Summary:

- Bullish outlook on Netflix with 77.8% growth potential based on regression analysis.

- The company’s growth prospects, innovation, and financial health support long-term growth.

- Technical analysis shows a strong upward trajectory, justifying a buy decision.

Marvin Samuel Tolentino Pineda

Investment Thesis

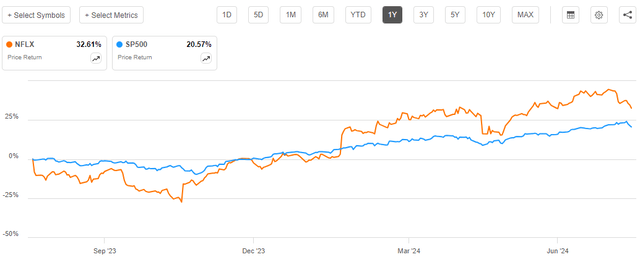

I am bullish on Netflix, Inc. (NASDAQ:NFLX) with a growth potential of 77.8% based on my regression analysis. This stock has been on an upward trajectory, gaining more than 32% over the last year and outperforming the S&P 500 by a margin of about 12%.

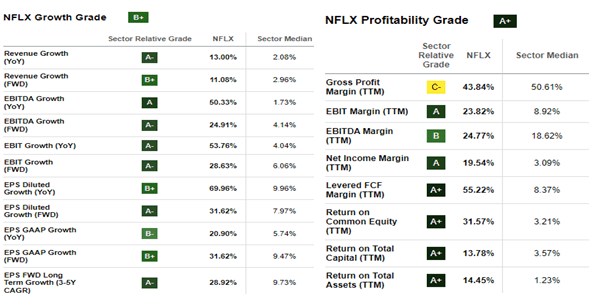

My bullish outlook stems from the company’s growth prospects, innovation, and market position. I find these parameters to be strong long-term growth levers. In addition, the company’s financial health is very compelling, characterized by attractive profitability and impressive growth metrics.

Seeking Alpha

In light of the growth levers mentioned above, which I will discuss in the sections that follow, I believe this company will sustain this robust profitability and growth, which could be a recipe for sustainable share price growth. Given this background, I rate this stock a buy.

Brief Company Overview

Netflix offers services for entertainment. It provides games, TV series, documentaries, and feature films in various languages and genres. Its members can also access streaming material on various internet-connected devices, such as mobile phones, set-top boxes, digital video players, and TVs. The company has a vast global presence, with its headquarters in Los Gatos, California.

This global diversity, which has made the company have a presence in more than 190 countries, is essential for its growth. For instance, the global expansion has enabled the company to tailor content and user experience, thereby achieving cultural representation and localization. A few examples of its localized contents include the Spanish series La Casa de Papel, the French series Lupin, and Sacred Games from India. These few examples demonstrate the company’s investment in locally relevant content, which enables it to reflect a variety of cultural perspectives and foster greater audience engagement. This is a significant competitive advantage, in my opinion, since regional limitations can encourage the development of regional streaming services, but Netflix’s offering of content that is carefully chosen to cater to local tastes promotes diversity and enables a wider representation of regional cultures and tales.

Technical View

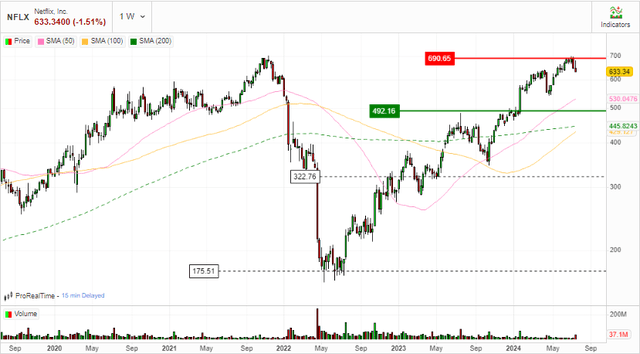

Since July 2022, Netflix has been on a strong upward trajectory, and the stock has formed an ascending channel pattern, which is a bullish configuration characterized by higher highs and higher lows.

