Summary:

- Netflix exceeded its Q2 2024 subscriber growth target, reaching 277.65M in paid memberships globally.

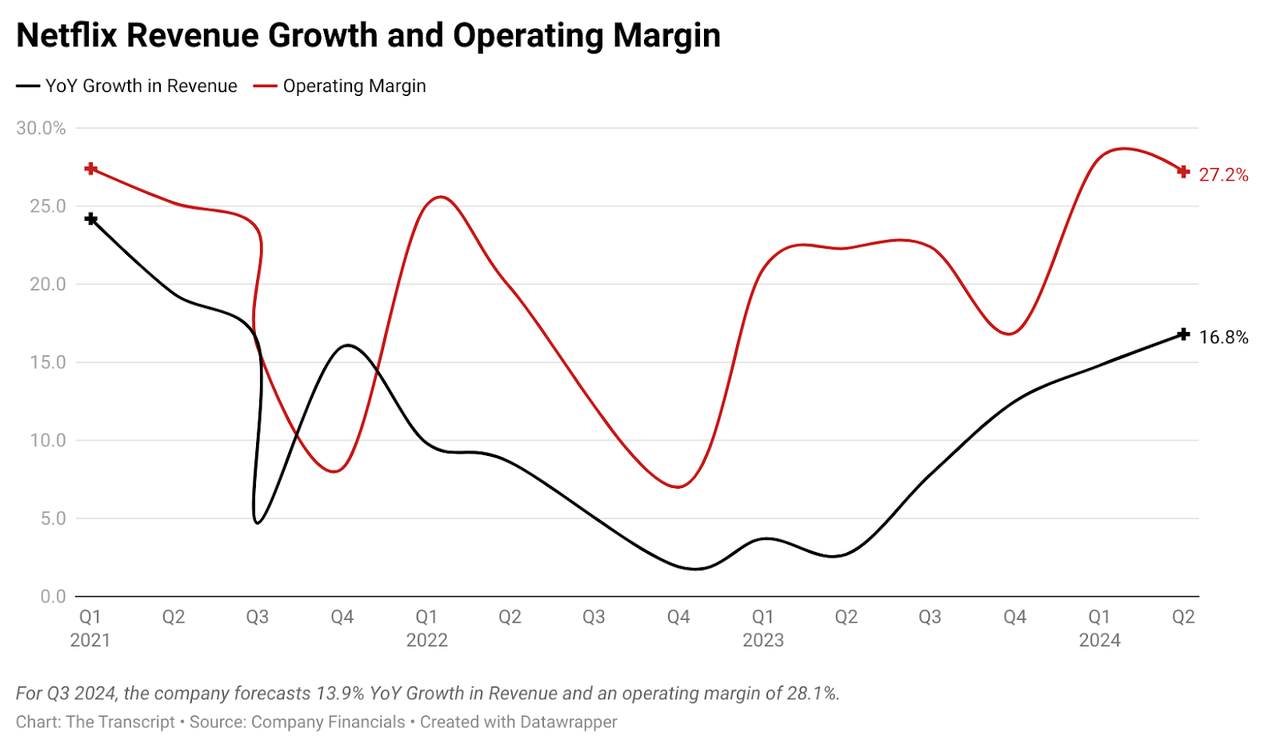

- Revenue for the quarter grew 17%, with operating income surging 42% and an operating margin of 27.2%.

- Despite intense competition, Netflix remains a leader in the streaming industry, investing in content, ads, and new growth avenues like live events.

