Summary:

- Netflix, Inc. just reported Q3 2024 results and outlook, making good on its shift in focus to revenue.

- We think Netflix will outperform in 2025 due to higher ARM and a pickup in investor confidence in the ad tier through the fiscal year.

- Netflix has pricing power, in our opinion, due to its first-mover advantage, which remains relevant today. We think potential price hikes down the road will boost ARM.

- The ad tier, despite a slow start, is expected to become a significant revenue driver as macro conditions improve and engagement remains high.

Talaj

We reiterate our buy on Netflix, Inc. (NASDAQ:NFLX). The company reported Q3 earnings results after the bell on Thursday, adding around 5M paid subscribers versus consensus for 3.5-4.5M adds, bringing its total global paid members to 282.72M for the quarter and reporting a revenue increase of 15% Y/Y to $9.82B.

Interestingly, the net adds, while beating consensus, are softer than a quarter ago and a year quarter ago, down 37% Q/Q from 8.05M adds last quarter and 42.1% Y/Y from 8.76M adds in 3Q23. Netflix management is slowly putting net adds focus on a backburner as a metric and shifting focus on profit, particularly ARM (average revenue per member). Q4 marked the last quarter when Netflix will announce subscriber numbers, quite literally taking investor and analyst eyes away from net adds towards how well these add can be monetized for a higher top line. There are a couple of catalysts in the works to boost profit and, simultaneously, grow costs slower than revenue to ensure solid margins. For the quarter, the operating margin increased to 30% from a year ago quarter margin of 22%, causing management to boost its FY24 expectation from 26% to 27%.

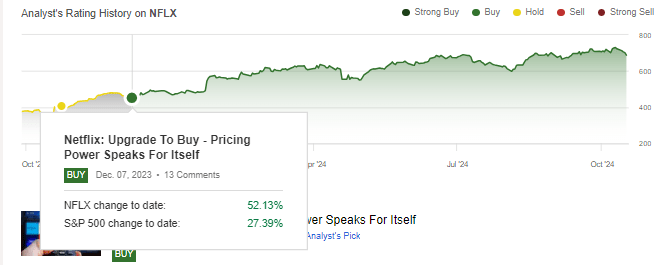

We upgraded Netflix in early December of last year to a buy. As shown in the chart below, since our upgrade, the stock is up ~53% versus the S&P 500 (SP500), which is up 28%. Our upgrade was based on our belief that the then price hikes and better-than-expected subscriber growth would support top-line outperformance.

Netflix has beat on the top line for four consecutive quarters, and on EPS for the past three. We’re now updating our investment thesis on the company for 4Q24 and FY25. We expect Netflix to outperform expectations and the peer group on its pricing power within the streaming industry, with expectations of more price hikes and the margin leverage they have as first-movers in the industry.

