Summary:

- Netflix’s success is attributed to its deep pure-play moat and innovative advertising, allowing it to generate healthy cash flows with strong margins, perpetuating a cycle of deep reinvestments into various components of Netflix.

- While Netflix dominates the VOD market currently, it is reaching saturation in the US. Netflix needs to focus on sub-retention and expanding into other regions for further growth.

- Shareholders must be wary of investment risks such as the rise of generative AI and increased competition from Netflix’s larger competitors.

- That being said, AI is both a risk factor and opportunity. Whichever streaming service can integrate such technologies into its own production first will have an immense advantage.

Robert Way

Just 1.5 years ago, Netflix’s (NASDAQ:NFLX) stellar run had come to a halt – stock prices fell greatly from its $690 high in Oct 21 to $175 in Jun 22. However since then, NFLX has regained its footing and stock prices rose back to all-time highs. It has kept its lead in subscribers, boasting solid financials and consistency in producing original content.

Investment Thesis

Netflix has stood the test of time as a pioneer amongst large conglomerates. As the first-mover into the streaming industry, it has built up a moat of flexibility through its pure-play ideology. Some key factors include innovative advertising capabilities that boost advertising margins, rich diversified content to spur subscription rates globally and strong investor sentiment albeit its intrinsic undervaluation. These in turn, drive unprecedented cash flows for reinvesting, promoting a sustainable cycle of long term growth within the saturated industry. However, NFLX’s performance moving forward will be contingent on how it deals with risk factors, namely the threat of AI and increasing competition from its bigger competitors.

Company Overview

Founded in 1997 as a DVD-by-mail movie rental service, NFLX Inc is now an evolved video on-demand (VOD) streaming platform with a vast library of TV shows, movies, and documentaries since 2009, a pioneer in streaming. Previously fully streaming licensed shows, NFLX has now evolved to produce more original content.

With Q3 surpassing expectations and Q4 earnings in the horizon, it is an appropriate time to assess NFLX holistically, look at its valuations and how current market trends in generative AI (GAI) could be harnessed to further assert its dominance in the industry.

