Summary:

- Warren Buffett recently mentioned that streaming is not a very good business, and I believe NFLX’s operating history is a prime example of why.

- The company’s growth story is fantastic on a GAAP EPS basis, but when looked at from a cash flow perspective, shareholder returns have been poor.

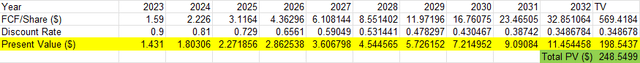

- Using optimistic assumptions for FCF growth, our models suggest NFLX is worth $250/share with 25% downside indicated at the time of writing.

- Growing free cash flow will be difficult given competition and the capital-intensive nature of the industry.

Brandon Bell

Executive Thesis

On a GAAP basis, Netflix (NASDAQ:NFLX) looks like a growth story with EPS and subscriber count swelling over the last 10 years. When turning to free cash flow, the story becomes a bit more convoluted and recent gains do not make up for longer term losses. Indeed, the company has consistently diluted shareholders and has not paid a dividend since it went public in 2002. To add insult to injury, Buffett recently took a swing at the entire streaming industry, calling it a poor business with deep pocket competitors. As Netflix is a pioneer in the industry, I wanted to take a deeper dive to quantify why exactly it could be considered a poor business.

Buffett On Streaming

Recently during a CNBC interview, Warren Buffett was asked about his investment in Paramount (PARA). He responded with the following:

Streaming that, you know, it’s not really a very good business. And, you know, it the people in entertainment that make lots of money, the shareholders really haven’t done that great over time.

PARA has recently been aggressively expanding into the streaming business, with the rebranding of its CBS All Access to Paramount Plus in 2021 and aggressive spending on content and advertising to entice new subscribers. The reward for this so far has been a huge increase in streaming subscriber count. On the flipside, free cash flow has swung to negative in 2022, for a historically cash flow positive company.

With PARA and many other companies eager to dive further into streaming and steal market share from NFLX, you would think NFLX would be a free cash flow generating machine. This does not appear to be the case, which brings us to our next section.

A Questionable Growth Story

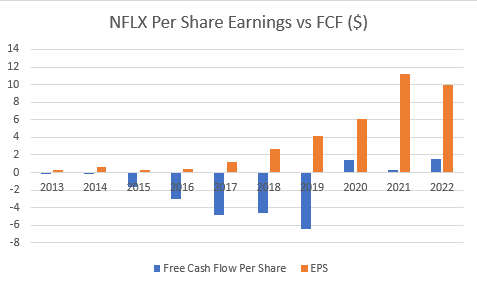

The growth story is amazing for Netflix, if you look at EPS. Indeed, from 2013 to 2022, the company has been able to grow EPS from a meager $0.26 to $9.95, which is about a 50% CAGR. If we instead look at free cash flow per share, a different story emerges. The company continued to lose money on a free cash basis from 2013-2019, with peak loss at around $-3 Billion in 2019, or around $-6.50 per share. It is not until the most recent 3 years that the company has been able to generate free cash, with $1.59/share generated in 2022. This is demonstrated below:

This Writer, Data from Morningstar

Netflix is a rather simple business compared to other media companies, as it basically operates in one segment. It charges a subscription fee for content that it either licenses, produces, or acquires. For NFLX, the main difference between free cash flow and EPS, is the amortization of content over time in the latter.

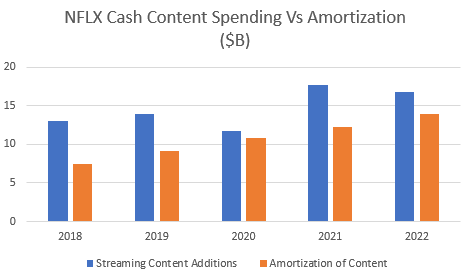

Recently, content spending has jumped to just under $18 billion in 2021, and $17 billion in 2022. There are some fluctuations when looking back at the data, but the long-term trend is clear, with a steady increase in cash content spending far outpacing amortization expenses. If this trend continues, and the company has no plans to fundamentally change its business model, GAAP EPS may be considered misleading as it is not representative of the cash that can be taken out of the business and paid to stockholders. These values over the last 5 years are represented below:

This Writer, Company Data

For a long time, NFLX had a few advantages. Subscriber growth was immense, it was a first mover in the industry and investor enthusiasm buoyed its share price well above free cash flow generating abilities. As growth has slowed in 2022 with a meager 4% y/y increase in subscribers, investor enthusiasm has waned and the stock experienced a nearly 75% decline peak to trough. With steadily rising stock based compensation ($575 million in 2022), and a historically free cash flow negative business, any share price weakness will impair the growth story as financing with equity will be more dilutive. Add intense streaming competition into the mix and it’s easy to see how equity investors could have a hard time getting paid in the long term.

Valuation

I took an extremely optimistic approach to my valuation. I assumed the company would be able to increase free cash flow per share at a 40% CAGR until 2032 by reducing content spend while continuing to increase subscriber count. The company would then be able to monetize its content as a long-term asset for years to come and grow with global GDP at 4% per year. I used a 10% discount rate as the company is capitalized minimally with debt, and this is likely the minimal rate of return equity investors would demand. Even with these lofty assumptions, our models indicate a fair value of around $250/ share, which is demonstrated below.

Inverting The Thesis

New Revenue Streams

Though Netflix operates exclusively as a streaming service, they could find other sources of revenue such as licensing small parts of their vast media library to competitors. This is unlikely, as company executives have recently stated this is not on the table.

Account Sharing Crackdown

Netflix has been in the news recently for initiating policies to reduce account sharing capabilities and limit a subscription to one household. This makes business sense, as having no restrictions on who can watch unlimited content seems like poor practice. Theoretically, this policy will increase subscriber count. Questions arise here though. If competitors don’t follow suit, will account sharing consumers move to other platforms with looser policies? Will subscribers cancel if they feel like they are being slighted by Netflix? Time will tell.

Content Spending May Decrease

Netflix may be able to find a way to decrease content spending without compromising quality. One idea is the potential use of AI to assist with writing screenplays to increase output. This idea is unproven and speculative in nature though, and any productivity enhancements could also be used by competitors. I am skeptical the company will be able to meaningfully reduce costs, considering the long term trend of content spending and the immense competition in the field.

Competition Could Decrease

Theoretically, other companies with more profitable segments may see the futility of trying to compete in streaming and reduce spending on the segment if it is not profitable. This seems unlikely, given the continued efforts from both big tech and legacy media companies to maintain market share.

Conclusion

I think Netflix is a great business that offers a fantastic product at a good price point but offers questionable returns to its equity investors. As our models indicate 25% downside from current market prices, or a $250/share fair value, I believe a sell rating is warranted here. That being said, I do not short, and I think it’s generally a bad idea to short a growing profitable company with a high degree of investor enthusiasm such as NFLX stock. Keynes put it best when he said, “markets can remain irrational longer than you can remain solvent.”

In order for NFLX to continue growing FCF/share, it will likely have to both aggressively increase subscriber count and decrease content spending to a more reasonable level. Content spending has ballooned in recent years and steadily increased over time, and streaming competition is intense. Therefore, large growth in FCF will be difficult. I believe this analysis should concern investors both of NFLX and of industry peers hoping to make a profit by emulating the NFLX model. The industry is capital intensive, the competition is fierce and the returns to shareholders are questionable.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PARA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.