Summary:

- Netflix knocked its third quarter earnings out of the park, as subscriber growth, margins, and guidance all exceeded expectations.

- The stock responded with a 16% surge, recovering the majority of the misinformed downfall.

- Netflix provided investors with everything they needed to hear, including increased share buybacks, continued margin expansion, accelerated subscriber growth, and a price increase effective immediately.

- As Netflix continues to expand its huge lead over its struggling competitors, the long-term thesis has never been more certain. Management reaffirmed the company’s return to double-digit growth and its immense operational leverage potential.

- Trading at a 25x P/E over 2024 earnings, I estimate the streaming giant will continue to provide market-beating returns. Thus, I reiterate Netflix stock as a Buy.

Tommaso Boddi/Getty Images Entertainment

Netflix (NASDAQ:NFLX) reported third-quarter results that exceeded expectations. Revenues totaled $8.54B, in line with the consensus, and EPS came at $3.73, a 6.6% beat, as operating margins continued to expand. The company added 8.76M net subscribers, significantly higher than consensus estimates of 5.5M.

The password-sharing crackdown is a major success, as revenue in each region is already higher than pre-launch, and sign-ups are materially exceeding cancellations.

Management’s guidance for the fourth quarter beat expectations on all fronts, expecting to add net subscribers at a pace similar to Q3 and generate free cash flow of $6.5B for the full year, as well as achieve operating margins of 20%, the upper end of their previous range.

As Netflix continues to expand the gap over its struggling streaming peers, management confirmed it expects to accelerate revenue growth to a double-digit pace through a combination of pricing and subscriber growth, and said it sees limitless operational leverage opportunities.

I reiterate a Buy rating and adjust my price target to $476 per share.

Background

Back in June, I published Netflix: 3 Reasons Why It’s Not Too Late To Buy, Yet and began my coverage of the company with a Buy rating. I urge you to read that article, in which I explained my investment thesis thoroughly. I described the company’s growth acceleration strategies, margin expansion potential, and free cash flow scalability, as well as provided a full valuation analysis, and went over the company’s major risks.

Now, let’s begin by revisiting the investment thesis. In my previous article, I summarized my thesis as follows:

My investment thesis in Netflix is simple. Looking at its historical content investments, we realize that right around the $17B level is where the company is able to grow subscribers and keep them satisfied. Thus, as it reaches scalability, every incremental dollar of revenues should lead to a better operating margin and a better free cash flow margin.

And while most of Netflix’s peers are struggling, most of the data suggests that Netflix’s trough is behind us. So the investment thesis is based on three legs. One, growth re-acceleration due to success in password crackdown and ad tiers, as well as overall market growth and market share gains; Two, continued margin expansion leveraging economies of scale and-; Three, sequential free cash flow growth as content investments become a lower portion of sales.

Let’s see how each of the growth acceleration, margin expansion, and FCF leverage pillars performed during the quarter, beginning with growth re-acceleration.

Growth Acceleration

Netflix reported revenues of $8.54B in the quarter, representing a 7.8% increase from the prior year period, slightly better than the 7.5% guide. The beat was a result of better-than-expected subscriber growth, as the streaming giant added 8.8M new subscribers, almost 50% more than initial expectations.

For Q4, management said it expects to add a similar amount of subscribers, meaning the second half of 2023 has the possibility to be a record half for the company, even better than the Covid hyper-growth years.

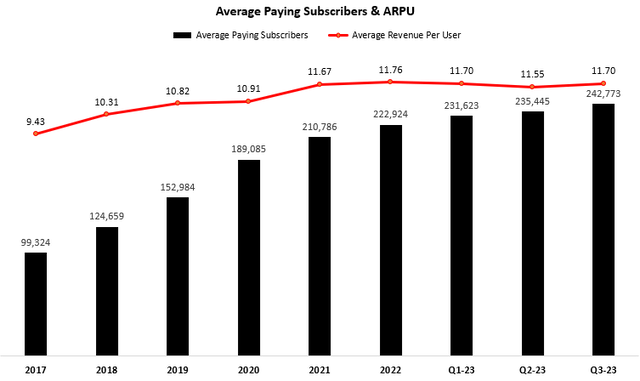

Created by the author using data from Netflix financial reports; Subscriber amounts in thousands.

Looking at the company’s average paying subscribers and ARPU (or ARM, the way Netflix calls it), we can see it’s relatively flat YoY, with a minor increase Q/Q. It’s been 18 months since Netflix last raised prices, which is inconsistent with the company’s historical pace of price increases. Understandably, management decided to focus on subscriber growth during the initial rollout of the sharing crackdown. Not anymore. Netflix announced price increases in the U.S., U.K., and France, three of its largest regions, and it expects to increase prices worldwide in the upcoming quarters.

