Summary:

- I am downgrading my rating of Netflix from Hold to Sell, as the valuation story is getting quite stretched, hurting future upside potential.

- Technical trading momentum is fading fast, as buying volumes have disappeared since the middle of November.

- Netflix should consider acquiring Paramount/CBS assets to expand its streaming library and improve financial performance.

Wachiwit

Time and again, Netflix (NASDAQ:NFLX) has been able to reinvent itself to deliver well above average operating growth vs. the overall economy. Starting with the mailing of DVD movie discs to your house, moving to streaming video entertainment, and lately revamping the subscription-only model to include lower tier pricing with ads, management has done an admirable job of riding customer viewership trends. Honestly, sales and now income growth have beaten my skeptical expectations most years.

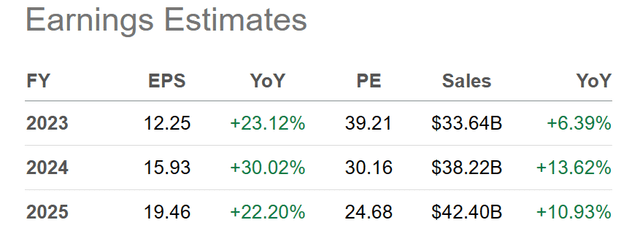

Today, however, a share price approaching $500 may be a little ahead of itself, especially if a recession pulls down growth rates in 2024-25 (not yet figured into analyst estimates). My view of consensus Wall Street analyst projections is they could prove entirely on the rosy side of reality in an economic contraction, where consumers look to cut entertainment spending. This situation is the exact opposite of overly negative analyst expectations in the middle of 2022.

Seeking Alpha Table – Netflix, Analyst Estimates for 2023-25, Made January 17th, 2024

My rating of NFLX shares has moved between Sell to Buy to Hold over my years writing on Seeking Alpha. While I took the contrarian position of buying shares closer to $200 in April 2022, the current price of $500 is getting on the richer side of the scale for me.

Seeking Alpha – Paul Franke, Netflix Article, April 20th, 2022

So, I am downgrading my last rating of Hold in early 2023 to Sell today. It’s nothing personal to Netflix stakeholders, I just feel the next swing in price will be lower to better balance the rise in interest rates during 2023 with a likely recession in streaming demand during 2024. A target price of $350 to $400 in 12 months makes the most sense to me now.

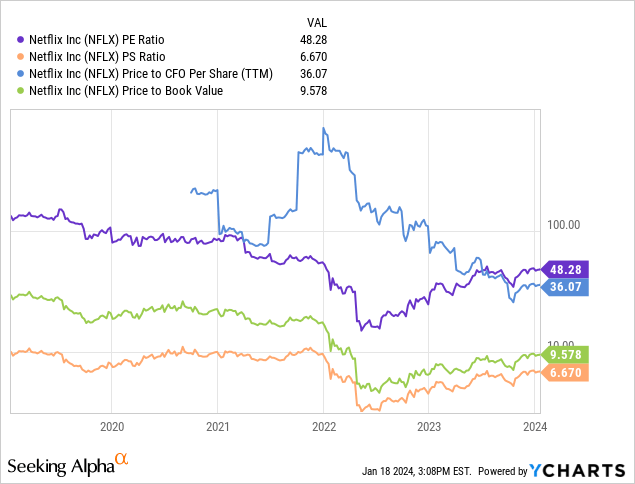

Excessive Valuation

When we review the basic fundamental valuation picture below, several different conclusions can be found. First, the valuation setup on earnings, sales, cash flow and book value is absolutely lower than five years ago. Second, the valuation now is dramatically higher than Q2 2022. For sure, the smartest time to buy Netflix since 2019 was under $200 in April-May of 2022.

