Summary:

- While revenues and operating income came in largely in line for 3Q23, net new additions and EPS exceeded expectations.

- 4Q23 net addition outlook, 2024 operating income margin outlook and the price hikes were all positive surprises as well.

- The strength in new subscriber additions were broad based and a result of roll-out of paid sharing intervention measures by Netflix.

- The company has multiple monetization tailwinds like price hikes, paid sharing and the growing ads business.

- Netflix has demonstrated its ability to build a sustainable streaming business with substantial operating margins and free cash flow growth to fund investments into content.

Giuliano Benzin

Netflix (NASDAQ:NFLX) has been seeing the results of their hard work after announcing, rolling out and ramping up its new initiatives like paid sharing and the Ads plan.

Today, I will be reviewing the opportunity for Netflix.

Netflix’s beat

Netflix’s revenue grew 8% from the prior year to $8.54 billion, beating consensus modestly as a result of better than expected growth in members.

Operating income came in at $1,916 million, or 22% margin, above consensus expectations of $1,900 million.

The beat in operating income was due to an upside in revenues and the timing of content as well as other spending.

3Q23 earnings per share of $3.73 beat consensus by 6%, and free cash flows for 3Q23 came in at $1,888 million, beating consensus by 75%.

In terms of subscriber metrics, 3Q23 paid subscribers grew by 8.8 million, 52% more than the consensus of 5.8 million. In terms of region, EMEA added 4.0 million subscribers, higher than consensus of 2.2 million, UCAN added 1.8 million subscribers, higher than consensus of 1.2 million, APAC added 1.9 million subscribers, higher than consensus of 1.6 million and LatAm added 1.2 million subscribers, higher than consensus of 1.1 million.

Solid guidance

Netflix expects 4Q23 revenue to grow 11% from the prior year, to $8.69 billion, slightly softer than what consensus was expecting.

However, net adds for 4Q23 were expected to be similar to 3Q23, or around 8.8 million. This beat expectations by 14% as the company continues to see strong subscriber growth as a result of its efforts.

4Q23 operating income is expected to come in at $1.16 billion or 13.3% operating margin, while consensus was expecting an operating income of $1.23 billion or 14.1% operating margin.

For 2023 operating margin guidance, the company is now pointing towards the high end of its earlier range of 18% to 20% operating margin.

If there are no material foreign exchange movements, Netflix expects 2024 operating income margins to come in between the range of 22% and 23%. Consensus for 2024 operating income margins was at 22%.

Monetization: Paid sharing

I think we are starting to see some results from paid sharing in the membership growth front, as Greg Peters co-CEO of Netflix mentioned in the 3Q23 earnings call:

And I’ll start by saying we’re just incredibly pleased with how it’s been going. And you can see the progress from our membership growth in Q2. Now in Q3, you can see it embedded in the revenue outlook for Q4.

Netflix management commented that the strong membership growth over the past two quarters along with the strong 4Q23 growth expectation is a result of the company taking action on paid sharing in every region it is operating in and rolling it out as planned,

Importantly, while paid sharing was launched, the reaction has been better than expected as cancellations have been lower than expected and many borrower households were converted into full paying members and have healthy retention as well.

I think that Netflix has been executing well on these borrower households, converting these extra members that were not paying into full paying members and generating that low-hanging fruit incremental revenue from these users.

Moving forward, the team will continue to optimize their approach to convert even more borrower households over the next few quarters into paying members.

In terms of how much upside to paid sharing there is remaining, Netflix commented that they have been rolling out paid sharing in a steady manner and executing a plan to different borrower cohorts. What this means is that Netflix has been building features and improving the accuracy of their models such that they know when and how to apply the interventions for paid sharing as effectively as possible. As a result, there are a number of borrower cohorts that have not experienced any interventions yet as these are planned and staged based on borrower behavior.

In short, Netflix has a plan for different borrower groups to maximize the chance of them converting into paying members based on their respective behaviors and patterns.

As a result, in terms of upside, paid sharing will continue to have upside for the next couple of quarters.

Monetization: Price hikes

Netflix announced that it will be increasing prices.

While price hikes were mostly paused as Netflix rolled out paid sharing, the company has announced that the newest price hikes will be in the US, UK and France. In the US, the basic plan will go from $9.99 to $11.99, an increase of 20%, and the Premium plan will go from $19.99 to $22.99, an increase of 15%, while the Ads and Standard plans remain the same. The basic plan is no longer offered to new users.

In the UK and France, their pricing for Ads, Basic, Standard and Premium are UK £4.99, £7.99, £10.99 and £17.99 in the UK and 5.99€, 10.99€, 13.49€ and 19.99€ in France respectively. The Ads and Standard plans in both the UK and France also remain unchanged.