Seeking Alpha

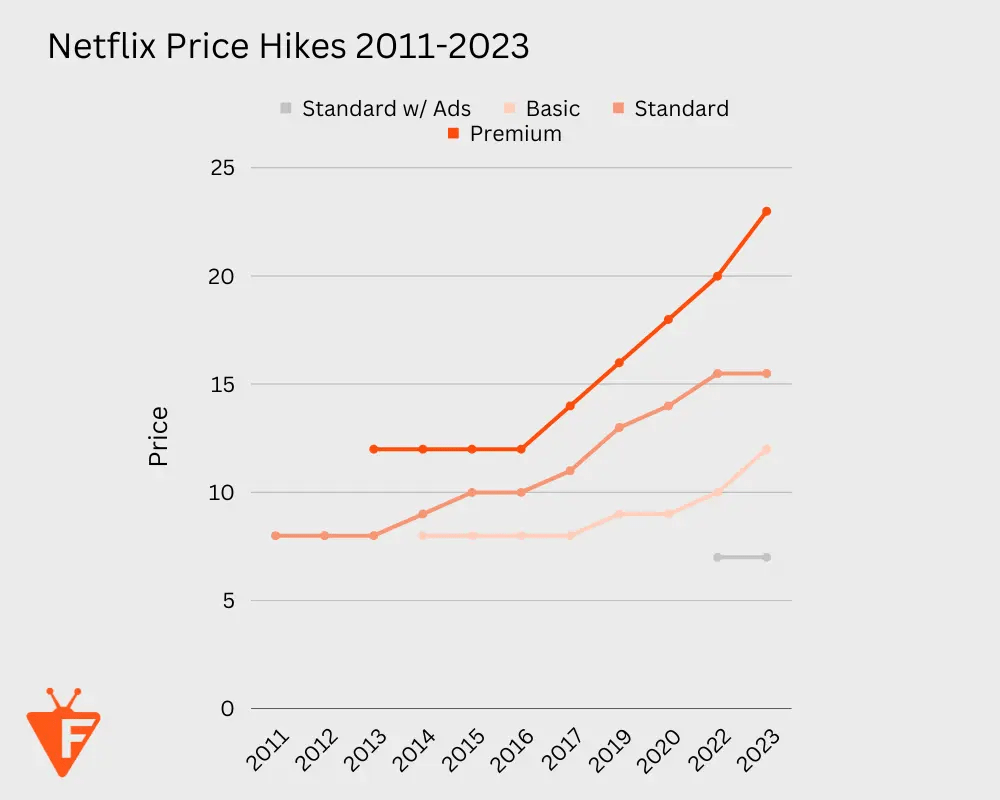

Netflix, which introduced its streaming alongside its DVD-by-mail service back in 2007, has a track record of price hikes similar to any other subscription-based service; the chart below gives some flavor to the pattern of the company’s price hikes. We think Netflix is very close to hiking prices after 1. no real price increases this year and 2. as the ad tier, wallet-friendly plan priced at $6.99/month, building its own customer base, will allow for higher pricing on the premium plan.

Flixed

The most recent price hike, which happened last year, brought prices to the following: standard with ads at $6.99, basic plan at $11.99, standard plan at $15.49, and premium plan at $22.99. Netflix holds pricing power within the streaming industry due to its first-mover advantage, which remains relevant today and acts as a big part of our positive sentiment on the stock for next year.

Netflix had something like 200M subscribers when today’s competition was just now jumping into the streaming industry, seeing its potential mid-pandemic. This advantage, to some extent, allows Netflix the option of increasing prices without a major risk of subscribers and/or revenue loss to its competition. Netflix has built itself as today’s “must-have TV.” Its positioning makes the company better positioned to raise prices and boost its ARM in FY25. For reference, ARM is defined by the company as “average streaming revenue divided by the average number of streaming paid memberships divided by the number of months in the period.”

Management, in our opinion, is shifting gears to focus on monetizing this sticky customer base, particularly as net add momentum is anticipated to fall off after the initial spike from the password crackdown lets out. We anticipate real momentum to be seen in ARM in FY25. Netflix is now guiding for FY25 revenue between $43B and $44B, a $4B to $5B increase, or 11-13% growth, over the anticipated 2024 revenue, on what management called “a combination of membership and ARM growth” on the Q3 earnings call.

Our positive thesis is also not isolated to FY25 and is applicable to 4Q24, which should be another top and bottom beat on the higher Q4 seasonality and specific series releases. Management now guides for Q4 revenue of $10.13B, ahead of estimates at $10.1B, with management noting, “We expect paid net additions to be higher in Q4 than in Q3 ’24 due to normal seasonality and a strong content slate.”

Ads will be important (soon)

This November, we’ll have hit the two-year mark since Netflix introduced its ad tier, which has taken longer than anticipated to boost top-line performance given the macro uncertainty. This is something that should materially reverse in 2025 and 2026 as ad firm and customer spending power rebounds. For the quarter, management reported that the ad tier represented +50% of signups, and ad-tier subscriptions increased 35% Q/Q. Netflix stated,

We’re roughly doubling revenue each year, but it’s off a small base.

