Summary:

- Paid account-sharing seem to be driving the Netflix, Inc. subscribers base, but should have negative effect on ARPUs.

- Despite possible slowdown of ARPU growth, revenue projections seem secured.

- Netflix is well positioned in terms of well structure, margins outlook positive.

- Content spend should be less elevated in the future, and we’ve increased the free cash flow forecast.

- After a long rally, Netflix seems to have limited price growth potential now, so we’re setting HOLD status. However, we believe the company still has further opportunities to grow, so monitoring continues.

Investment Thesis

Netflix, Inc. (NASDAQ:NFLX) Q2 earnings brought a bit more certainty. The paid-sharing strategy is developing well and supporting growth rates, and both cash costs and content investments show positive dynamics. Since our initial coverage, NFLX share prices have significantly increased and now the upside is limited, so we’re setting a HOLD status on $NFLX. However, further fundamental improvements are yet to be, so investors should be watching for the price and waiting for the updates.

Account-sharing is likely to decrease ARPUs, but support customer base growth rates

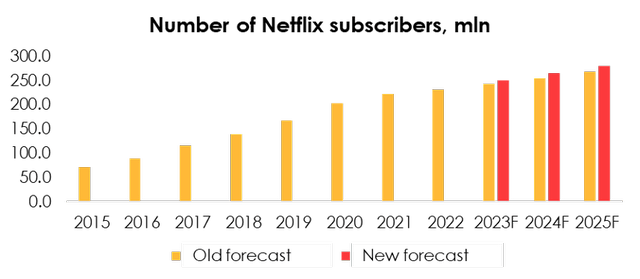

Netflix again showed strong subscriber growth in Q2. The number of U.S. accounts reached 75.6 mln (compared with our forecast of 74.0 mln), and international accounts 162.8 mln (compared with the forecast of 159.7 mln).

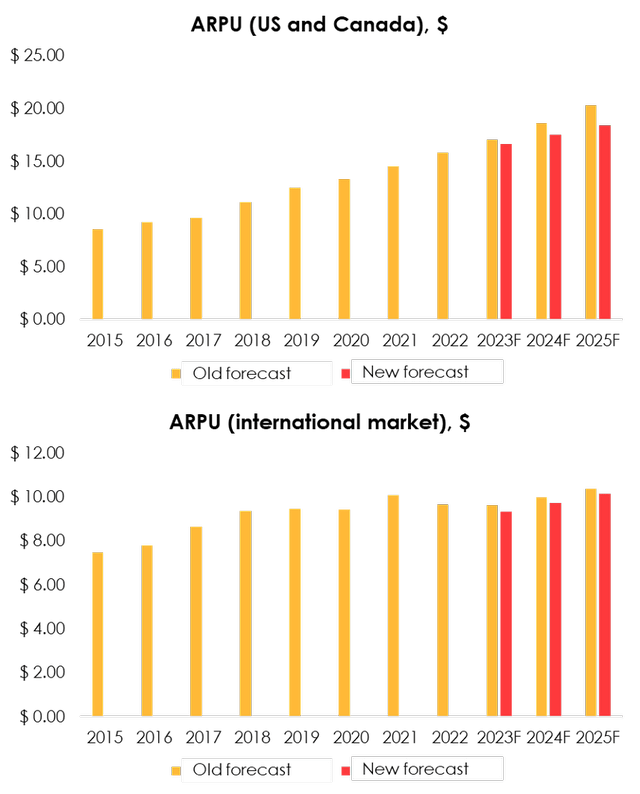

It was an important factor that Netflix introduced subscription sharing in more than 100 countries in 2Q. We suspect that shared accounts still count as individual users as the ARPU strongly deviated from the trend: North American ARPU was $16.00 (+0.3% y/y), compared with the forecast of $16.97 (+6.4% y/y), while internationally it was $9.41 (-5.4% y/y) compared with the forecast of $9.48 (-4.7% y/y).

Netflix has also disabled the basic subscription option for new users in several markets. Customers can now choose between the ad-supported option, the standard and the premium plans (the US rates are $6.99, $15.49 and $19.99, respectively). Because ads generate an estimated $3.5 to $6 per account, the transfer of users from the basic subscription to the ad-supported subscription will not have a meaningful impact on ARPU, which will even improve in 2024 due to the recovery of digital marketing.

However, the widespread popularity of account sharing, even as it will accelerate the growth of the subscriber base, should have a negative impact on average revenue per user. Currently, the price of purchasing an extra member slot is about half as much as buying your own standard account, which is probably the reason for the sharp drop in ARPU growth rates in 2Q.