Dominance In Industry

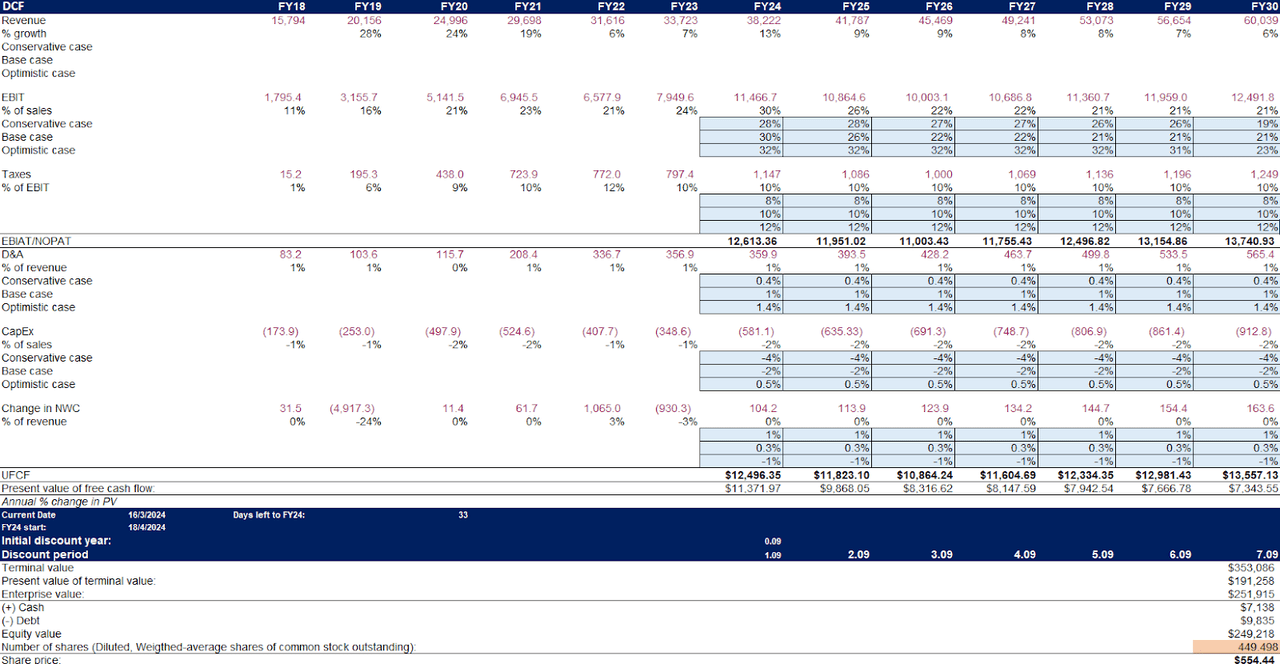

From the highest to lowest subscriber count, the market consists of these competitors: NFLX, Amazon Prime Video (AMZN), Disney+ (DIS), HBO Max (WBD), Paramount+ (PARA), Hulu and Peacock (CMCSA).

Streaming Industry Subscriber Share, in millions (Author)

By pure subscriber count, NFLX leads the way with a 28% global subscriber share in the $554 million market, followed by AMZN Prime Video of 22% and Disney+ of 16% market share.

However, the US market is reaching saturation. A study in 2024 reported that over 95% of all USA households possess a streaming subscription. This raises two points: first, the increased need for sub-retention by providing customers value. Secondly, streaming services need to expand into other regions to grow.

Factors

First, Its Unique Ideology Facilitates Organic Content Creation

NFLX adopts a “pure-play” ideology, being the only streaming service focused solely on VOD streaming. While some other companies are larger in sheer scale with cable and broadcast networks, this lack of legacy infrastructure allows greater autonomy for NFLX to focus on its technology and content. These components are vital for streaming.

This position provides them the moat of flexibility. Without being tied down by legacy contracts, NFLX can readily acquire and produce content without worries of clashing ownership and geographical market rights, enhancing the quality and quantity of shows it offers which maximises its success rates.

It also maximises algorithms: every platform has these systems to gather data on viewer preferences. In NFLX’s case, its “Most Popular Lists” showcase the series that hold the longest hours viewed divided by the run time of the show.

Moving forward, NFLX can use this insightful data to better strategise the types of programmes they can produce or acquire based on the reception to particular genres and series. This moat enables NFLX to attract and keep subscribers constantly hooked, as it can capitalise on its most popular formulas unlike any other platform to release popular hits periodically and keep user libraries packed with entertainment.

A case in point is NFLX adopting staggered releases of its popular hit shows. Uploading episodes in batches at regular intervals keep viewers anticipated and creates buzz for future content. Combining this with other shows gives viewers a constant stream of personalised content. An instance was, NFLX releasing its Season 4 of its most popular hit “Stranger Things” in two parts: the first half in May and the second half in July 2022. Thereafter, “Wednesday” premiered as an entire season, exploding in popularity. This contributed to a rise of 4.9 million subscribers in Q3, reversing the decrease in subscribers that Q2 saw.

Ted Sarandos, Co-CEO of NFLX, stated in a Q4 2022 conference call that “it’s our ability to fire on those cylinders and create hits, but more than that create the expectation that as soon as you are done with this one, there is another one waiting for you.”

With such features, it is no surprise that NFLX holds the highest subscriber retention rates. NFLX has the highest proportion of net additions of subscribers of 13.1 million in Q4 23, far exceeding Wall Street expectations of 8 to 9 million. Also, it holds the longest average subscriber duration, a sign of healthy viewer retention rates as users are highly compelled to stay the most loyal to it. NFLX’s content still outshines other platforms and it shows.

Second, its Diversified Content Appeals to Global Audiences

NFLX flourishes in this regard. In the recent Morgan Stanley Technology, Media & Telecom Conference on 4th March, Spencer Neumann (NFLX’s CFO) stated that it possesses “a content model that is so diversified to…satisfy such a broad range of cases and moods and cultures around the world”.

