Summary:

- Netflix reported strong Q3 results with 8.8 million net subscriber additions and expects robust growth in Q4.

- The company announced price increases in the US, UK, and France markets, which should increase average monthly revenue per paying membership.

- Netflix’s margin outlook is positive, with management guiding for an operating margin of 22% to 23% in FY24 despite a ~$17 billion investment in content.

demaerre

Investment Thesis

Netflix (NASDAQ:NFLX) has reported an impressive net subscriber addition of 8.8 million in Q3 and anticipates another robust quarter in Q4. With subscriber growth gaining momentum, recently announced price increases, the expansion of their advertisement tier, and diminishing competitive threats as peers reevaluate their content and subscriber acquisition investments, Netflix is well-positioned for substantial growth in the upcoming years. Additionally, the company’s margin outlook is encouraging, with management guiding for an operating margin in the 22% to 23% range for FY24 (up from expected 20% in FY23, according to management guidance), despite an expected $17 billion investment in content for FY24. The valuation is also reasonable, and the P/E multiple could experience a meaningful re-rating as the company continues to deliver strong subscriber and revenue growth, along with margin expansion. Therefore, I have a “buy” rating on the stock.

Revenue Analysis and Outlook

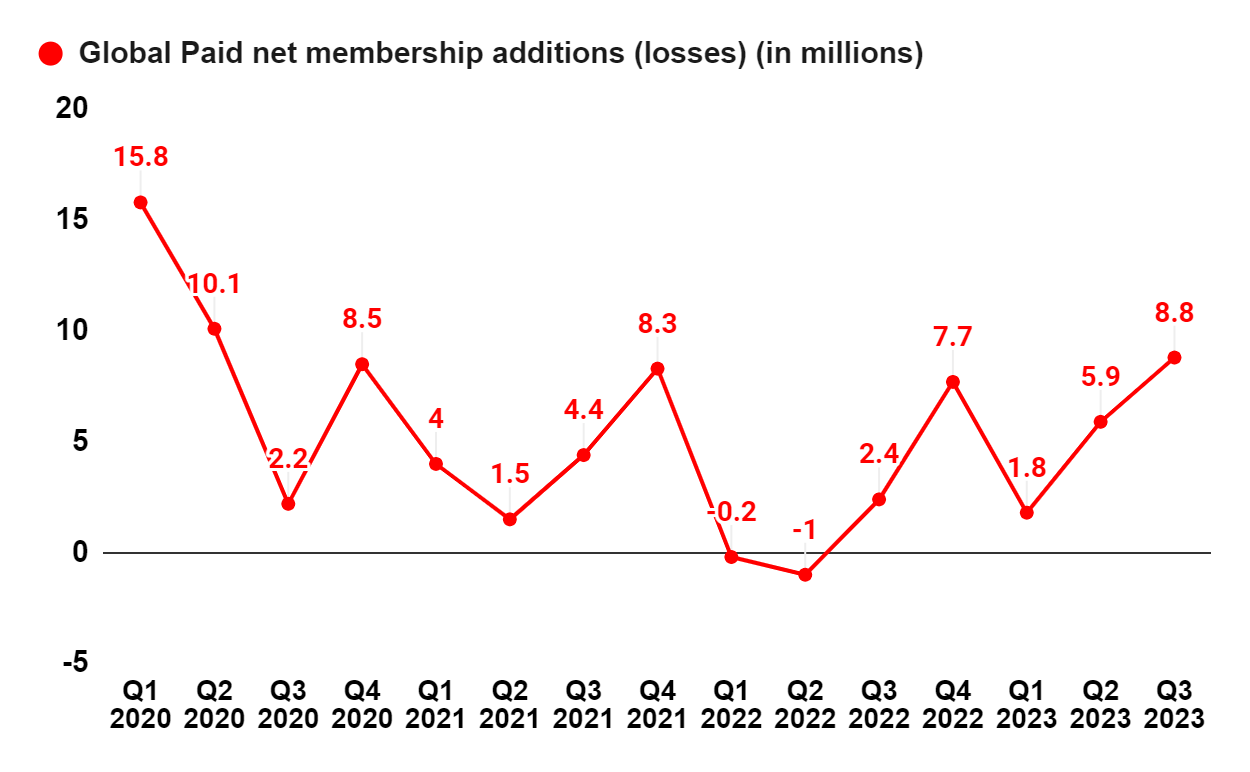

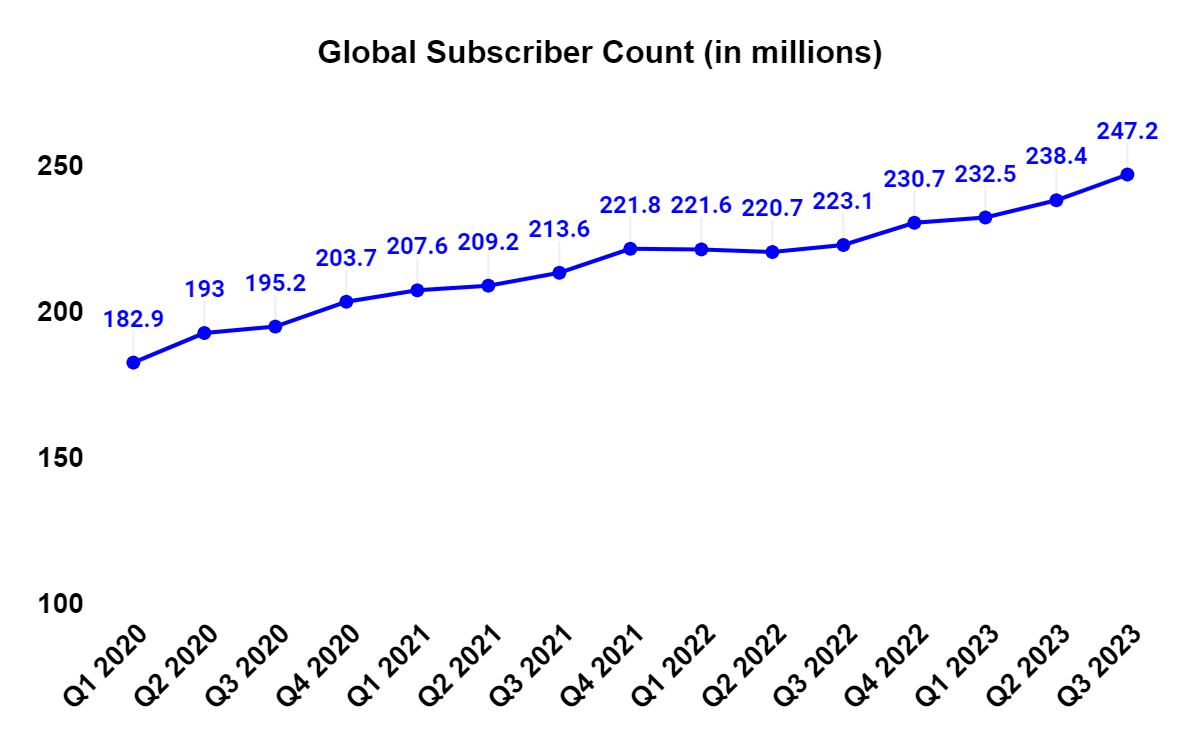

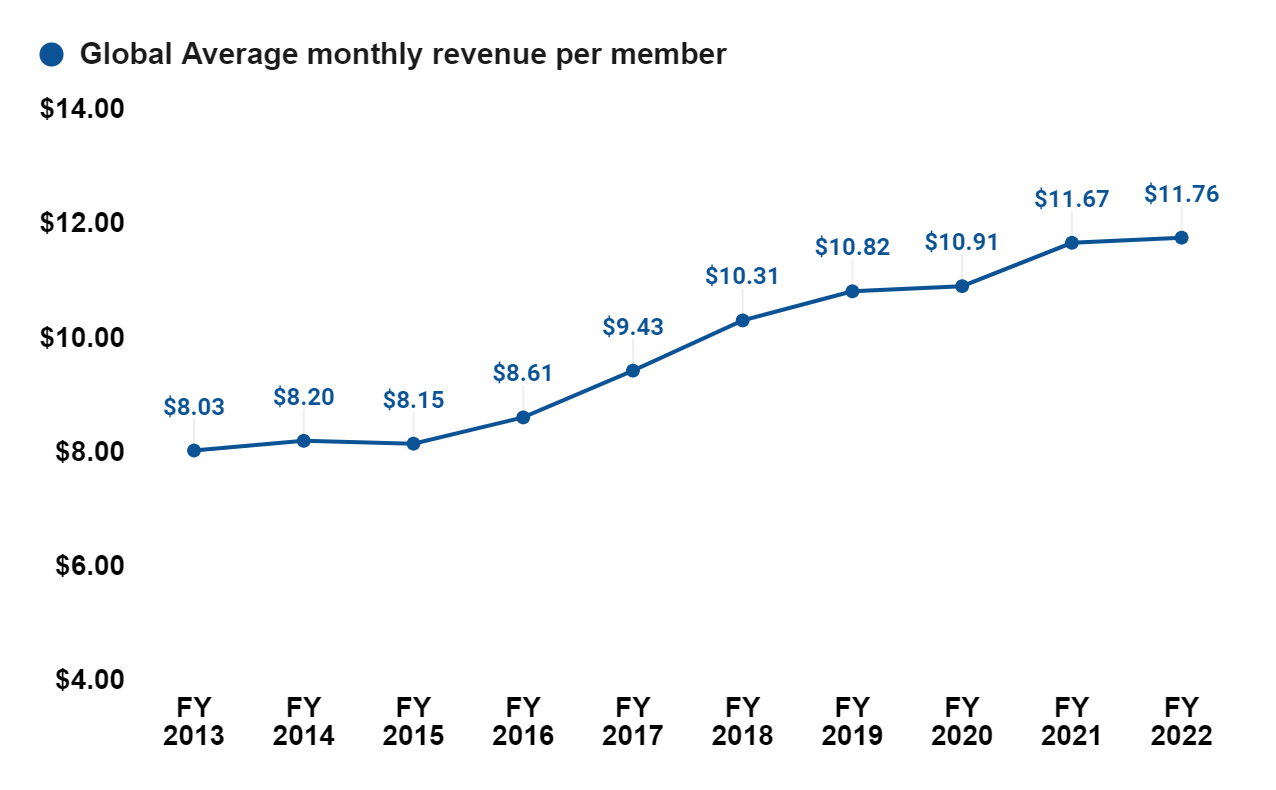

Netflix reported strong Q3 FY23 results and provided encouraging guidance commentary positively surprising analysts. While the company’s revenue was relatively inline with the street at $8.54 billion (+7.8% Y/Y or +8% Y/Y, excluding FX), its EPS beat the consensus estimates by 23 cents and came in at $3.73. This increase in revenue was driven by 9.4% Y/Y growth in average paying membership partially offset by 1% decrease in average monthly revenue per paying membership (ARM). The decrease in ARM was partially due to the mix shift from higher membership growth in regions with lower ARM, and limited price increases over the last 18 months. The company’s net subscriber additions in the quarter jumped to 8.8 million thanks to the crackdown on password sharing, strong content offering, introduction of lower-priced advertising supported offering and the ongoing expansion of streaming globally. With these 8.8 million paid net additions, Netflix now has 247.2 million customers worldwide, up 10.8% Y/Y.

NFLX’s Global Paid net memberships additions (losses) (Company Data, GS Analytics Research) NFLX’s Global Subscribers count (Company Data, GS Analytics Research) NFLX’s Historical average monthly revenue per paying membership (ARM) (Company Data, GS Analytics Research)

Looking forward, the company’s revenue growth outlook remains solid.

