Summary:

- Q3 revenue nearly hit $10 billion, with a 15% YoY growth rate and a significant leap in operating margin to almost 30%.

- Netflix’s net profit margin TTM surpassed 20% for the first time, indicating significant dominance and an efficient business model.

- Improved cash flow from operations, with earnings quality reaching 100%, addresses previous concerns about Netflix’s financial performance.

- Advertising will be a priority over the next years to become a solid source of revenue.

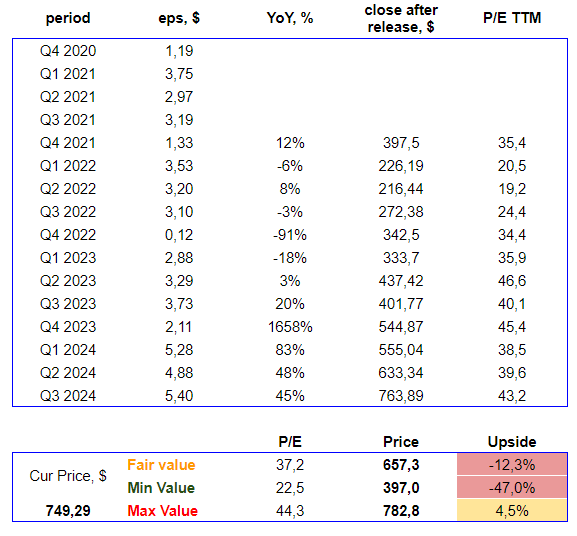

- Based on a quantitative assessment using the historical multiples method, the current price is 12% higher than the fair one, which creates a short-term risk.

Nanci Santos

Netflix, Inc. (NASDAQ:NFLX) has released another strong report confirming the growth re-acceleration. The subscriber’s amount has grown, prices are on a gradual rise track, and the advertising platform will be launched globally in 2025. These are three key drivers of future sustainable growth. But despite this, the current share price of $749.29 (as of 10/23/24) makes the company quite expensive. It leaves almost no reasonable potential for growth in the short term despite the positive fundamental background, but in the long term the investment can bring reasonable return and this explains my HOLD rating.

Q3 Earnings Results Highlights

Record quarterly revenue, which came close to $10 billion, confirmed the trend towards increasing growth rates in recent periods (15% YoY vs. 12.5% a year earlier) and allowed for a significant leap in operating margin (almost 30% vs. 22% a year earlier).

This brings the net profit margin TTM to the 20% threshold for the first time in history. For me, this is a signal of the company’s transition to the “major league”. Because it indicates the company’s significant dominance in its area since the growing scale allows for savings on costs due to the extremely efficient business model.

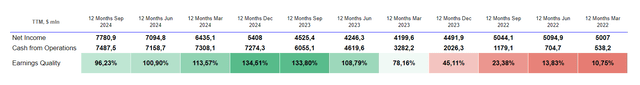

I would especially like to outline the cash flow provided by operating activities improvement. My main complaint about Netflix’s financial performance previously was the inability to confirm accrued net income with real cash flows since additions to content required too many expenses. This item in the cash flow statements remained at ~$4b ($3.7b to be exact, with $3.6b a year earlier, the same as at the end of Q3 2022), but growing revenue and, as a result, net income with a relatively lower amortization of content value allowed the earnings quality to reach the desired level for me, as a value investor, of 100%.

Netflix Earnings Quality. Data: Seeking Alpha (Own calculations)

Since June 2023, earnings quality, which I calculate based on the ratio of net income to cash flow from operations (TTM), has fluctuated around 100%, although before that, it was closer to zero.

Fundamental Prospects For Reaccelerated Growth

Theodore A. Sarandos, CEO, began his earnings call with the phrase:

We had a plan to reaccelerate growth, and we delivered on that plan.

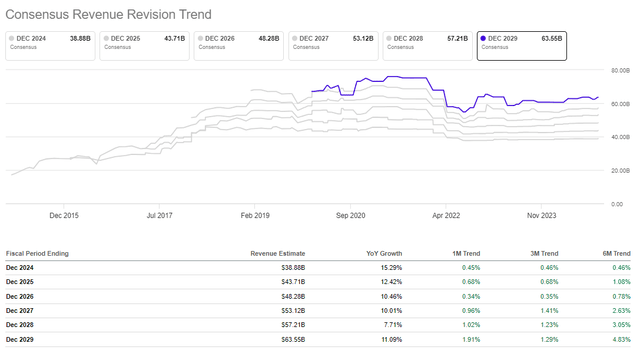

Actual Q3 results were above guidance and allow us to expect a strong finish to FY24 and a good start to next year, where revenue is expected to be at $43-44b (+11-13% YoY).