NFLX’s global reach is unparalleled. Albeit its competitors specialising in the North American demographic, NFLX still yields the most paid subscribers in the US and Canada (80.13 million), on top of other regions like Europe, the Middle East & Africa (88.81 million), and Latin America & Mexico (46 million). In addition, it boasted the highest increase in subscribers in the Asia Pacific region in 2023, with 45.3 million new users to cement its lead.

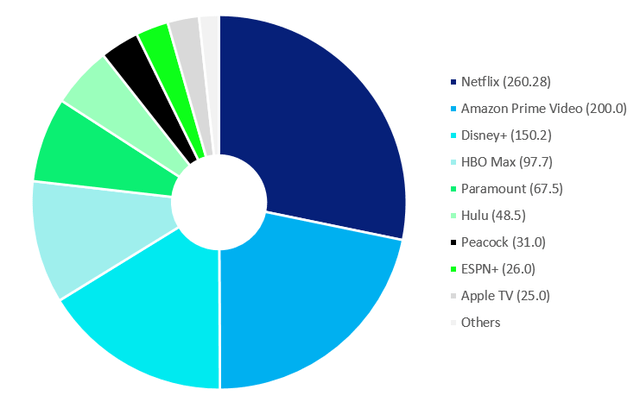

Share of Viewing for Streaming Services Across Regions (Netflix)

With its flexibility, NFLX also showcases authentic content from different countries, perforating domestic markets. NFLX is expected to spend $2.5 billion on Korea in the next 4 years. The Korean entertainment industry is rising in global relevance, with well received authentic shows like Squid Game, Home-town Cha-Cha-Cha, Singles Inferno and Physical 100, no other mainstream platform has reached individual markets with this much diverse content, and to such levels of depth.

Third, Redefining Advertising to Optimise Margins

NFLX is also integrating lucrative advertising into its arsenal of strategies. Acknowledging the room to grow to have “a better slate, easier discovery and more fandom”, NFLX widened its horizons to advertise their films or TV series through games. Since Nov 2021, NFLX games were featured on the platform, allowing users to download them for free through their NFLX subscription. Games take inspiration from shows such as “Queen’s Gambit: Chess”, a win-win for both parties as more users can join the platform, while users can enjoy free, exclusive content. This was followed up in Nov 2022 with its cheapest subscription tier of $6.99 USD per month. As a result, 20 out of 30 million new subscribers in 2023 joined this ad-supported tier.

Across social media platforms, NFLX holds the largest fan base. It has the highest number of followers on TikTok, Instagram and YouTube. Most notably, NFLX runs the most Instagram accounts (over 40). These include accounts featuring exclusive content for regions such India, UK & Ireland, Canada and Japan. Bigger and more popular original shows also boast their own accounts. The latter is used to promote new seasons of acclaimed shows or a trending series like “Wednesday”, churning out notable clips, behind the scenes bloopers and even interviews with the actors to spark greater interest and maximise engagement rates. Thus, NFLX is capitalising the most out of its social media presence, and is the only service that dedicates accounts for so many of its original shows, showing how much they focus on engagement and providing fan service not just for Netflix as a platform, but for well liked shows. This enhances the longevity of each show, and builds an intricate network between shows and their fans.