10’000 Hours

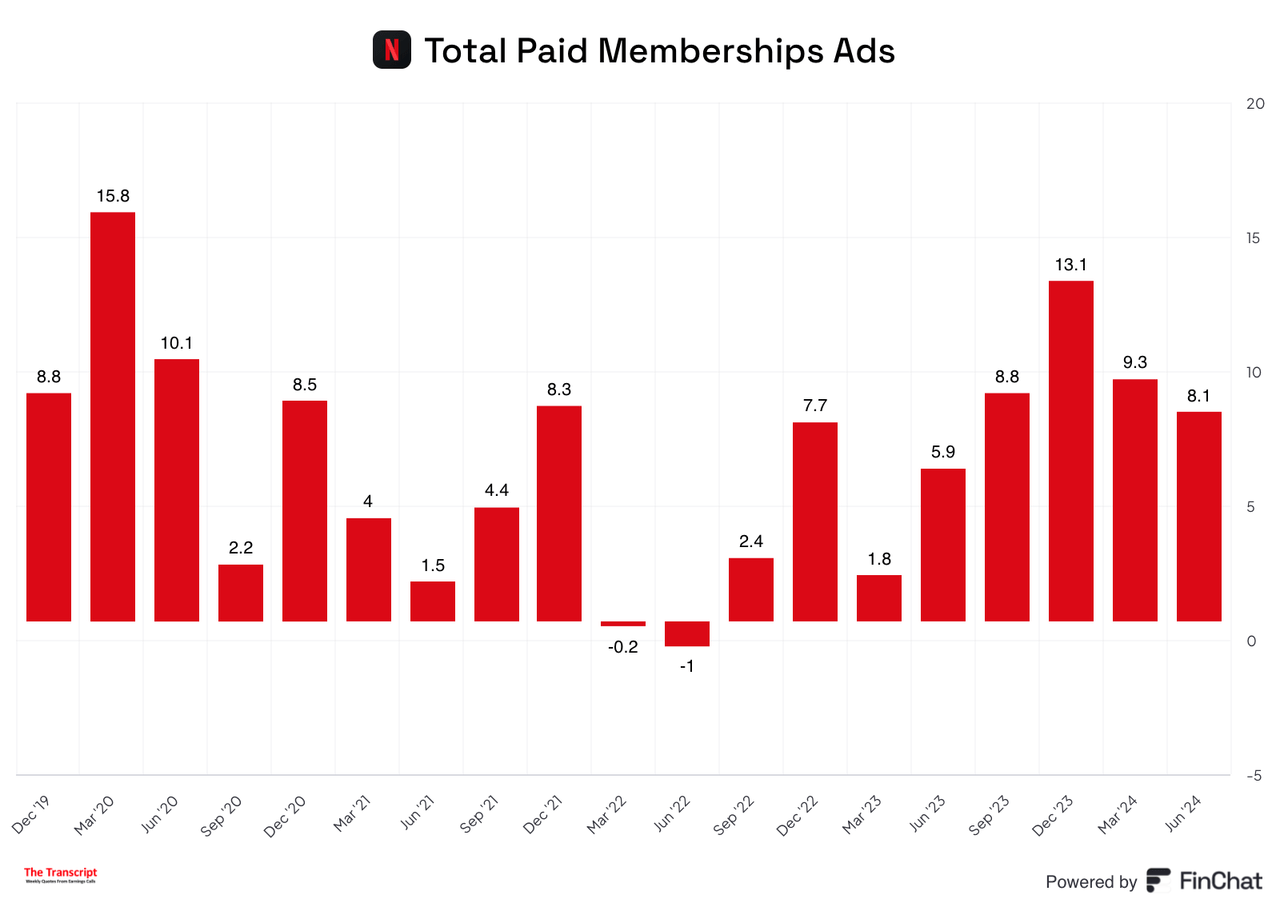

Netflix (NASDAQ:NFLX) delivered a stellar performance in Q2 2024, exceeding expectations in subscriber growth and revenue. The streaming giant added 8M subscribers globally, surpassing their projected target of 5.9M and reaching 277.65M paid memberships. This remarkable growth solidifies Netflix’s leading position in the streaming industry.

