Summary:

- Netflix continues to grow rapidly, with a 35.5% stock increase since April, outperforming the S&P 500, yet I maintain a ‘hold’ rating due to valuation concerns.

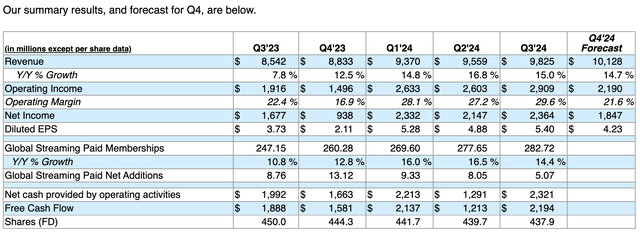

- Q3 2024 saw record-breaking revenue of $9.82 billion and a subscriber base of 282.72 million, driven by strong regional performance and pricing strategies.

- Despite impressive growth and profitability, including a net profit jump to $2.36 billion, NFLX’s high trading multiples make it a challenging buy for value investors.

- The future outlook remains positive, with expected revenue growth of 15% for Q4 2024 and 11-13% for 2025, but shares remain too expensive for my liking.

bymuratdeniz

When it comes to streaming, there is no denying that Netflix (NASDAQ:NFLX) is the largest pure-play firm out there. For quite a while now, the company has been on a growth spurt. A couple of years ago, there were concerns about market saturation, especially with many other companies launching their own streaming services. However, Netflix has bucked the odds and continues growing nicely year after year. As a value investor, growth investing is a tricky endeavor. I don’t have a problem paying a premium for companies that are growing at a rapid pace. But the price has to be right. Unfortunately, back in April of this year, I ended up downgrading Netflix from a ‘buy’ to a ‘hold’ based on valuation.

Since then, the stock has continued its ascent, rising by 35.5% compared to the 16.8% increase experienced by the S&P 500 over the same window of time. And since I last reaffirmed my ‘hold’ rating in August of this year, the stock is up 27.6% compared to the 13.1% rise experienced by the broader market. Typically, when I rate a company a ‘hold’, I am stating that I don’t think the stock is likely to perform materially different than what the broader market should experience over the same window of time. Clearly, this call has been off. However, much of this outperformance can be attributed to the 11.1% surge that shares experienced on October 18th.

On that day, the company saw its share price increase materially in response to management announcing financial results covering the third quarter of the 2024 fiscal year. They also gave some indication as to what they expect for 2025. This clearly energized the market. After all, the performance the company achieved during that window was remarkable. But even with that strong growth, I would make the case that further upside from here, relative to the market, will not come easy. Because of this, I am maintaining my ‘hold’ rating for now.

Great growth at a high price

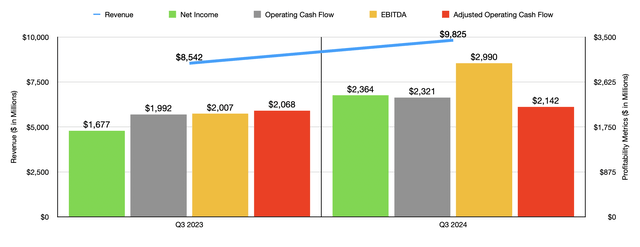

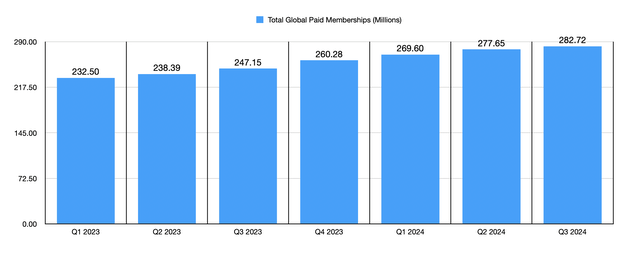

Fundamentally speaking, Netflix is doing better than it ever has. Consider financial performance during the third quarter of its 2024 fiscal year as an example. During this time, revenue for the business was $9.82 billion. That represents an increase of 15% compared to the $8.54 billion the company reported one year earlier. This expansion for the business came from continued growth in its subscriber base. At the end of the quarter, the company had a record-breaking 282.72 million global streaming paid members. That’s 5.07 million above the 277.65 million reported for the second quarter. It also represents an increase of 14.4%, or 35.57 million, members compared to what the company saw in the third quarter of 2023.

