Summary:

- Netflix’s valuation is lofty with a P/E ratio of ~35, requiring future growth. Current FCF yield of <2% is insufficient to justify this valuation.

- Revenue growth is slowing, with $9.8 billion in the recent quarter and net income volatile, highlighting the need for substantial growth to sustain valuation.

- Many popular shows are in later seasons, indicating a lack of new hit series. Moderately successful content won’t drive significant growth.

- Strong market position and ad revenue, but competition and slowing growth rates make Netflix a poor long-term investment at this time.

MoMo Productions/DigitalVision via Getty Images

Netflix (NASDAQ: NASDAQ:NFLX) went up by double-digits to a market capitalization of $330 billion. We discussed our opinion a few months ago about how the company is an overvalued streaming company. That hasn’t changed. While we were wrong about how well the company’s ads tier would perform, the company’s growth is slowing and it doesn’t have the FCF to justify its valuation.

Netflix Results

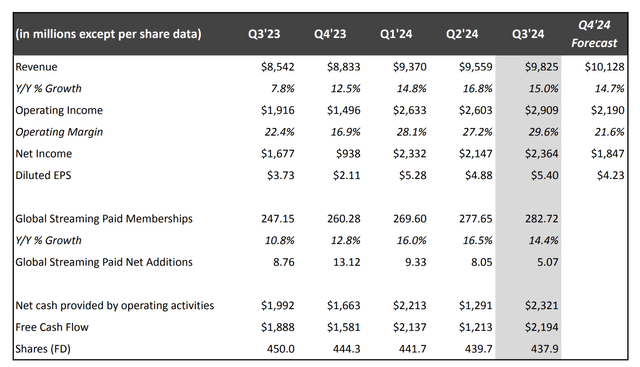

Netflix has reported strong YoY results, however, the company’s pace of growth has slowed down.

The company saw $9.8 billion in revenue in the most recent quarter, with its YoY growth rate down and revenue growth down to $225 million QoQ. Going into the end of the year, the company expects both these numbers to slow down even further. The company earned $2.4 billion in net income, annualized at roughly $10 billion.

This highlights how the company is trading at a lofty valuation, with a P/E of ~35 which requires future growth. At the same time, the company’s net income remains very volatile, as seen with its Q4’24 expected decline, which means the company’s true P/E TTM is more like 50+.

The company has been repurchasing shares but share repurchases remain minimal and represent virtually all shareholder returns, at roughly 3% outstanding share count decline YoY. This highlights how the company trades at a lofty valuation.

Netflix Highlights

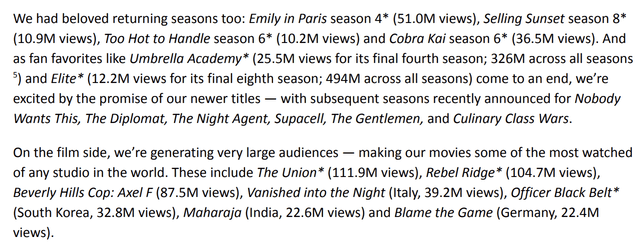

The company has continued to launch new series and movies that do well.

However, we want to highlight some things here. The first is that many of the company’s most popular shows are on their 4/5/6 seasons. This shows that the company hasn’t released any major TV shows in a while, its more popular shows are ones that were released several years ago. The company has yet to build a replacement here.

The second is that while the company continues to see strong viewership on its movies, that’s partially a side effect of having a massive audience. While some titles can generate buzz and new viewers, the company already has an incredibly strong position in the market. Our view is that moderately successful shows and movies won’t do anything to enable the company.

Netflix Financials

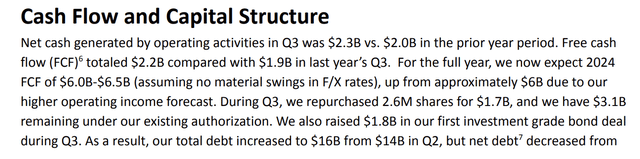

The company’s financial picture shows some strength, however, it also shows the company has a long ways to go in justifying its valuation.

The company expects $6-6.5 billion in 2024 FCF, which is a FCF yield of <2%. This shows how much additional growth the company needs in order to be able to justify its valuation. The company has roughly $6.8 billion in net debt, a relatively irrelevant amount given its size, however, it is important to make sure the company doesn’t sue debt for share repurchases.

The company’s overall financial position remains strong, however, it doesn’t justify the company’s valuation without the company seeing lofty growth.

Netflix Outlook

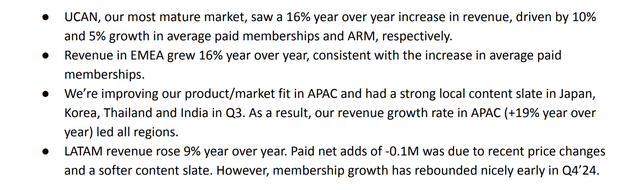

The company has continued to see strong growth as the company’s ad business has done well.

UCAN saw 16% YoY revenue growth driving most great. EMEA helped as well. APAC remains the company’s stronger market, while LATAM underperformed. The company also has forex risks outside of UCAN. The company’s growth was substantial in these markets boosted by an ad-free tier, however, we expect that growth to slow down.

The company’s guidance indicates that. The company’s incredibly strong YoY peaked in the 2Q, however, it seems to be slowing down. The company hasn’t given subscriber guidance for the next quarter, which it doesn’t do in its outlooks. However, the company’s 5 million in QoQ subscriber growth in the most recent quarter is the company’s weakest in a number of quarters.

That outlook shows a potential slowdown in the company’s markets, which could hurt future growth. The company needs substantial growth to justify its valuation.

Thesis Risk

The largest risk to our thesis is that Netflix has an incredibly strong position in the streaming market. That’s a market that seems unlikely to disappear anytime soon and the company has continued to generate strong ad revenue.

Conclusion

Netflix has seen its share price outperform over the past year, however, the company’s recent guidance indicates that growth is slowing down. Revenue growth rates and subscriber growth rates are slowing down. At the same time, many of the company’s shows are more established, indicating potential future growth risks.

The company is already huge in its established markets. Competition remains strong with competitors that don’t need the same profits. That, combined with the run-up in the company’s share price, makes it a poor long-term investment at this time in our view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.