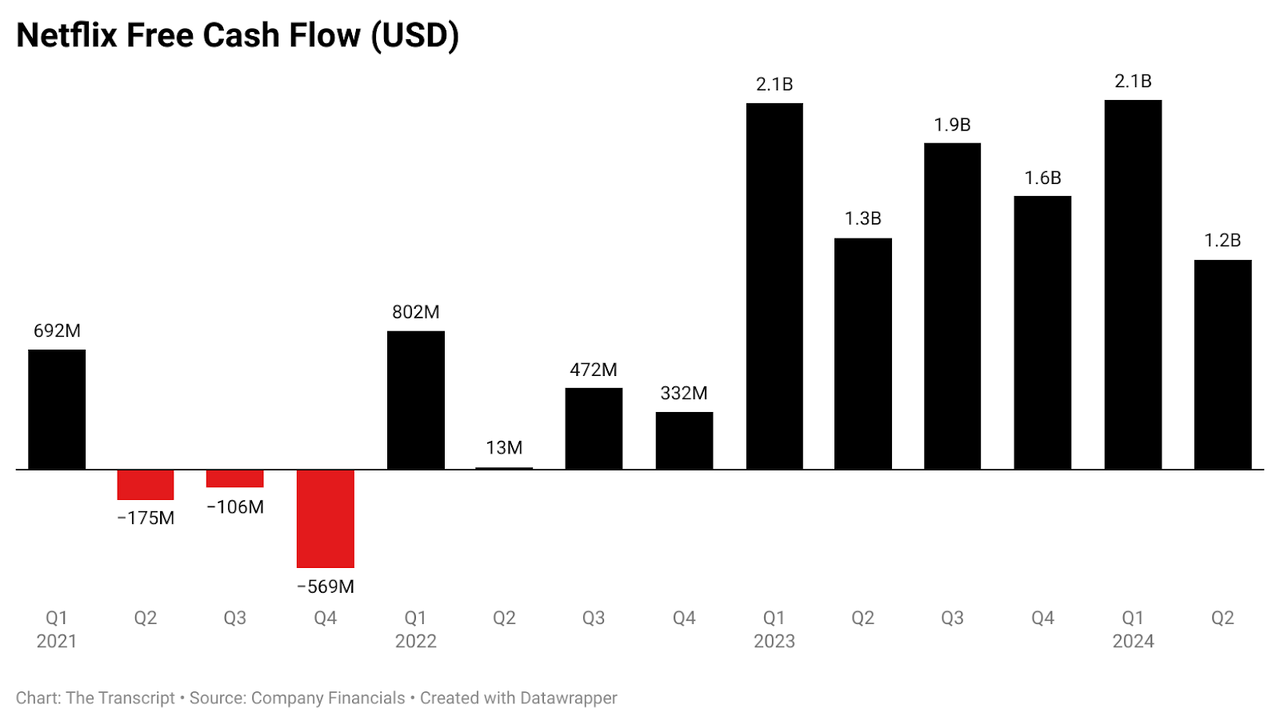

Our primary financial metrics are revenue for growth and operating margin for profitability. Our goals are to sustain healthy revenue growth, expand our operating margin, and grow free cash flow

—- Source: (Q2 24 Shareholder Letter)

Ads are adding

We don’t expect advertising to be a primary driver of our revenue growth in 2024 or 2025. The near-term challenge (and medium-term opportunity) is that we’re scaling faster than our ability to monetize our growing ad inventory. It’s why continuing to build our ad sales, measurement, and tech capabilities is so important. Based on everything we’ve learned and our progress over the last 18 months — we’re confident that advertising will be a key component of our longer-term revenue and profit growth

—- Source: (Q2 24 Shareholder Letter)

Revenue for the quarter reached $9.56B, a growth of 17% compared to the same period last year and slightly above analyst projections. This growth was primarily driven by the stronger-than-expected subscriber additions and the continued benefit from their paid sharing initiative. Operating income also saw a significant boost, surging 42% to $2.6B, with an operating margin of 27.2%, a 5 percentage point improvement from the previous year.

Our engagement on our ads plans is very similar to what we see on our non-ads plan. That’s close to the approximately 2 hours of viewing per member per day across all the plans that you can calculate globally from our engagement reports. So you should think of that as roughly how our ads plan members are engaging as well. And then on terms of ads arm, so ads arm, which is, of course, the combination of the subscription amount plus the ads revenue, currently, because we’ve been scaling so rapidly, we are not — we’re racing behind essentially to fulfill all of that increasing inventory and we’re lagging in that regard. So currently, our ads arm is lower than our non-ads arm

—- Source: Chief Product Officer Gregory Peters (Q2 2024 Earnings Transcript)

The Transcript

“There was strong performance across the board, good momentum across the business, strong revenue growth, member growth, and profit growth. In terms of that member growth and churn, I’d say the kind of outsized paid net adds in the quarter was primarily driven by stronger acquisition, a little stronger than we expected, but also very healthy, continued healthy retention in the quarter, and that’s across all regions”

—- Source: Chief Financial Officer Spencer Adam Neumann (Q2 2024 Earnings Transcript)

Globally, streaming paid memberships closed at 277.5M, up 16.5% year-on-year, and on a net basis, the additions were 8.05M, a decline from 9.33M in Q1 2024, albeit an increase from 5.89M recorded in Q2 2023. As a result of the year-on-year growth in the net additions, global revenue grew 1% relative to Q1 2024. In the nascent ads business which is just over 18 months old, ads tier membership was up 34% from Q1 2024 and accounted for more than 45% of all sign-ups across Netflix’s ads markets. Particularly, the two streams offered by the ads tier, HD downloads, and the end of the Basic plan in some markets helped to drive membership to the ads tier.

