Summary:

- I’m reiterating Netflix with a buy rating post 2Q24 earnings as Netflix continues to show momentum in its overall subscriber growth quarter over quarter.

- I think this quarter proved that we’ll see subscriber growth before top-line growth, but the latter should follow by the end of FY24.

- Netflix’s competitive edge over its rivals in the streaming industry, Disney and Warner Bros., comes from its original content, and we have yet to see the full upside from that.

- I hereby share my thoughts on Netflix here and why I have a positive sentiment for FY2024.

Abstract Aerial Art/DigitalVision via Getty Images

Investment thesis:

I’m updating my thoughts on Netflix (NASDAQ:NFLX) and reassessing how my thesis is playing out post-2Q24 earning results and outlook. I last wrote on Netflix in early July, reiterating my positive outlook in light of “management’s commentary about shifting more focus to engagement as the new key growth metric” anticipating improved “top-line growth supported by management’s focus on profitability and their improved go-to-market strategy.” This positive thesis remains intact, as I think we still haven’t seen the full upside potential of focus on engagement and original content, and this quarter’s results confirmed that.

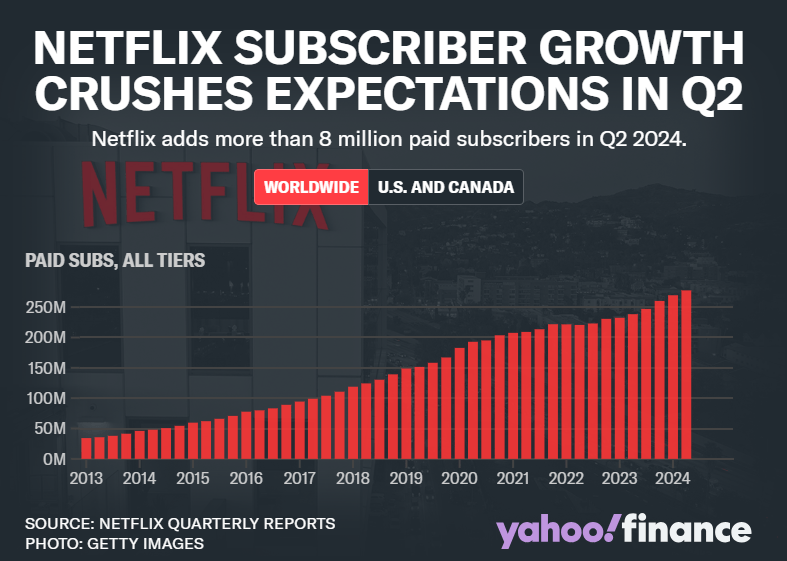

The stock dipped ~6% in after-hours trading as investors reacted badly to a miss in the 3Q24 outlook against Wall Street’s expectations; Netflix is expecting a 3Q24 revenue of $9.73 billion, missing consensus of $9.83 billion and guiding for EPS of $5.10, above consensus of $4.74. The stock erased some of its losses after the initial dip as investors woke up to Netflix’s subscriber add beat for the quarter. Subscriber additions came in at 8.05 million, beating expectations of 4.7 million; that is a ~36% increase year-over-year from 5.89 in a year-ago quarter. Global streaming paid memberships came in at 277.6 this quarter, a 16% year-over-year increase from a year-ago-quarter. I think this quarter proved that we’ll see subscriber growth ahead of top-line growth. I’m not too worried about this, as historically, Netflix’s subscriber boosts have been followed by better top-line growth, confirming my bullish stance on Netflix into 2HFY24. Below is a Yahoo Finance chart showing Netflix’s paid subscribers from 2013 to the current quarter.

Yahoo Finance Chart

Revenue grew 16.8% year-over-year to $9.56 billion for the quarter versus $8.18 billion in a year ago quarter, slightly beating estimates of $9.53 billion. Diluted earnings per share (EPS) also beat estimates of $4.74 with a +48% increase year-over-year from $3.29 in 2Q23 to $4.88 in 2Q24. The company also raised full-year revenue guidance by 0.5% to 14%-15% compared to the previously projected 13%-15%. According to management, the “updated revenue forecast reflects solid membership growth trends and business momentum, partially offset by the strengthening US dollar vs. most other currencies,” mainly referring to the devaluation of the Argentinian peso against the dollar due to local inflation in the country.

In my opinion, Netflix continues to show momentum in its overall subscriber growth quarter over quarter, and original content and enhanced engagement are the main drivers for that. I see the company exiting 2024 better than it entered it; I don’t think Netflix dipped too bad for 1H24, considering the rough macroeconomic backdrop visibly weighing on consumer spending. The stock was up ~33% versus the S&P 500 up 14%. I think we’ll see more material outperformance from the S&P 500 in the second half of the year and 2025.

