Summary:

- Netflix is facing major challenges as the stock closes the previous peak of over $675 which it reached at the end of 2021.

- There is an increase in streaming competition from Big Tech companies who are going all in to add new subscription revenue stream.

- The overall streaming business is also facing a saturation point as customers are unwilling to pay higher prices for several streaming platforms.

- Investors should also be wary about the recent bull run in Netflix which has made the stock too pricey.

- I believe Netflix’s high growth days are behind it and with a PE ratio of 45 the stock could see a strong correction if there is any dip in revenue growth.

ATHVisions/E+ via Getty Images

Netflix (NASDAQ:NFLX) stock is close to reaching its previous peak of over $675 which we saw towards the end of 2021. There was a strong correction in the stock in late 2021 and early 2022 which saw the price dip by a staggering 75%. As the stock reaches close to its previous peak, the company is facing several headwinds which can lead to a bearish momentum in the next few quarters. I believe the stock can see a correction to PS ratio of 3 to 5 from the current 8.5 over the next few quarters if the YoY revenue growth falls to a single digit rate. This could lead to a 40%-45% Netflix stock price correction. There have been a number of price increases in the streaming platforms over the last few quarters. These increases will start hurting customers’ budgets in my view, and we could see slower membership growth in Netflix and other streaming platforms.

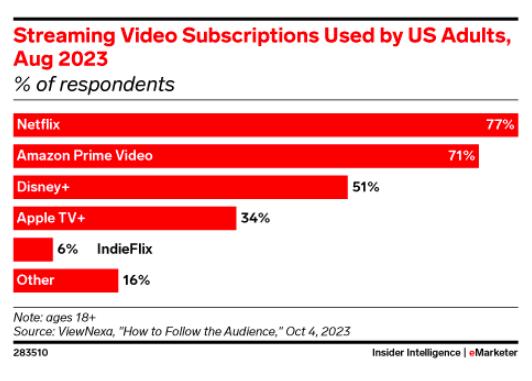

The biggest argument against Netflix stock at the current price is that the streaming budget of customers is not unlimited. The past few quarters have seen a hike in subscription prices from almost all streaming platforms. A recent eMarketer report shows that 21% of customers are now looking to reduce their streaming subscriptions. There is also an increase in churn rate among streaming players, according to Antenna research. I believe that the churn rate will increase dramatically over the next few quarters as the price hikes in streaming platforms start to take effect.

Big Tech companies like Amazon (AMZN), Apple (AAPL), and Google (GOOG) (GOOGL) are also increasing their efforts to gain more subscribers for their streaming platforms. Google is not a direct streaming competitor for Netflix, but it is showing strong growth in paid subscriptions and Google has announced a big hike in the recent quarters. Google shared the milestone of reaching 100 million subscribers in the YouTube Premium platform. At the current growth rate, Google could overtake Netflix in terms of paid subscribers by the end of 2026. All these tech companies have the resources to invest tens of billions of dollars over the next few years, which will inevitably hurt Netflix’s market leadership position in my opinion.

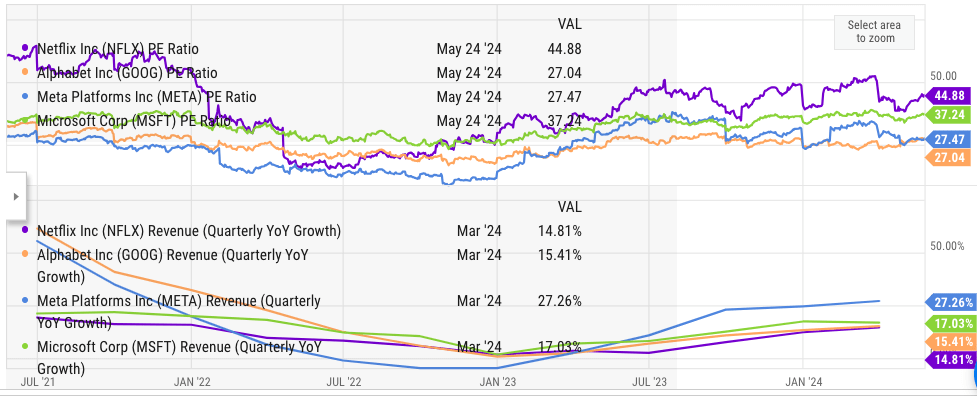

Finally, Netflix’s stock is just too pricey at the current point. With a PE ratio of 45, PS ratio of 8.5, and market cap of $280 billion, the stock has limited upside potential and is highly unlikely to outperform the broader market over the short and medium term. The YoY revenue growth is barely in low teens, and the recent increase in revenue growth has been helped by easy comps from the year-ago period.

The recent ad growth is a positive for the company, but this alone will not be sufficient to drive long-term revenue growth. Investors should also note that Netflix has limited monetization options for its subscribers compared to Amazon, Google, and Apple, which gain a flywheel effect from their subscription business. Due to these disadvantages and the current price, Netflix stock should have a Sell rating and investors should wait for a better entry point.

