Summary:

- Netflix market capitalization surpasses $250 billion, driven by ad-supported tier popularity and strong revenue growth.

- Despite maintaining a strong share of screen time, competition in the streaming market is increasing, limiting Netflix’s potential market share growth.

- Netflix’s focus on driving shareholder returns through forecast FCF of just over 2% and share repurchases may not justify its current valuation, making it an overvalued investment.

Riska

Netflix (NASDAQ:NFLX) has continued to move towards all-time highs, pushing its market capitalization past $250 billion. The company has been buoyed by the unexpected popularity of its ad-supported tier as the company rehashes the reasons for cable, both through ads and channel availability. As we’ll see throughout this article, the company is overvalued making it a poor investment.

Netflix Quarterly Results

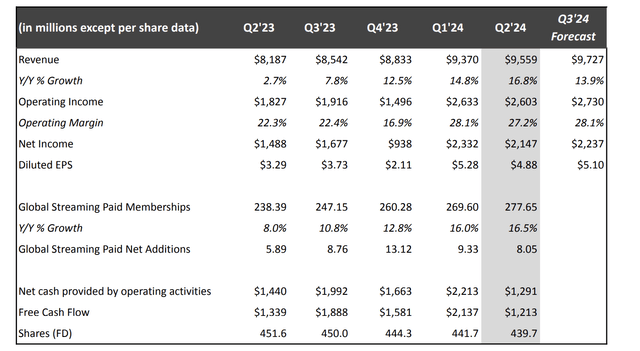

The company saw revenue continue to grow as it returned to YoY growth. Growth hit the double-digits, supporting income.

Netflix Press Release

That’s been supported by a massive growth in paid memberships to 16.5% YoY as the company has added millions of memberships on a monthly basis. The company has been supported heavily by its ad-supported tier as it’s returned to effectively what the company was trying to remove with cable providers.

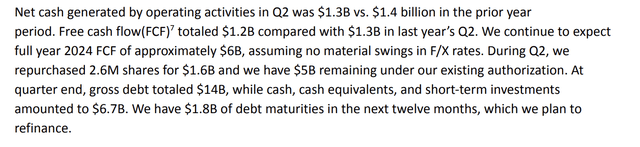

That has enabled FCF for the company to remain stronger, and less volatile, however, annualized FCF, mostly going towards share buybacks is still only ~$6-7 billion. That puts the company at a FCF of 2-3%. Netflix has more than 40 million subscribers on its ad supported tier, rapid growth in less than two years, and highlighting the popularity of the tier.

Still, with a market capitalization of more than $270 billion, the company needs to justify its valuation. It needs substantial growth going forward.

Netflix Screen Time Share

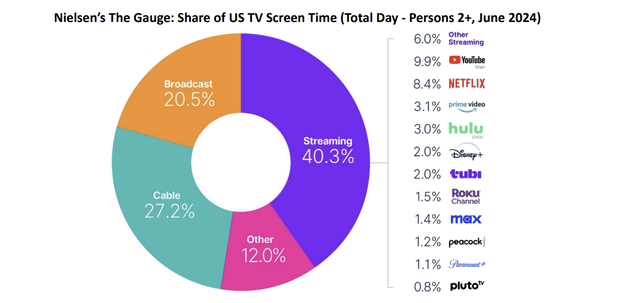

The company has maintained a reasonably strong share of screen time, but competition is increasing.

Netflix Press Release

For perspective, in July 2022, streaming was 34.8% of U.S. screen time and Netflix made up 8% of screen-time with 7.3% going to YouTube / YouTube TV. Prime Video was at 3%, Disney+ at 1.8%, and Max at 1%. Since then, streaming has grown its share of the market, to 40.3%, taking up an extra 5.5% of the market.

However, YouTube has actually grown the most, going to a 9.9% share. Netflix has grown slightly, gaining 0.4% in total share, but that’s the same as Max. Disney+ has grown, and additional streaming services have become more relevant, such as Paramount+ and Peacock. Cable has taken a big hit too, while broadcast has taken a minor hit and Other has grown.

There is a limit to how large streaming can grow, and it’s worth noting that as competition remains strong, we expect Netflix’s gain in market share to be minor.

Netflix Shareholder Return Potential

Netflix is focused on driving shareholder returns, with forecast FCF at just over 2% and share repurchases.

Netflix Press Release

The problem is the company isn’t sitting on a pile of cash (almost $8 billion in net debt) and its FCF yield is just over 2%. The company needs to see FCF grow to 4-5x its current level once growth stops to justify its valuation. That’s a tough prospect for a company that’s already ubiquitous with 280 million total subscribers.

It’s also tough for a company that’s already holding on to 8.4% of the viewership. That conundrum is why we see the company as overvalued without having a path to justifying its valuation.

Thesis Risk

The largest risk to our thesis is the company’s return to growth and the potential earnings from an advertising business. That could result in the company’s FCF growing faster than we expect, which could enable it to drive long-term shareholder returns at a faster rate than we expect.

Conclusion

Netflix is an overvalued company. The company is a great company with a great product, but at a valuation of more than $270 billion, it doesn’t have the FCF to justify its valuation. It’s expected annualized FCF for 2024 is $6 billion, just over 2%, and the company continues to have a net debt position. The company is slowly buying back shares.

As a result of these things, we think the company is an overvalued investment at this time.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.