YCharts – Netflix, Basic Fundamental Valuation Ratios, 5 Years

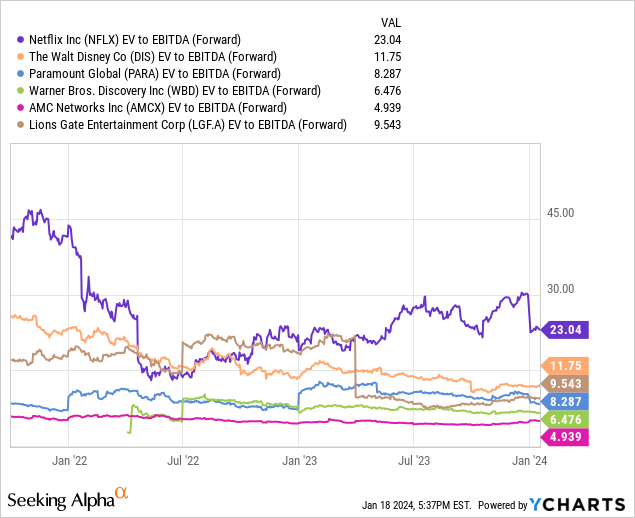

What are the bearish valuation issues going forward? For starters, the enterprise valuation (equity market capitalization plus debt minus cash held) on forward core-EBITDA is again too high for my comfort vs. streaming-focused film/TV companies. The 23x multiple is just too expensive vs. the median average under 9x. Today’s “relative” premium to peers is about the same setup as late 2021!

YCharts – Netflix vs. Peer Streaming Names, EV to Forward EBITDA Estimates, Since October 2021

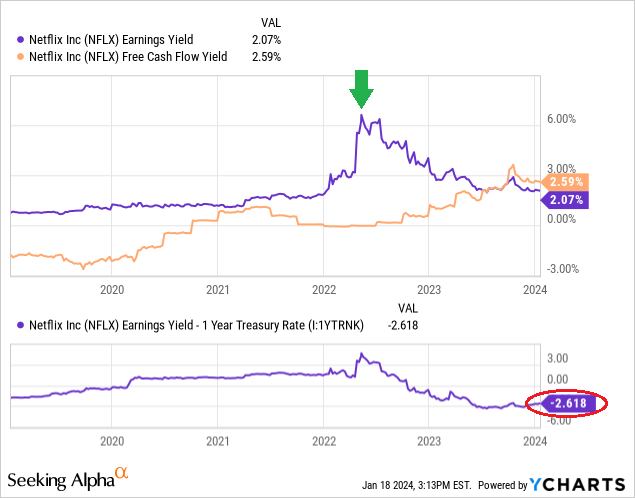

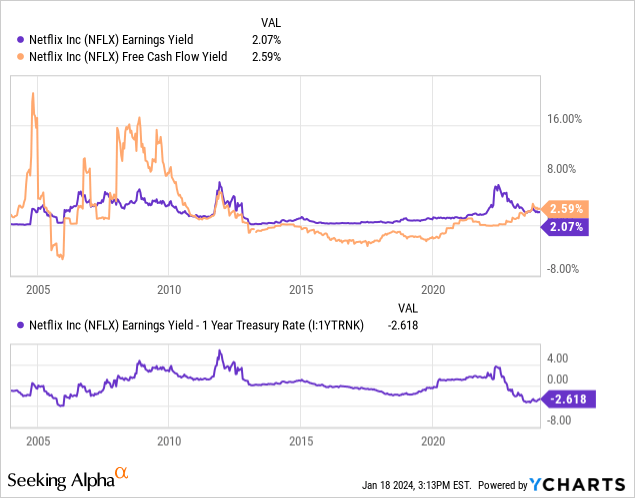

The truly bad news (and the same for nearly all Big Tech names in early 2024) is earnings and free cash flow yields are huge failures vs. risk-free Treasury bills and notes currently.

Below I have charted the “relative” NFLX earnings yield vs. 1-year Treasury bill rates. When you buy any business, investors should demand income levels on investment be a positive number at a minimum vs. risk-free cash-like securities (unless wild business growth is all but guaranteed). For example, the April-May 2022 period witnessed a nearly 7% earnings yield from Netflix vs. cash yields of 2.5% at the time. The positive +4.5% relative yield from Netflix (marked with a green arrow) was worth the price of admission and risk to investor capital.

Yet, right now this relative yield is a NEGATIVE -2.6% (circled in red), its lowest reading since late 2005. Why not just own T-bills and get 4.7% for a guaranteed yield, in addition to the guaranteed return of 100% your initial investment? If a recession and bear market are next in America, Netflix could decline in value rather rapidly.

