Summary:

- Netflix might find a new lease on life amid a pivot into underserved markets in both developed and developing countries.

- Password sharing and industry consolidation remain key risks. However, they might be combated by ad revenue and expanding market reach.

- Netflix’s $1 billion revolving credit facility could become productive when interest rates pivot. Additionally, Netflix has the potential to lower its cost structure.

- Recent options activity suggests traders are hedging Netflix’s stock. However, an absolute valuation implies the stock is severely undervalued.

demaerre

Many might think of Netflix, Inc. (NFLX) as a retrospective growth story with diminishing returns en route.

However, in today’s article, we argue that Netflix possesses external growth opportunities that could reignite the firm and its stock’s growth story. Moreover, internal growth may occur as structural and economic variables start to align.

Before getting into the analysis, I want to highlight that today’s report is an isolated vantage point, which should ideally be combined with other analyses before making an investment decision. Now, with that being said, let’s get stuck into a few of Netflix’s growth prospects.

Let’s Set A Foundation

At forecasted compound annual growth rates of 21.50% and 17.30% apiece for the streaming and digital ad industries (measured until 2023), there’s little doubt that Netflix remains a highly lucrative business.

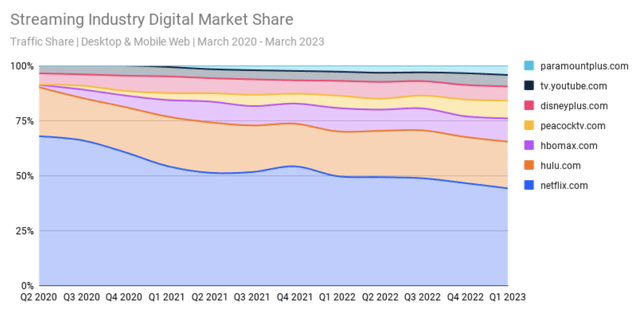

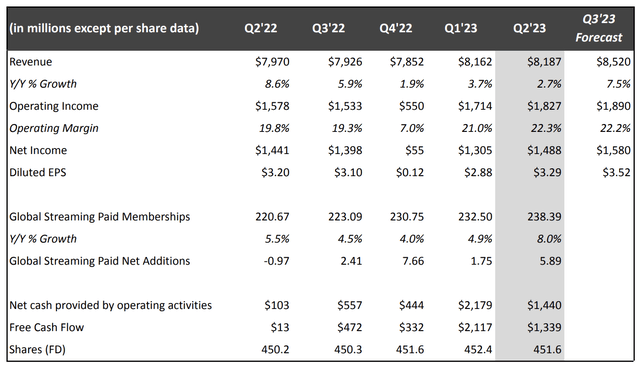

However, with all great markets come rising competition – And, as illustrated in the diagram below, an influx of competition and aggressive CapEx cycles by big companies have led to diminishing market share for Netflix. In fact, Netflix’s second-quarter revenue experienced a mere 2.72% year-on-year increase, which is shallow for a firm with a realized 5-year CAGR of 18.28%, illustrating the structural shifts forming within the streaming business.

In our view, Netflix’s diminishing market share is mostly due to the natural process of an industry lifecycle. The streaming business is entering a consolidation phase, whereby a significant influx of competitors and increasing research and development spending is leveling the playing field. In addition, the streaming business has low barriers to entry; as such, many minor players are likely to enter the fray in the coming years, diluting the addressable market per market participant even further.

Will Netflix’s descendancy resume? I, unfortunately, do not have a crystal ball in front of me; however, I can say that we think both external and internal growth opportunities have surfaced, which could present Netflix with a new lease on life.

External Market Prospects

To address this sub-topic, I assumed a vantage point with an outlook on emerging market subscription potential and how both ‘tiered pricing’ and advertising revenue could form a significant part of the growth story.

I plotted a few diagrams below, but first, herewith are descriptions of the denotations.

- UCAN – United States and Canada

- LATAM – Latin America

- EMEA – Europe, the Middle East, and Africa

- APAC – Asia Pacific

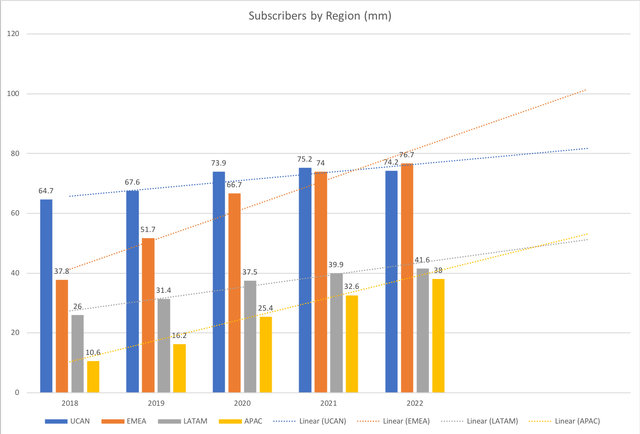

The first diagram shows that Netflix’s subscriber base is becoming more broadly dispersed. Based on its data, the company’s strategy is to tap into other developed markets, such as Europe, for diversification benefits while also entering emerging markets for their future growth prospects.