2023 is a unique year in which growth came entirely from memberships. From 2024 and beyond, management expects a more balanced mix of membership and ARM growth. As the company aligns its price tiers with its ads plan, and competitors continually raise prices trying to mitigate their losses, I expect an immaterial response to its price increases.

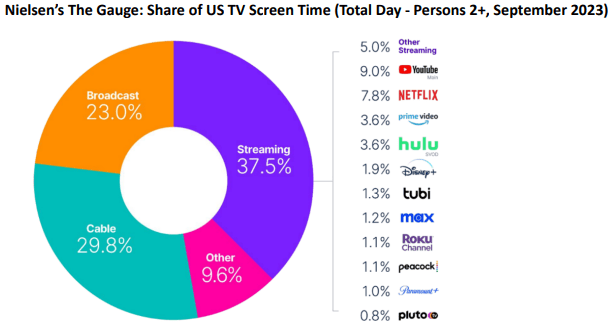

Netflix Q2-23 Letter To Shareholders; Based on Nielsen Data.

Looking at streaming share, it’s continuing to grow, taking 37.5% of U.S. TV screen time in September 2023, compared to 26.0% in May 2021, and 34.0% in the first quarter of 2023. Furthermore, Netflix continues to take share in streaming, with 20.8% in September 2023, compared to 20.5% in Q1-23.

This is enabled by the company’s unparalleled content offering. Netflix had the top original streaming series in the US for 37 out of the first 38 weeks of 2023, and the top movie in 31 of those 38 weeks.

Netflix provided investors with everything they needed when it came to growth expectations. The password-sharing crackdown is a multi-quarter tailwind; Ads are growing impressively with 70% Q/Q subscriber growth, accounting for 30% of new sign-ups in available countries; The announced price increases are effective immediately; And subscriber growth in the fourth quarter should remain high.

Overall, I believe double-digit growth in 2024 is almost a certainty at this point.

Margin Expansion

While revenue growth is an extremely important part of the long-term Netflix thesis, margin expansion is just as crucial. For Netflix to provide market-beating returns, it will have to showcase immense operational leverage.

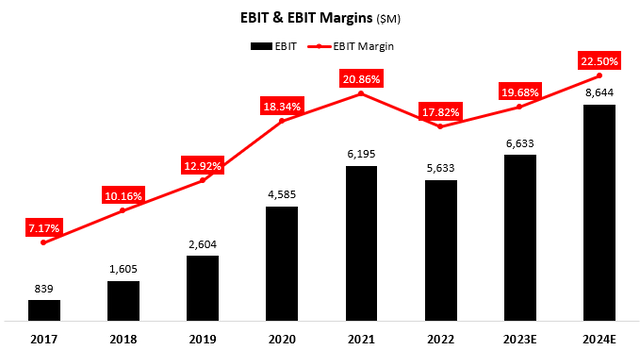

Created and calculated by the author using data from Netflix financial reports, the author’s projections, and management’s guidance.

In Q3, operating profit amounted to $1.9B, reflecting a 22.4% operating margin, which is 3.1 percentage points higher than the prior year period and 0.1 points higher Q/Q. Specifically, marketing expenses and R&D as a percentage of sales continued to decrease materially, demonstrating Netflix’s clear operating leverage. Looking forward, management is guiding for 20% for the full-year, and 22%-23% margins in 2024.

On the call, management stated they don’t think they’re anywhere near margin limits. Logically, there’s nothing to suggest operating margins can’t increase materially, as incremental content spend per new subscriber is immaterial, and operating expenses are amortized on an increasingly larger number of members (and revenues).

Free Cash Flow & Content Investments

Netflix’s free cash flows were a major drag on its stock price despite the company’s profit generation, as investors questioned the cash cycle of the streaming business model. Well, it seems those questions, at least when it comes to Netflix, are a thing that belongs to the past.

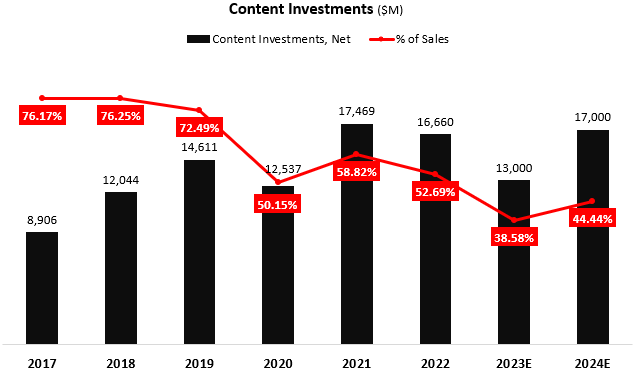

Created and calculated by the author using data from Netflix financial reports, the author’s projections, and management’s guidance.

Netflix’s content investments as a percentage of revenues are gradually decreasing with the company’s increasing scale. In 2023, content investments are especially lower due to production delays caused by the writers’ and actors’ strikes, with the latter group’s strike still ongoing.

