Summary:

- Stock splits have boosted share prices for companies due to investor psychology, despite no change in business value.

- Netflix may announce another stock split soon, following previous success in driving share prices higher.

- Netflix’s pricing power, growing subscriber base, and strong cash flow support continued growth and potential for share price increases.

Mike Harrington/DigitalVision via Getty Images

One of the best ways for companies to see their shares rise recently has been to announce a stock split. Numerous large-cap names have rallied on these announcements in recent quarters, all due to investor psychology, despite there not being any fundamental change to the value of the actual business. Sunday marked nine years to the day when streaming giant Netflix (NASDAQ:NFLX) announced a stock split when shares were trading at a price that was just $5 below where they finished last week (accounting for the split). It wouldn’t surprise me to see the company announce another one in the coming quarters as it looks for shares to head even higher.

Previous Coverage:

I last covered the name in April 2023 when the stock fell after giving weak current quarter guidance. Management had pushed back plans on the rollout of paid account sharing, which it believed push some subscriber additions and revenue growth a quarter into the future. At the same time, a Q1 revenue miss helped shares to initially drop.

I urged investors at the time to believe in the long-term story. The company has always been the streaming leader, and the pandemic helped that situation take off a bit even more. Now, the company is delivering meaningful profits and cash flow, which is even allowing the share count to come down over time. Since my previous article, the stock has more than doubled, outpacing the S&P 500’s return by almost 80 percentage points.

I Believe in Pricing Power:

Streaming services have become incredibly popular as consumers cut the cord, where they look to ditch traditional cable television packages. Whether it be to save money or just because they don’t use the service enough, Netflix provides nice value through its catalog of both shows and movies, and it is getting into live sports. Cable packages can start at $40 and easily run well over $100 a month based on the latest spending data.

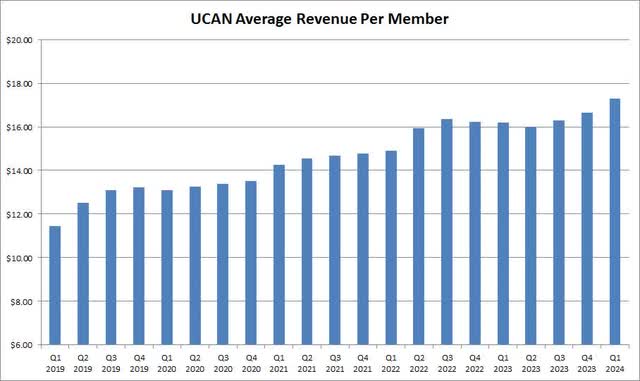

Netflix offers a variety of plans, but its leading presence in the streaming space has allowed it to raise prices at a nice clip over time. As the chart below shows, the US/Canada average revenue per member per month figure has increased by more than 51% over the past four years as detailed in the quarterly earnings letters. This means that Netflix has basically gotten 8.6% more per year per subscriber in its key geographical region.

Netflix UCAN ASP (Company Earnings Reports)

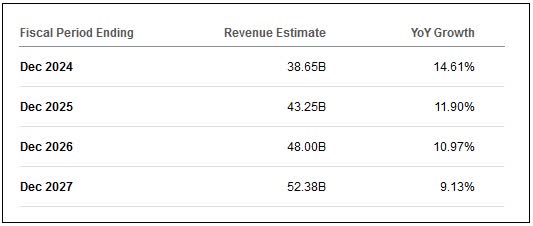

I believe that we will continue to see gradual price increases over the next couple of years. That pricing power, combined with the continued rise in global Netflix subscribers, is a key reason why revenues are expected to grow by double-digit percentage wise each year through 2026. The company topped $20 billion in total revenue for the first time back in 2019, but that number could be over $50 billion in less than three years. The following graphic shows current analyst revenue estimates through 2027.

Netflix Revenue Estimates (Seeking Alpha)

In the UCAN region, for example, Netflix could potentially raise prices by around 20% over three years if the above pattern continues. At that rate, it wouldn’t need too much subscriber growth to get to a 25%-30% overall revenue increase over that time. In foreign markets, pricing power may not be as strong, but Netflix has more opportunities for sub growth as it continues to build out its international platform and provide more country-specific content.

