Summary:

- We’re sell-rated on Netflix, Inc. post 2Q23 earning results, as we don’t expect paid sharing or ad-tier subscriptions to boost revenue growth in the near-term due to macro weakness.

- While Netflix added 5.9M subscribers this quarter, the company missed revenue estimates for the second quarter in a row.

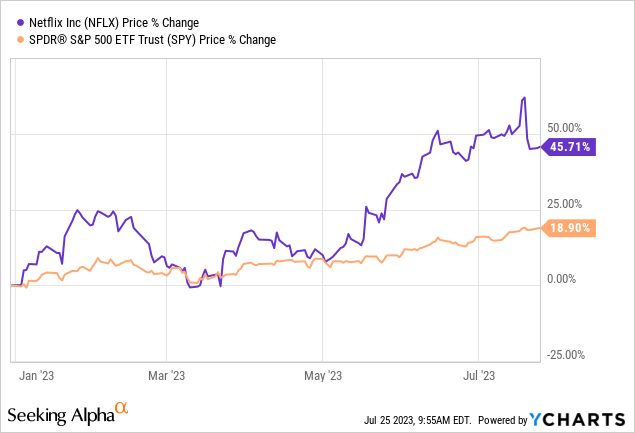

- The stock is up 46% YTD, outperforming the S&P 500 by 27%. The stock dropped roughly 11% after reporting earnings.

- We’re constructive on the stock’s position to outperform in the mid to long run but don’t see a clear path to revenue growth reaccelerating in 2H23.

- We recommend investors count their Netflix, Inc. profits at current levels and exit the stock to revisit at more attractive entry points toward 2024.

Giuliano Benzin

Netflix, Inc. (NASDAQ:NFLX) reported Q2 2023 earnings results late last week, reporting 5.9M added subscribers but missing on revenue for the second quarter in a row. We’re sell-rated on NFLX stock heading further into 2H23, as we expect the company’s financial performance to be under pressure as management signals that returns from the password-sharing crackdown may take several months to play out and as the macro headwinds pressuring consumer spending carry into 2H23. We also think management was somewhat guarded in comments on their ad-tier subscriptions; we believe ad spending is slowing this year as companies reel in spending due to inflationary pressures and higher interest rates.

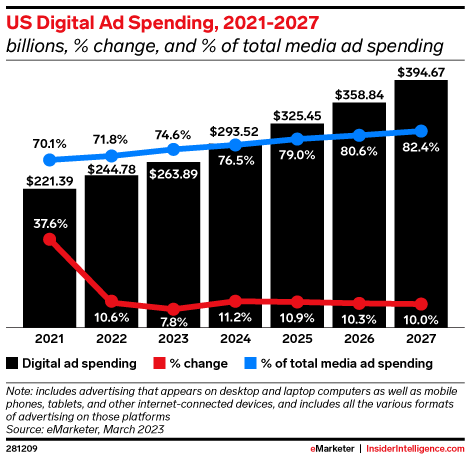

Digital ad spending is facing its slowest growth in a decade; digital ad spending in the U.S. has not been as low as 7.8% since 2009. We think investors should be cautious about getting too excited about Netflix’s ad-tier subscription added last November, as we don’t think the macro backdrop will work in Netflix’s ad-tier subscription’s favor this year. We’ve seen the impact of softer ad spending on Alphabet (GOOG) earlier this year, and we think the broader trend of tighter ad spend will be a near-term headwind for the company.

The following graph outlines the U.S. digital ad spending forecast until 2027.

Insider Intelligence

Additionally, management highlighted the lack of price increases or “price adjustments,” suggesting that higher inflationary pressures may be beginning to impact Netflix’s ability to “crank up” subscription prices. Discretionary spending continues to be limited under the current macro backdrop as households look for windows to trim spending in 2023.

The stock is up 46% YTD, outperforming the S&P 500 (SP500) by around 27%. The company significantly rebounded from its steep subscriber loss last year in the post-pandemic environment; in April of last year, Netflix announced its first-ever subscriber loss since 2011 of 200,000 subscribers in 1Q22 and then again in 2Q22 of almost 1M subscribers. Despite the impressive recovery of subscriber growth, we don’t see Netflix’s revenue growth accelerating meaningfully in 2H23 and continue to recommend investors exit the stock at current levels.

The following graph outlines Netflix’s YTD stock performance against the S&P 500.

YCharts

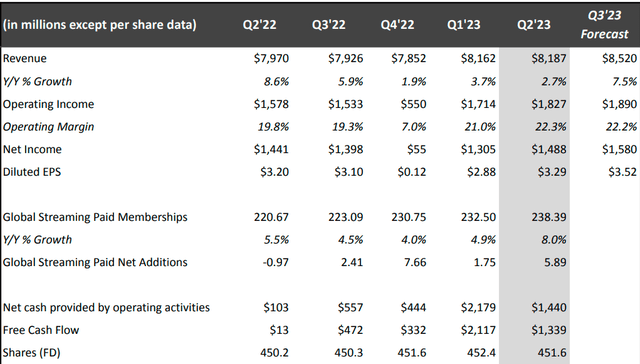

Added subscribers increase, but revenue misses

Netflix stock dropped roughly 11% after announcing 2Q23 earning results; the company reported revenue of $8.19B, up 2.8% and 0.36% sequentially, and GAAP EPS of $3.39. Consistent with our expectations in March, Netflix is struggling to boost revenue growth due to macro weakness; revenue missed estimates by $100M this quarter, marking the company’s second consecutive miss on revenue. Revenue growth percentage is also stuck in the single-digit percentage, and percentage growth slowed this quarter in comparison to 1Q23; last quarter Netflix reported revenue growth of 3.7% Y/Y versus this quarter at 2.8% Y/Y revenue growth. We do see more meaningful revenue growth in Netflix’s horizon, but we believe it’ll take time for the ad-tier and paid-sharing strategies to materialize into revenue growth.