Why Netflix is too pricey

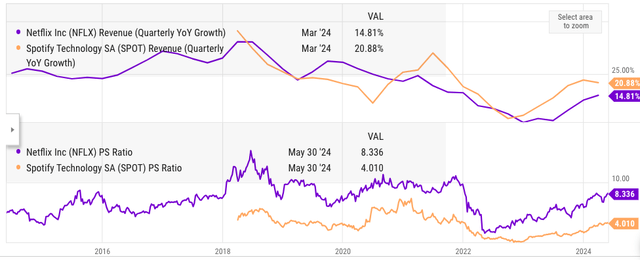

Netflix is trading at 45 times the PE ratio, with YoY revenue growth of 14.8% in the recent quarter. In the year-ago quarter, YoY revenue growth was less than 4% which helped provide easier comps to Netflix. The PS ratio is 8.5, which is very close to the pandemic-era peak of 10. There are few comparisons for Netflix, which is a streaming-only player. However, both Netflix and Spotify (SPOT) have gained a very strong bull run in the last few quarters, which might be overdone.

Figure: Comparison of PS ratio and YoY revenue growth of Netflix and Spotify. Source: Ycharts

At its bottom, Netflix’s PS ratio was 2.5 when YoY revenue growth dipped sharply in 2022. I believe we could see Netflix stock move to a similar level if the current revenue growth trajectory falters. Netflix has been helped by the easier comps in the last few quarters, which would not be the case in the next few quarters. Netflix’s crackdown on password-sharing and boosting ad-supported membership have given it a short-term boost. The long-term issue is the changing competitive field in the streaming industry and massive price increases, which will inevitably hurt the retention ability of membership for Netflix, in my opinion.

Netflix has shown a strong growth in ad-supported membership. The ad-supported membership almost doubled to 40 million in recent quarter, compared to 23 million in January. Almost all streaming companies are now looking to raise prices. Even Amazon has announced an additional price for streaming ad-free content for Prime members. These price hikes could start having a negative impact by the end of 2024 when all the customers will be moved to the new pricing structure in almost all streaming platforms.

Big Tech competition is heating up

As a rule of thumb, it is preferable not to invest in companies that directly compete with Big Tech companies. Big Tech companies can continue to invest heavily in a business segment that pushes down the pricing power of other competitors. Netflix is competing with three main tech companies as it tries to increase the subscriber base and hike the prices. Amazon, Apple, and Google have made it clear that they see their streaming subscription business as a key pillar to attract customers.

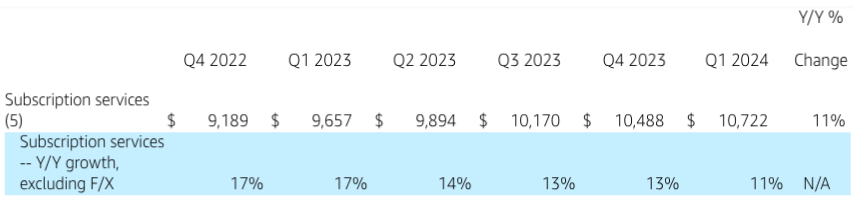

Amazon increased its content spending by 14% to $19 billion in 2023. This increase closely mirrors the overall increase in subscription revenue of the company.

Amazon Filing

Figure: Growth in subscription service of Amazon. Source: Amazon Filing

Amazon’s recent quarterly earnings showed subscription revenue of over $10 billion or $40 billion on annualized basis. Hence, Amazon is investing close to 50% of the subscription revenue in content. This shows the importance given to this business by the company. Even at a modest 12% CAGR, Amazon’s content spending could increase to over $40 billion annually by 2030.

Google has also recently announced that it has reached 100 million subscribers for its YouTube Premium platform. Back in late 2021, Google mentioned that it had 50 million subscribers. The rapid growth of subscribers should allow Google to increase the subscription price.

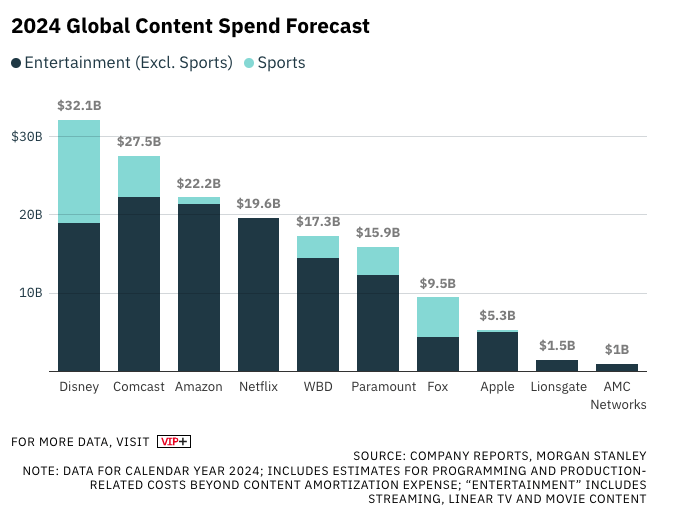

Apple does not announce its content spend or its subscriber base. However, Morgan Stanley has recently projected that the company will see a whopping 23% CAGR growth in content spend between 2023 and 2026. Apple does not have an anchor service like Amazon’s Prime business and Google’s YouTube platform. Hence, it is likely that Apple will try to build its streaming platform as an attractive option to gain and retain subscribers.

