Summary:

- Netflix faces challenges, including the Hollywood strike, the ad tier, and declining average revenue per user.

- Despite these challenges, Netflix remains the leading entertainment service with a large library of original content and a global reach.

- The company is expected to demonstrate operating leverage and generate strong revenue in Q3-23, and is considered a good long-term investment.

Mario Tama/Getty Images News

Netflix (NASDAQ:NFLX) faces a critical earnings release in Q3-23 after a sell-off in Q2 and several challenges, including the Hollywood strike, the ad tier, and free cash flow. We’ll discuss these and other factors to see where Netflix stands and what to watch for in the upcoming results.

Business Overview

Netflix is a global streaming service that offers TV shows, movies, and games to its subscribers. It has over 238 million paid memberships in over 190 countries. Netflix subscribers can watch as much content as they want, anytime, anywhere, and can change their plans at any time

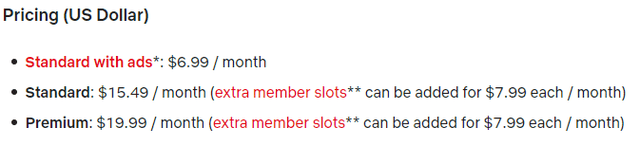

Netflix membership plans (Netflix website)

Netflix’s business model is based on subscription fees. Members pay a monthly fee to access Netflix’s library of content. Netflix also generates revenue from licensing its content to other streaming services and broadcasters.

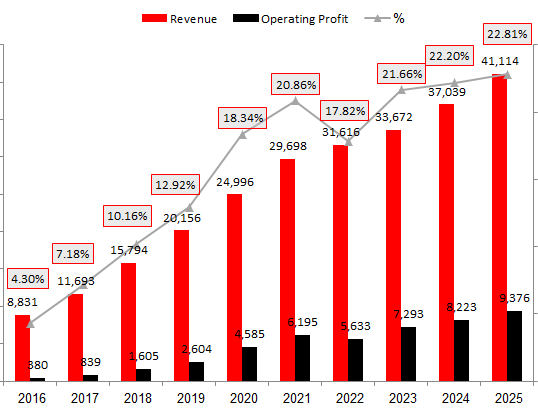

Netflix’s revenue (Authored using company financial data)

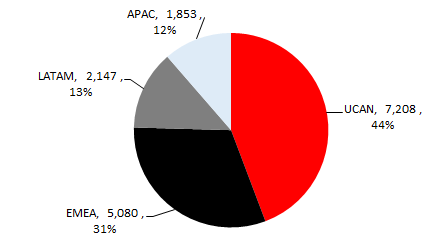

The revenue breakdown for Netflix in 2023 shows that the United States and Canada (UCAN) is the largest region, accounting for 44% of total subscription revenue. Europe, the Middle East, and Africa (EMEA) is the second-largest region, with 31% of subscription revenue. Latin America (LATAM) is third with 13% of subscription revenue, followed by Asia-Pacific (APAC) with 12%.

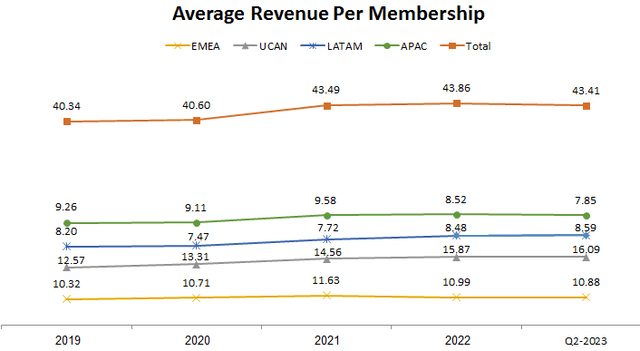

Netflix’s average revenue per membership (Authored using company financial data)

Netflix’s average revenue per membership (ARPU) has been on an upward trend in recent years, but it began to decline in 2021. This decline may have been accelerated by the announcement of the ads tier in November 2022. In the upcoming earnings results, I expect to see the ARPU decline continue, as Netflix has not increased prices and has said that it does not expect the ads tier to have a significant impact on revenue in the near term.

