus

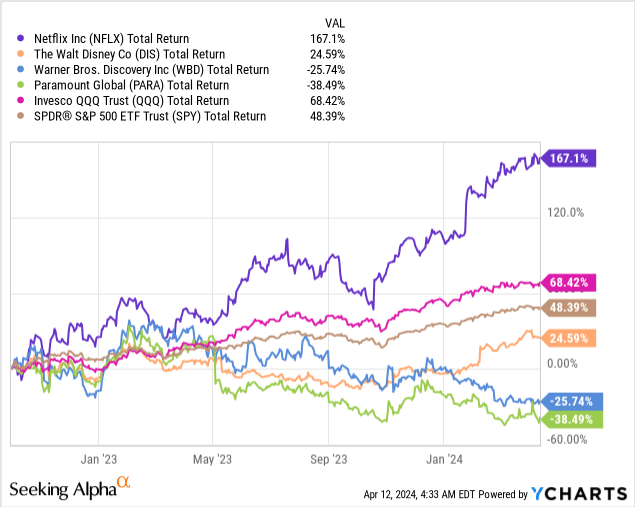

Netflix (NASDAQ:NFLX) has been one of the best-performing stocks since the 2022 bear market. With a 113% total return since 2023, the streaming giant almost doubled the Nasdaq and more than tripled the S&P 500.

This impressive performance results from the bullet-proof combination of accelerating revenue growth, margin expansion, and declining debt.

Heading into Q1 results which are due this Thursday, Netflix is trading at a 36.6x multiple, which means valuation is now much more aligned with the company’s prospects.

That said, the long-term trajectory remains extremely attractive. So, let’s dive into the key focus points to monitor in the print and see if Netflix remains a Buy.

Introduction

I’ve been covering Netflix on Seeking Alpha since June of 2023. Throughout the period, I maintained a Buy rating, listing the main drivers for future outperformance, and explaining why the market misunderstands the company’s strengths.

In short, it’s pretty much a done deal – Netflix has won streaming. Aside from YouTube, which in my view plays in a different field, no streamer comes even remotely close to Netflix.

Not in terms of profitability, not in terms of mind share, not in terms of growth prospects, and most importantly, none of them is a pure-play streamer, which sandals them from making the correct strategic decisions.

As we can see, since the market lows in October 2022, Netflix hugely outperformed the Nasdaq, the S&P 500, and its supposable competitors.

With that said, all of this belongs to the past. Let’s see what lies in Netflix’s future.

Revisiting The Three-Legged Investment Thesis

For each company I own or cover, I like to envision the path to outperformance. Usually, it comes down to above-market top-line organic growth combined with margin expansion and attractive cash conversion, but the specifics and the predictability aspects are what matters.

In Netflix’s case, it’s quite simple. The company should continue to grow subscribers as it has an unparalleled content offering and best-in-class distribution. Whether members subscribe to the ad tier or not doesn’t matter in the sense that Netflix’s ARPU will continue to go up, especially when lesser competitors are raising prices to remain above water.

Transitioning to margin expansion. The majority of Netflix’s costs are fixed and have no direct relation to revenues. Aside from the incremental distribution costs per customer (which are immaterial), the product that Netflix provides is content, and this content has a similar cost whether 1 person watches it or 250 million people watch it.

Just a few years ago, investors feared the streaming business model wasn’t sustainable because there’s a need for huge cash investments to generate content to keep members subscribed.

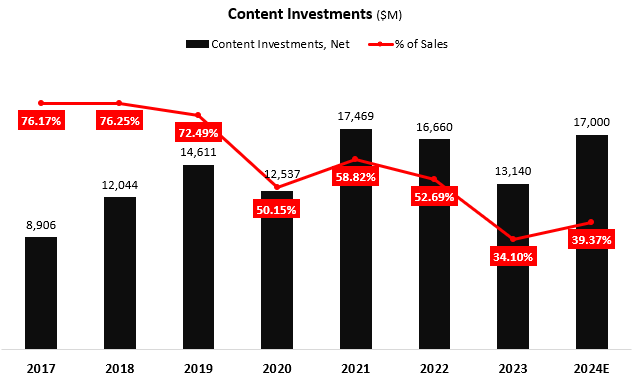

It turns out, that at a certain scale, this wheel turns on its head. Today, Netflix spends approximately $17 billion annually on content, a similar level to what it did in 2021 and 2022 (would have been in 2023 if it weren’t for the strikes).