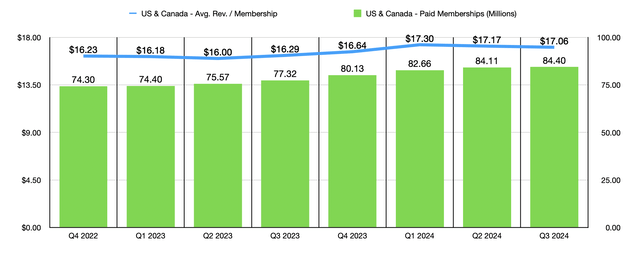

Looking deeper, we can see results on a region-by-region basis. Take the US and Canada as an example. During the quarter, the company generated an all-time high $4.32 billion from these two countries. That’s well above the $3.74 billion reported the same time last year. This was driven in large part by an increase in the number of subscribers from 77.32 million to 84.80 million. However, there is no denying that the increase in average revenue per membership also improved, growing from $16.29 per month to $17.06 per month. This might not seem like such a large increase. But when applied to the 84.80 million members that the company had as of the end of the third quarter, that’s an extra $65 million per month, or about $779.9 million each year.

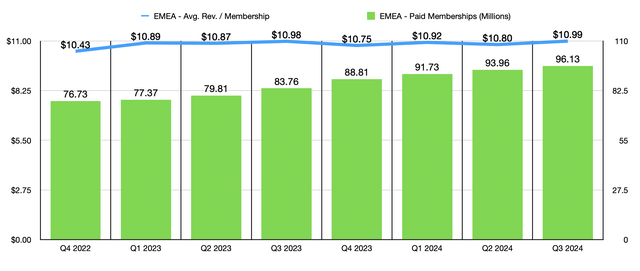

This is not the only area of the company experienced record-breaking results in. The EMEA (Europe, Middle East, and Africa) region achieved sales of $3.13 billion. That compares nicely to the $2.69 billion reported the same time last year. A jump in the number of users from 83.76 million to 96.13 million did the heavy lifting. However, the company also benefited to the tune of $0.01 per month in the form of higher pricing. Spread out over a year, this small amount of money adds up to an extra $11.5 million of revenue for the business.

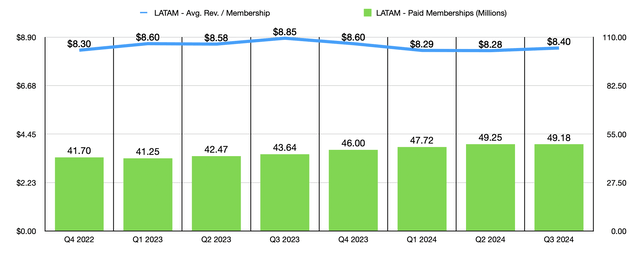

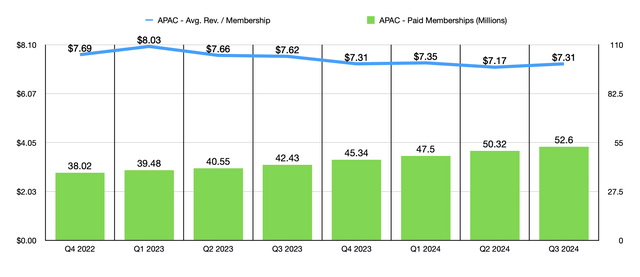

In the Latin America region, the company achieved sales of $1.24 billion. That happens to be 8.6% above the $1.14 billion the company reported for the third quarter of 2023. As was the case with the other two segments, the business generated higher sales because of a growth in its number of users, in this case from 43.65 million to 49.18 million. However, pricing offset this to some extent, dropping from $8.85 per month to $8.40 per month. However, this was only because of changes in foreign currency. In the third quarter on its own, on a neutral currency basis, membership revenue per month would have actually been 27% higher year over year. Finally, in the Asia Pacific region, revenue grew to $1.13 billion from $948 million one year earlier. Even though the average revenue per user per month dropped from $7.62 to $7.31, the overall number of paid subscribers expanded from 42.43 million to 52.60 million.

I would like to out that this growth has been spurred on by management running a quality business. For instance, at the 2024 Primetime Emmys, its content received 107 nominations and 24 wins. Management claims that Netflix nominated titles generated more Nielsen Top 10 view hours, and appeared on those lists more frequently, than all other streaming platforms combined. In fact, engagement on the platform averages around 2 hours per day per paid membership, making it a major source of time allocation by its customers. And many of its different shows rack up tens of millions of views. As an example, The Perfect Couple received 62.5 million views during the quarter. Monsters: The Lyle and Erik Menendez Story, attracted 54.6 million. Even returning content, such as the sixth season of Cobra Kai, raked in 36.5 million views. There are many other examples I could give. But you get the point.