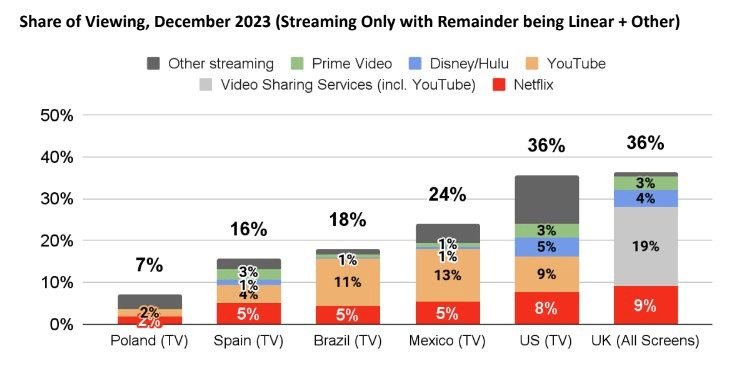

With innovative advertising means and hyper-personalisation, NFLX announced the biggest annual subscriber growth in its history in 2023. ARPU also increased in each region less APAC, the highest being 3% in the UCAN region. Operating margins rose from 17.8% in 2022 to 20.6% in 2023, close to margin highs in 2021 (20.9%).

Operating Margins (Netflix)

With these investments, NFLX nearly tripled content amortisation to $14.6 billion in 2023 and grown free cash flow from negative $3.3 billion to a positive $6.9 billion. In comparison, other streaming services reported content amortisation of $5-8 billion – showcasing NFLX punching above its weight.