The following chart outlines Netflix’s financial metrics this quarter.

2Q23 earnings shareholder level

Revenue growth this quarter was attributed to a 6% increase in average paid membership, while average revenue per membership or ARM dropped 3% Y/Y versus a 1% decline last quarter. Management ascribed the ARM drop Y/Y to Netflix’s limited price increases over the past year and “a higher mix of revenue growth from lower ARM countries.” We continue to see Netflix’s revenue growth under pressure as revenue growth Y/Y slows and ARM declines.

Additionally, investors should be wary of overlooking the strikes of Hollywood actors and writers; some 65,000 SAG-AFTRA members began protests joining 11,000 members of the Writers Guild of America. The unions are seeking higher base pay and a more significant cut of streaming companies’ revenue “in the form of residual or licensing fees.” The strikes have contributed to Netflix’s higher free cash flow forecast for 2023 to $5B from the previously forecasted $3.5B. Netflix has significantly reduced operational costs as a result of strikes delaying production schedules. Actors and writers are discontent with the massive growth of streaming video that does not equally benefit the producers/creators of hyper-popular content. Management emphasized on the earnings call that they’re working to find a conclusion to the strikes that can allow business to move forward as usual. We’ll continue to monitor how the strikes play out.

Valuation:

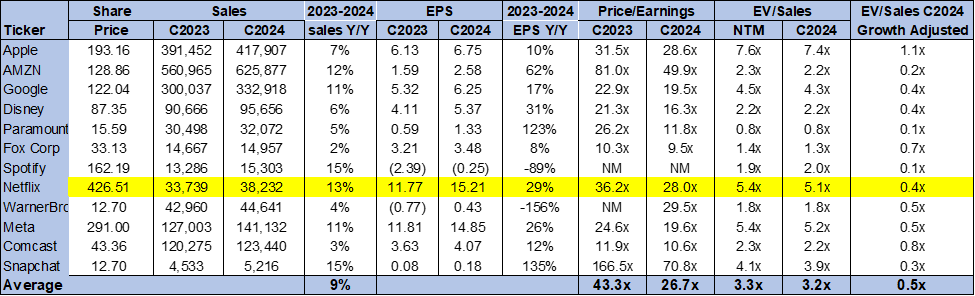

Netflix is trading well above the entertainment sector peer group, and we don’t think the stock’s higher multiples are justified. Netflix is no longer a high-growth stock. On a P/E basis, the stock is trading at 28.0x C2024 EPS $15.21 compared to the peer group average of 26.7x. The stock is trading at 5.1x EV/C2024 Sales versus the peer group average of 3.2x. We don’t see a favorable risk-reward profile for the stock at current levels; we recommend investors wait out the near-term weakness and wait for signals of revenue growth recovery before exploring entry points into the stock.

The following chart outlines Netflix’s valuation against the peer group.

TSP

Word on Wall Street

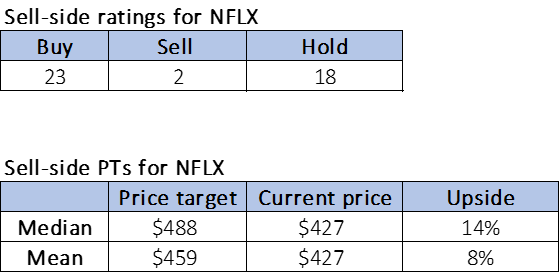

Wall Street is bullish on the stock. Of the 43 analysts covering the stock, 23 are buy-rated, 18 are hold-rated, and the remaining are sell-rated. We attribute Wall Street’s bullish sentiment to the longer-term outlook on Netflix’s growth prospects as the leader of the streaming industry and recent developments with the company’s password-sharing crackdown and ad-tier subscription.

The stock is currently priced at $427 per share. The median sell-side price-target is $488, while the mean is $459, with a potential 8-14% upside.

The following charts outline Netflix’s sell-side ratings and price-targets.

TSP

What to do with the stock

We’re sell-rated on Netflix stock, as we expect the company’s financial performance to moderate in 2H23; revenue growth is slowing, and ARM continues to decline. Management highlighted that accelerating revenue growth is their primary goal in Q3, guiding revenue of $8.5B, up 7% Y/Y; we expect the paid sharing will positively impact the financial outlook but don’t see this having an immediate effect. We think the stock doesn’t provide a favorable risk-reward profile in the near term due to the current macro headwinds weighing on consumer discretionary spending and global ad spending.

We do see Netflix, Inc. stock outperforming the entertainment sector in the mid-to-long run, but see no clear catalyst driving revenue growth in 2H23. The stock is also trading at premium multiples for the near-term headwinds pressuring revenue growth. We recommend investors exit the stock at current levels and revisit once the risk-reward profile becomes more favorable.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.