Another thing that has helped the company has been its effort to diversify its monetization activities. It does increase prices from time to time. In fact, earlier in the month of October, it increased its prices in some countries in the EMEA regions, as well as in Japan. And as I type this, the firm has officially increased prices in both Spain and Italy. A big and controversial initiative by the company some time ago was to eventually phase out its Basic Plan and to instead have an ad supported version. During the third quarter of this year, its ads plan accounted for over 50% of sign-ups in the countries in which they are offered. This resulted in its ads supported program growing by 35% on a quarter-over-quarter basis. And by next year, the firm expects to reach what it considers to be a critical ad subscriber scale for advertisers in all of its ads countries. Growth here is so impressive, in fact, that management said that they are still in the early phases of growing out advertising opportunities and that they are scaling faster than their ability to monetize their growing ad inventory. These are good problems to have.

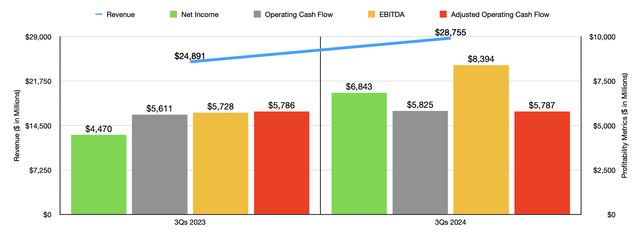

With revenue for the company expanding nicely, it stands to reason that profitability could also grow. Year over year, net profits for the company jumped from $1.68 billion to $2.36 billion. Other profitability metrics increased as well. Operating cash flow expanded from $1.99 billion to $2.32 billion. If we adjust for changes in working capital, we get an increase from $2.07 billion to $2.14 billion. And finally, EBITDA for the company grew from $2.01 billion to $2.99 billion. In the chart above, you can see financial performance for the first nine months of 2024 compared to the same time of 2023. This shows that the third quarter on its own was not a one-time thing. Instead, it is part of a much larger trend.

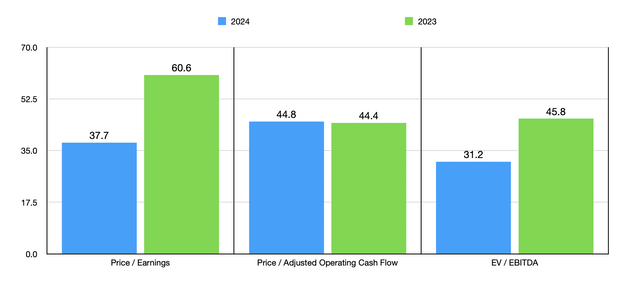

When it comes to the 2024 fiscal year in its entirety, we don’t know exactly what to expect. But by annualizing the results we have seen so far, we get adjusted operating cash flow of $7.31 billion and EBITDA of $10.71 billion. And based on management’s guidance for earnings, net profits should be around $8.69 billion. Using these figures, as well as historical results for 2023, we can see in the chart above how the stock is currently priced. While some investors might feel comfortable with these kinds of trading multiples, they are ones that, to me, are very hard to accept.

Even though I have decided to rate the company a ‘hold’, this does not mean that I expect its growth to cease or slow down. Management has even come out and said that the near term outlook is really positive. For the final quarter of this year, the company expects 15% revenue growth on a year-over-year basis. Total sales should come in at approximately $10.13 billion. Net profits will only be around $1.84 billion. Significantly higher than the $938 million reported the same time last year. Beyond this year, management is forecasting continued expansion. For 2025, they currently believe that they should generate revenue of between $43 billion and $44 billion. This would imply top-line growth of between 11% and 13% compared to what is estimated to be $38.9 billion this year. Management even went on to say that they ‘still see plenty of room to increase’ the firm’s margins over the long term.

Takeaway

By all accounts, Netflix is a really great business. The firm is growing at a strong pace, and it is not showing any real signs of slowing down just yet. Additional opportunities to monetize its operations should bear fruit as well. However, because of how expensive shares are, it’s difficult to get too excited. I don’t mind paying for growth. But multiples like this are too rich for my liking.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!