Click on Image to Enlarge (Author’s Work; Data from Business of Apps)

We think a pivot into Europe and China will be met with fierce local competition as both regions are industrialized, meaning Netflix will likely face the same competitive issues as in the U.S.; nevertheless, it broadens its revenue base and opens up opportunities for synergies.

The firm’s expansion into Latin America, Africa, and the Middle East is where we see the most opportunity for Netflix. These economies are densely populated, developing at scale, and still behind in industrialization. As such, we think adopting foreign technology is more likely in these regions than in China and the EU; moreover, a significant scale is possible as the economies continue to integrate with the developed world.

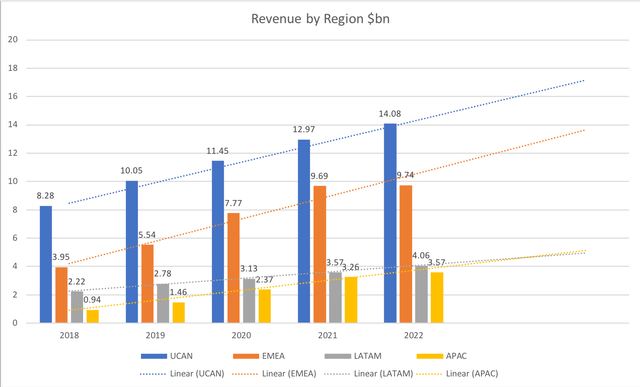

The following diagram illustrates Netflix’s revenue by region. As with the previous diagram, I added in a forecasted intercept, providing a baseline to work from when forecasting future growth.

It’s clear that Netflix has struggled to scale revenue in LATAM and APAC. However, EMEA revenue is growing substantially. In our view, it is only a matter of time before Netflix optimizes its tiered pricing solutions and scales revenue in its emerging market regions.

Click on Image to Enlarge (Author’s Work; Data from Business of Apps)

You might have realized by now that the aforementioned data ended in 2022. As such, we must incorporate the prospects of Netflix’s ad revenue, which is an initiative that was set into place eight months ago.

More data needs to settle for us to provide a reasonable conclusion about the segment. However, at face value, the segment could provide bright results as it is anticipated to reach an annual revenue of $3.95 billion by 2023. Moreover, initial data (Q2 earnings) suggests that users are comfortable with non-ad-free viewership as membership growth continues on trend and revenue per non-ad-free user remains approximately $8.50 higher (than ad-free).

Netflix’s advertising revenue rollout, paired with its increasing emerging market reach, might lead to significant financial performance. To what extent remains unclear; however, the possibilities are undoubtedly present.

An Improving Cost Structure & Possible Latitude For a CapEx Cycle

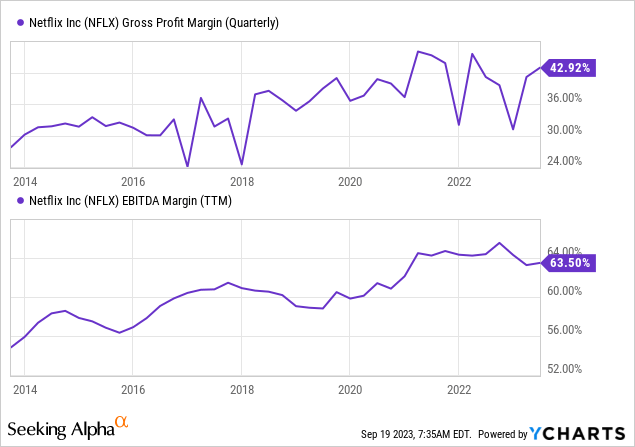

Netflix suffered from rising input costs in 2021 and 2022 due to shortages in the labor force and higher inflation overall. Thus, its CapEx and R&D roadmap suffered dents in the last twelve months as spending slumped by 33.97% and 2.15%, respectively.

However, the firm’s long-term margins remain in an uptrend, and a cooling in overall inflation (especially in the labor market) might lead to wider near-term margins and higher spending on expansion projects.

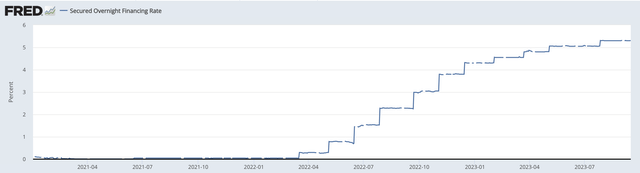

Furthermore, Netflix might soon find relief in the debt market, adding to the argument that its CapEx and R&D spending could increase to reignite growth spending. Although yet to occur, the U.S. is nearing an interest rate pivot, sending variable-rate borrowing costs down and providing Netflix with much relief.