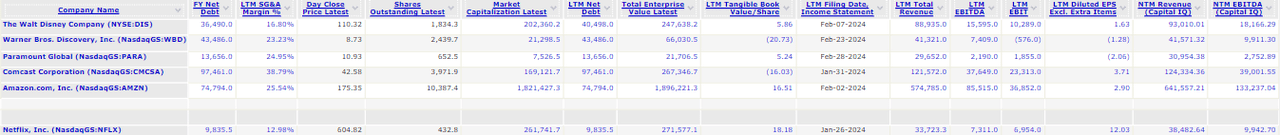

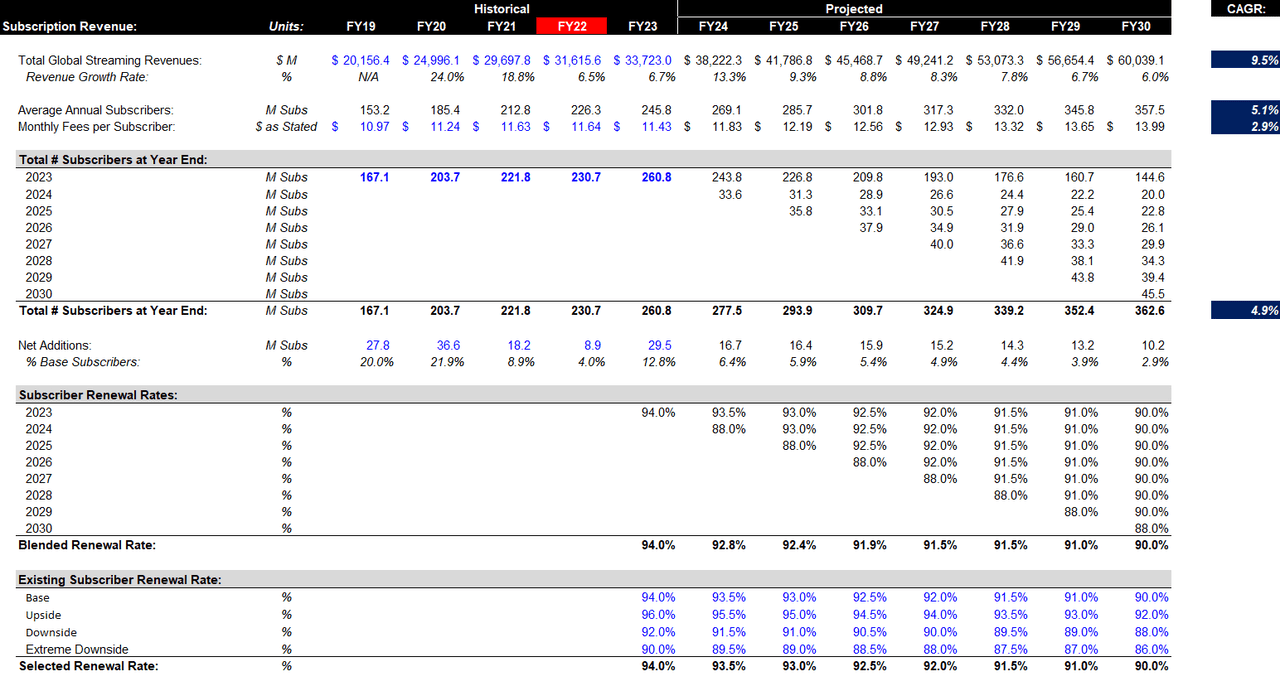

Yet, NFLX’s SG&A margin is 12.98%, the lowest amongst its competitors. On top of having a proportionately healthy cash balance, it maintains the lowest net debt of $9.8 billion.

Comparable Comps of Streaming Industry (CapIQ)

Hence, NFLX still compounds on its early movers advantage into the streaming industry, with its sole focus on streaming and taking advantage of its already massive monthly active user (MAU) base contributing to its unwavering, substantial cash-generation. This is a case in point that going all-in on production in the content industry can drive healthier, more sustainable cash growth.

More specifically, readers are interested in its unlevered free cash flows (UFCF). It is the “holy grail” that allows companies to buy back shares, pay down debt and reinvest in itself without incurring more debt. NFLX’s UFCF is $19.8 billion, close to that of WBD and CMCSA and exceeding that of DIS and PARA. This is an impressive number on two accounts – its cash flows are healthier than its other competitors who have advantages in revenue streams to generate cash, ranging from Sports, news channels and even theme parks; and this then allows NFLX to devote all its cash flows to this sole streaming service.

Comparable Comps for Streaming Industry (CapIQ)

Finally, Efficient Use of Invested Capital to Spur Further Development and User Reach

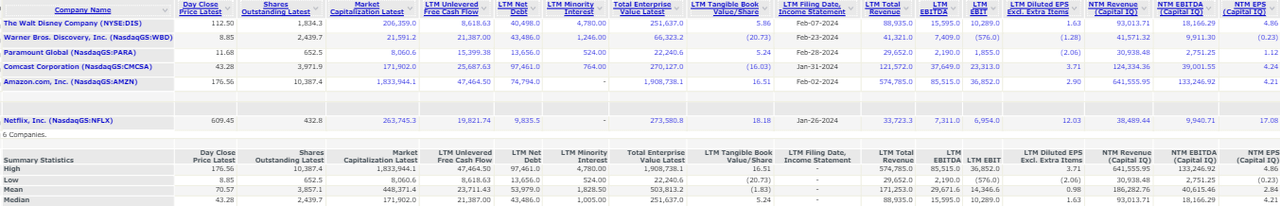

We are now back full circle. Quarterly ROIC rose to an all time high in December 2021 amidst hits such as “Squid Game” and “Money Heist” in the pandemic period. It dropped from Jan 2022 to Mar 2023, explained by the reduced amount spent on content acquisition and an emphasis on reducing operating costs as it slowly regained its footing.

NFLX’s ROIC Over The Years (Finbox)

In terms of return on capital (ROC), it outshined the rest at 18.5, with the second highest at 10.9 (Comcast) and the lowest being -0.6 (Warner Bros).

Evidently, NFLX has been utilising these rich cash flows to maximise reinvestments effectively in terms of content, user personalisation, marketing and controlled interface tests. These developments will continue to value-add to subscribers globally, in turn providing high returns for both equity and debt investors.

