Summary:

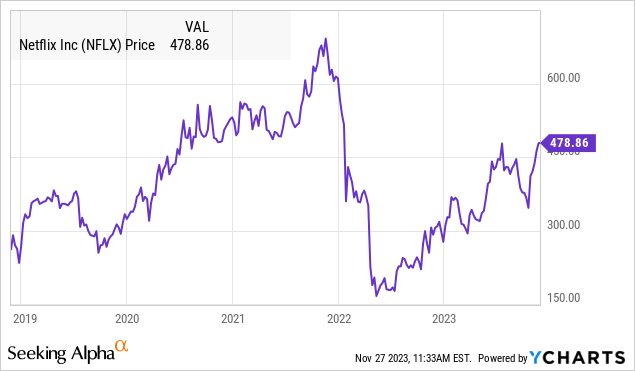

- NFLX has tripled from its 2022 low amid a string of impressive operating and financial results.

- The company is finding success in its new ad-supported streaming plans as a new growth driver.

- We are bullish on NFLX and see the potential for shares to reclaim their all-time high by next year.

Matt Winkelmeyer/Getty Images Entertainment

Netflix Inc. (NASDAQ:NFLX) has been a big winner this year with shares up 65%, skipping ahead of the disastrous 2022 episode when the stock lost more than half its value. Newfound earnings momentum with sharply higher margins and climbing free cash flow is the plot twist. Furthermore, a rebound in subscriber growth including success with the new ad-supported plan helps explain the current strength in the stock.

We last covered NFLX back in 2020 with an article alluding to what may have been some pandemic-era hype. For what it’s worth, the stock is still down from that bearish call. A lot has changed, and it’s time for an update.

We’ve been impressed by the turnaround and see a path for NFLX to reclaim its all-time high by next year. Several operating and financial tailwinds support a continuation of the current rally and we see an upside to current earnings estimates. Ultimately, Netflix is a high-quality category leader that justifies a premium valuation and we rate shares as a buy.

NFLX Financial Recap

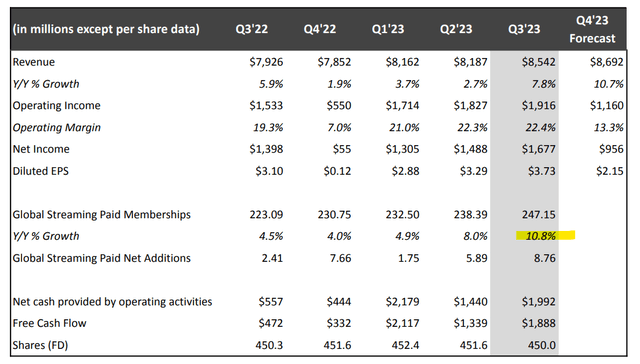

Netflix reported its Q3 earnings in October with EPS of $3.73 coming in $0.23 ahead of the consensus. Revenue of $8.5 billion climbed by 7.8% y/y. Global streaming paid memberships increased 11%, reaching 247.15 million, adding 8.8 million in the quarter, the strongest gain since Q2 2020 at the peak of the pandemic boom.

Within this amount, the (EMEA) region was the growth driver adding 4 million subscribers in the quarter. The 2 million subscriber gain in the core United States, Canada, and Australia (UCAN) region compares to a gain of just 0.1 million in Q3 2022.

Management is pointing to the adoption of the discounted ad-supported plans which are capturing 30% of new signups, outperforming internal expectations.

At the same time, the average revenue per membership user globally was down by -1% y/y. The context here considers the shifting mix with the lower price ad plans, as well as limited regular price hikes over the past year. Stronger growth from emerging markets countries with lower average pricing has also added to the volatility in this metric.

Still, the trends were good enough to push the operating margin to 22.4%, the highest level in two years. Notably, marketing expenses as a percentage of revenue at 6.5% this past quarter is down from 7.2% last year reflecting some efficiency measures and cost rationalization. Management is now guiding for a full-year operating margin of around 20%, at the top end of a prior target between 18%-20%

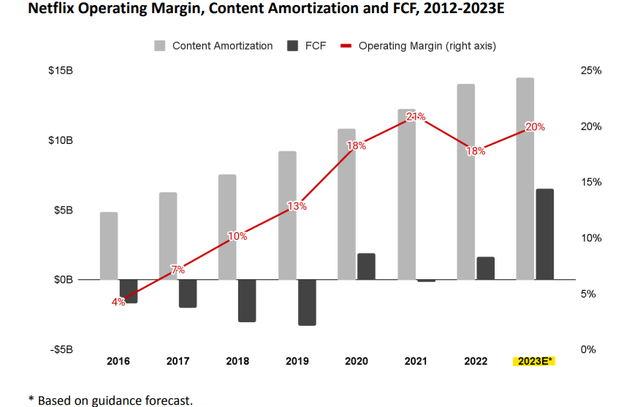

Maybe the biggest surprise over the past year has been the climb in free cash flow, reaching $1.9 billion in Q3. A portion of that has been based on lower-than-expected cash spending based on the impact of the headline-making WGA and SAG-AFTRA industry strikes that pushed back the production of content.

Nevertheless, the full-year 2023 free cash flow guidance by management at $6.5 billion is still running $500 million above prior forecasts even including the industry strike impact which has since been resolved. The implication here is for free cash flow to see some “lumpiness” over the next several quarters, but Netflix still expects to deliver “very substantial positive free cash flow in 2024”.