We think ads could be a big midterm driver for Netflix but don’t see it pushing the top line in 1H25. Management said the following regarding their ads business:

“We continue to build our advertising business and improve our offering for advertisers… Ads membership was up 35% quarter on quarter, and our ad tech platform is on track to launch in Canada in Q4 and more broadly in 2025.”

When it comes to Netflix’s ad tier, we think material revenue will follow scale, not the other way around. We say this because we think the appetite is already there: “Engagement rates, which average out to two hours a day per paid membership, are similar across both ad and non-ad plans.” We expect consistent engagement, and a better macro backdrop allows Netflix to scale its ad tier and turn a large profit on it.

Valuation & Word on Wall Street

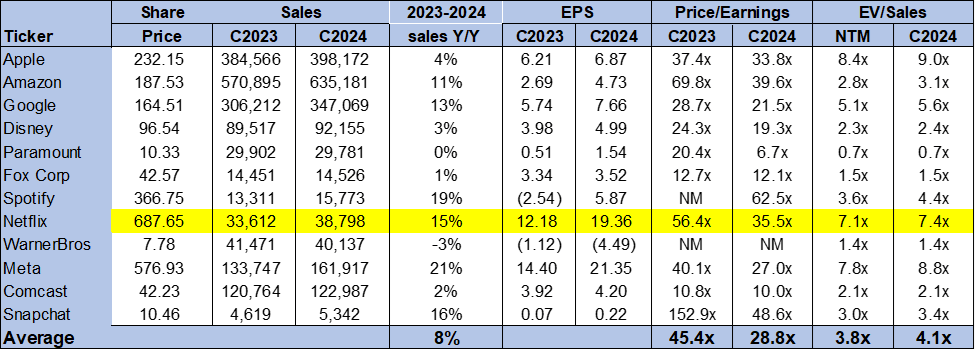

Netflix isn’t cheap, and it shouldn’t be, in our opinion. On a P/E basis, the stock trades at 35.5x CY2024 compared to the group average of 28.8x. The stock’s EV/Sales ratio sits at around 7.4x, versus a group average of 4.1x. The stock visibly trades above the group average; this doesn’t make us too concerned, considering management’s profiteering mode for FY25, which should enable it to grow into the market’s expectations. Furthermore, we think the higher valuation is somewhat justified, given Netflix’s pricing power. The following outlines Netflix’s valuation against the peer group.

Tech Stock Pros

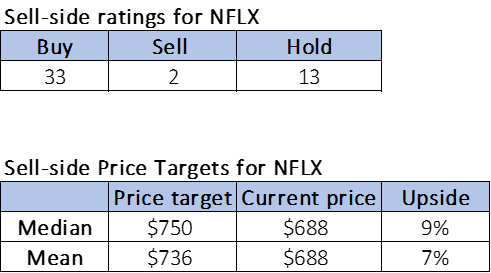

Wall Street continues to like Netflix, and so do we. Of the 46 analysts covering the stock, 33 are buy-rated, 13 are hold-rated, and the remaining two are sell-rated. This reflects a sentiment similar to last year, where we had 29 buys, 13 hold, and two sells on the stock. The potential upside from sell-side price targets is more favorable now than almost a year ago. The stock is currently priced at $688 per share with a median of $750 and a mean of $736 for a potential upside of 7-9% better than the 3-5% upside in our last article. The following charts outline Netflix’s sell-side ratings and price-targets.

Tech Stock Pros

What to do with the stock

We think Netflix will outperform in 2025 due to higher ARM and a pickup in ad tier through the fiscal year. Management noted on the earnings call that it is still “working to improve our monetization by refining our plans and pricing.” We expect the monetization efforts to go hand in hand with management’s focus on increased engagement through attracting a wider customer base. This is whether in terms of spending power by offering a cheaper ad tier and a more expensive premium one, or in terms of a more serious venture into sports. That will be with the streaming of the Jake Paul vs. Mike Tyson fight or the NFL games this Christmas. We see plenty of green shoots for FY25 from these engagements and profiteering focuses. Plus, we think Netflix will benefit from a friendlier interest rate environment that’ll boost consumer spending power.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.