Summary:

- Netflix is continuing to struggle to generate cash flow and any form of substantive shareholder returns.

- The company’s dilemma is a lack of multiple sources of revenue generation, meaning it needs to earn higher margins than competitors in streaming.

- We expect the company to continue to underperform versus deep-pocketed peers, hurting future returns.

Wachiwit

Netflix (NASDAQ:NFLX) has almost doubled from its 52-week lows as the company’s share price onslaught slows down, pushing the company’s market capitalization back over $140 billion. However, as we’ll see throughout this article, the company remains fraught with risk with a stagnating business that indicates it’s no longer a valuable investment.

Netflix As A Trend Follower, Not Setter

Netflix was forced to become a trend follower as the market has become increasingly expensive. The company recently announced an ad-supported tier, after long swearing off the ad business, after needing a way to both maximize revenue and keep the costs directly paid by customers lower. It remains to be seen how this’ll pan out.

At the same time, the company has been forced to tone down ambitions such as its video gaming division, and expand its theatrical movie releases, after the company has realized that the traditional media model has a number of advantages. Those advantages were avoidable when the company was the only streaming service, but they’re less avoidable with increasing competition.

Netflix Has Nothing Else

At the core of Netflix’s problem is that they have nothing else. They’re a streaming company, that’s it. A traditional media company like Disney (NYSE: DIS) has numerous sources of diversification, including theme parks, theatrical releases, streaming, and cable. That means Netflix needs to earn everything from a single business.

Netflix releases new shows and it earns no additional money. Even if Disney earns no extra money from a streaming service show, it earns toy sales, park visits, and cruises. It makes the business much more robust and it enables the company to accept much lower margins for its streaming business. That’s tough for Netflix.

The company is finally slightly branching out with ads, but will it be too little too late?

Netflix’s Financial Stagnation

Financially, Netflix’s guidance indicates continued stagnation.

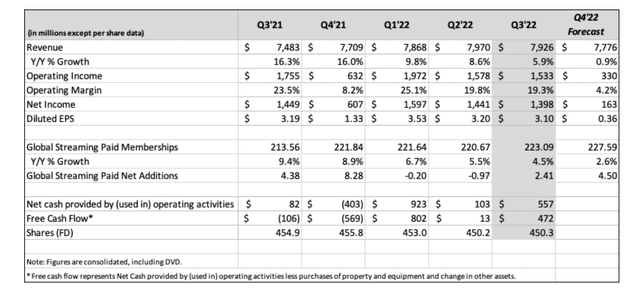

(Source: Netflix Financials – Netflix Press Release)

The company’s most recent quarter saw just under $7.93 billion in revenue, a slight QoQ decrease. Through the 1st 3Q 2022, the company’s revenue has remained fairly constant. The company’s forecast is for a decline of $150 million of revenue in 4Q 2022, resulting in 0.9% Y/Y revenue growth for the company.

The company’s operating margin is expected to be much lower in the 4Q 2022, after the company had higher margins in the 3Q by shifting expenses to the 4Q. The company expects diluted EPS for the quarter to be a mere $0.36.

Netflix Pricing Power

Netflix’s risk is pricing power.

Followers of Netflix now believe that the company is losing money as it has continued to raise prices and annoy users. The company has blamed password sharing and increased competition. However, regardless of all of this, the main takeaway is that the company’s pricing power has eroded substantially. It can no longer continue to rapidly increase prices.

HBO recently raised prices by $1/month, indicating that competitors as a whole might raise prices, but until then we expect Netflix won’t be able to improve margins much.

Our View

Netflix created a new industry and then came to dominate it. The company is the largest streaming service in the world and generates tens of billions of dollars in annual revenue each year. The company has also become one of the largest content producers in the world and it’s now spending almost $20 billion annualized on content.

Unfortunately, the company has also become a victim of its own success. Other large media companies have realized the opportunity in streaming and they’ve stepped up in a big way. Netflix is right when it talks about how its competitors are losing money, but that doesn’t mean they’ll stop, with billions earned from other businesses.

In the meantime, Netflix’s pricing power has eroded and we don’t expect the company to continue performing well financially. The company needs to earn substantial profits to justify its valuation, and we expect it’ll struggle to do that, generating mediocre shareholder rewards going forward. Let us know your thoughts in the comments.

Pair Trade

For those looking at a potential investment, we recommend a potential pair trade. Investors can short Netflix and invest in Warner Bros. Discovery (NYSE: WBD) and Disney. That’ll enable investors to take advantage of a recovery in the markets or the entertainment industry, while taking advantage of our expectation for Netflix’s continued weakness.

Thesis Risk

The largest risk to our thesis is that there’s a large percent of the global population that doesn’t have access to the internet or use a streaming service. Therefore, there’s still a large untapped market and Netflix is the largest player in the streaming market. That means that as market growth continues, Netflix will be able to increase its market positioning.

Conclusion

Netflix seems to have peaked. The company’s forecast for YoY growth is expected to drop into the low-single digits in the upcoming quarter. The company’s expectation for revenue is to drop as well in the upcoming quarter. The company’s overall annualized revenue appears to have peaked. At the same time, the company’s strong recent margins will be crushed.

The company’s outstanding shares are remaining fairly constant, or even decreasing slightly; however, the company’s FCF is essentially nothing. The company doesn’t have a path towards fixing that or revamping growth, but at its market cap it needs $15 billion in stable long-term FCF or 50% of its revenue.

For this reason, we see Netflix as still being heavily overvalued.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.