The Transcript

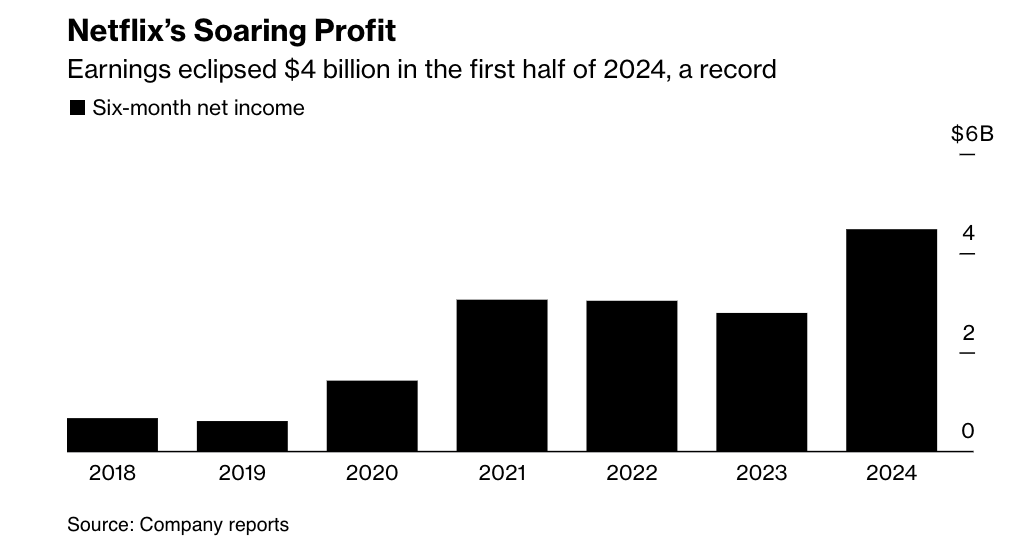

Soaring Profits

Net income for the quarter was $2.1B, up $659M or 44.3% year-on-year and down $185M or 7.9% quarter-on-quarter. Notably, the net income included $43M in non-cash unrealized gains accrued from the remeasurement of Euro debt held on the books. Earnings Per Share were $4.88 compared to $3.29 in Q2 2023 and $5.28 in Q1 2024. On valuation, the company looks reasonably valued at a forward P/E multiple of 27.1 based on estimated 2025 earnings.

Bloomberg

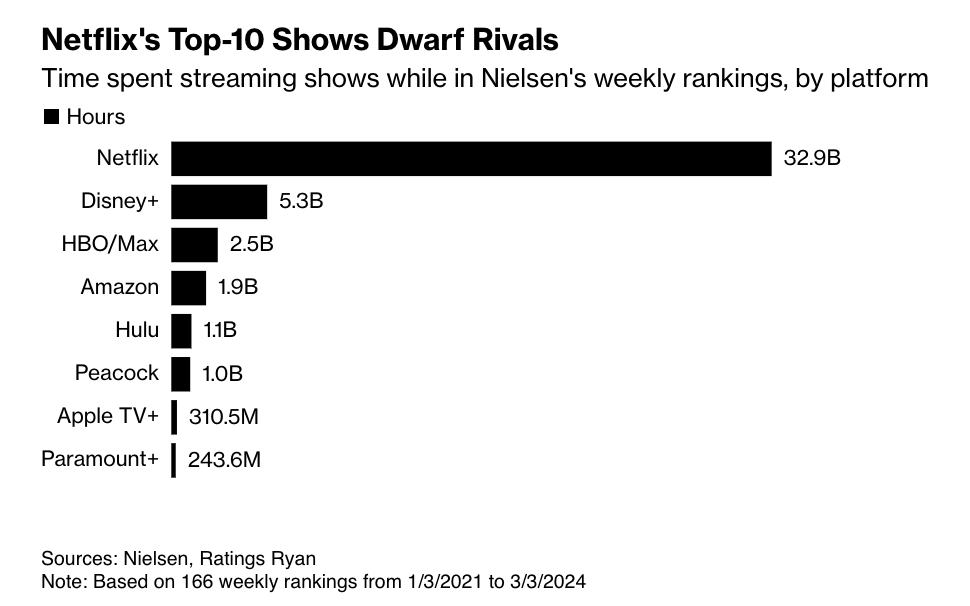

Smoking the Competition

Competition for entertainment is super intense, and we compete for every second of view time we get. So beyond that, kind of that competitive intensity that’s always been out there, we also anticipated some headwinds in our engagement because of paid sharing. And even with all of that, so beating down the headwinds of that and beating down competition, we’re still about 10% of TV time in every country we operate in. So still lots of room to grow, but very pleased with our engagement but not fully satisfied

—- Source: Chief Content Officer Theodore Sarandos (Q2 2024 Earnings Transcript)

While competitors like Disney, Warner Bros. Discovery, Paramount, and NBCUniversal struggle to match Netflix’s scale and profitability, the company is not resting on its laurels. Netflix continues to invest in expanding its content library, enhancing its recommendation algorithms, and building its ad-supported tier. Furthermore, the company is exploring new avenues for growth, such as live events, which they expect to become a significant contributor to revenue by 2026. Apple is cutting down on production costs for its content on Apple+ as competition in streaming tightens.