The consensus for 2029 revenue is $63.5b, which implies a 9.7% CAGR. This rate is in line with current actuals and certainly does not fit the description of “reaccelerated”. Moreover, I believe it is already priced.

When asked about investment priorities, the company’s management focused on investing in content. The current model works (we can see this by the margins) and should provide organic growth. Gaming, going live (Netflix plans to broadcast live boxing and NFL games in December) and similar initiatives are not game-changers but should provide improvement of AMR (streaming revenue divided by the average number of streaming paid memberships divided by the number of months in the period).

Something more is needed, and that has to be advertising, although management is currently avoiding predictive numbers and is very cautious about expectations for the launch of its ad-tech platform, which will be tested in Canada next month.

Here’s why I’m betting on advertising becoming a solid source of cash flow in the long term:

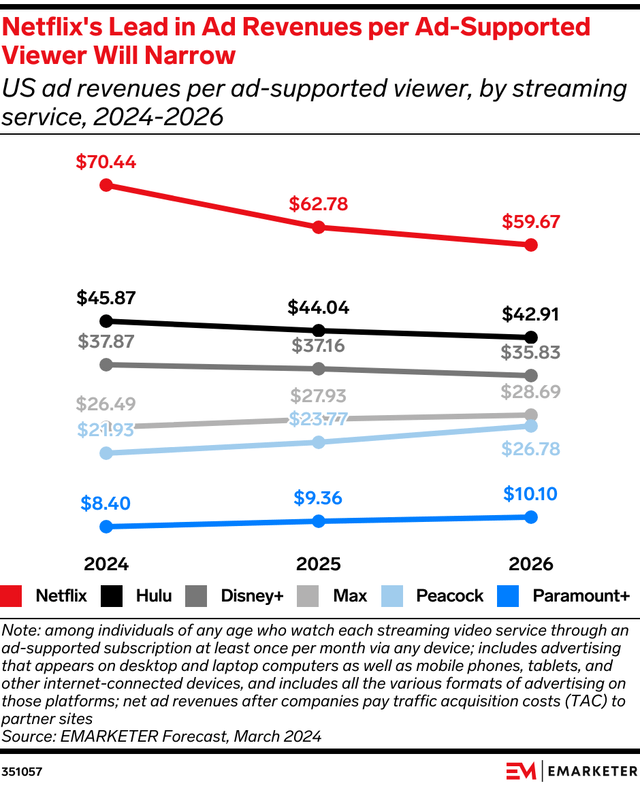

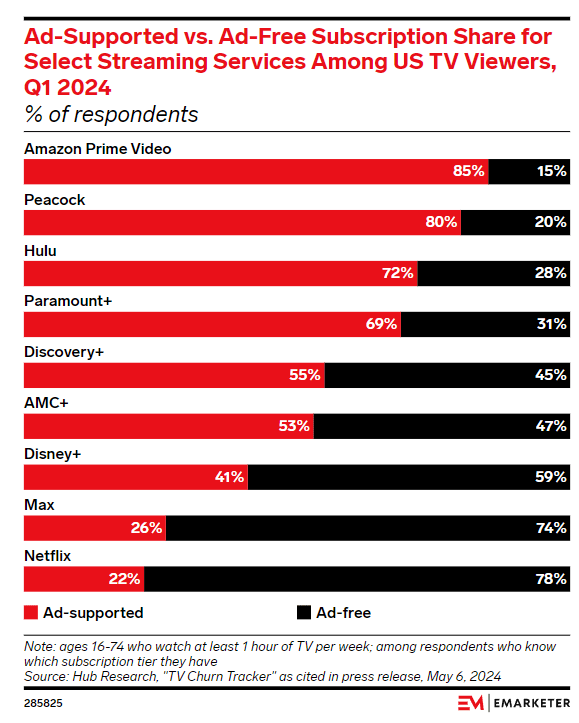

- Netflix has the lowest share of ad-supported users of any streaming service. As of Q1 2024, the share of add-free subscribers was 78%, which gives the company a huge reserve and potential. Ads membership was up 35% quarter on quarter based on the results of Q3 2024.

Emarketer

- Netflix’s revenue per ad-supported user is about $70, and even despite the predicted decline in this value by 2026, it will remain by far the largest among competitors.

