Summary:

- Netflix management bought back 6 million shares in 3Q23, indicating confidence in the future economics of the company.

- Netflix’s unique global platform with hundreds of millions of viewers gives management confidence about the future and sets them apart from competitors.

- Netflix can improve margins by raising prices due to their mature global business at scale.

Wachiwit

Introduction

Per my April article, Netflix (NASDAQ:NFLX) has made it to the other side. They have the right business model for profitability in the streaming era whereas other companies are still trying to figure things out. Per the 3Q23 letter, management spent $2.5 billion buying back 6 million shares in the period which comes out to about $417 per share. This is more than 1% of the market cap in a single quarter and it is more than the free cash flow (“FCF”) of $1,888 million for the quarter so it is consequential. My thesis is that Netflix management bought back a significant amount of stock during the 3Q23 period because they have confidence in the future economics. One reason for the confidence is because management is amenable to a global view whereas many outsiders tend to be constrained by a lens that is US-specific.

Unique Global Platform

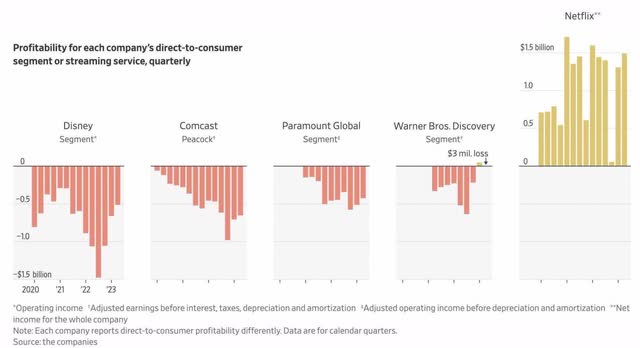

Netflix management has years of profits under their watch as they see competitors floundering around while failing to match Netflix in terms of controlling expenses. An August WSJ article by @RWhelanWSJ, @JBFlint and @naterattner shows how Netflix stands out from Disney (DIS), Comcast (CMCSA), Paramount (PARA) and Warner Bros. (WBD) with respect to streaming profitability. The graph doesn’t fully capture the differences as the numbers for Netflix are after depreciation, amortization and taxes are subtracted while the numbers for the others leave these considerations out. The graph ends with 2Q23 and it shows a net profit of $1,488 million for Netflix below in that period but this is after $89 million in depreciation and amortization of property, equipment and intangibles, $3,410 million in amortization of content assets and $192 million in taxes so a figure that is more apples to apples would be closer to $5,179 million:

The above graph only goes through 2Q23 but the 3Q23 numbers were even better for Netflix as they had net income of $1,677 million

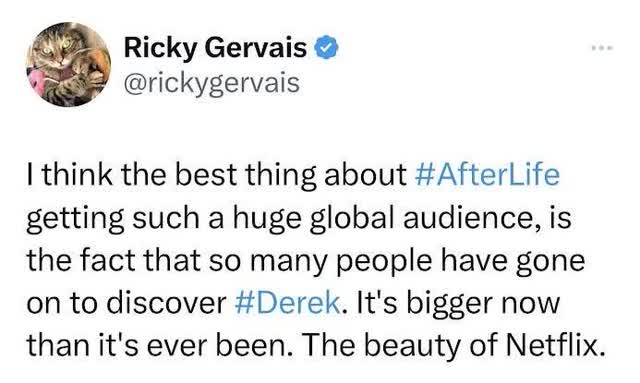

Netflix’s unique global platform with hundreds of millions of viewers gives management confidence about the future. Iconic global comedians like @rickygervais from the UK are writing about “the beauty of Netflix.” Less mature competitors are racing to catch up such that they can get this type of global publicity:

Ricky Gervais praises Netflix (X/Twitter)

Management knows there will be more shows like Ballers and Suits that will thrive on Netflix’s unique global platform despite not doing well on other platforms. An August thread from @thaddeus_hatter explains why Ballers flourished on Netflix despite the fact that it wasn’t widely viewed when it came out on HBO 8 years ago. The first consideration is that Netflix has more viewers than the other platform. Additionally, Netflix has a better recommendation engine than other platforms. Also, the Netflix Top 10 list is a powerful signal.

Co-CEO Ted Sarandos talked about these unique global considerations in the 3Q23 call. Netflix is unmatched with respect to their distribution footprint and their recommendation system (emphasis added):

I think Suits is a great example of the impact of the Netflix effect that we can have because of our distribution footprint and our recommendation system, we were able to take Suits, which had played on cable and had played out in other streaming services and pop it right into the center of the culture in a huge way, not just in the U.S. but all over the world. According to the Nielsen charts then, Suits was the number one watch streaming series for 13 straight weeks. That’s like – that is a record for Nielsen.