Bloomberg

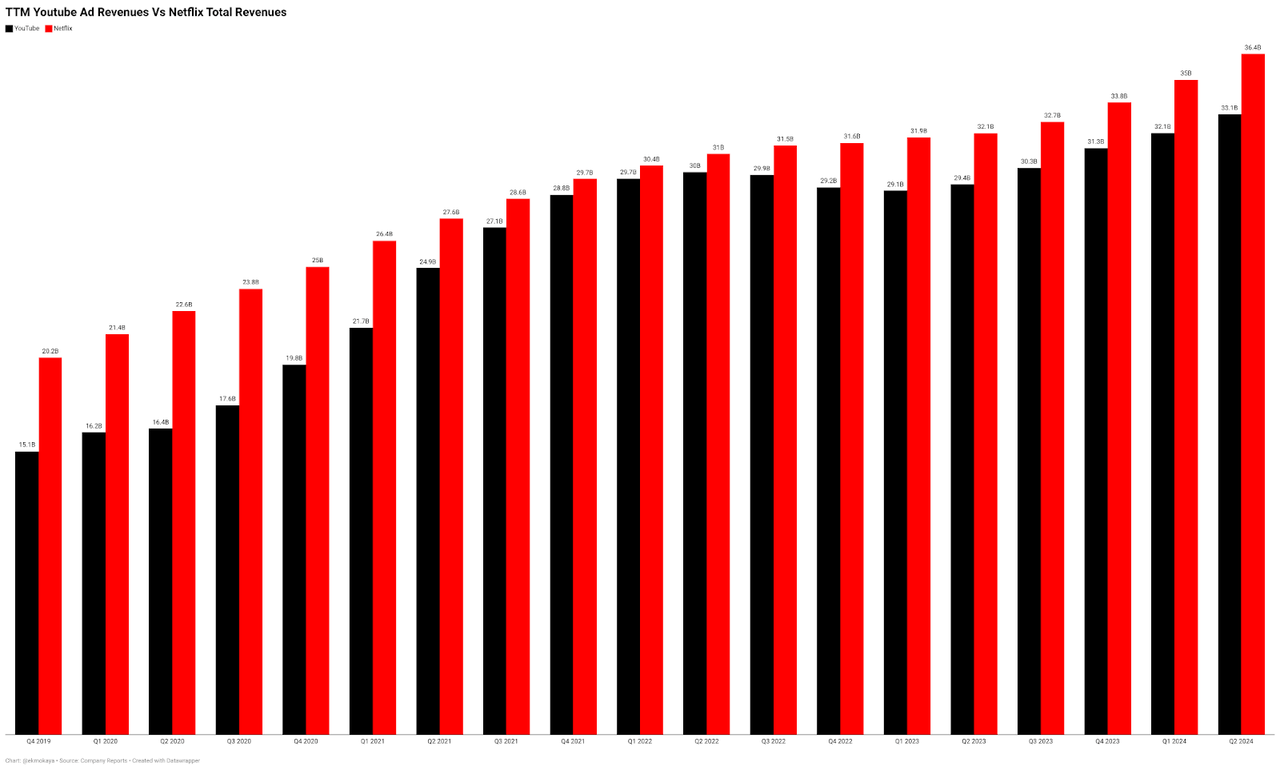

One Netflix competitor that many don’t seem to take into consideration, but management does, is YouTube. Management referenced Nielsen’s June data, which showed that Netflix and YouTube are the clear leaders in direct-to-consumer entertainment, with about 50% of all streaming to TV in the U.S.

The Transcript

Cash Rich

Free Cash Flow closed Q2 2024 at $1.2B, which was 9.4% lower than the $1.3B recorded in Q2 2023, and 43.2% lower than the $2.1B recorded in Q1 2024. For the 2024 fiscal year, Netflix projects FCF to stand at $6B.

The Transcript

Conclusion

Overall, Netflix’s Q2 2024 results showcase a company firing on all cylinders. The impressive subscriber growth, robust revenue, and expanding profit margins demonstrate a business model that continues to thrive in the ever-evolving streaming landscape. With a focus on innovation and a commitment to delivering quality content, Netflix is well-positioned for continued success in the years to come.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.