The company announced price increases in the U.S., U.K. and France markets yesterday. In the U.S., NFLX basic plan price will now be $11.99 (up 20% versus previous $9.99), while the U.S. premium plan will now be $22.99 (up 15% prior $19.99). The pricing of ad tier and standard ad free tier will remain the same at $6.99 and $15.49, respectively. Similarly the company has increased the pricing of basic and premium plans in the U.K and France while keeping entry level advertising-supported plans constant. This pricing increase should help the company increase its ARM in the coming quarters. The company’s peers have also announced price increases recently which bodes well for the whole streaming industry.

NFLX’s ARMs should also benefit as it ramps up advertisements on its ad-supported tier. The company’s ad tier is in its initial stages of gaining traction and, as the company continues to build advertising pipeline and improves customer targeting, the number of ads shown as well as price per advertisement should increase, benefiting ARMs. According to management estimates, advertising is a $180 billion opportunity (ex China and Russia) and the company is well positioned to grab its share of the pie in the long run.

The company’s subscriber growth outlook also remains solid with the strong content slate in the coming month which includes the final season of its Emmy award winning drama – The Crown; Berlin the latest series of the Money Heist franchise; and Squid Game: The Challenge. Management has guided for subscriber additions in Q4 FY23 to be in a similar range as Q3 FY23 which is encouraging.

In addition to a strong content slate, the company’s subscriber growth is also well positioned to benefit from continued traction of its ad tier offering and crackdown on password sharing. Last quarter, the company’s ad tier saw 70% sequential quarter-over-quarter growth in membership. This was on the top 100% quarter-over-quarter growth in Q2 2023, and 30% of new sign-ups are choosing advertisement plans in the countries where this plan is available. I expect this momentum to continue moving forward.

Further, I believe after an intense last couple of years, the competition in the industry is moderating. The last few years have seen streaming companies investing heavily in content and subscriber acquisitions and the market was rewarding this behavior. However, of late, there has been a renewed focus on return of these investments. For example, after acquiring Hotstar and investing heavily on content to grow subscribers in the low ARPU Indian market, there are speculations that Walt Disney (DIS) is now looking to sell its Indian Streaming business. The company has also announced its plan to double investments in Disney Parks over the next 10 years indicating some shift in growth priorities. Another NFLX competitor, Warner Bros. Discovery (WBD) which had big content investment plans post-merger between erstwhile Discovery and AT&T’s (T) Warner Media is also reeling under pressure from a high debt load. So, the content spending at WBD should also be muted.

Further, as the competitors are realizing their limitation to compete against Netflix, there is also a good likelihood that in the future they will be more willing to monetize some of their content by licensing it to Netflix which should further help improve NFLX’s content slate and attract more subscribers.

Also, just like NFLX entered advertising supported business, there is a good likelihood that the company will enter other areas like live sports broadcasting in the long run which can meaningfully improve the number of subscribers as well as their monetization. So, I am optimistic about the company’s near as well as long term growth prospects.

