Summary:

- Netflix shares have returned close to 200% since July 2022, but following Q1 2024 results I am downgrading the stock to “Sell”

- Despite strong results for the first quarter, I am concerned about Netflix growth outlook, while I also believe that shares are trading at a premium to fair value.

- Multiple factors are expected to impact 2024 commercial momentum negatively, including a shift to lower-priced plans as well as geographical shifts in Netflix’s growth upside.

- Netflix’s decision to stop reporting quarterly membership and ARM figures starting from Q1 2025 is worrisome, as the move is perceived as a likely effort to obscure disappointing numbers.

- For investors looking to gain exposure to the streaming narrative, I argue that Spotify should be the preferred pick over Netflix.

stockcam/iStock Unreleased via Getty Images

Netflix shares (NASDAQ:NFLX) have returned close to 200% since I have advised investors to buy the dip back in July 2022. In a nutshell, I argued that

[…] Netflix will continue to grow attractively for years to come, although likely at a significantly slower pace. Furthermore, the advertising-supported strategy might be more attractive than investor response suggests.

However, following Netflix results for Q1 2024, I am downgrading NFLX shares to “Sell”. Despite strong results for the first quarter, I am concerned about Netflix growth outlook, as multiple factors are expected to impact 2024 commercial momentum negatively, including a shift to lower-priced plans and geographical shifts in Netflix’s growth upside. Moreover, Netflix’s decision to stop reporting quarterly membership and ARM (Average Revenue per Member) figures starting from Q1 2025 is worrisome, as the move is (and should be) perceived as a likely effort to reduce transparency on potentially disappointing numbers. Lastly, I see NFLX shares as overvalued above $447/share; and for investors looking to gain exposure to the streaming narrative, I argue that Spotify should be the preferred pick over Netflix.

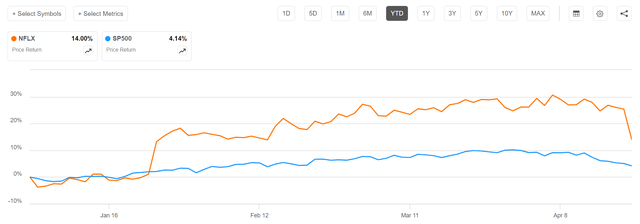

For context, NFLX shares have outperformed the broader U.S. equity market YTD: Since the start of the year, Netflix stock is up about 14%, compared to a gain of approximately 4% for the S&P 500 (SP500).

Netflix Smashes Consensus Estimates In Q1 …

Netflix reported results for first quarter of 2024 on Thursday, 18th April, and smashed consensus estimates on both topline and earnings: During the period from January to end of March, the world’s leading TV/movie streaming company generated $9.27 billion of sales, up close to 15% YoY compared to the same period one year prior. The topline growth was driven by a healthy addition of 9 million new paid users, up 16% YoY. Notably, Netflix’s Q1 2024 revenue and subscriber estimates topped analyst consensus estimates by about $95 million and 5 million, according to data collected by Refinitiv.

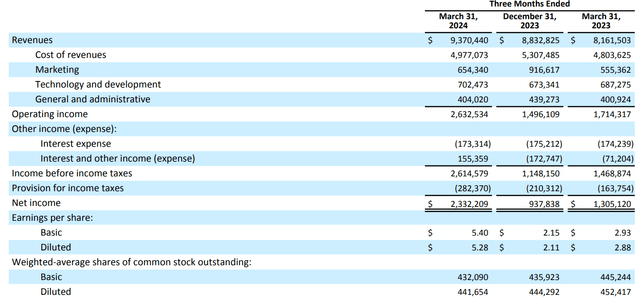

On profitability, it is noteworthy to highlight that Netflix’s operating margin surged to 28.1%, up 710 basis points from the 21% seen one year prior. In dollar numbers, operating income jumped to $2.6 billion (up close to 53% vs Q1 2023). This profitability expansion is fully based on operating leverage, as all OPEX buckets either remained flat or increased YoY: Marketing up 18%, Technology and development up 2%, and G&A up 1%. After accounting for about $301 million of interest and tax expenses, Netflix posted a net income of $2.3 billion, or $5.28/ share (versus $4.53 expected by consensus, according to estimates data by Refinitiv).

Netflix ended the quarter with a strong balance sheet, reporting $16.6 billion of debt versus $7 billion of cash and cash equivalents. Quarterly free cash flow came in at $2.1 billion.

… But Guidance Suggests Slowing Growth Momentum

Despite strong momentum in the first quarter, management commentary and guidance suggest that Netflix growth may be slowing, especially on the earnings front: For Q2 2024, Netflix forecasted about $9.5 billion in revenues (only up 1% QoQ) and earnings of $2.06 billion ($4.68 per share and down 11% QoQ). Netflix did not guide for paid memberships. However, reverse engineering the estimate based on revenue projections and Q1 2024 ARPU numbers, I warn that that new additions could fall below 3 million ($120 million of incremental growth divided by $15-17/$45-51 million of monthly/quarterly revenue per user)

Looking to the rest of 2024, I expected a further deceleration in revenue and user growth. Despite the successful implementation of pricing adjustments in select countries in the past, I point out that broader pricing increases have not been executed in nearly two years. Moreover, I foresee average revenue per member to face several challenges throughout 2024: Firstly, I expect that there will be a notable shift in plan mix, mainly attributed to the introduction of lower-priced tiers. Secondly, while the ad-supported tier has been seeing good user traction, its monetization has likely been slower than hoped, quite certainly being ARM dilutive. Thirdly, I argue that growth skew relating to geographic membership could contribute to notable pressure on ARM, as Netflix future growth is increasingly dependent on emerging markets.