Expecting a resolution sometime before the end of this year, management has said it expects content investments up to $17B in 2024, which came below consensus estimates, as market participants expected more lumpiness in 2024. In general, it seems that Netflix is quite comfortable in the $17B range when it comes to content investments.

As per the long-term module, management sees content spend to content amortization in the 1-1.1x range as the golden spot.

Important Notes

[Password-Sharing Rollout] Our plan has been to stage out this rollout. We’ve been delivering our product experience to different borrower cohorts according to that plan. And as a result, I think as you’re alluding to, there are a number of borrower cohorts, which has, as of today, have not received part of that experience. We’re going to continue the rollout for the next couple of quarters

And then just stepping back, there’s a set of borrowers that we’re not going to convert. That represents how we think about paid sharing going forward, and we have many hundreds of millions of qualified households out there, and those borrowers we’re not going to convert in the next couple of quarters represent that same group.

— Greg Peters, Co-CEO, Q3-23 Earnings Call, Edited by the Author

Simply put, they divided borrowers into several cohorts, some with a higher probability to subscribe than others. The rollout is steadily progressing, while some cohorts are yet to be impacted, and should provide incremental adds for several more quarters. The company treats borrowers who did not subscribe similarly to the hundreds of millions of potential customers with smart TVs that are yet to subscribe to Netflix. To acquire those, Netflix is going to continue to invest in high-quality diversified content, which they still view as the number one driver of new subscribers.

This is a $180 billion opportunity when you think about linear TV, you think about connected TV, not including YouTube, not including China and Russia. Scale is the number one priority. Second big priority for us is delivering features and products that advertisers want.

— Greg Peters, Co-CEO, Q3-23 Earnings Call, Edited by the Author

Aside from the nice words they had to say about the previous leader of ads, they insinuated that what they want is someone who can push the ads business more aggressively. They estimate the potential market at $180B excl. Russia and China, and they want to scale as quickly as possible. Part of the price hikes and the changes in tiers are aimed at incentivizing new subscribers to join the ad tier.

They view scale as a relative target, looking at it compared to other advertising channels in every geography. For example, they’ll need to reach a certain % of penetration in ad-based subscribers in the U.S. before they become competitively relevant compared to traditional media channels.

[Netflix House Announcement] This initiative is inside of our Consumer Products and Experiences Group. It’s really important in a way to kind of deepen fandom. You kind of see it on a large scale with theme parks, these build-outs are not going to be like a theme park, both in that they won’t have that gigantic CapEx. And they also – we expect that fans will go multiple times a year, not just once every couple of years.

— Ted Sarandos, Co-CEO, Q3-23 Earnings Call, Edited by the Author

My initial thought when the Bloomberg article was published, amid market pessimism over Netflix’s Q3 numbers, specifically in ads and subscribers, was that Netflix is trying to generate new sources of revenue to accelerate growth. After listening to the call and seeing management’s optimism about the core streaming business, I’m much more optimistic about the Netflix House initiative. Similar to the gaming division, I view this as more of an ancillary business with no material importance for shareholders at its current size.

Valuation

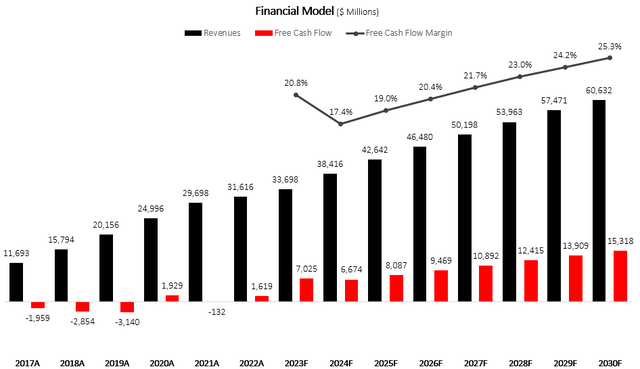

I used a discounted cash flow methodology to evaluate Netflix’s fair value. I assume the company will grow revenues at a CAGR of 8.8% between 2023-2030, based on the growth prospects discussed above.

I project free cash flow margins to increase incrementally up to 25.3% in 2030, as the company’s scale will cause content investments and operating costs to become a significantly lower portion of total sales.

Created and calculated by the author based on Netflix financial reports and the author’s projections

Taking a WACC of 8.5% and adding its net debt position, I estimate Netflix’s fair value at $211.0B or $476 per share.

Conclusion

Aside from the actual reported numbers which were much better than what the pre-release valuation reflected, Netflix’s third quarter pretty much cemented the investment thesis for the next couple of years.

Increased share buybacks, unlimited operational leverage opportunities, sustained free cash flow generation, and double-digit revenue growth driven by a balanced mix of membership and arm growth from 2024 and beyond.

At a 25.5x P/E multiple over projected 2024 earnings, I believe there’s ample room for upside. Therefore, I reiterate Netflix as a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.