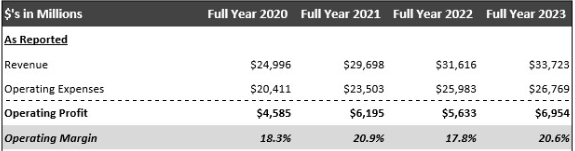

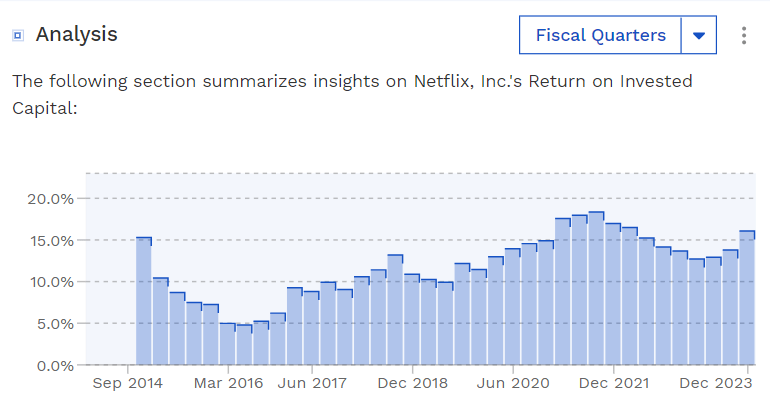

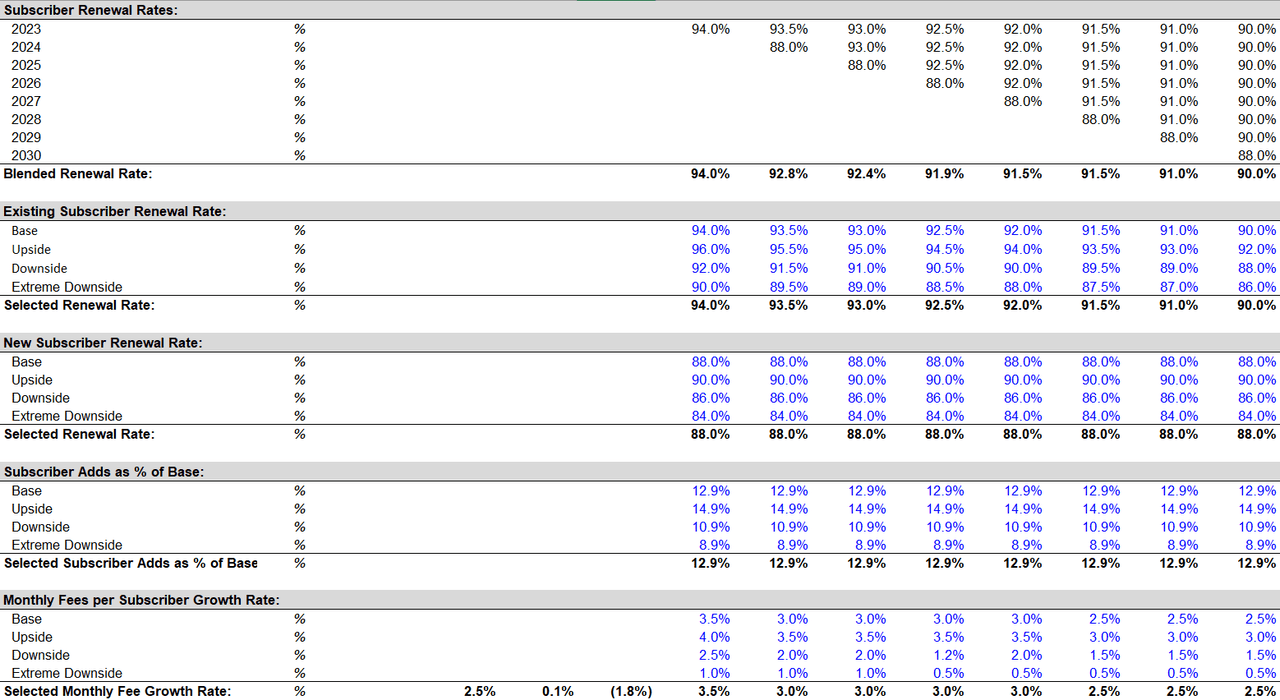

Valuations: Great Expectations to Meet

I adopted a subscription revenue model to forecast NFLX’s future revenues, using estimates of renewal rates and net additions based on analyst consensus of future revenues and compounded annual growth rates (CAGR). From reports that state NFLX’s renewal rates range from 88-98% across regions, I estimated a base existing subscriber renewal rate (SRR) of 94%, and adapted accordingly for the new SRR. The SRR ‘waterfall’ can be seen below. I assume these retention rates will decrease overtime as the entertainment market gets increasingly saturated. With these variables in place, a CAGR of 9.5% was projected to 2030, aligned with consensus of 9.89%.