The difference is Netflix serves 45 million more subscribers, at a higher ARPU, and with lower marketing spend.

So this is the three-legged thesis in a nutshell – continued top-line growth which will translate into incremental profitability due to operational leverage.

Let’s dive deeper into each leg.

Organic Growth Through Subscribers & ARPU

Netflix estimates there are currently 500 million households with connected TVs worldwide, out of a billion plus broadband households. As such, Netflix is only in 50% of currently available households, and the number of those continues to grow as well.

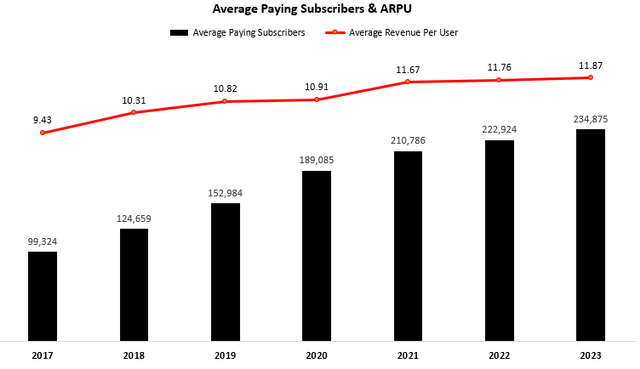

Created by the author using data from Netflix financial reports; Subscriber amounts in thousands.

With the help of its password-sharing crackdown and the introduction of an ad tier, Netflix achieved a record Q4 for subscriber additions, while maintaining an industry-high ARPU.

The company ended the year with 260 million subscribers, which provides a baseline for 2024 average subscriber growth of at least 11%. It’s highly likely Netflix will reach at least the mid-teens, as it guided for more than 1.8 million ads in Q1, which is seasonally a low quarter.

Furthermore, Netflix announced price increases in several of its main geographies, and as usual, we shouldn’t expect major resistance in the form of churn, especially due to the fact almost all of its competitors raised prices as well.

This solidifies top-line growth for 2024 but also reflects the long-term growth algorithm for the company. Notably, consensus estimates place revenues for the year at $38.6 billion, which is only slightly above the baseline (260 million subscribers multiplied by $11.87 ARPU). I expect the company to surpass those estimates handily.

Margin Expansion

Netflix’s management is quite transparent and ambitious, yet they refrain from providing a long-term margin target. In my view, this is simply because they truly believe they can achieve 40%+ EBIT margins and don’t want to come out as delusional or overly optimistic.

It’s all a matter of scale, and it will probably take more than a decade, but there’s no ceiling to Netflix’s operational leverage in near sight.

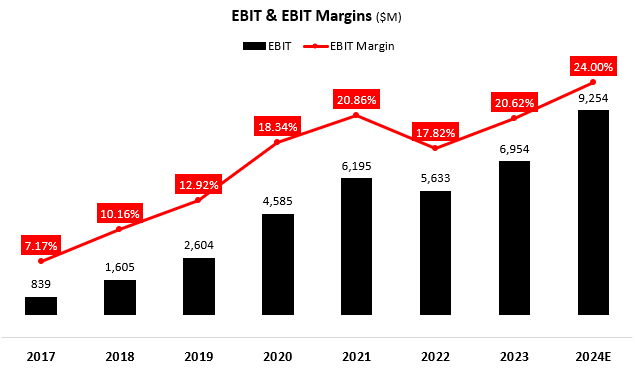

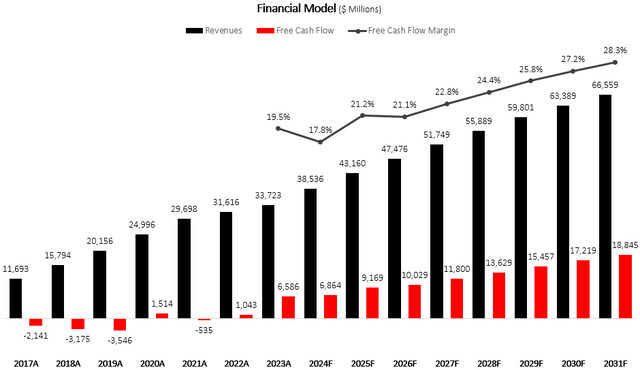

Created and calculated by the author using data from Netflix financial reports, the author’s projections, and management’s guidance.

