Summary:

- Netflix, Inc. reported mixed Q2 earnings with strong subscriber growth due to a crackdown on password sharing, but it missed revenue estimates.

- The streaming giant added 5.9M new subscribers in Q2, reaching a total of 238.4M global memberships.

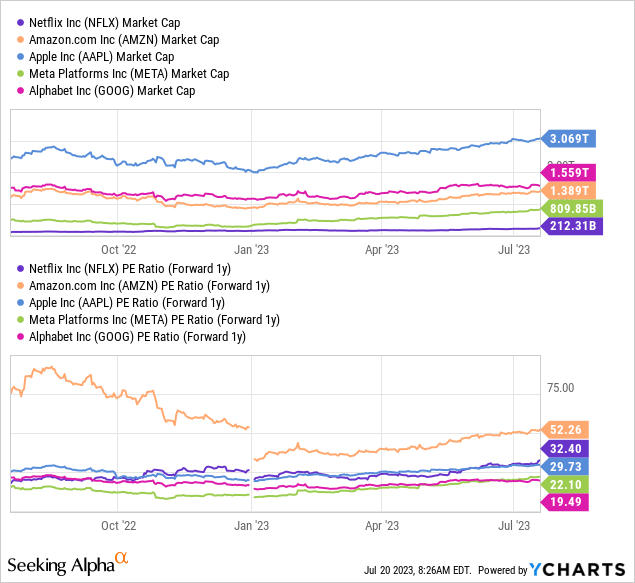

- Netflix is valued at a P/E ratio of 32.4X, making it the second-most expensive FAANG stock after Amazon.

- The company’s growth large comes from developing markets in Latin America and Asia, which generate lower average revenue per user.

demaerre

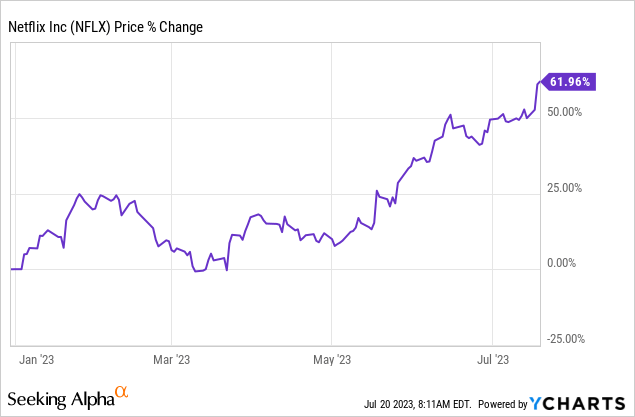

Netflix, Inc. (NASDAQ:NFLX) submitted a mixed Q2 earnings sheet on Wednesday. On the one hand it showed strong subscriber growth, driven by a crackdown on password sharing, but on the other, the firm’s revenue missed estimates and Netflix did not manage to show a revenue acceleration quarter-over-quarter. In total, Netflix generated 8% subscriber growth in Q2, and while the crackdown on account sharing has yielded positive results so far, I see obstacles to ARPU and valuation growth. In fact, Netflix is now the second-most expensive FAANG stock with a FWD P/E ratio of 32X, and I consider the risk profile to be skewed to the downside. For those reason, I maintain my sell rating on Netflix!

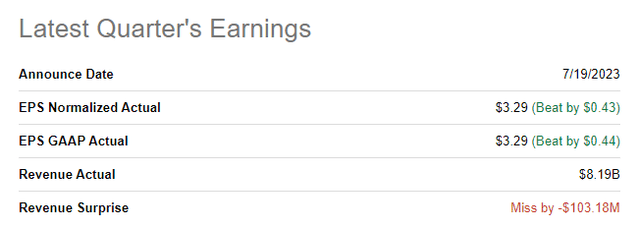

Mixed earnings card for Q2

Netflix reported revenues of $8.19B for the second-quarter, missing estimates by $103M. Adjusted earnings came in better than expected at $3.29, compared against the consensus estimate of $2.86 per share.

The most important takeaway from Netflix’s second-quarter earnings report relates to its crackdown on the widespread practice of password sharing. In the past, Netflix has said that more than 100 million households are sharing account passwords with each other, making the streaming company lose out on subscription revenues.

In the second quarter, Netflix started to crack down on this practice and started to charge extra money for Netflix users in other households. The practice looks to have been a success so far, as the company said in its Q2 shareholder letter that signups are exceeding cancellations and have affected 80% of the company’s revenue base.

As a result, Netflix saw a surge in new accounts in the second-quarter: the streaming company added 5.9M new subscribers in the second-quarter, showing 8% year-over-year growth. In the previous quarter, Netflix added 1.8M subscribers to its streaming platform. At the end of the second quarter, Netflix had total global memberships of 238.4M.