Growing Margins, Producing Strong Cash Flow:

With Netflix cementing its place on top, it hasn’t just grown its revenue base. The company has also been able to enjoy economies of scale at this size, and it is continuously looking to improve its margins. After having an operating margin that was barely in the double digits in 2018, percentage-wise, the company is targeting a 25% operating margin this year with further room to grow in the future.

Back in 2019, Netflix reported just $4.13 per share in earnings. This year, it is expected to more than average that each quarter for the year. More than 20% earnings per share growth is expected each of the next two years, with the possibility that the company could do over $30 per share in 2027. Part of that improvement may come from the buyback, which gets me to another key point.

Netflix finished the first quarter of this year with gross debt of $14 billion and cash and cash equivalents of $7 billion. The company will continue to target an investment grade credit rating and is expected to generate $6 billion of free cash flow this year. That number could easily grow into the double-digit billions in the coming years as net income rises, which will allow for even more share repurchases or acquisitions to further bolster its content portfolio.

The Valuation is Still Reasonable:

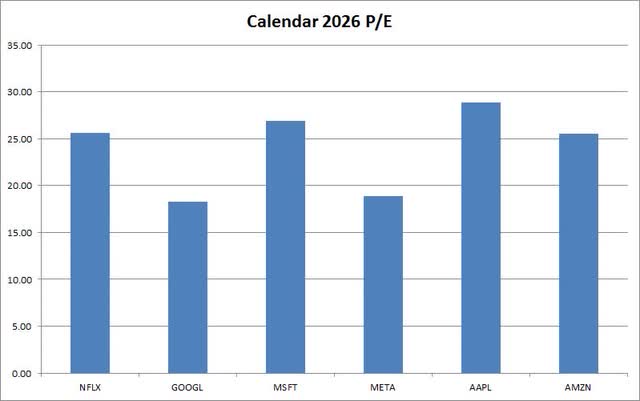

Despite Netflix shares soaring in recent years, the stock isn’t that expensive when you compare the name against some of its fellow large-cap tech peers. In the chart below, you can see price to earnings ratios for five other giants – Alphabet (GOOG) (GOOGL), Microsoft (MSFT), Meta Platforms (META), Apple (AAPL), and Amazon (AMZN), based on their calendar 2026 street estimated earnings per share.

Calendar 2026 P/E (Seeking Alpha)

Netflix is projected for very strong growth in the coming years. For calendar 2026 itself, earnings per share are expected to rise by about 21%. That’s quite a bit above the average of the five names above, which sit at about 15% growth for calendar 2026, or about 19% if we take out Apple. Netflix also has more short-term earnings growth potential than most of those names, according to analysts. As we approach the halfway point of this year, Netflix trades for about 37.4 times this year’s expected earnings. Even if that comes down say 5 points by mid-2026, and the company does $27 in earnings that year (about 1% above the street’s current estimate), you get a price target of roughly $875 per share.

I mentioned in my opening the possibility of Netflix announcing a stock split. That happened nine years ago at a very similar price, and it was a sign from the board that it believed in the company’s future. Some investors, as well as company employees, don’t like the idea of high-priced stocks, so a $100 stock looks much more attractive than a $700 one, even if nothing fundamentally has changed. As we’ve seen with the likes of Nvidia (NVDA), Broadcom (AVGO), and Chipotle (CMG) recently, a stock split announcement is usually good for another leg higher in the name, and shares could run even more once they trade at the lower numerical price.

Perhaps the biggest risk for Netflix currently is that subscriber growth starts to plateau a bit. Investors and analysts were a bit concerned at the Q1 report when management announced it would stop providing subscriber numbers in 2025. This sparked fears that sub growth was starting to slow a bit, which would make the company more reliant on price increases to drive overall revenue growth. In the near term, Q2 is usually the company’s weakest sub growth period, and the Olympics in Q3 along with an increased focus on this year’s Presidential Election could limit subscriber growth a little.

Final Thoughts/Recommendation:

With the Netflix rally over the past year putting shares at nearly $700, the company may again look to split its stock like it did at a similar price back in 2015. This would be another bullish sign in the long-term trajectory for the streaming giant, as it looks to continue its strong revenue and earnings growth in the coming years.

Until we see a major change in the competitive landscape here, or Netflix numbers start to weaken, I will keep my buy rating in place. The valuation is fair compared to large-cap tech peers, given better growth prospects over the next few years. With the company increasing its net income levels, cash flow trends should improve, and that will result in more share buybacks. A split would be icing on the cake here, potentially sending Netflix to a new all-time high.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.