Summary:

- Netflix is digging themselves out of their self-imposed hole.

- Simply put, the content is better the last 15 months.

- Margins are expected to return to pre-Covid numbers, and possibly better than that.

- Free cash flow is expected to triple by 2026.

- The valuation is still an issue, but 2023 could be the year where Netflix wins back investors’ confidence.

Wachiwit

Netflix (NASDAQ:NFLX) is scheduled to report their Q1 ’23 financial results after the closing bell on Tuesday, April 18th, 2023, with analyst consensus expecting $2.86 in EPS on $8.17 billion in revenue for expected y-o-y growth of -19% and +4% respectively.

Guidance will be critical for the rest of 2023, as the full-year 2023 analyst consensus currently stands at +16% estimated EPS growth and +9% expected revenue growth.

In Q4 ’22, the big surprise was the “net new adds” of 7.66 million, which was the best quarter of new adds since December ’20, in addition to management guiding to “better margins” (presumably operating) of 18-20%, which is more in line with pre-Covid numbers (per my spreadsheet).

Other positive news was that the “password sharing” drag would be addressed by Q2 ’23 (although management might have addressed it already) and capex is expected to be kept flat for some time, allowing free cash flow to grow.

Trend in EPS and revenue consensus:

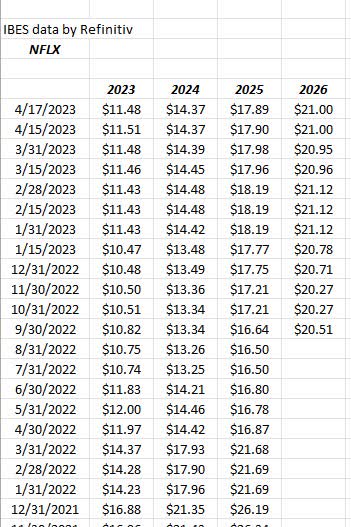

NFLX EPS revisions (IBES data by Refinitiv)

NFLX revenue revisions (IBES data by Refinitiv)

Readers can see the impact on the expected EPS for Netflix for 2023-2026 that occurred starting in late 2021, when the shares peaked between $680 and $700 per share.

It’s clear margins were the issue for Netflix, but that was caused by content issues in late 2021, as well as some other issues which will be talked about in a minute.

Revenue and EPS estimates stabilized in late 2021 and improved with the Q4 ’22 earnings release, but it’s clear that investors and Wall Street are waiting on better numbers.

Valuation:

| Price-to-sales | 3.6x |

| Avg expected 3-yr EPS growth | 22% |

| Avg expected 3-yr rev growth | 10% |

| Avg 3-year P/E | 26x |

| Price-to-cash flow | 71x |

| Price-to-free cash flow | 101x |

| moat | narrow |

(Source: Valuation spreadsheet and moat from Morningstar)

What’s interesting about the Netflix analysis from Morningstar (and I think Morningstar does a great job for subscribers) is that Morningstar expects Netflix to return to a 23% operating margin by 2027, while the guidance for 2023 after the last quarter was 18-20% or more in line with Netflix’s O/M in 2019 or pre-Covid.

No question too, the price-to-sales, although still salty at 3.6x, is way down from its peak over 9.0x in September 2020.

The P/E-to-growth looks reasonable as you’d expect as skeptical investors revisit the stock again after its horrid drop from $700 to $150.

Free cash flow (FCF) estimates:

| FCF estimates | FCF estimate per yr (ml’s) | (# of est’s) |

| 2026 | $9,029 ml | (7) |

| 2025 | $6,847 ml | (16) |

| 2024 | $5,164 ml | (21) |

| 2023 | $3,438 ml | (21) |

(Source: IBES data by Refinitiv)

Here’s the key to NFLX: with stable capex and additional revenue from advertising, the company’s free cash flow will undoubtedly grow.

As you can see from the IBES estimates, free cash is expected to triple by 2026.

Netflix’s FCF as of 12/31/22 was $1.4 billion to provide readers with a baseline.

Summary / conclusion

In his CNBC interview from Japan last week, Mr. Buffett thought the streaming business was too crowded with too much supply, and he is probably right.

The thing is, Netflix has always had the first-mover advantage, and I think that still applies.

My own story for the stock with clients was that in late 2021 or sometime in the second half of 2021, Netflix came out with this movie called (I think) “Don’t Look Up”, and you talk about a world-class cast, i.e., Jennifer Lawrence, Ryan Gosling, Jonah Hill, and even Meryl Streep (maybe Leo DiCaprio too?) and the movie was so bad I could only sit through a half hour of it on Netflix and had to turn it off, but with the resolve to give it one more try later that week. Well, the second chance didn’t last long either, and while the stock wasn’t a big position (not even top 30 in client accounts at the time), it was sold by the end of 2021. (More luck than brains.)

Really, my only conclusion was that there was such little good content to watch on Netflix, I probably shouldn’t own the stock even for younger, wealthier clients that liked growth stocks with emerging technology and leading market shares.

Well, after the drop in the stock price, and after management said that they were going to be less patient with some of their more woke employees, what struck me was that the content has gotten better in the last 15 months.

The first movie watched that I thought was decent was “The Grey Man” with Ryan Gosling, and then the Manti Te’o documentary and seeing what that poor kid went through, and then recently watching The Mauritanian and, finally this week, the documentary on the Boston Marathon bombing with all the principals 10 years later was all good product, in my opinion. These weren’t the only movies or documentaries, but they are the better ones, in my opinion, and I consider my own tastes about average relative to the rest of America.

Put simply, Netflix is making better movies and putting out better content. And that can make for a good business.

The free cash flow estimates published by IBES data by Refinitiv are probably conservative, but let’s see how 2023 turns out and whether capex can remain stable while revenue grows.

Across accounts, more NFLX is owned today than in 2021. The advertising revenue and the password sharing are potential catalysts, and if Morningstar is right on the operating margin, then there is more upside to margins than the Street might have built into current models.

The valuation on the stock is an issue, no question, but it’s at a cheaper price-to-sales and a more attractive P/E-to-growth than late 2021.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

NFLX reports after close tuesday, 4/18

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.