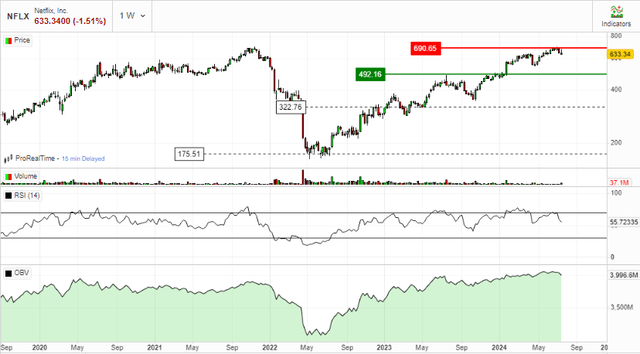

With this bullish configuration, let’s assess the technical indicators to affirm the bullish outlook. First off, the price is above the 50-day, 100-day, and 200-day MAs with all the MAs moving upwards, a strong confirmation of a sustainable uptrend. Most importantly, there have been two golden crosses with the 50-day MA crossing above both the 100-day and 200-day MAs further confirming the bullish trajectory is very strong and sustainable.

Further, the RSI is currently at 55.7 implying that the stock has ample space to grow before hitting the oversold region of about 70. Considering that trading volume is essential in assessing a stock’s outlook, it is promising to see that Netflix has a consistently growing OBV implying that its marginal trading volume is positive, and this indicates that the stock has an increasing cumulative demand, which is a catalyst for sustainable share price growth.

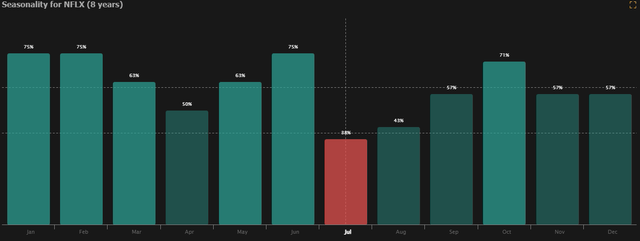

In conclusion, technical analysis shows a clear bullish outlook backed by increasing trading volume and golden crossovers. For this reason, I believe a buy decision is justified. To support my buy recommendation is the stock’s seasonality chart. Over the last 8 years, July appears to be the best month to buy this stock because it is the dip month after which solid growth kicks in. This year isn’t an exception, since over the last month, the stock is down about 7.22%, a testament that it is obeying its seasonality, justifying July as the best month to buy.

Technically, I am bullish, but follow along as I statistically estimate my price target in the section that follows.

Regression Analysis: 2027 Price Target

In this section, I’ll use regression analysis to project my price targets for this company over the next three years. My model is based on a fundamental background, and my inputs, or rather independent variables, are a mix of company-specific elements (revenue and EPS) and macroeconomic aspects (market growth and interest rates). In my estimation, I will run the model using data from the last five years, and then use the output to generate my price target. My assumption is that there is a linear relationship between the stock price and the independent variables, and that the effect of changing the X variable on the Y variable is constantly independent of the other factors in the model.

My adoption of revenue and EPS is informed by the fact that a company’s financial health is very critical in determining its stock performance. For market growth, I chose to include this variable because it is a strong indicator of its future earnings potential. The company is operating in a rapidly growing market, and this means that it’s likely to grow its revenue and profits.

Lastly, the interest rate is a risk factor in my model in this sense:

A higher interest rate makes debt more expensive. A firm like Netflix may need to use debt financing to fund its operations and growth, so higher costs can result in shrunken profit margins, whose ultimate result is deterioration in stock value.

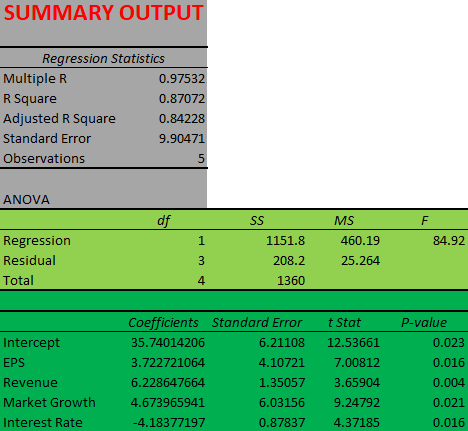

With this background, I ran my model at a 95% confidence interval, and below is my output.

Author

According to the results, the model has an adjusted R Square of 0.842, implying that it explains roughly 84.2% of the variability in the dependent variable, and so it is a good fit because a higher R Square shows that the model explains a bigger fraction of the variation. Furthermore, the t-stat for all variables is greater than two, and the p-values are less than 0.05, which is the confidence interval, indicating that all variables are statistically significant and hence valid predictors of the dependent variable.

Given this rationale, the output demonstrates that revenue, EPS, and market growth all have positive beta coefficients, implying that any additional unit in the three variables influences the stock price by a positive magnitude equivalent to the beta coefficient. On the other hand, the interest rate has a negative beta coefficient, which means that each additional unit has a negative influence on the stock price equal to its beta.