Speaking at the September 2023 Goldman Sachs (GS) Conference, Co-CEO Greg Peters said it is more than just scale effects behind the durable competitive advantage at Netflix (emphasis added):

I think the under-appreciated component is to do that, to be successful, you have to bring together a set of capabilities and competencies that really haven’t had to exist in one company before. So you’ve got to be great at producing content across multiple different genres, multiple different languages, multiple different countries. You have to be connected into the creative community in all these countries around the world, have trust with creators so they’re going to bring their best stories to you. You have to know how to speak to fans in all those different countries in the world and connect them with the content, enhance the quality and the value they’re viewing because of that fandom. You have to think about product experiences and go-to-market that make that whole experience feel native. How do you work with the right partners? How do you collect payments around the world?

Margin Expansion

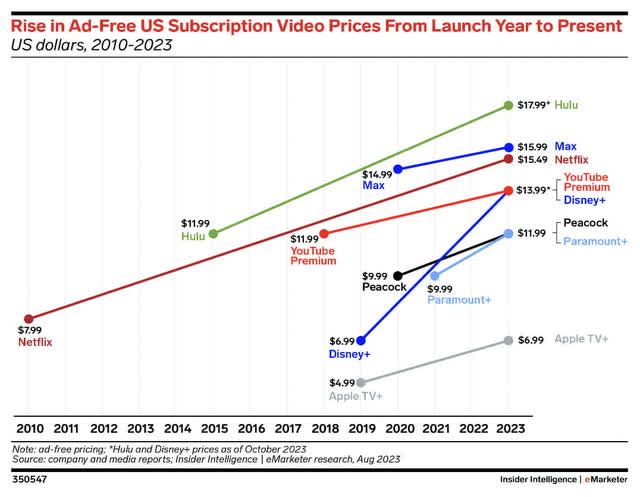

Netflix management knows they can improve margins by raising prices. Many streaming companies including Netflix have the ability to do this per an October eMarketer article by @RossBenes:

In the 1Q23 call, Co-CEO Ted Sarandos explains how Netflix, being a mature global business at scale, can drive up operating margins in the future (emphasis added):

The scale of the business being global, is that every one of our big content wins starts as a local win. And then in success, they roll out and they get regional, then they reach diaspora, then they get global and it’s a huge success, and there’s no marginal cost to all that additional audience when we get it right. So by driving – creating those stories that drive growth of the business in local territories, it provides content into the pool that people can fall in love with and it’s just as likely that we can get a gigantic hit from anywhere in the world and that’s really the scale of our operating business. And to go back to what Spence said about, the potential for – to even grow margins beyond where we are at today is very, very high.

Asked about pricing in the September 2023 Bank of America (BAC) Presentation, CFO Spence Neumann said they deliver amazing global entertainment at scale and then price into it. Netflix will continue to do this regardless of choices made by competitors (emphasis added):

I think it’s good for the industry generally that folks are, I would say, pricing a bit more appropriately to the value that they’re delivering, right, as opposed to just subsidizing and giving away the product, but we really don’t price to our competitors. Our pricing philosophy is unchanged. We start with delivering amazing entertainment, amazing TV, amazing film and increasingly, hopefully, amazing games to our members at scale, delivering more and more value and then pricing into it.

Valuation

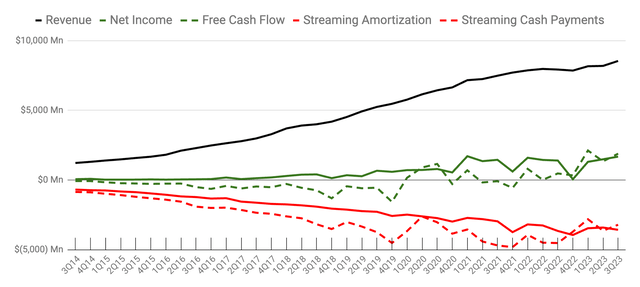

Looking at the quarterly numbers over the years, free cash flow (“FCF”) didn’t really get going until quarterly revenue started exceeding $6 billion in 2Q20:

Historical FCF (Author’s spreadsheet)

We see the power of the 3Q23 buybacks in the 10-Qs as the 2Q23 10-Q shows 443,146,751 shares through June 30th while the 3Q23 10-Q shows the total went down more than 1.2% to 437,679,669 through September 30th.

I don’t think management would have bought back a large amount of stock during 3Q23 unless they thought it was worth at least 10% more than their purchase price of about $417 per share. As such, I think the stock is worth at least $460 per share when rounding to the nearest ten dollars. It closed at $478 on November 22nd and I think it is a hold.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX, AAPL, AMZN, DIS, GOOG, GOOGL, PARA, WBD, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.