Why I care about original content:

Management is focused “so relentlessly” on further improvements in the entertainment offerings, mainly series and film. CEO Ted Sarandos believes the company certainly “compete[s] with Hollywood to make the best and most popular programming in the world” in countries like India, Spain, Italy, Germany, Korea, Japan, France, etc. The EMEA, specifically the UK team, delivered global hits, and both Baby Reindeer and The Gentleman got Emmy nominations yesterday; over 50% of Netflix’s members in the UK watched the two shows, reiterating the fact that they’re a “phenomenon in the UK.” According to management, the year is packed with new opportunities for growth through the return of Squid Game and Emily in Paris before the end of the year. The former is one I’m watching closely. Netflix released Squid Game on September 17, 2021, and got a “mind-boggling 142 million member households globally have chosen to watch the title in its first four weeks”. I expect an even higher number in this release as the show visibly gained a strong fan base. I’m also particularly excited about the Finale of The Umbrella Academy coming on the 8th of August because 1. I’m a massive fan of the show, and 2. I believe it’s a great opportunity to grow subscriber retention rates, as is the case with other hit shows like Love Is Blind, Selling Sunset, The Diplomat, etc. I think Netflix’s original content is the ticket for subscriber growth against its competition Disney (DIS) and Warner Bros. (WBD).

What I’m prematurely but surely watching:

Netflix introduced the gaming initiative around three years ago, and I see it having a minimal impact on Netflix considering the current scales at which it functions. Management didn’t mention this initiative until asked about it in the earnings Q&A, confirming that Netflix placed it on the back burner. According to Co-CEO, Greg Peters, “investment level in games relative to our overall content spend is also quite small,” raising discipline in how they scale it. I say the game’s initiative is still a rough first draft. The company launched more than 100 games and has over 80 games in development; the way Netflix is approaching the initiative raises my confidence. Peters explained they are focused on engagement and trying to reach the members by connecting them “with games based on specific Netflix IP that they love.” I see this initiative showing up on engagement metrics in the longer term.

What’s next?

One trend I noticed with Netflix for the first half of their fiscal year is management guided lower than consensus for both Q1 and Q2 but printed a top and bottom-line beat both quarters. Here are the numbers: in 4Q23, the company guided for revenue of $9.24 billion, lower than the consensus of $9.26 billion, but beat on revenue report of $9.37 billion, beating by $90 million in 1Q24. The second quarter followed suit; the company guided for revenue of $9.49 versus a consensus of $9.53 and reported revenue of $9.56 in 2Q24, beating by $30 million. I believe Netflix is edging closer to beating the Street outlook by the end of FY24. I would warn investors not to get disheartened by management’s miss on guidance in the first half because I think Netflix is now better positioned to outperform than it was at the start of the year but also because there’s seasonality to factor for. Studying Netflix’s seasonality across the past ten years, a trend appears, showing July as the lowest-performing month at ~36% compared to the highest month at ~80% (which I’ve found to be February). Combining this with the tailwinds working in Netflix’s favor that I outlined in this article one and prior ones, I see a great opportunity to jump in at the current price.

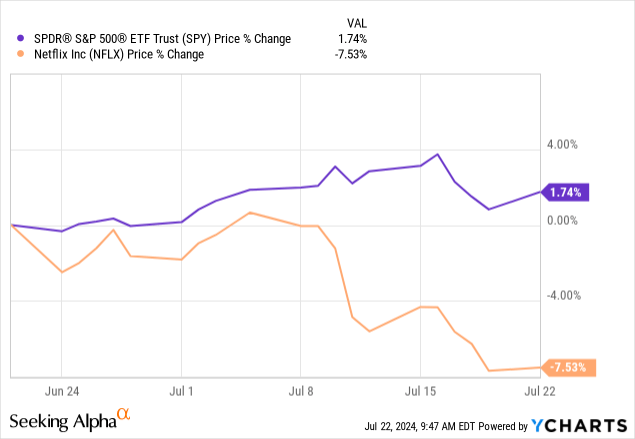

Netflix has been underperforming against the S&P 500 on the one-month mark. The company was down ~7.5%, significantly lower than the S&P 500, which came in at a ~2% increase, as seen below.

YCharts

I know how this looks, but I believe the company is better positioned to outperform in 2H24 as it leaves the threats of seasonality behind. All in all, Netflix is gaining momentum in the ever-expanding SVoD market. I see Netflix having yet another impressive next quarter, mainly driven by its original content and the “hyper-focus” on engagement.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.