Summary:

- Netflix is one of the world’s largest entertainment companies and is the world leader in the global video streaming market.

- On October 18, Netflix will publish its financial report for the third quarter of 2023.

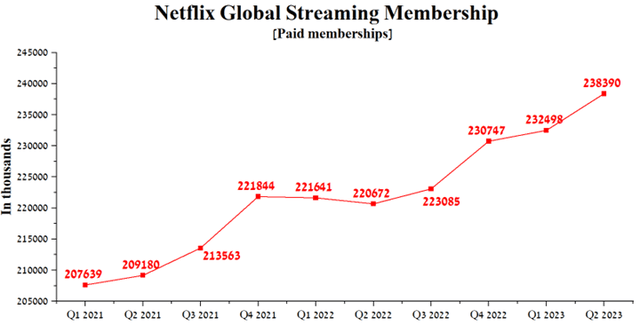

- The company’s paid memberships amounted to 238.39 million at the end of the second quarter of 2023, which is about 17.72 million more than the previous year.

- At the same time, the company’s Non-GAAP P/E [TTM] is 39.76x, which is 205.15% higher than the sector average and 44.63% lower than the average over the past five years.

- We initiate our coverage of Netflix with a “hold” rating for the next 12 months.

AzmanJaka/E+ via Getty Images

Netflix (NASDAQ:NFLX) is one of the world’s largest entertainment companies and continues to be the world leader in the global video streaming market. The company delights tens of millions of viewers with an extensive library of films, anime, documentaries, and such popular TV series as Wednesday, House of Cards, The Witcher, Ozark, and more.

Netflix’s high-quality content is driving its subscriber growth quarter after quarter, while other streaming services are struggling with audience growth. The company’s paid memberships amounted to 238.39 million at the end of the second quarter of 2023, which is about 17.72 million more than the previous year.

Author’s elaboration, based on quarterly securities reports

Moreover, the fourth quarter of 2023 began with a wave of publications, including changes in Netflix’s leadership and news of a planned price increase for its subscription plans.

On October 3, 2023, The Wall Street Journal reported that Netflix plans to raise the price of its ad-free service after the Hollywood actors’ strike ends. The ongoing labor dispute continues to cause significant damage to the industry, leading to a substantial decline in the production of new TV series and films. We believe that raising prices is a necessary action on the part of the company’s management to mitigate the impact of increased bonus payouts and higher royalties for Hollywood writers and actors.

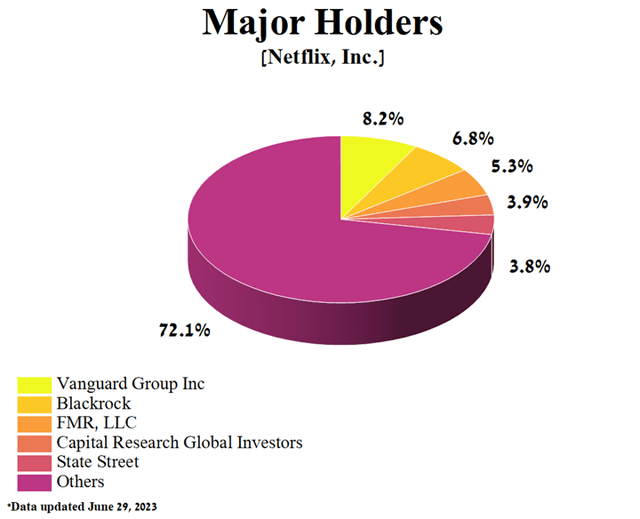

Despite the slowdown in consumer spending around the world due to rising interest rates, Netflix’s five largest shareholders, including Wall Street giants such as Vanguard Group, Capital Research Global Investors, FMR, Blackrock, and State Street, collectively hold a significant 27.93% stake in the company.

Author’s elaboration, based on Yahoo Finance

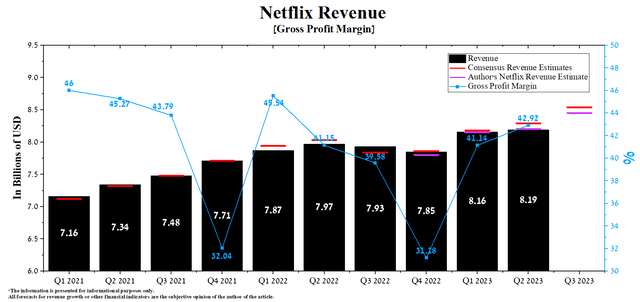

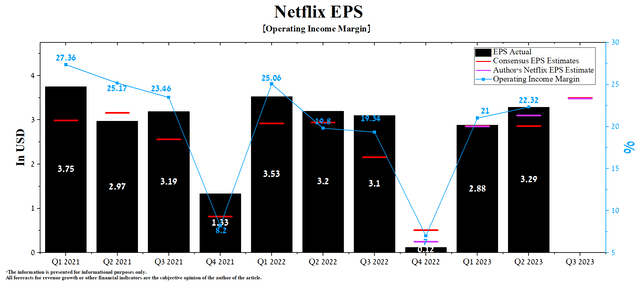

The second quarter of 2023 showed mixed results. On the one hand, Netflix’s revenue failed to exceed analysts’ expectations, but at the same time, it showed EPS growth in recent quarters. As a result, this is one of the factors demonstrating to financial market participants that the company’s business strategies, designed to enhance its margins during challenging times for the industry, continue to be effective.