Competition

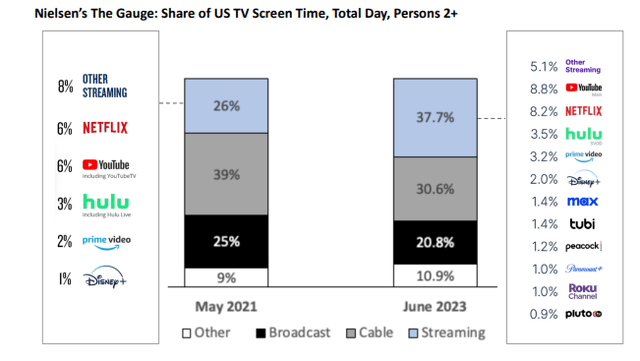

Netflix Q2-23 Letter To Shareholders; Based on Nielsen Data. (Netflix Q2-23 Letter To Shareholders; Based on Nielsen Data.)

As a customer, I have many entertainment choices, including movies, TV shows, sports, news, gaming, and social media. I expect competition in the streaming industry to remain intense, but Netflix has shown that it can be a successful business with strong execution and focus. Netflix’s streaming share continues to grow, taking market share from its competitors. In June 2023, Netflix had 37.7% of U.S. TV screen time, up from 26% in May 2021.

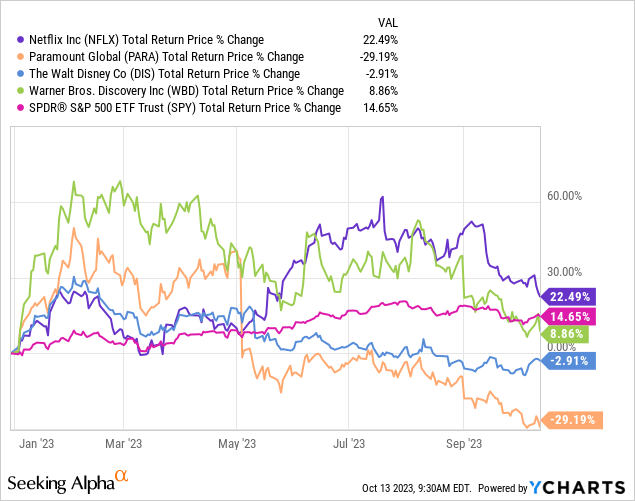

NFLX vs Competitors

Netflix had a mixed bag of news in 2023, with both positive and negative developments.

- Netflix launches ad-supported tier. In November 2022, Netflix announced that it would be launching an ad-supported tier of its service in early 2023. The ad-supported tier is a cheaper option for subscribers who are willing to watch ads in exchange for a lower monthly fee.

- Netflix cracks down on account sharing. In March 2023, Netflix announced that it would be cracking down on password sharing outside of households. The company said that it would be sending out warnings to subscribers who are sharing their accounts with people outside of their households and that it could eventually start charging extra for additional users.

- Netflix loses subscribers in Q1 2023. For the first time in over a decade, Netflix lost subscribers in the first quarter of 2023. The company blamed the slowdown on several factors, including increased competition from other streaming services, the war in Ukraine, and the end of the pandemic stimulus checks.

The Hollywood Strike of 2023 and Its Impact on Netflix

The Hollywood strike of 2023 is a major labor dispute between the Writers Guild of America (WGA) the Screen Actors Guild-American Federation of Television and Radio Artists (SAG-AFTRA) and the major Hollywood studios.

The strike was over a dispute over compensation for streaming content. Actors and writers argued that they were not being paid fairly for their work on shows that are streamed on services like Netflix, Hulu, and Amazon Prime Video. The studios argued that they were already paying actors and writers fairly and that they could not afford to increase their compensation rates without raising the prices of their streaming services.

The Hollywood strike had a significant impact on Netflix. The strike delayed the production of many of the company’s original shows and films. This led to a slowdown in the release of new content on Netflix, which may have contributed to the company’s subscriber losses in the first quarter of 2023.

Despite the impact of the strike, Netflix is still in a better position than its competitors. Netflix has a large library of original content that was produced before the strike began. The company also has a deep bench of talent, and it is still investing heavily in new content production.

Netflix’s competitors, such as Disney+ (DIS), HBO Max (NASDAQ: WBD), Amazon Prime Video (AMZN), Paramount (NASDAQ: PARA), NBCUniversal (CMCSA), are more reliant on new content to attract and retain subscribers. These companies were more negatively impacted by the strike, as their content release schedules were disrupted.

Overall, the Hollywood strike of 2023 was a major setback for the entertainment industry. However, Netflix is in a better position to weather the storm than its competitors.