Based on these findings, the overall model equation is Y=Bo+B1X1+B2X2+B3X3-B4X4+e, Where;

B0-Y Intercept

B1-Beta coefficient for EPS

X1-EPS

B2-Beta coefficient of Revenue

X2-Revenue

B3-Beta coefficient for Market growth

X3-Market growth

B4-Beta coefficient of interest rate

X4-Interest rate

e-the standard error.

Using the overall model above, we can forecast the price of this stock for the next three years, which is the price target for 2027. To accomplish this, I will use the estimated revenue, EPS, interest rate, and market size for 2027. For EPS and revenue, I will use the data from Seeking Alpha, while for market growth I will use the 2027 market value from Statista, and for interest rate, I will use the estimated Fed rate for 2027. The estimated revenue and EPS as of 2027 are $52.17 billion, and $31.76 respectively while the projected market size and fed rate are $138 billion and 2.90% respectively. Plugging these figures into the model equation yields a price target of $1,126.31, implying a 77.84% growth potential.

In light of this great growth potential over the next three years, and the strong bullish momentum demonstrated by the technical indicators, I believe Netflix is a buy. To establish a strong investment case, I will give an overview of the growth levers that I believe will propel this firm forward.

Growth Levers

NFLX has solid growth levers in its innovations and market position. It boasts being the most popular streaming company subscribed globally, with total subscribers amounting to 270 million. As of March 31, 2024, the company had 269.6 million paying subscribers worldwide. This figure increased 16% YoY and 3.6% from the previous quarter. This leading position and growing customer base not only speaks volumes of the company’s sustainable growth, but also of its customer satisfaction, which I believe stems from its strategic investment and approaches. For instance, it has successfully exploited the language barriers by using aggressive marketing, language dubbing, and subtitles. Consider the Squid Game phenomenon, which introduced Korean television series to a global audience. Additionally, there’s always something fresh to watch on Netflix, because new content is added regularly.

To demonstrate the company’s innovation in improving content quality, I will give an example of its technological advancement. NFLX mostly depends on technology to improve the quality and delivery of its content. For flawless streaming, it has created advanced recommendation algorithms and content delivery networks (CDNs). Additionally, it is now able to offer high-definition videos that greatly enhance the viewing experience, courtesy of its investments in the creation of original content using cutting-edge production methods like 4K HDR.

These inventions have enabled the firm to stay at the forefront of the streaming service market by offering top-notch programming that appeals to a wide range of international consumers. It is logical to believe that these innovations will enable the company to prevail in the battle for market share.

With its strong market position and innovations, NFLX is taking prudent steps to strengthen its revenue base. The introduction of a lower-cost ad-powered tier, as well as the increase in subscription costs, are deliberate steps aimed at increasing revenue. This approach paid off in the MRQ, where sales increased by 17% YoY to $9.56 billion, and operating margins increased from 22% to 27%. The advertising tier membership growth, which saw a 34% QoQ rise in subscribers, was particularly noteworthy. In addition, it added 8 million subscribers, which contributed to a 44% surge in net income, to $2.15 billion.

In general, the Q2 performance shows a robust growth trajectory, particularly regarding profitability and new subscriber acquisitions. An effective cost-management strategy and a sound financial structure are indicated by the rising profit margin. The company’s sustained popularity and market power are reflected by the sharp increase in profits and subscriber growth, indicating a promising future for the business. This performance is a positive indicator of the company’s ability to navigate the competitive streaming landscape and invest in content and technology to retain and grow its subscriber base.

Given these strategic decisions, which are very promising given the MRQ performance, I am confident that this company is strategically positioned to leverage the strong projected market growth and sustain its growth in the long term. According to Grand View Research, the global video streaming market is projected to grow by a CAGR of 21.5% between 2024 and 2030.

In summary, NFLX is better positioned to sustain its growth through innovation, market dominance, and strategic pricing, a matrix that I believe will enable it to seize the projected market growth.

Risks

Despite my strong conviction in this stock, investing in it has some risk, just like any other investment. One potential risk of this investment thesis is the crackdown on password sharing and changes in the advertising business, which may impact subscriber growth and income. Investors should be aware of regulatory pressures and potential saturation in core markets.

The company must deal with varied content quotas, levies, investment commitments, and potential content limitations imposed by different governments. Furthermore, intellectual property conflicts and content liability concerns pose persistent dangers to Netflix’s operations and reputation.

Conclusion

Netflix makes a compelling investment case due to its growth potential and market domination. Its 77.8% upside potential and inventive approach to content and market expansion make it an attractive addition to any investment portfolio. Consequently, I rate the stock a buy.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Growth Idea investment competition, which runs through August 9. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.