Summary:

- 1Q23 earnings show, again, that Netflix is a low-growth business with deteriorating profitability, while the stock is priced for the exact opposite.

- We think it’s time investors wake up to the company’s fundamentals and value it accordingly.

- We continue to find that Netflix remains highly overvalued and should trade closer to $175/share.

Wachiwit

After the release of 1Q23 earnings, we continue to find that Netflix (NASDAQ:NFLX) remains highly overvalued and should trade closer to $175/share.

1Q23 earnings show, again, that Netflix is a low-growth business with deteriorating profitability, while the stock is priced for the exact opposite: soaring revenue and profits. As we noted in our report Netflix: A Meme Stock Original, NFLX has historically moved more on narrative and sentiment than fundamentals. We think it’s time investors wake up to the company’s fundamentals and value it accordingly.

What Happened?

In its 1Q23 earnings release, Netflix missed on the top-line despite a slight beat on earnings. While Netflix added subscribers, average revenue per membership fell year-over-year (YoY). Guidance for 2Q23, along with the muted growth in 1Q23, highlights that Netflix is not the growth story implied by its current valuation, as we’ll show below.

Warren Buffett believes “streaming isn’t a very good business”, and with Netflix, we agree.

Slowing Growth and Falling Margins: In 1Q23, Netflix’s revenue grew just 3.7% YoY, which is well below the long-term goal to “sustain double-digit revenue growth” announced during the company’s 4Q22 earnings release. The quarter ahead looks just as bleak, given that management forecasts just 3.4% YoY revenue growth in 2Q23.

Profitability is heading in the wrong direction as well. Netflix’s reported operating margin was 21% in 1Q23, which is down from 25.1% in 1Q22. Expect further margin deterioration going forward, given that management forecasts operating margins of 19% in 2Q23, which would be down from 19.8% in 2Q22.

Without a significant increase in revenue and margins, Netflix simply cannot justify the expectations baked into its stock price.

Netflix is Just Another Streamer: While Netflix was once the dominant player in the streaming industry, its recent actions prove that its first-mover advantages are gone. It is now just one of many streaming services. The addition of ad-based plans, long believed to be something Netflix would never do, and a crackdown on password sharing highlight the company is out of innovative ways to grow. Simply throwing more capital at content isn’t a long-term profitable solution either.

Cash Incinerator: Netflix has generated negative free cash flow in 10 out of the past 12 years, and a cumulative -$7.6 billion in FCF over the past five years alone. We would expect cash burn to continue, as the company continues to increase its content spend to churn out new originals and keep subscribers on the service.

What Does it Mean?

Netflix remains overvalued, even if difficult to short given its irrational bull runs in the past. 1Q23 earnings do little to ease concerns that the company is fighting against competitors with deeper pockets, each of which can use streaming as a loss-leading customer acquisition funnel to grow their more profitable operations.

Netflix Priced to be Bigger Than Disney

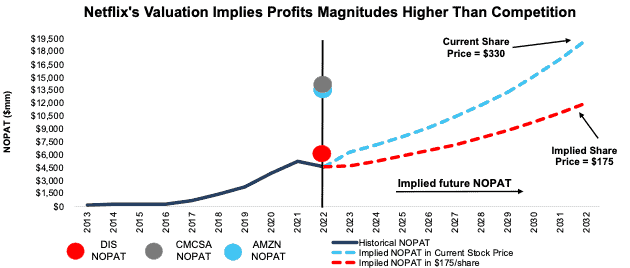

We use our reverse discounted cash flow (DCF) model to quantify the expectations for future profit growth baked into Netflix’s stock price. To justify Netflix’s price of ~$330/share, the company would have to:

- improve NOPAT margin to 18% (previous company high in 2021, compared to 15% in 2022) and,

- grow revenue 13% compounded annually over the next decade (vs. consensus estimates of 9% in 2023, 12% in 2024, and 11% in 2025).

In this scenario, Netflix’s revenue (management’s preferred top-line metric, as opposed to subscriber growth) in 2032 would be $109.2 billion, or 1.4x the combined TTM revenue of Fox Corp. (FOXA), Paramount Global (PARA), and Warner Bros. Discovery (WBD), and 1.3x the TTM revenue of Disney (DIS).

Netflix’s implied NOPAT in this scenario is $19.3 billion in 2032, which would be 1.6x Amazon’s TTM NOPAT, 3.3x Disney’s TTM NOPAT, and 1.6x Disney’s highest-ever NOPAT, which the company achieved in 2018.

There’s 47% Downside Even if Netflix Maintains Margins

Even if Netflix maintains margins, and grows revenue at consensus estimates, the downside is large. Specifically, if we assume:

- NOPAT margin equals 14% (five-year average) from 2022 through 2032,

- revenue growth at consensus rates in 2023 (9%), 2024 (12%), and 2025 (11%), and

- revenue grows 11% (continuation of 2025 estimates) each year from 2026 through 2032, then,

… the stock would be worth just $175/share today – a 47% downside. In this scenario, Netflix’s revenue in 2032 would be $87.6 billion, or 104% of Disney’s TTM revenue and 111% of the combined TTM revenue of Warner Bros, Paramount, and Fox Corp.

Netflix’s implied NOPAT in this scenario would also be 2x Disney’s TTM NOPAT and 99% of Disney’s highest NOPAT in 2018.

Figure 1 compares the firm’s historical NOPAT and implied NOPAT for the scenarios above to illustrate the expectations baked into Netflix’s stock price. For reference, we include the 2022 NOPAT for Disney, Amazon (AMZN), and Comcast (CMCSA).

Figure 1: Netflix’s Historical NOPAT vs. DCF Implied NOPAT

New Constructs, LLC and company filings

Scenarios Above May Be Too Optimistic

The above scenarios assume Netflix’s YoY change in invested capital is 10% of revenue (equal to 2022) in each year of our DCF model. For context, Netflix’s invested capital has grown 36% compounded annually over the past decade and change in invested capital has averaged 23% of revenue each year over the same time.

It is more likely that the change in invested capital will need to be much higher to achieve the growth in the above forecasts, but we use this assumption to underscore the risk in this stock’s valuation. For reference, Netflix’s economic book value, or no growth value, is just $102/share.

This article was originally published on April 18, 2023.

Disclosure: David Trainer, Kyle Guske II, and Italo Mendonça receive no compensation to write about any specific stock, sector, style, or theme.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.