Subscription Based Growth Model (Author) Subscription Based Growth Model Percentages (Author)

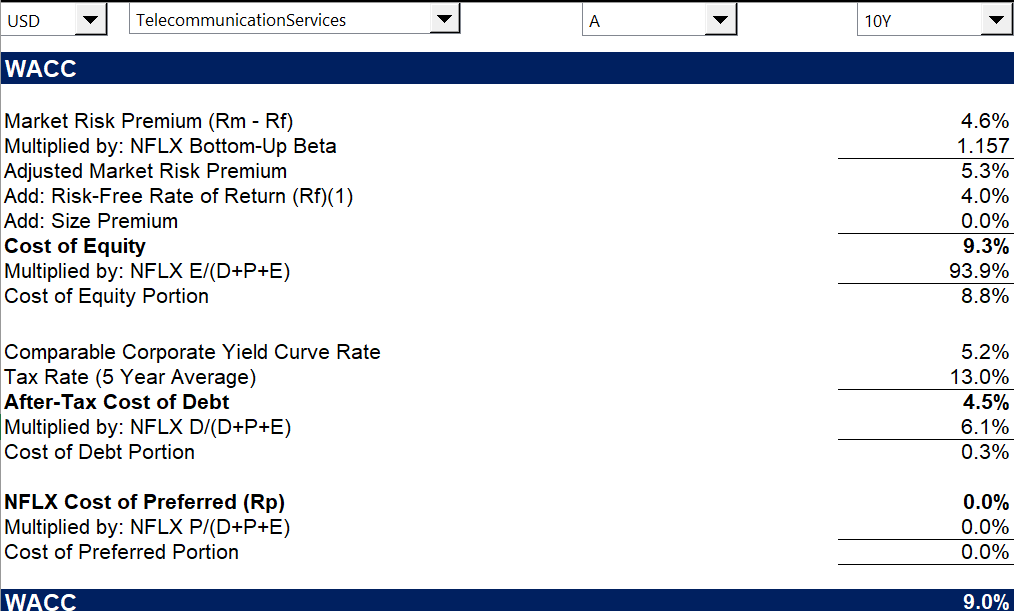

For WACC, I used estimates of tax rates, risk-free rate of returns and the S&P 500 market return.

NFLX’s WACC (Author)

Accounting for WACC, along with a terminal growth rate of 5% for a soon to mature industry, my valuation gives me a share price of $554.44 (considering diluted weighted-average shares of common stocks outstanding), a downside of 8%. This aligns with other analysts who also reached the consensus that the stock currently signals overvaluation.

A quick technical analysis supports this theory, as RSI levels have recently hovered near the 70s range and then dipped to 34, helped by the positive results from Q3 and Q4 earnings that boosted investor sentiment.

Expectations are high for Q1 24, with EPS estimates are nearly double of the reported EPS in Q4 23. Thus, I believe if Q1 24’s earnings exceeds expectations again, its share price will continue to rise. Otherwise, potential overvaluation could bring down prices nearer to intrinsic calculations.

In the increasingly mature streaming market, I believe that a golden wildcard NFLX should vie for is AI, which would greatly alleviate margins and have a positive cascading effect to its other areas.

Investment Risks

AI: Risk or Opportunity?

Recently, videos have circulated showing the massive improvements in OpenAI’s SORA platform in the span of 1 year. Its GAI went from sloppy, mechanical animations to highly rendered, smooth clips in the span of a year. Many wonder whether GAI will eventually take over the film industry due to the significantly less effort, budget and time it would need to churn out entertainment. NFLX’s annual 10K report has raised these concerns: “If our competitors gain an advantage by using such technologies, our ability to compete effectively and our results of operations could be adversely impacted.”