Differences between Netflix and its competitors

Netflix differs from its competitors in a few key ways. First, Netflix is focused on original content. The company produces a wide range of original shows and films, from comedies to dramas to documentaries. This gives Netflix a competitive advantage, as it can offer its subscribers content that cannot be found anywhere else.

Second, Netflix has a global reach. The company is available in over 190 countries and territories. This gives Netflix a much larger potential customer base than its competitors, which are typically only available in a limited number of countries.

Netflix’s differences from its competitors have helped the company to become the leading streaming service in the world. However, the Hollywood strike of 2023 is a reminder that Netflix is not immune to the challenges facing the entertainment industry.

Netflix has had a lot of recent news, mostly bad, but it has dealt with it well. The company continues to deal with password sharing and the writer’s strike, which is coming to an end. Netflix’s recent price increase has been met with negativity from investors, but it is too early to assess its impact. I will keep you updated on any developments in the comments.

Margin Expansion

Given the decline in Netflix’s ARPU (Average Revenue Per User/Membership), we cannot expect impressive revenue growth. Therefore, Netflix must demonstrate operating leverage.

This data was created and calculated by the author using Netflix financial reports and the author’s projections. (.)

Netflix’s operating margin in Q2 was 22.3%, up 2.5 percentage points from the same period last year and 1.3 percentage points from the previous quarter. Management is guiding for a 22.2% margin in Q3 and a 19% margin for the full year.

Valuation

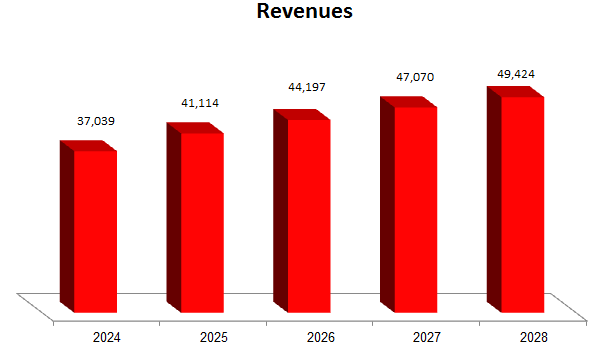

Netflix’s Estimates Revenue (Authored using Netflix financial data and the author’s projections)

I used a discounted cash flow (DCF) methodology to estimate NFLX’s fair value. I assumed that the company would grow its revenue at a compound annual growth rate (CAGR) of 8% between 2024 and 2028. Using a weighted average cost of capital (WACC) of 14.50% and factoring in NFLX’s net debt position, I estimated the company’s fair value to be $383 per share.

Based on my 2024 EPS forecast, the valuation reflects a forward P/E of 27.21x, which is above consensus due to strong share buybacks as directed by management.

Based on Netflix’s Q2-23 results, I expect the company to generate revenue of $8.71 billion in Q3-23. This is based on seasonality, the strength of Netflix’s content library, and the continued growth of the streaming market., which is above the consensus forecast and management’s guidance of $8.52 billion. I also estimate that the operating profit margin will increase to $1.8 billion in Q3-23 or 21.7%, which is in line with management’s guidance of $1.9 billion. This is based on the company’s focus on cost control and the increasing popularity of Netflix’s ad-supported tier.

After adjusting my model to reflect Netflix’s Q2-23 results, I now expect the company to generate $33.53 billion in full-year revenue in 2023, which is in line with consensus. This represents 6.1% growth of the company’s revenue in 2022.

Conclusion

Netflix is facing several challenges, including increased competition, the Hollywood strike, and a decline in average revenue per user. However, the company remains in a strong position, with a large library of original content, a global reach, and a subscription-based business model.

I believe that Netflix will be able to overcome these challenges and continue to grow in the long term. The company has a strong track record of innovation and execution. Netflix is also investing heavily in new content production, and it is expanding into new markets.

Overall, I believe that Netflix is a good investment for long-term investors. The company is facing some challenges, but it is well-positioned to overcome them and continue to grow.

Additional thoughts

In addition to the above, I would also like to add that Netflix is facing increasing regulatory scrutiny in some markets. For example, the European Union is considering new regulations that could force Netflix to offer more European content and to share more data with regulators.

However, I believe that Netflix is well-positioned to deal with these challenges. The company has a strong track record of compliance, and it is investing heavily in European content production.

Overall, I am still bullish on Netflix. I believe that the company has a strong track record, a bright future, and a valuable portfolio of assets.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.