We have reflected the short-term effect of the cannibalization of existing accounts in the forecast period (affecting ~1% of subscribers over the next six months), while making an assumption for the medium term that the increase in the number of shared accounts will be 50% of the rate at which organic growth of personal accounts will take place.

Therefore, we are raising the forecast for the number of subscribers to the service from 242.9 mln (+5.25% y/y) to 249.7 mln (+8.23% y/y) for 2023, and from 255.3 mln (+5.12% y/y) to 265.3 mln (+6.25% y/y) for 2024.

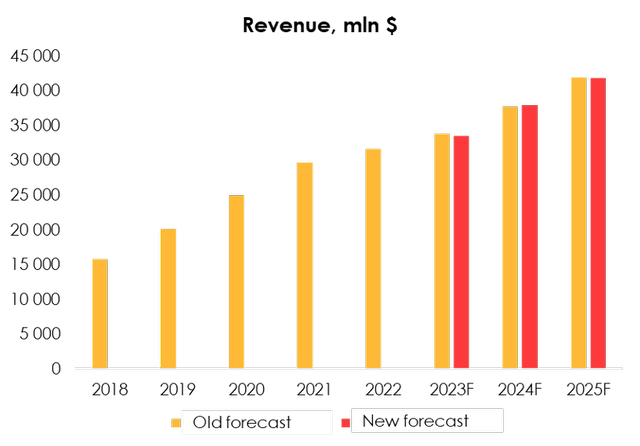

We are lowering the revenue forecast from $33 866 mln (+7.2% y/y) to $33 863 mln (+7.1% y/y) for 2023 and from $37 905 mln (+11.9% y/y) to $37 772 mln (+11.6% y/y) for 2024 due to:

- The reduction of the forecast for the service’s subscriber additions from 13.74 mln to 12.13 mln for 2023 and from 12.78 mln to 12.40 mln for 2024.

- The increase of the US ARPU forecast from $17.00 to $17.07 for 2023 and from $18.55 to $18.64 for 2024, and the increase of the ARPU forecast for the international business from $9.48 to $9.53 for 2023 and from $9.84 to $9.88 for 2024 because of the successful implementation of the strategy to introduce ad-supported subscriptions.

Because the price of account sharing is much lower than the price of purchasing a new account, we have given consideration to the rising popularity of sharing and reduced our forecast for ARPU. We estimate the proportion of shared accounts could reach 8.2% by 2025, which would significantly slow the growth of ARPU, even with regular rate increases.

We are lowering the forecast for U.S. ARPU from $17.07 (+7.65% y/y) to $16.63 (+4.84% y/y) for 2023 and from $18.64 (+9.15% y/y) to $17.56 (+5.60% y/y) for 2024. We are lowering the forecast for the ARPU of the international business from $9.64 (-0.24% y/y) to $9.35 (-3.20% y/y) for 2023 and from $10.00 (+3.72% y/y) to $9.73 (+4.07% y/y) for 2024.

Therefore, we are lowering the revenue forecast for 2023 from $33 863 mln (+7.1% y/y) to $33 520 mln (+6.0% y/y) and raising it for 2024 from $37 772 mln (+11.5% y/y) to $37 910 mln (+13.1% y/y).

Cost structure remains stable, slightly positive updates taken into account

We have introduced the following changes to the costs outlook:

- We have cut the forecast for gross cash costs from $5 387 mln to $5 158 mln for 2023 and raised it from $5 612 mln to $5 686 mln for 2024. The metric used to reflect y/y changes, which caused an inaccuracy with forecasting 2Q EBITDA. Because the company doesn’t have any prominent seasonality in this cost item, we have transitioned to computing it as a % of revenue, so that the forecast is proportionate to business growth.

- The company’s management has issued a guidance regarding future investment in content. According to the guidance, the ratio of investment to amortization will equal about 1.1х, which caused us to cut the forecast for investment in content from $16 123 mln to $15 418 mln for 2023, and from $18 985 mln to $17 394 mln for 2024.

Netflix could potentially incur additional costs as employees of the U.S. media industry are currently on strike seeking long-term royalty checks in a film industry that has been taken over by the streaming model. However, we believe that Netflix will either not be affected at all, or the effect will be insignificant, as a considerable share of its content is concentrated in local markets, and remuneration arrangements are discussed on a case-by-case basis.