- The majority of Netflix’s audience is made up of Generation Z (68% of Zers surveyed watch Netflix, putting it second only to YouTube). This audience tends to opt for cheaper ad-free plans, fueling the growth of the ads segment. Netflix also boasts high engagement rates and is the most used streaming service by users of other ones. This level of loyalty will help balance subscription revenues and advertising growth.

The company’s response to the slowdown in 2022 was timely. Today, the combination of strong financial performance and advertising plans make Netflix the obvious number-one investment idea in the industry for me. And even Disney can’t stop it.

Why I Bet on Netflix Over Disney

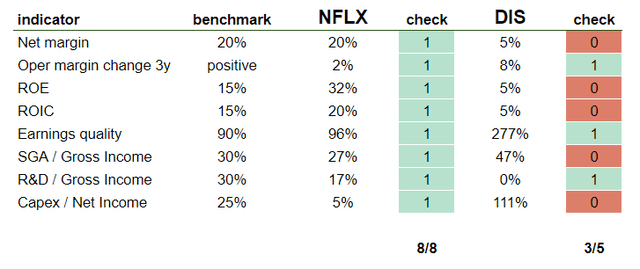

The Walt Disney Company (DIS) is often cited as a major competitor and even a favorite to battle Netflix, not only in the context of Disney+, ESPN, and Hulu services but also due to its more diversified business than pure streaming. I will use an objective and undeniable quantitative approach to demonstrate why I believe NFLX is a more efficient unit.

Quantitative comparison of Netflix and Walt Disney’s financial performance (Own calculations)

To identify competitive advantages and market dominance, I use a quantitative valuation model consisting of 8 key metrics, mostly collected from the income statement. Key comparison metrics such as net profit margin (20% for Netflix vs. 5% for Disney) and ROIC (20% vs. 5%) put NFLX ahead for me. In addition, Netflix’s projected revenue CAGR is significantly higher: 9.7% vs. 2.7%.

Main Risks

As a long-time Netflix user, I don’t consider the risk of content production and sales to be significant, since the company has created a working system of content production and licensing for every taste and in different regions. This can be confirmed by the qualitative trend of subscriber base growth to almost 283 million people (14.4% YoY in the last quarter).

Since Netflix is currently trading as a growth story, the obvious risk is a miss in the forecasts and the reaccelerating growth model. Although management is reserved in its expectations, the current valuation (43x) suggests that investors are expecting more than the current ~15% YoY. I did not see a single number about ads (in $) in the latest presentation for the upcoming 2025, which personally made me wary ahead of a new phase of business scaling and changes in monetization.

There is also a minor solvency risk. Netflix’s total debt is about $16b. This is 0.7 of shareholders` equity and more than 2 times the annual cash flow from operating activities. While interest expenses make up only 7% of operating profit, the debt burden is not so significant, however, as a conservative long-term investor, I keep an eye on solvency metrics.

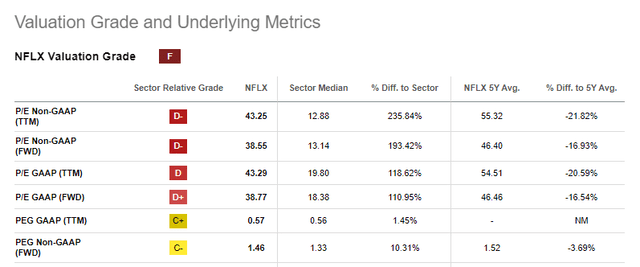

But the main risk is the company’s valuation. And this risk is already being realized today.

Overvalued Relative To Fair Price By 12%

I don’t like comparing companies to each other or the sector average. The fact that Netflix is valued at 43x P/E today compared to the sector median of ~13x doesn’t mean much to me personally.

However, I agree with the rather low NFLX valuation grade, although from an entirely different perspective.

Since the company passes my test of profitability, financial health, and growth, and I consider it an investment attractive outside the context of its price per share, I evaluate it relative to itself. To achieve this, I only need the earnings data for the last 16 quarters and the closing prices (as of the quarterly report date).

NFLX valuation by historical multiples method (Own calculations)

Takeaway

Netflix is taking its business to new heights, providing shareholders with a promising growth story. The HOLD rating on NFLX shares is a combination of the company’s overall investment attractiveness and its relatively overvalued current price. At levels above $800, I would consider reducing my current position to manage market risk. In the long term, I believe in the company’s future, which is well illustrated by a quote from Theodore A. Sarandos, CEO:

Over $600 billion in consumer spend in the areas and countries that we operate, we’re only capturing roughly 6% to 7% of that today. That’s a tremendous upside if we can just stay focused on that continuous improvement and drive to that future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.