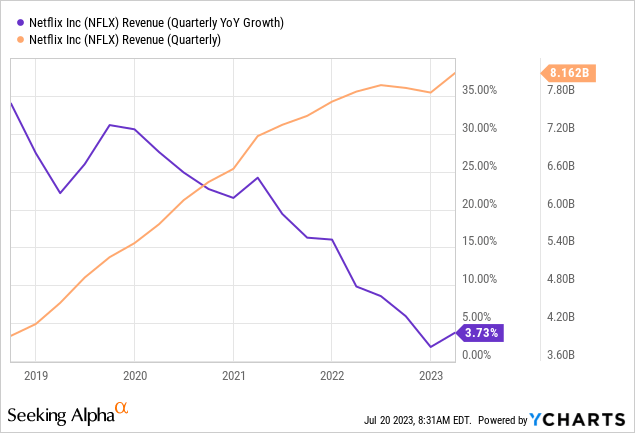

Although Netflix hit a homerun with its crackdown on password sharing, the market is still waiting for a revenue acceleration… which Netflix did not deliver in Q2. Netflix generated $8.2B in revenues in the second-quarter, showing just 2.7% Y/Y growth compared to 3.7% Y/Y growth in Q1’23.

While Netflix has succeeded in growing subscribers due to new successful movie releases on its platform, such as Murder Mystery 2 and Extraction 2, Netflix still needs to prove to the market that subscriber growth actually translates to revenue growth.

Outlook for Q3 2023

Netflix projects 7.5% year-over-year revenue growth for the third quarter, driven by higher average memberships. This, of course, is the result of the company’s crackdown on account sharing. Netflix forecasts $8,520M in revenues for Q3 2023 as well as operating income of $1,890M.

A key risk for Netflix: weakening ARPU

A key measure of monetization success is Netflix’s average revenue per user/ARPU figure. In the second-quarter, Netflix’s ARPU declined successively in every region: U.S./Canada, Europe, Latin America and Asia-Pacific. This is especially a concern because Netflix achieves its growth predominantly outside of U.S./Canada, and falling ARPUs indicate weakening monetization. I would expect continual pressure on Netflix’s ARPU figure because subscribers outside of the U.S./Canada region are worth significantly less than a U.S. subscriber.

| In millions | Q2’22 | Q3’22 | Q4’22 | Q1’23 | Q2’23 |

| UCAN | |||||

| Paid Memberships | 73.28 | 73.39 | 74.30 | 74.4 | 75.57 |

| Paid Net Additions | -1.30 | 0.10 | 0.91 | 0.10 | 1.17 |

| Average Revenue Per Membership ($) | $15.95 | $16.37 | $16.23 | $16.18 | $16.00 |

| EMEA | |||||

| Paid Memberships | 72.97 | 73.53 | 76.73 | 77.37 | 79.81 |

| Paid Net Additions | -0.77 | 0.57 | 3.20 | 0.64 | 2.43 |

| Average Revenue Per Membership ($) | $11.17 | $10.81 | $10.43 | $10.89 | $10.87 |

| LATAM | |||||

| Paid Memberships | 39.62 | 39.94 | 41.70 | 41.25 | 42.47 |

| Paid Net Additions | 0.01 | 0.31 | 1.76 | -0.45 | 1.22 |

| Average Revenue Per Membership ($) | $8.67 | $8.58 | $8.30 | $8.60 | $8.58 |

| APAC | |||||

| Paid Memberships | 34.80 | 36.23 | 38.02 | 39.48 | 40.55 |

| Paid Net Additions | 1.08 | 1.43 | 1.80 | 1.46 | 1.07 |

| Average Revenue Per Membership ($) | $8.83 | $8.34 | $7.69 | $8.03 | $7.66 |

(Source: Author.)

Netflix’s valuation

Netflix is now the second-most expensive company that investors can own in the FAANG group, after Amazon (AMZN), based off of earnings. Shares of Netflix are currently valued at a FWD P/E ratio of 32.4X which, in my opinion, reflects an unattractive risk/reward profile, especially because well-managed and highly profitable companies like Alphabet/Google (GOOG) are trading at a significantly lower FWD P/E ratio. I expect Google to report strong results for Q2’23 next week and recommend GOOG as my highest-conviction idea due to firm’s resilient free cash flow, AI potential, stock buybacks and valuation.

Risks with Netflix

Netflix is seeing decent subscriber growth, but the company is still facing pressure from changes in the subscriber mix, meaning more subscribers are added in lower value markets (from an ARPU perspective) than in higher value markets like the U.S. and Canada. Netflix’s average revenue per membership declined in every single geography in Q2, 2023, which could pose revenue headwinds for Netflix in the future.

Final thoughts

Netflix’s earnings card for the second quarter was mixed: while the streaming company beat on earnings, it missed on revenues. The biggest investor takeaway from the earnings release was that Netflix has been successful in capturing incremental subscriber growth through cracking down on the password sharing practice. The outlook for the third-quarter is not bad, either.

However, Netflix will still have to prove that it can engineer a re-acceleration of its revenue growth… which could be a positive catalyst for Netflix shares. Since Netflix shares are already expensive based off of P/E, and I feel that ARPU headwinds are not properly accounted for, I continue to believe that Netflix, Inc. stock has an unattractive risk profile and reiterate it as a sell!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.