Pointing to the challenges above, I argue that my concerns are broadly confirmed by Netflix management’s decision to top reporting both user and ARM numbers. In a note to investors, pointed out the following:

As we’ve noted in previous letters, we’re focused on revenue and operating margin as our primary financial metrics – and engagement (i.e. time spent) as our best proxy for customer satisfaction. In our early days, when we had little revenue or profit, membership growth was a strong indicator of our future potential. But now we’re generating very substantial profit and free cash flow (FCF). We are also developing new revenue streams like advertising and our extra member feature, so memberships are just one component of our growth. In addition, as we’ve evolved our pricing and plans from a single to multiple tiers with different price points depending on the country, each incremental paid membership has a very different business impact. It’s why we stopped providing quarterly paid membership guidance in 2023 and, starting next year with our Q1’25 earnings, we will stop reporting quarterly membership numbers and ARM.

Now, while it may certainly be true that financial metric are becoming increasingly important for the Netflix equity story, Netflix’s decision to stop reporting user metrics could (and should be) be perceived as an attempt to reduce transparency for investors, making it more challenging to assess the company’s performance and shifts in consumer behavior. And to counterbalance this challenge, investors will likely demand a higher risk premium for investing in NFLX stock — rightly so.

Raise Target Price To $447/ Share

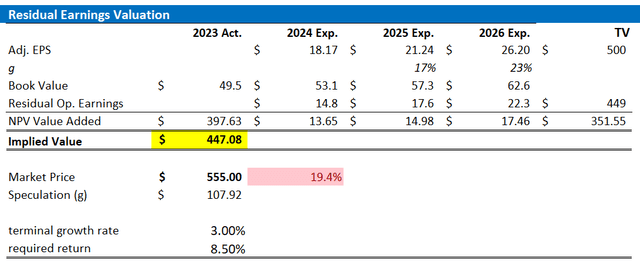

After almost two years since I have published my valuation framework for Netflix, it is time for me to update my assumptions. Anchored on analyst consensus estimates as collected by Refinitiv (+/- 10%), I now project that Netflix’s earnings per share for FY 2024 will range between $18 and $20 (non-GAAP), with forecasts of reaching $21.2 in FY 2025 and $26.2 in FY 2026. Post FY 2026, I continue to view an earnings compound annual growth rate (OTC:CAGR) of 3% as reasonable (approximately 75-100 basis points higher than estimated nominal GDP growth). Similarly, I maintain my base-case cost of equity estimate at 8.5%. Given the upüdates, I now estimate the fair value of Netflix stock at $447, up considerably from the prior estimate of $250, but notably below the NFLX market trading price of around $555.

For context, the value “Speculation” is just the difference to fair implied value. A positive value implies a premium; or in other words, markets are speculating to price more fundamental upside compared to my estimates.

Company Financials; Author’s EPS Estimates; Author’s Calculation

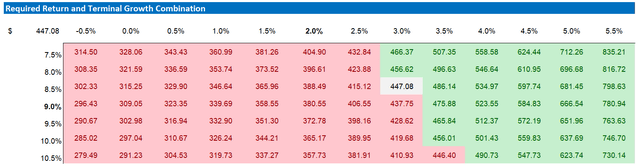

Below also the updated sensitivity table.

Company Financials; Author’s EPS Estimates; Author’s Calculation

Why Netflix Is Not My Top Pick In Streaming

Apart from the growth and valuation concerns that I highlighted, I am cashing out on my Netflix shares due to opportunity cost considerations. Specifically, I am shifting my Netflix investment to Spotify (SPOT), as I believe Spotify operates a much better, more profitable streaming business than Netflix for multiple reasons: Firstly, I highlight that Spotify has much lower content costs. In fact, the cost of music rights, although significant, is relatively more predictable and stable expense compared to the volatile costs associated with producing or acquiring original video content. This benefit should lead to more stable financial planning and potentially better margin control. Secondly, and related to the first argument, I point out that Spotify’s content library is more timeless compared to Netflix’s. While music can be consumed over and over again, without getting boring, most TV shows/movies are more like a one-time-consumption product. This content difference should result in a stronger competitive moat and better user retention. Moreover, Spotify is truly a “platform-only” business, leveraging content from various creators and reducing its dependency on expensive original content production, unlike Netflix, which increasingly must invest heavily in original movies and series to keep subscribers engaged. Thirdly, I highlight that Spotify’s audio content requires significantly less bandwidth than Netflix’s high-definition video streams, resulting in lower data delivery costs per user. This scalability advantage can lead to a much more efficient and rapid expansion, especially in regions with limited internet infrastructure. Lastly, I highlight that Spotify is trading at

3.3x (FWD) EV/Sales, compared to 6.2x for Netflix–despite Spotify having better growth/ penetration upside and an arguably better business model (as highlighted in previous arguments), in my opinion. For context, a more detailed and specific take on my Spotify argument can be found in this article: Spotify Technology: My Top Recommendation For Potentially Explosive Upside.

Investor Takeaway

Netflix shares have returned close to 200% since July 2022, but following Q1 2024 results I am downgrading the stock to “Sell”. Despite strong results for the first quarter, I am concerned about Netflix growth outlook, as multiple factors are expected to impact 2024 commercial momentum negatively, including a shift to lower-priced plans as well as geographical shifts in Netflix’s growth upside. Moreover, Netflix’s decision to stop reporting quarterly membership and ARM figures starting from Q1 2025 is worrisome, as I perceive the move as a likely effort to reduce transparency on likely disappointing numbers. For investors looking to gain exposure to the streaming narrative, I argue that Spotify should be the preferred pick over Netflix.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPOT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.