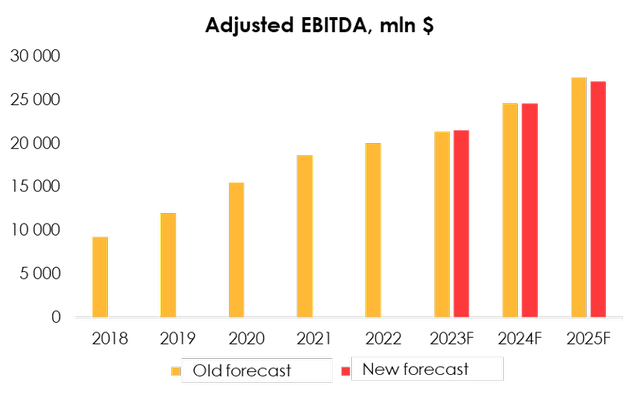

We are raising the forecast for adjusted EBITDA from $21 327 mln (+6.7% y/y) to $21 515 mln (+6.7 % y/y) for 2023 and from $24 527 mln (+15.0% y/y) to $24 563 mln (+14.2% y/y) for 2024 due to:

- the reduction of the revenue forecast for 2023 from $33 863 mln (+7.1% y/y) to $33 520 mln (+6.0% y/y) and the increase of the revenue forecast for 2024 from $37 772 mln (+11.5% y/y) to $37 910 mln (+13.1% y/y);

- the reduction of the forecast for gross cash costs from $5 387 mln to $5 158 mln for 2023 and the increase of the forecast from $5 612 mln to $5 686 mln for 2024.

Note: we’re calculating adjusted EBITDA as EBITDA ex. Content amortization, which isn’t a cash cost by nature.

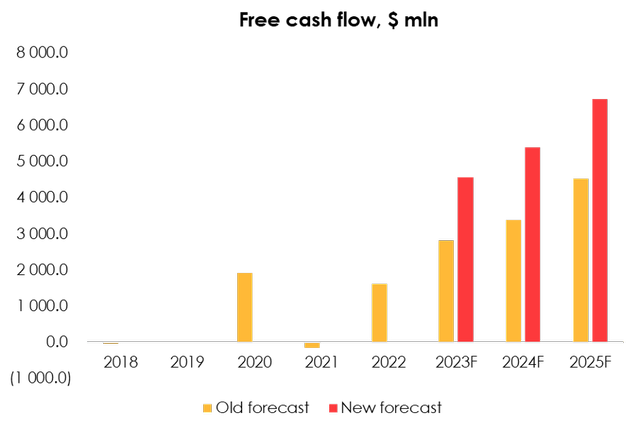

Free cash flow update

With moderating content spend to 1.1x of D&A, we have reassessed our FY23-25 Free cash flow projections. With updated numbers, we see that the company’s cash generation ability is much higher than we initially expected.

We’re raising the free cash flow forecast from $2 822 mln (+74.4% y/y) to $4 566 mln (+182.1% y/y) for 2023 and from $3 382 mln (+19.8% y/y) to $5 389 mln (+18.0% y/y) for 2024.

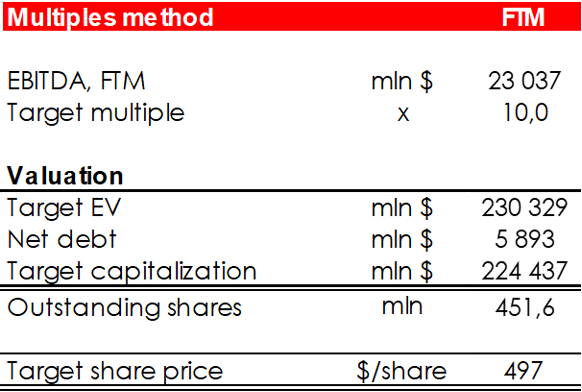

Valuation

We are evaluating NFLX target price based on FTM EV/adj. EBITDA multiple. Adjusted EBITDA doesn’t include content assets amortization.

The fair price for the shares is $497. Based on the new assumptions, we are lowering the rating for the company to HOLD since our previous article.

Invest Heroes

Conclusion

Netflix stock price has significantly risen since our initial coverage and now price potential is rather limited. Still, we believe that the Netflix strategy works well in current conditions and the company will be improving its financials further, both on growth and margins sides: pricing power is strong enough, while customers are also offered with cheap plans (ad-based or sharing). For now, we believe there are better opportunities on the market after a long rally, but NFLX should be monitored.

For those investors considering buying Netflix now, we recommend opening a position in small installments due to high probability of index decrease. To manage your position, we suggest keeping an eye on Netflix’s financial statements and industry research (JustWatch, Nielsen, Parrot).

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.