In 2024, management guided for 24% operating margins. My number is higher, but let’s stick to their targets. Based on current consensus estimates for revenues, EBIT is expected to grow more than 33% in 2024.

With marketing, R&D, and G&A expenses all growing slower than revenues, I believe Netflix will get closer to the 25% level, which would bring us to nearly 40% growth.

Cash Conversion & Content Investments

Surprisingly, management said they expect to invest their typical $17 billion in content this year, whereas many analysts, including myself, expected them to compensate for 2023 with increased investments in 2024.

That said, management did guide for lower free cash flow this year, at $6 billion, a $1 billion decline, which would have been a small increase if it weren’t for the benefit of the strike in 2023.

Created and calculated by the author using data from Netflix financial reports.

Similar to the margin story, operational leverage will definitely translate into increasing free cash flows as well. I expect FCF growth will be even faster because the content is amortized over time (P/L) whereas cash will remain fixed at an annual rate of ~$17 billion.

Key Points In Q1’24 & Long-Term Focus

As we’ll discuss in the valuation section, Netflix is no longer vastly underappreciated by the market. Historically, the stock experienced sharp moves after earning reports, with subscriber numbers being the major driver.

I don’t know how the market will react when subscriber growth slows from ~13 million net adds to ~2 million, despite management’s guidance and usual seasonality. I also don’t know how the market will react if ARPU doesn’t increase because price increases haven’t fully kicked in, and the ad tier might have a negative effect on the headline number.

With that said, I do believe that Netflix will beat consensus estimates in the quarter, especially on profitability which management likely intentionally provided a beatable bar.

I encourage investors to come into the print with a long-term focus. As long as Netflix continues to add subscribers, grow ARPU, and demonstrate operational leverage, trying to sell high and buy low won’t work. Investors have much more to gain if they stick with Netflix throughout this period of elevated growth.

If something breaks in the algorithm, that’s something else, but I view that as highly unlikely.

Valuation

Netflix is expected to achieve $17.2 EPS in 2024, reflecting 43% growth. That puts the stock at a 36.5x P/E, which seems high. However, normalized for growth, the PEG is 0.85x.

2024 will still have the benefit of easier comparisons (Netflix’s recovery really started in Q3’23), so the 43% growth number is arguably not representative.

For 2025, Netflix is expected to bring in $21.2 in EPS, or 23% growth, which is more of a normalized level. This would put the company at a 2025 P/E of 29.7x, and a PEG of 1.3x, still quite reasonable.

Netflix doesn’t really have any comparable peers, and its historical valuations are irrelevant because the company is much more mature today. So aside from multiples, I’m using a DCF model to support my analysis.

Created and calculated by the author based on Netflix financial reports and the author’s projections

In my model, I assume Netflix will grow revenues at a 9% CAGR between 2023-2031, while FCF margins will increase gradually to 28.3%, leading to a 14% CAGR in free cash flows.

Taking an 8.3% WACC, I estimate Netflix’s fair value at $675 a share, reflecting a 7% upside.

Although it seems somewhat low, I have high confidence in Netflix’s ability to surpass my expectations significantly. Additionally, I expect the stock will follow earnings growth for the foreseeable future, which should mean high-teens annual returns.

Conclusion

Netflix is set to report its Q1’24 earnings on Thursday, April 18th. The company is coming into the print with higher expectations, with the stock up 2.7x since its October 2022 lows.

For several quarters in a row, Netflix was able to beat expectations by a significant margin, as its must-have positioning has led to industry-leading subscriber growth, while its leadership is managing operations exceptionally well.

I see no reason for this to change, and reiterate a Buy rating despite the sharp surge in price.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.