YCharts – Netflix, Earnings & Free Cash Flow Yields, With 1-Year Treasury Rate Adjustment, 5 Years YCharts – Netflix, Earnings & Free Cash Flow Yields, With 1-Year Treasury Rate Adjustment, Since 2004

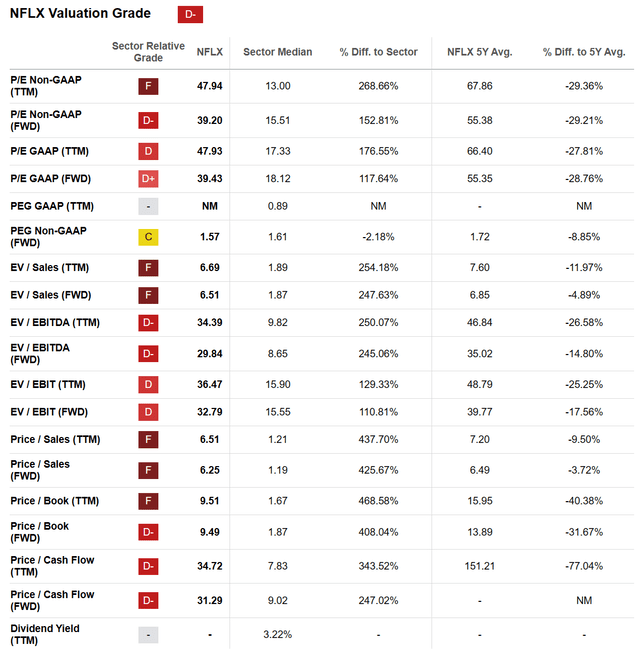

Lastly, Seeking Alpha’s Quant Valuation Grade is a rotten “D-” in January 2024. Compared to peers and competitors in streaming and entertainment, plus its 5-year history, Netflix is far from a bargain. You could say shares are fully priced, counting on a soft landing or no landing at all in the general economy. Such is required to keep sales and earnings growing at a decent clip, in my opinion. There really is no room for error, if you want the stock price to stay around $500 the rest of the year.

Seeking Alpha Table – Netflix, Quant Valuation Grade on January 17th, 2024

Technical Trading Upside Exhaustion?

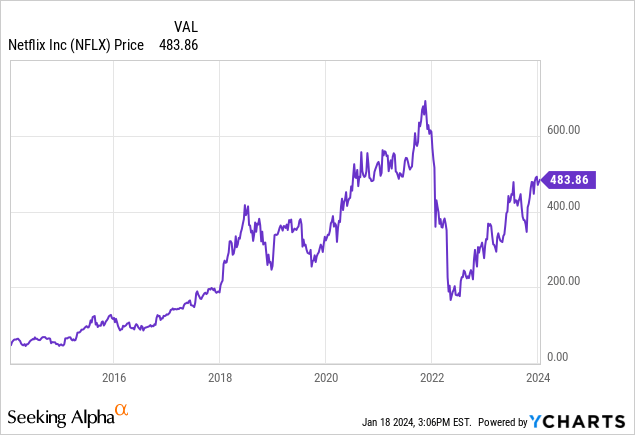

If you bought a position 10 years ago, Netflix has made you considerable investment profits. On the other hand, if you bought between late 2018 and early 2022, you might be sitting on considerable losses to rather minor gains. If timing is everything, new potential buyers and those looking for the exits should be getting nervous. Technically speaking, the move from May 2022 may simply be a rebound retracement of the massive -75% loss off the November price peak around $700 per share.