In addition to its approximate $14 million in fixed-rate public debt, Netflix has access to a $1 billion variable-rate revolving credit facility. As matters stand, overnight funding rates remain high, limiting the viability of tapping into the facility. However, if interest rates were to decrease, Netflix could: 1) adopt additional fixed-rate debt at a lower cost; and 2) tap into its revolving credit facility at lower rates and invest in expansion initiatives in an accretive manner.

Secure Overnight Funding Rate (St. Louis Fed)

Valuation

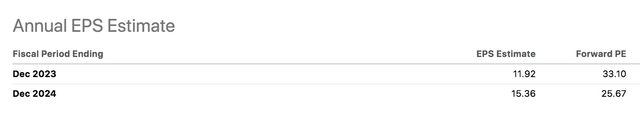

Netflix’s stock is currently priced at around $395 per share after its 60% year-on-year surge. However, with its stock trading at 5.46x sales and 42x earnings, the question becomes: Is Netflix overvalued?

As mentioned earlier in the analysis, I do not have a crystal ball in front of me; however, I can provide some input on Netflix’s valuation for you to consider.

Technical Aspects

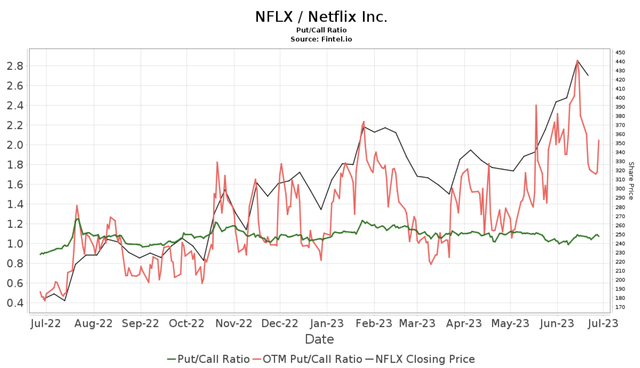

As things stand, Netflix’s Put/Call Ratio is above 1, communicating that the options market is starting to hedge against a Netflix downturn.

The options market is often a useful gauge of short-term price action as options traders use implied volatility to gauge their market sentiment, which is a forward-looking metric that plays a key part in the market’s general direction.

Further, many portfolio managers use options to adjust their existing exposure to a stock; as such, high demand for put options suggests portfolio managers might be sizing down on their Netflix exposure.

Absolute Valuation

According to the price-to-earnings extension formula and data from Wall Street estimates, Netflix’s stock has a December 2023 fair value of $719. Of course, an 82.5% surge by December is improbable; nevertheless, the formula’s result indicates that the market likely underscores Netflix’s earnings-per-share potential.

Formula = 5-Y AVG Fwd P/E x EPS Forecast for DEC 2023 = 60.32 x 11.92 = $719.

Ongoing Risks

As many might be aware, Netflix is battling with password sharing. Although initiatives such as paid sharing and verification codes are limiting damage, the problem remains far from solved.

Furthermore, as mentioned earlier, Netflix is wound up in an industry consolidation, which has resulted in a loss in market share. Unfortunately, global growth opportunities might not be enough to curb diminishing revenue growth as the firm’s competitors have access to the same markets.

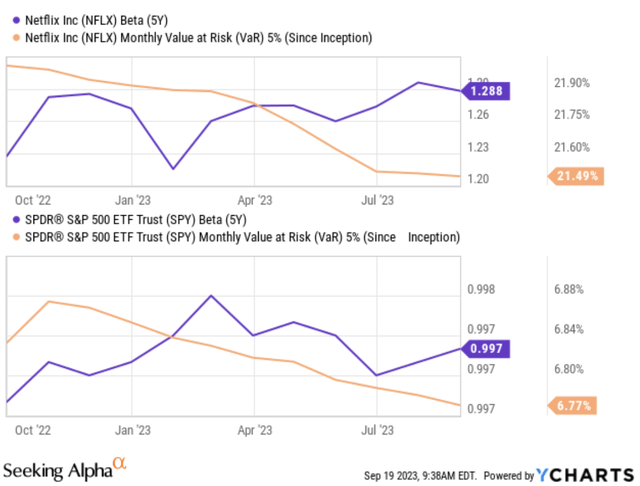

Lastly, Netflix is a high-beta, high-value-at-risk stock, which could add risk to most investment portfolios. Therefore, investors must ideally consider the implications of holding Netflix’s stock in an unfavorable market environment.

Final Word

Netflix might find a new lease on life amid a pivot into underserved markets in both developed and developing countries. Although events such as industry consolidation and password sharing are headwinds, the magnitude of contrasting factors such as external growth opportunities, the potential for a lower cost structure, and a favorable stock valuation mean we are bullish on Netflix stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for structured portfolio ideas? Members of The Factor Investing Hub receive access to advanced asset pricing models. Learn More >>>