The other side of that discussion connects to the stock repurchasing policy where Netflix has committed to returning cash above the minimum requirement. In Q3, Netflix bought back $2.5 billion in stock, with the board of directors increasing the existing authorization by $10 billion in September.

The flexibility ties into Netflix’s solid balance sheet with a net leverage ratio under 1x. The company ended the quarter with approximately $7.9 billion in cash and cash equivalents against $14.3 billion in financial debt. Overall, solid fundamentals in our opinion.

What’s Next For NFLX?

What we like about Netflix is the sense that following more than a decade of pursuing a growth at-all-costs type strategy, the company is finally bearing the fruits of its global scale with accelerating profitability.

At this point, the streaming service in developed markets like the U.S. is hardly a novelty, and the market can start looking beyond “subscriber growth” as the key indicator. What’s more encouraging is that churn or cancel has been low, even following steps to cut down on paid sharing. This aspect of high retention means that subscribers are committed to the platform and support a long runway for future growth.

Of course, there is still plenty of room to capture signups in developing regions like APAC and LATAM, for example, but the bigger opportunity as we see it is for management to optimize its monetization.

In this case, Netflix has a lot of room to work with in terms of adjusting pricing where many countries are still at a large spread to the U.S. standard plan benchmark of $15.49 per month. Between gradual price hikes expected over time and room for additional subscriber gains, the path is for the average revenue per membership to continue trending higher.

Separately, we can comment on how Netflix has proven its ability to launch blockbuster franchises like “Stranger Things” and “Squid Game” from scratch, along with multiple accolades, at a time when other media players are relying more and more on legacy properties.

The interpretation here is that Netflix is rich in data on what works and that can translate into structurally higher margins going forward. Putting it all together, the path here is for climbing earnings from what has evolved into a cash flow juggernaut that may just be getting started.

The Bullish Case For NFLX

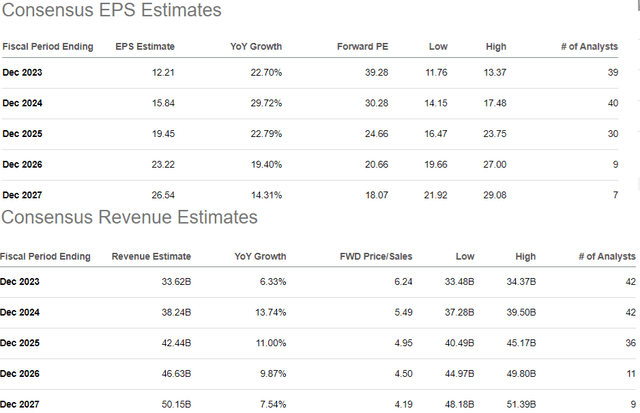

According to consensus estimates, the market sees revenue growth averaging around 11% annually through 20217, while EPS is stronger above 20%. We believe these figures may prove to be conservative considering the opportunity in advertising on top of the ad-supported plan revenue that remains in the early stages.

Looking into 2024, the market forecast is for 14% revenue growth while EPS climbs by 30% to $15.84. Some of that momentum reflects expected price hikes in the U.S. with the impact carrying over into 2025.

The insight we offer is that the macro picture could play into even stronger than expected results. In particular, we’re watching a weakening U.S. Dollar which has reversed lower in recent weeks. Lower-than-expected inflation data, building a case for the Fed to back off from its rate hiking cycle, has driven bond yields lower while pressuring the Dollar.

This is important for Netflix, as the company generates nearly two-thirds of its revenue outside the United States. Going back to the last quarterly report, management cited a “strengthening” U.S. Dollar at the time as representing a drag within its Q4 outlook. In other words, the turn of events now supports stronger earnings over the next few quarters as a tailwind for the stock.

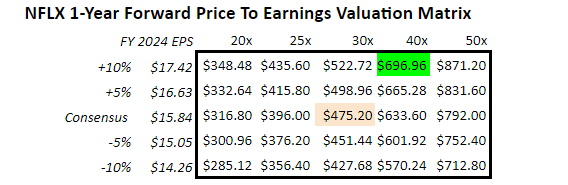

As it relates to valuation, NFLX is currently trading at a 39x earnings multiple on the current year consensus EPS or 30x into 2024. In a scenario where the operating metrics continue performing, we see room for a combination of stronger-than-expected earnings supporting an expansion of these valuation multiples to push shares higher.

From the current 2024 consensus EPS of $15.84, assuming Netflix can beat that figure by 10% towards $17.42 and applying a 40x 1-year forward multiple arrive at our price target of ~$700 by next year.

source: author estimates

Looking at the stock price chart, NFLX is approaching the $500 price level which appears to be a key technical area of support between 2020 and 2021, and now representing some resistance. The ability to break out higher here opens the door for a continuation of the move back toward the all-time high over the next 12 months.

Final Thoughts

There’s a lot to like about Netflix. While there is the group of mega-cap tech leaders colloquially known as the “Magnificent 7”, there is a strong case to be made that NFLX deserves a spot as number eight among the most important growth stocks in the market. We believe shares should perform well amid a positive macro backdrop into next year defined by a resilient global economy.

To conclude covering the risks of considering, weaker-than-expected results over the next few quarters would introduce some renewed volatility into the stock. Monitoring points include the average revenue per membership as a key metric along with the operating margin trend. On the downside, as long as shares remain above $400, the momentum remains positive with bulls in control.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NFLX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click for a two-week free trial.