On October 18, Netflix will publish its financial report for the third quarter of 2023. According to Seeking Alpha, Netflix’s third-quarter 2023 revenue is expected to be in the range of $8.46 billion to $8.66 billion, up 8.9% year-over-year and 3% higher than analysts’ expectations for the previous quarter. However, according to our model, the company’s total revenue will be slightly below this range, amounting to $8.45 billion. Our more pessimistic expectations are mainly related to a strengthening in the US dollar relative to foreign currencies, which negatively affects the average monthly revenue per paying membership.

Author’s elaboration, based on Seeking Alpha

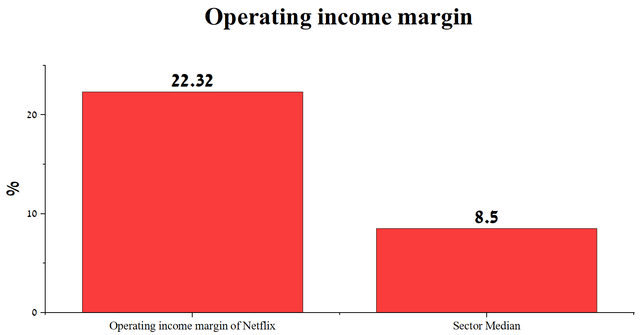

On the other hand, Netflix’s operating income margin in the second quarter of 2023 was 22.32%, a slight increase relative to the first quarter of 2022, but more importantly, it continues to remain significantly higher relative to the communication services sector.

Author’s elaboration, based on Seeking Alpha

We forecast that Netflix’s operating income margin will reach 18.2% by 2023. At the same time, in 2024, this financial metric will increase to 19.1%, thanks to increased prices for streaming plans, an increase in the number of new subscribers, and optimization of administrative costs.

According to Seeking Alpha, Netflix’s Q3 EPS is expected to be $3.10-$3.73, up 17.8% from the Q2 2023 consensus estimate. On the other hand, according to our model, Netflix’s EPS will be slightly below the median value of this range and will be $3.48.

At the same time, the company’s Non-GAAP P/E [TTM] is 39.76x, which is 205.15% higher than the sector average and 44.63% lower than the average over the past five years. On the other hand, Netflix’s Non-GAAP P/E [FWD] is 31.38x, which is one of the factors indicating its slight overvaluation by Mr. Market during the current period of growing geopolitical tensions in the Middle East.

Author’s elaboration, based on Seeking Alpha

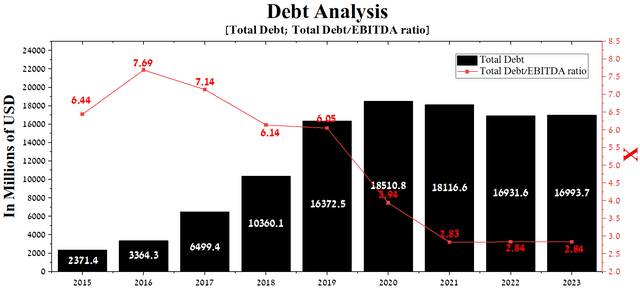

At the end of the second quarter of 2023, Netflix’s total debt was about $16.99 billion. On the other hand, due to the company’s sharply increased EBITDA during the COVID-19 pandemic, its total debt/EBITDA ratio remains almost the same despite the decline in its debt in recent years.

Author’s elaboration, based on Seeking Alpha

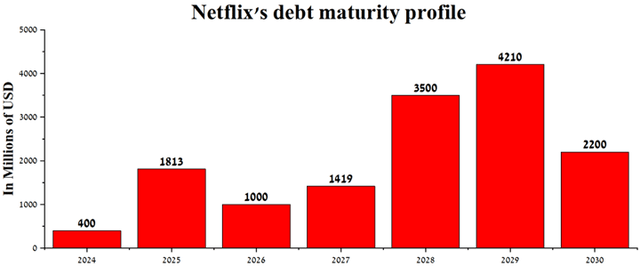

Thanks to growing cash flow and management’s planned price increases for subscription plans, we don’t expect Netflix to have difficulty paying off the senior notes due between 2024 and 2030. Moreover, the company’s total cash and short-term investments continue to grow yearly, totaling $8.58 billion at the end of June 2023.

Author’s elaboration, based on quarterly securities reports

Conclusion

Netflix is one of the world’s largest entertainment companies and is the world leader in the global video streaming market. The company delights tens of millions of viewers with an extensive library of films, anime, documentaries, and such popular TV series as Wednesday, House of Cards, The Witcher, Ozark, and more.

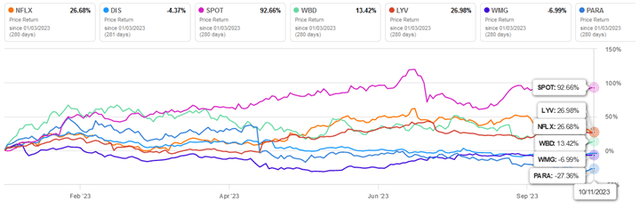

Thanks to the continued trend of operating income growth year on year and the launch of new popular TV series, the company’s share price has increased by more than 26% since the beginning of the year. As a result, this allowed Netflix to outperform pivotal competitors in the sector, such as Warner Bros. Discovery (WBD) and Paramount Global (PARA).

Author’s elaboration, based on Seeking Alpha

On the other hand, the main risks to Netflix’s financial position are the continued rise in U.S. household debt, the expected increase in expenses due to raised bonus payouts for Hollywood writers and actors, and increased competition in the global video streaming market. Additionally, given the technical analysis, we believe the price level at which the risk/reward profile would be attractive is $344-$345 per share.

We initiate our coverage of Netflix with a “hold” rating for the next 12 months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, and does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.