In my view, whoever can integrate such technologies into its own production first will have an immense early-mover advantage. Like other sectors that have been revolutionised by GAI, the tedious aspect of filmmaking can directly alleviate the streaming process, such as preparing the set and adding visual effects to a scene. This allows studios to focus on the storytelling component (how they can add their personal, unique touch to their work). Creativity is not replicable by AI in the foreseeable future, all the more emphasising the importance of filmmakers to make content that outshines the rest.

Furthermore, GAI can also make advertising more actionable and user-friendly. Ira Dworkin, Managing Director of Communications, Media, & Entertainment at IPT talked about AI’s potential in “significantly reducing both content provider and service provider costs while also improving the end user experience. GAI is certainly the next step towards improved cost margins, better user engagement and deeper personalisation of content.

Risk factor: If NFLX’s competitors take the initiative to announce the adoption of GAI into their algorithms or the production of shows in their studios, subsequently reporting significant reduction in their production and capital expenses which boosts operating margins to levels overtaking that of NFLX.

Competition

Acquisitions

NFLX has stated its disinterest in “acquiring linear assets”, believing it will not “materially change the competitive environment”. However we see two types of acquisitions that NFLX has to contend with:

Firstly, acquisitions with companies from other regions. One pertinent example was DIS acquiring Hotstar to expand into the Asian markets in 2019. Albeit a lower ARPU in the Hotstar service, the focus on localised content has allowed it to capture significant numbers of subscribers in the APAC region. This has provided a layer of protection for Disney+’s growth, seen in Q1 24. Simply put, having more content catered to the APAC region greatly has provided DIS an edge in the thriving film and TV region.

Risk Factor: If NFLX’s competitors acquire entertainment platforms from other regions to expand globally, and see significantly high subscriber growth these moves are well-received in that region.

Second, acquisitions that lead to show removals. NFLX is in a race to reduce its reliance on popular licensed shows and creating originals that stand on their own. Look at fan favorites like “Family Guy”, “How I Met Your Mother” and “Modern Family” when DIS acquired 20th Television. This transition must carry on smoothly, otherwise subscribers will leave as non-original shows get removed overtime.

Risk factor: If NFLX lose its streaming rights to shows at a faster rate than the production of originals, causing pick-up and churn rates to deteriorate.

NFLX has always had a healthy lead. However, it needs to step up its expansion efforts to other regions or content types to stay ahead if it does not wish to resort to acquisitions.

Bundling services

With DIS, its bundling of services pose a significant threat. First, its trio bundle. Consumers enjoy price savings of 49% overall compared to individually paying for each service. This has worked immensely, providing DIS the lowest churn rate in the industry of 2% (better than NFLX’s 3% and industry rates of 7%). DIS reaps the benefits of subscriber loyalty simply due to the higher sunk cost by unsubscribing.

Amazon Prime video also adopts a similar strategy, bundling its same-day delivery features on Amazon Delivery, gaming benefits and exclusive streaming content. This strategically looks at other services that maximise online consumer convenience. Customers mix-and-match the features they desire into one personalised package, reinforcing their commitment to use AMZN’s services.

Unfortunately, NFLX’s pure-play concept hinders it from bundling services.

Risk Factor: if other competitors look into bundling their entertainment with their streaming services, and gives consumers better cost savings in relation to NFLX’s packages (especially the ad-tier package).

Conclusion

NFLX has faced several issues in the past, such as cracking down on password sharing, and losing streaming rights to shows.

In the near term, all eyes should be on NFLX’s Q1 24′ earnings as it continues to enhance its technology infrastructure, reinforce its ad-supported tier and further invests into original shows. With current overvaluation, I believe that NFLX may experience slight dips in its share price. However, given the momentum and general sentiment that NFLX has regained its footing in the industry since late 2022, NFLX is still a good buy.

Looking longer term, it is not difficult for shareholders to see the potential risk factors turning to fruition over time. If these factors arise, then it will be timely to reassess Netflix’s relative standing in the industry.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.