Variety

Figure: Estimates of content spend by major companies. Source: Morgan Stanley, Variety

Saturation in the market

Netflix has been the market leader in the streaming business and has made several good decisions in the past few years. However, it will have to contend with a rapidly saturating market. Almost all streaming platforms have been increasing their prices, which has started to hurt end customers. In the initial growth days, streaming platforms were more attractive compared to traditional cable due to the massive price difference. However, as several companies have joined the bandwagon and have been increasing their prices, we could see customers reducing the number of subscriptions.

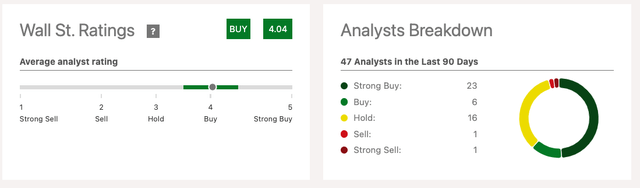

Figure: Wall Street’s ratings for Netflix. Source: Ratings

Wall Street analysts have given a very bullish rating to Netflix stock while it is close to its peak. According to published ratings, 23 analysts out of a total of 47 gave the stock a Strong Buy rating. On the other hand, only 1 analyst gave the stock a Sell rating and another gave the stock a Strong Sell rating. Investors should be cautious of this sentiment especially when Netflix does not have a very big moat against big tech streaming competitors. Because of the massive investment in content spending, we could see another round of price hikes by many streaming companies. This will further squeeze customers budget and increase the possibility of cancellations or increase in churn rate in my view.

An eMarketer report mentioned that 21% of customers were looking to reduce the subscriptions they have in 2024. Netflix is the market leader and will likely face the biggest headwind due to this trend. It should also be noted that Netflix has a standalone streaming platform, unlike Amazon, Apple, and Google. A standalone streaming platform reduces the customer loyalty and can lead to higher churn rate among customers looking for specific content.

eMarketer

I believe the announcement by Netflix of not revealing membership metrics should be taken as a big red flag, which also potentially shows that the company is wary of the coming tide of subscription cancellations as price increases start hurting the customers.

Netflix does have a few advantages

Despite the above headwinds, Netflix has a few advantages in this business. It is the market leader which allows the company to distribute the content costs over a larger audience base. It has also undergone several challenges within the streaming business in the last few years and has performed relatively well. This shows that the management is quite agile in looking at future trends. Netflix’s content budget is also massive which gives the company greater wiggle room in the type of content it wants to produce. Netflix can produce certain content which Big Tech companies and other streaming companies like Disney (DIS) would generally hesitate to produce. This certainly gives Netflix an edge over its competitors.

However, the overall trend in the streaming business is quite clear. Higher prices would inevitably lead to greater cancellations in subscriptions, especially for companies with a standalone streaming business like Netflix. Massive investment by Amazon, Apple, Disney, and other streaming companies would also put price pressure on Netflix where it becomes more expensive to gain new subscribers and retain them.

Netflix’s stock comparison with Big Tech

The biggest headwind against Netflix stock is the current price of the company. It is close to its previous peak of $675 and has a market cap of over a quarter of a trillion dollars. The PE ratio is over 45 and PS ratio is 8.5. The YoY revenue growth has increased in the last two quarters and has reached close to 15% in the recent quarter, which was helped by easier comps in the year-ago quarter. However, due to the above-mentioned headwinds, Netflix will likely find it difficult to maintain the current revenue growth rate. Due to the current elevated stock price, even a minor disappointment in growth or profitability can cause a major correction in the stock, in my view.

Ycharts

Figure: Comparison of Netflix’s PE ratio and revenue growth. Source: Ycharts

Netflix’s PE ratio is higher than several Big Tech companies while the YoY revenue growth is the lowest. Any misses in the next few quarterly earnings could cause a big correction in the stock. At the current price point, I believe there are few upsides to entering the stock making it a Sell.

Investor Takeaway

Netflix is trading at PS ratio of 8.5 which is close to the pandemic era peak of 10. The competitive landscape has changed dramatically in the last few quarters as all streaming players announce massive price hikes. Many streaming companies including Big Tech have been rapidly increasing their streaming budget. Netflix could see a higher churn rate due to these dynamics which will hurt the YoY revenue growth trend for the company.

If Netflix reports single-digit YoY revenue growth in the next few quarters, it could cause a big shift in sentiment toward the stock. I believe we could see the stock correct to a PS ratio between 3 to 5 in the next few quarters which would equate to 40%-45% correction from current price. I rate Netflix stock as a Sell at the current price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.