Monetization: Ads

For Netflix’s advertising business, it will take time for it to become more material to its business and it will not suddenly emerge as a significant driver in 2023.

However, I think that the long-term opportunity for Netflix looks quite optimistic given that the advertising business has a huge market of $180 billion excluding Russia and China, and how competitive Netflix is as streaming continues to gain share from linear. Also, within streaming, Netflix is a leader in streaming engagement so it has a strong potential to turn its advertising business into a multi-billion dollar revenue stream with time.

The near-term focus will be to grow its ad membership and as seen in 3Q23, ads membership grew by 70% sequentially and now makes up 30% of all new sign-ups in the 12 countries where Netflix has ads.

This growth in ads membership is contributed by continued improvements to its Ads plan and the phasing out of the Basic plan.

After phasing out the Basic plan in the US, the UK and Italy, Netflix will be also making the same change to other countries like Germany, Spain, Japan, Mexico, Australia and Brazil.

Netflix is improving the features for the Ads plan, like introducing downloads in the coming month.

With a strong ad membership, Netflix would become highly attractive for advertisers as the company attracts many eyeballs and the high engagement of the Netflix platform.

Netflix has also been working with advertisers and brands to create formats which will help them add value. This may be in the form of sponsorships, like how Nespresso and T-Mobile are sponsors for The Netflix Cup, Netflix’s own live sports event.

Lastly, Netflix is also launching a new ad product for members who binge watch. For these members that watched a few episodes in a row, they will be served a hero spot where the next episode will be commercial-free, “made possible by XYZ brand.”

The long-term business

While streaming is a competitive business, Netflix has demonstrated its ability to build and grow a sustainable streaming business.

And this is done so through a focus on the long-term, investing heavily in content while being disciplined about margins.

This one sentence sounds simple but it is the essence of why Netflix will be around for the long term.

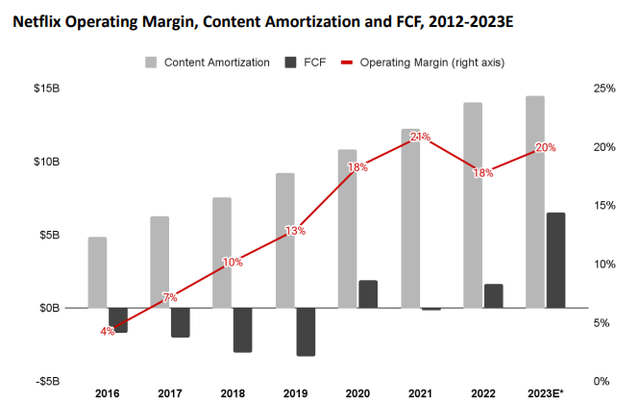

Content amortization has grown by three times from $5 billion in 2016 to about $14.5 billion in 2023.

This comes as Netflix needs to spend and invest in top-quality content to make members happy and thus, willing payers for the service, and as Netflix launched the service globally in 2016.

In addition, operating margins have grown by five times, from 4% in 2016 to 20% in 2023. Free cash flows also went from negative $1.7 billion in 2016 to positive $6.5 billion in 2023.

Content spend and operating margins (Netflix)

The takeaway is that it is a virtuous cycle. Higher margins and free cash flows lead to more ability to spend and invest in content, which leads to happier members and even higher margins and free cash flows, and the cycle continues.

Valuation

Netflix is trading at 26x 2024 P/E. I think there’s upside to these numbers given the upside potential from paid sharing and the ads business.

For reference, through 2022 P/E was at 16x and 5-year average P/E was 115x.

While the competitive landscape has certainly changed in the last five years and 115x P/E is certainly elevated, 3-year revenue and EPS CAGR are expected to be 12% and 25%.

My one-year price target is based on 30x 2024 P/E, implying a one-year price target of $480.

Concluding thoughts

While revenues and operating income came in largely in line for 3Q23, net new additions and EPS exceeded expectations.

In addition, the 4Q23 net addition outlook, 2024 operating income margin outlook and the price hikes were all positive surprises as well.

In general, the rhetoric and results of paid sharing are positive as we are seeing this translating to new subscriber growth. Upside potential remains given Netflix has been doing this in phases and the next few quarters will continue to bring idiosyncratic tailwinds for the company in terms of subscriber growth.

The Ads business is definitely promising to me as well given the huge market, Netflix’s appeal to advertisers, and the growing ads membership. While it will take time, the business is working its way to becoming a multi-billion dollar revenue stream in a few years time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, as well as access to The Barbell Portfolio.

The Barbell Portfolio has outperformed the S&P 500 by 34% in the past year through owning high conviction growth, value and contrarian stocks.

Apart from focusing on bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join us for the 2-week free trial to get access to The Barbell Portfolio today!