YCharts – Netflix, 10 Years of Weekly Price Change

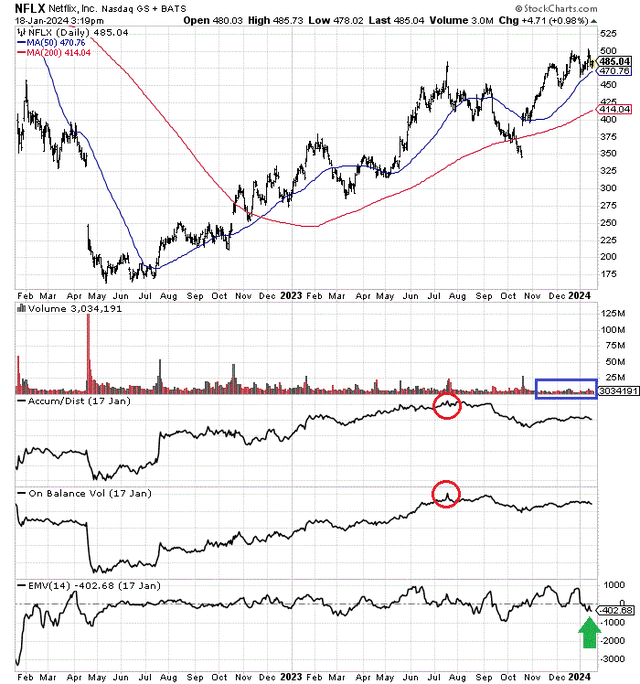

What has me particularly worried is upside “momentum” peaked between July and September 2023, with the 52-week highs of November to the present occurring on fading buying interest. Why do I say that?

I have drawn a 2-year chart of daily price and volume changes below. The first data point that jumps out is volume has all but disappeared since the end of November (boxed in blue). While bottoms are usually a high-volume affair, price tops in blue chips often coincide with a huge drop in buying interest. This may explain our position on the Netflix chart best.

Plus, the Accumulation/Distribution Line and On Balance Volume topped in July (circled in red). A healthy chart would include new ADL and OBV highs with the latest price upmove. This non-confirmation of the bull trend is very concerning.

I have also drawn the 14-day Ease of Movement indicator. Very limited selling volume in January has pushed its reading into negative territory (green arrow). This signal caller should be watched closely into February, because large EMV swings can indicate the start of an oversized short-term price move in either direction.

Taken together, all of these momentum constructs are hinting a major top could be forming in Netflix shares, which might prove the high trades of the New Year.

StockCharts.com – Netflix, 2 Years of Daily Price & Volume Changes, Author Reference Points

Final Thoughts

How can the company keep building for the future?

I have advocated for several years the best fit for Paramount/CBS (PARA) (PARAA) assets is under the Netflix umbrella. All of the talk in early 2024 of Paramount being for sale should encourage Netflix managers to seriously consider a bid. The opportunity to acquire a major television broadcast network and greatly enlarge its streaming entertainment library in one fell swoop should not be disregarded lightly. Such an opportunity in a single transaction may never become available again.

My view is Netflix should use its expensive equity to fund an all-cash offer to buy out Paramount on the cheap. Versus the Netflix equity base of $210 billion currently, I estimate some $15 billion to take over 100% Paramount ownership, and another $15-20 billion in new equity issuance would pay off most all its debt. Such a transaction would be accretive to sales, cash flow and earnings per share for Netflix, while cementing streaming leadership on its dramatically expanded owned-content library.

How could Netflix get to $550 or even $600 during 2024? That’s a good question. You have to believe in goldilocks for a financial world outcome this year. A strong economy with lower inflation/interest rates would do the trick. Higher EPS, EBITDA and cash flow combined with lower alternative returns from risk-free cash would encourage new buyers to jump into shares.

Outside of this bullish scenario, I see downside “risk” back to $400 in a mild recession that slashes Netflix operating results, to $350 assuming a deep contraction is our future. Somehow market forces have to rebalance the valuation equation of low NFLX earnings yield vs. high short-term interest rates as an investment alternative. Given 2024 EPS of $13 to $16, inflation rates of 3%-4%, and Treasury yields of 4%-5%, a P/E above 30x makes no rational sense to me on slowing long-term growth. In a worst-case scenario, where crude oil spikes, inflation/interest rates stay high, while consumer spending moves in reverse, $14 in EPS multiplied by 20x gets Netflix under $300 by late 2024.

Upside goldilocks potential of +20% vs. downside estimates of -40% given a stagflation future for calendar 2024 argue you avoid this stock in January.

I rate Netflix a Sell and believe better risk/reward opportunities exist for your investment capital. I write about many of them in my Seeking Alpha articles.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.