Margin Analysis and Outlook

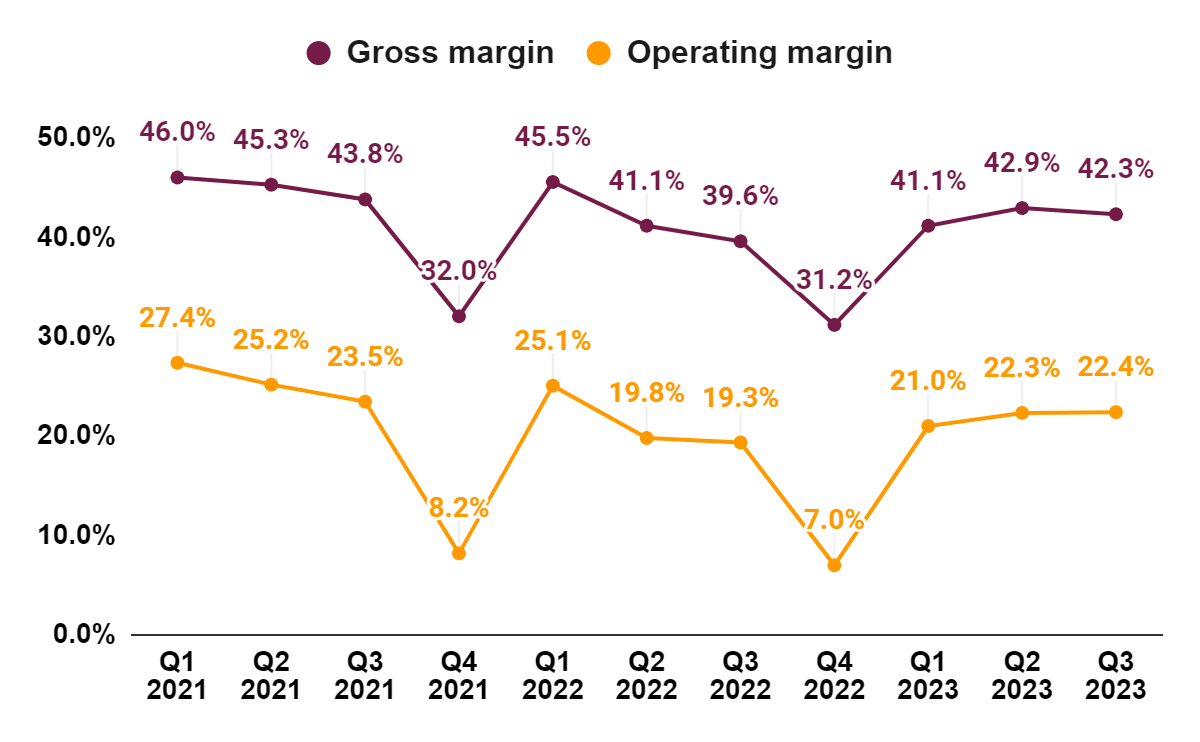

In Q3 2023, the company saw a 270 bps Y/Y improvement in gross margin to 42.3% and 310 bps Y/Y increase in operating margin to 22.4% due to sales leverage as well as a delay in content and other spending due to the writers’ strike.

NFLX’s Gross margin and Operating margin (Company Data, GS Analytics Research)

The company has guided for operating margins to be at the high end of FY23 guidance of between 18% to 20% and has also guided for FY24 operating margins in the 22% to 23% range. Prior to earnings, sell-side consensus was modeling 22% operating margin for FY24 and the mid point of the company’s FY24 operating margin guidance is higher than that.

This margin guidance is impressive as management’s FY24 content spend estimate of ~$17 billion is meaningfully higher than FY23’s $13 billion. Management has done a good job in balancing growth investments and margins over the last several years and I expect this discipline to continue. The company has multiple years of margin growth potential helped by increasing subscribers base (which gives better leverage on content spend), pricing increases, and increasing ad monetization. While management has not given long term operating margin targets, some Wall Street analysts believe that the company can reach 40% to 50% operating margins at scale which is inline with where some of the well run legacy linear TV networks were during their peak. These expectations look reasonable and I believe there is a multi-year runway for margin expansion in the years ahead.

Valuation and Conclusion

Netflix has historically traded at high P/E multiples given its long term growth opportunity and, over the last five years, its average forward P/E multiple was 58.50x. This multiple has contracted meaningfully in the last couple of years as the investors were worried about slowing subscriber growth and competitive threats. The current earnings release and Q4 guidance indicates a meaningful subscriber growth this year which should allay some of these concerns.

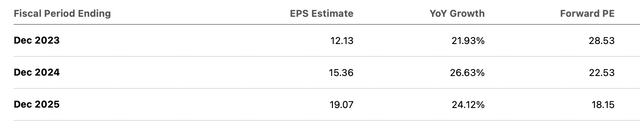

According to the latest consensus estimates, the company’s EPS is expected to grow over 20% Y/Y for the next few years.

NFLX Consensus EPS estimates (Seeking Alpha)

With some analysts still updating their estimates after strong Q3 earnings, and the company posting better than expected subscriber growth, announcing price hikes, and guiding the higher than expected margins for FY24, the sell-side numbers are likely to go up. While the stock is already up over 10% in pre market trading, the potential for upward revision in estimates and valuation multiple re-rating suggest further upside and hence I believe the stock is still a good buy at these levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Ashish S.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.